Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

➡️ Mortgage rates are at a one year low dropping from highest 7.79% last year to 6.35%, activating the priced out buyers due high rates.

➡️ Albany topped the list with the highest demand score and a staggering 47.5% five-year property appreciation, making it a leading market for both buyers and investors.

➡️ Dayton’s 57% property appreciation over the last five years, coupled with a 6.51% rental yield, positions it as a top contender for investors seeking high returns.

2023 saw a significant slowdown in the US housing market, largely due to continuous interest rate hikes by the Federal Reserve and mortgage rates reaching their highest levels in a decade. As buyers were priced out of the market, demand became heavily suppressed, leading to a cooling of activity across many metropolitan areas.

Our Chief Real Estate Advisor, Michele Lawrie, echoes this sentiment, stating, “High mortgage rates kept many buyers on the sidelines in 2023, really bottling up demand. But now, as rates start to cool down, we’re expecting a real surge in buyer interest.”

However, 2024 brings a different story. With mortgage rates finally easing, dropping to 6.35% from the October 2023 peak of 7.79%, buyer interest is set to rebound.

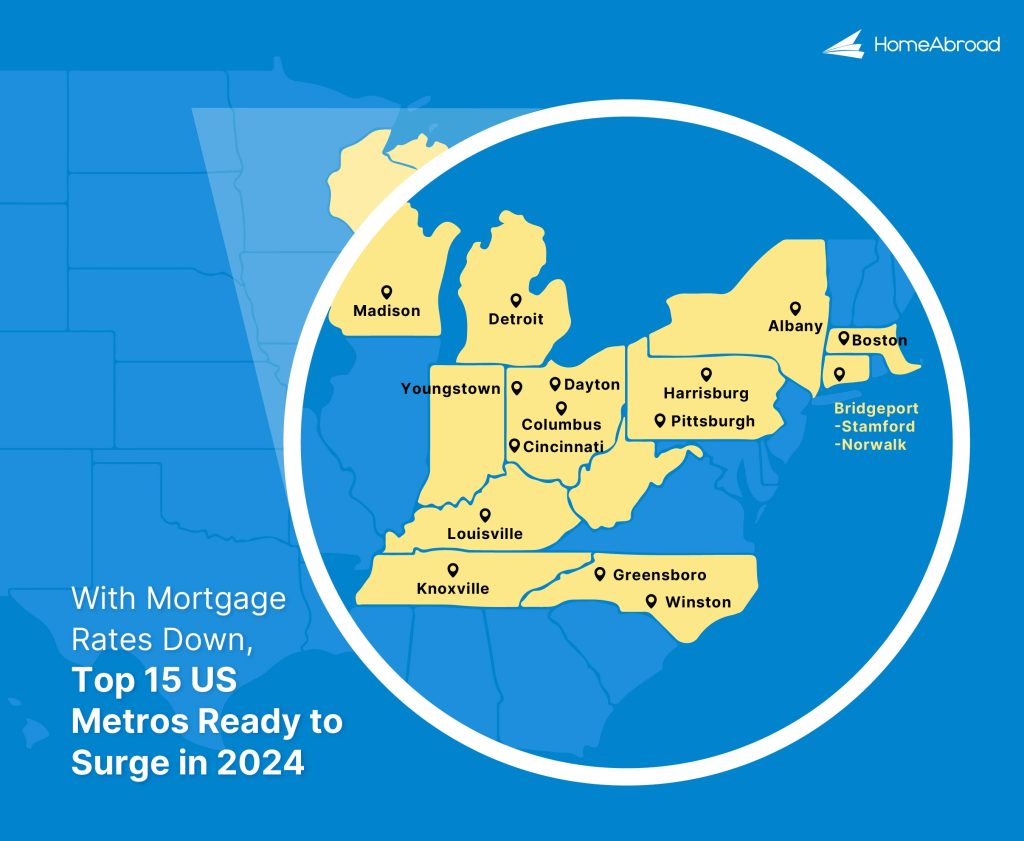

HomeAbroad conducted an in-depth analysis of the top 100 US metros to identify the markets where demand was most suppressed and is now poised to surge.

These markets represent significant opportunities for investors looking to capitalize on the renewed activity and potential for growth in the coming year.

Table of Contents

Top 15 US Housing Markets Primed for a Real Estate Boom

We analyzed key factors such as total inventory, days on market, supply and demand scores, and home price appreciation, combined with an economic indicator like job growth, to pinpoint the US cities with the most suppressed demand.

Read the full methodology here.

Here are the top 15 housing markets with key investment details.

1. Albany-Schenectady-Troy, NY

Median House Price (July 2024)

$441,725

5-Year House Price Appreciation

47.5%

Median Rent

$1,500

Albany-Schenectady-Troy saw a slight decline in inventory from August 2023 to July 2024, coupled with a decrease in median days on market (from 50 to 43 days). Despite higher mortgage rates, the market showed resilience with an increase in home prices from $419,900 to $441,725, reflecting a 1.8% job growth. This suggests that demand was suppressed but strong economic growth and now-lowered rates are likely to drive a surge in buying activity.

2. Boston-Cambridge-Newton, MA-NH

Median House Price (July 2024)

$868,950

5-Year House Price Appreciation

44.8%

Median Rent

$3,225

In Boston, inventory increased over the year, and median days on market remained stable around 37-38 days. This stability, despite the economic headwinds, reflects suppressed demand held back by high mortgage rates. With a modest 0.7% job growth and home prices increasing from $844,200 to $868,950, the area is poised for a resurgence as rates fall.

3. Bridgeport-Stamford-Norwalk, CT

Median House Price (July 2024)

$895,000

5-Year House Price Appreciation

27%

Median Rent

$2,789

Bridgeport-Stamford-Norwalk saw inventory rise and median days on market drop from 50 to 34 days, indicating a tighter market even before the rate drops. Home prices experienced a slight decrease from $949,950 to $895,000, but with 1% job growth and stronger demand indicators, the area is primed for a strong comeback as lower rates make buying more attractive.

4. Cincinnati, OH

Median House Price (July 2024)

$362,450

5-Year House Price Appreciation

28.3%

Median Rent

$1,300

Cincinnati’s inventory and median days on market remained relatively stable, with a slight increase in supply score. The area’s home prices decreased from $375,000 to $362,450, indicating potential buyer hesitation due to high rates. However, with 0.6% job growth and a solid demand base, Cincinnati could see significant activity as rates decline, unlocking this pent-up demand.

5. Columbus, OH

Median House Price (July 2024)

$356,500

5-Year House Price Appreciation

11.1%

Median Rent

$1,500

Columbus faced an increase in inventory and median days on market, reflecting a cooling market held back by high mortgage rates. Yet, with prices dropping from $386,250 to $356,500 and 0.8% job growth, Columbus shows the potential for a surge in demand as rates decrease, making homes more affordable for buyers.

6. Dayton-Kettering, OH

Median House Price (July 2024)

$257,450

5-Year House Price Appreciation

57%

Median Rent

$1,400

Dayton-Kettering’s inventory and median days on market increased, but home prices saw a healthy rise from $248,700 to $257,450. This market, held back by higher rates, could now see a significant boost in demand, particularly with 1.1% job growth signaling strong economic conditions that will support a market resurgence as rates come down.

7. Detroit-Warren-Dearborn, MI

Median House Price (July 2024)

$279,950

5-Year House Price Appreciation

7.7%

Median Rent

$1,650

Detroit’s inventory slightly decreased, and median days on market dropped from 36 to 32 days, showing a tightening market even in challenging conditions. With a modest 0.4% job growth and slight price appreciation from $272,400 to $279,950, the area is ready for a demand surge as rates fall, unlocking the buying potential that was previously constrained.

8. Greensboro-High Point, NC

Median House Price (July 2024)

$346,000

5-Year House Price Appreciation

29.7%

Median Rent

$1,550

Greensboro-High Point maintained stable inventory levels and days on market, reflecting a market held in check by high mortgage rates. The modest increase in home prices from $332,172 to $346,000, combined with 1.2% job growth, indicates that the area is set for significant growth as lower rates bring more buyers back into the market.

9. Harrisburg-Carlisle, PA

Median House Price (July 2024)

$357,200

5-Year House Price Appreciation

53.3%

Median Rent

$1,350

Harrisburg-Carlisle saw inventory increase slightly, with a reduction in median days on market from 34 to 30 days. Home prices increased from $337,225 to $357,200, showing that demand was suppressed, not absent. The area’s strong 1.8% job growth suggests economic vitality that will drive a market surge as rates drop.

10. Knoxville, TN

Median House Price (July 2024)

$478,280

5-Year House Price Appreciation

59.5%

Median Rent

$2,100

Knoxville experienced a significant increase in inventory and a slight rise in median days on market. Despite this, home prices remained stable, reflecting a market held back by high rates. However, with rates now decreasing, Knoxville’s solid economic base, as indicated by job growth, suggests that demand will likely surge in the coming months.

11. Louisville/Jefferson County, KY-IN

Median House Price (July 2024)

$337,400

5-Year House Price Appreciation

21%

Median Rent

$1,329

Louisville saw a slight increase in inventory and median days on market, along with stable home prices rising from $322,500 to $337,400. The area’s 1.2% job growth signals strong economic conditions, and with mortgage rates declining, suppressed demand is expected to drive significant market activity.

12. Madison, WI

Median House Price (July 2024)

$484,900

5-Year House Price Appreciation

37.5%

Median Rent

$1,823

Madison’s inventory increased, and median days on market dropped from 41 to 38 days, showing a market tightening even before rates fell. With home prices holding steady and 0.7% job growth, Madison is well-positioned for a demand surge as lower rates make homes more affordable, unlocking the market’s full potential.

13. Pittsburgh, PA

Median House Price (July 2024)

$250,000

5-Year House Price Appreciation

25.1%

Median Rent

$1,469

Pittsburgh experienced a slight increase in inventory and a drop in median days on market, suggesting a resilient market despite high rates. Home prices remained stable at around $250,000, with a 1.9% job growth, the highest in this list, indicating strong economic conditions that will likely fuel a significant market boom as rates decline.

14. Winston-Salem, NC

Median House Price (July 2024)

$355,193

5-Year House Price Appreciation

28.9%

Median Rent

$1,495

Winston-Salem saw a slight increase in inventory and median days on market, with home prices increasing from $339,898 to $355,193. This indicates a market with strong potential that was held back by high mortgage rates. With a stable economy and the job growth rate steady, the area is ready for a resurgence in demand as rates fall.

15. Youngstown-Warren-Boardman, OH-PA

Median House Price (July 2024)

$189,950

5-Year House Price Appreciation

46.2%

Median Rent

$975

Youngstown experienced a slight increase in inventory, with median days on market dropping from 40 to 39 days. Home prices rose from $180,538 to $189,950, and the area saw 0.7% job growth, reflecting a market with latent demand. With mortgage rates dropping, Youngstown is poised for a boom as more buyers re-enter the market.

As mortgage rates continue to decline in 2024, more buyers will become eligible for homeownership, leading to increased buyer activity nationwide. This trend is expected to drive a significant surge in demand across various markets. Our analysis of the top 15 metros reveals where this rebound is anticipated to be the most explosive. Investing in these high-potential markets could be a strategic move as the US housing market experiences renewed vigor and growth opportunities.

How We Came Up with This List?

The methodology for identifying top real estate investment markets focused on uncovering hidden gems with explosive growth potential. We selected 100 cities known for their investment promise but went beyond the mainstream to spotlight underrated locations ripe for significant demand surges.

Over a year, we analyzed key metrics such as total listings, median days on market, median prices, supply and demand scores, and job growth. This data revealed trends that highlighted cities on the brink of substantial growth. [Data Sources: Realtor.com, Zillow.com, and the Bureau of Labor Statistics (BLS)]

Our final report features the top 15 cities poised for explosive investment opportunities, offering investors a chance to capitalize on emerging markets before they hit the mainstream.

We’ve detailed the entire process with supporting data in the methodology document below. Check out!

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Realtor.com: Total inventory, Days on Market, Demand Score, Supply Score, Median House Prices

Zillow.com: Median Rent

Bureau of Labor Statistics: Job Growth

Mortgage Rates – Freddie Mac: Latest Mortgage Rates

![15 Underrated US Cities Primed for a Real Estate Boom as Rates Fall [2026]](https://homeabroadinc.com/wp-content/uploads/2024/09/15-underrated-cities-with-highest-real-estate-demand-as-mortgage-rates-fall-500x325.jpg)

![6 Best Places to Buy Rental Property in Florida [2026]](https://homeabroadinc.com/wp-content/uploads/2022/12/Best-Places-to-Buy-a-House-in-Florida.jpg)

![10 Best Places to Buy a House in Texas [2026]](https://homeabroadinc.com/wp-content/uploads/2022/12/Best-places-to-buy-house-in-Texas.jpeg)