Key Takeaways:

➡️ Foreign nationals, including newcomers and investors, can get loans in the US without a US credit history.

➡️ Expats don’t need a green card, and investors don’t need a visa to qualify for a foreign national mortgage.

➡️ Foreigners can buy primary residences, second homes, vacation houses, or investment properties with foreign national mortgages.

In 2024, international buyers invested a staggering $42 billion in US residential properties, according to the National Association of Realtors. Despite this, many foreign nationals still believe that purchasing property in the US is out of reach due to a lack of US credit history.

Fear not! There’s a beacon of hope for you. HomeAbroad Loans offers tailored foreign national mortgages specifically designed to help expats and foreign investors buy US real estate without a US credit history.

This guide explores these unique mortgage programs, how they work without a US credit history, and the steps to qualify.

Table of Contents

Can Foreign Nationals Get a Mortgage in the US?

Yes, foreign nationals can get a mortgage and buy a house in the US with little to no credit history. Your citizenship, immigration, or residency status does not affect mortgage qualification.

HomeAbroad Loans offers tailored US mortgage programs called foreign national mortgages, which allow newcomers on H1B, L1, or other visas and foreign investors to qualify for a mortgage without a US credit history.

Want to know what foreign national loans are? We got you covered!

What is a Foreign National Mortgage?

A foreign national loan is a US mortgage program designed for US newcomers and foreign investors who want to secure a loan with no US credit history.

US newcomers don’t need a green card or US citizenship to obtain mortgages. Similarly, foreign investors can secure loans without needing a US credit history.

HomeAbroad Loans offers these tailored foreign national mortgages without a US credit history. Our mortgage officers provide personalized support for foreign buyers, considering your immigration and credit situation.

If you’re an expat with a good credit score, HomeAbroad Loans can also help you qualify for a conventional mortgage, differentiating ourselves from our lenders as we understand the unique situation of an expat on a work visa.

Our expertise ensures a smooth, hassle-free journey to securing your mortgage. Get started today!

Now, let’s explore the different types of foreign national mortgages we offer and help you find the one that’s right for you.

Types of Foreign National Mortgage Loans

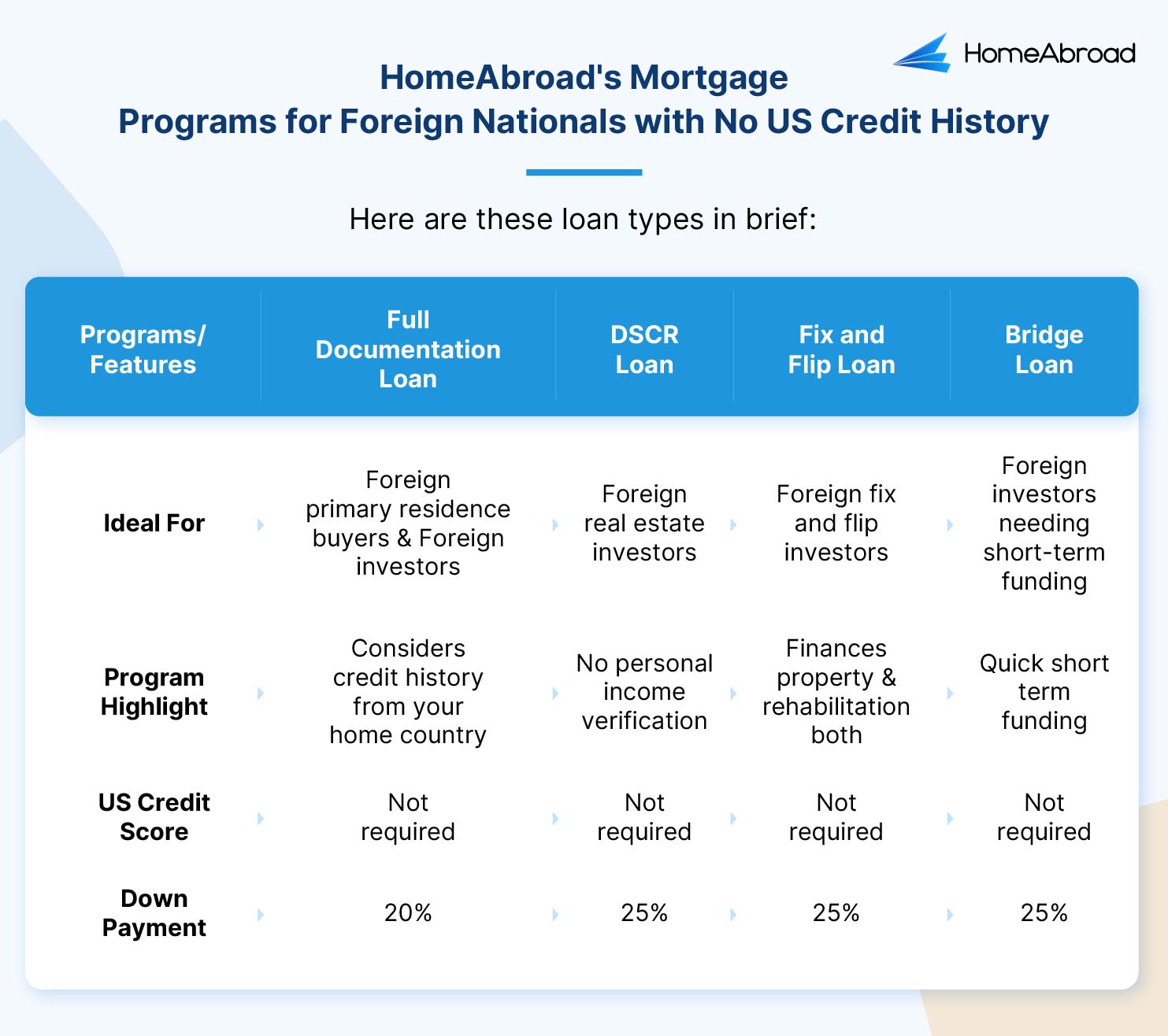

We provide four types of foreign national mortgages to meet the different home buying and investment needs of international real estate buyers in the US: Full Documentation Loans, DSCR (Debt Service Coverage Ratio) Loans, Fix and Flip Loans, and Bridge Loans.

Now, let us look at these loan programs in detail.

1. Full documentation loan

A Full Documentation Loan is a loan option for US newcomers and foreign investors with no US credit history. It requires extensive documentation to verify income, assets, employment status, and debts.

As US credit history is not available, we will require an International Credit Report (ICR) from your home country to assess your creditworthiness and financial history.

We also accept a bank reference letter or history of payment on two tradelines such as a credit card, mortgage etc. in the home country in lieu of a credit report from the home country.

Benefits:

- Qualification with no US credit history

- Foreign income and credit accepted

- Can qualify based on assets

Full Documentation Loan Requirements:

2. DSCR Loan

A Debt Service Coverage Ratio (DSCR) loan is a US mortgage program designed for real estate investors who who may not have a US credit history.

DSCR loans consider the income from the investment property instead of the borrower’s personal income, making it easier for foreign investors with no financial footprint in the country to qualify.

With these unique features and qualification methods, DSCR loans are a convenient US mortgage option for foreign real estate investors.

Benefits:

- No US credit history needed

- Qualification based on property’s income

- Multiple loans can be financed at the same time

- Fast approvals in less than 30 days

Please note these are general document requirements, and specifics may vary based on your lender.

DSCR Loan Requirements for Foreign Nationals:

- DSCR ratio of 0.75 or higher.

- Minimum down payment of 25%

- Amortization: 15- & 30-Year Fixed Rate and 30 Year Fixed – Interest Only

- Market rent appraisal or 12-months documented rental income

- 6 Months of PITIA Cash Reserves

- 12-month rental income history for short-term rentals (e.g., Airbnb)

- US Visa preferred but not required (For non-resident investors)

- Can close from the home country.

3. Fix and Flip Loan

Fix and Flip Loans are for real estate investors with no US credit looking to purchase, renovate, and resell properties for profit.

These short-term loans fund property purchases and renovations, helping investors capitalize on increased property value through renovations.

Benefits:

- Quick approval and closing under 15 days

- Funds for purchase and renovation

- Flexible terms

- Potential for high returns on investment

Fix and Flip Loan Requirements for Foreign Investors:

- 6-24 months loan term

- Down Payment of 25% – 30%

- LTC (Loan-to-Cost) up to 85%

- ARV (After Repair Value) of up to 75%

- Detailed renovation plan with cost estimates

- Proof of previous successful flip projects

- Fast approvals within 2 weeks

4. Bridge Loan

Bridge Loans are short-term financing solutions for real estate investors needing immediate funds to bridge the gap between selling an existing property and purchasing a new one.

They provide quick access to capital without a US credit history.

Benefits:

- Fast funding to secure new property before selling the old one

- Flexible terms and repayment options

- Usable for various property types

- Close in less than 15 days

Bridge Loan Requirements for Foreign Investors:

- 6-24 months loan-term

- Down Payment of 25% – 30%

- Up to 75% LTV (Purchase)

- Up to 70% LTV (Rate term Refi)

- Up to 65% LTV (Cash Out Refi)

- Proof of existing property equity

- Exit strategy for loan repayment (e.g., sale of property)

- Property appraisal

- Fast approvals within 2 weeks

This is it. Ready to get one of these foreign national mortgage programs?

HomeAbroad makes US real estate and mortgages easy and accessible for foreign nationals. We offer the best loan terms and experienced mortgage officers who specialize in working with foreign nationals, ensuring an effortless financing process.

Get started today!

Don’t take our word for it. Let us see what our client, Sophie Tremblay (Canada), who successfully secured a foreign national mortgage with no US credit history has to say:

HomeAbroad made the process of buying a vacation home in the US incredibly smooth. Their expertise in foreign national mortgages helped me secure a loan without the need for a US credit history. I couldn't be happier with the outcome.

Sophie Tremblay - Snowbird - Purchased a Vacation home in Miami, FL

Did that motivate you to apply for a DSCR Loan? Let me show you how you can do it!

How to Apply for a Foreign National Loan

Applying for a foreign national loan can seem challenging, but with proper preparation and guidance from HomeAbroad, the process can be straightforward and efficient.

Here’s a step-by-step guide:

Step 1: Assess Your Financial Situation

Understand your financial health by creating a budget to determine your mortgage allocation.

Assess your income, expenses, and savings to get a clear picture of your financial standing. Use our foreign national loan calculator to estimate your potential loan amount and monthly payments.

This step ensures that you are financially prepared and sets realistic expectations for your home search.

Step 2 – Get Started with HomeAbroad Loans

Finding trustworthy lenders who specialize in foreign national loans is essential.

Consider HomeAbroad Loans for competitive rates, flexible loan terms, and exceptional customer support.

We specialize in assisting US newcomers and foreign investors by offering tailored loan solutions without the need for a US credit history.

Our experienced mortgage officers will guide you through every step of the mortgage process.

Get started today!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

Step 3 – Connect with a HomeAbroad Mortgage Officer

After receiving your details, our mortgage officer will contact you to discuss your needs and answer any questions you may have.

Step 4 – Get Preapproval

Obtain a preapproval letter to indicate your borrowing capacity and serious intent to buy the property.

This letter strengthens your position with sellers, making your offers more competitive.

Our mortgage officer will request a few basic financial details based on your specific foreign national mortgage program for preapproval.

Step 5 – Gather Your Documents

Collect your documents for your specific loan program. Our mortgage officer will provide a detailed list of documents and guide you through the process for swift approval.

Our mortgage officers also help expats with established US credit history to secure a conventional mortgage as a foreigner.

Step 6 – Make an Offer on Your Dream Home

Once you find the perfect home, make an offer. Partner with our agent with international expertise to simplify the homebuying process.

They will also help you research and prepare a competitive offer.

Our expertise in negotiating and understanding market trends can give you an edge in securing your desired property.

Get a HomeAbroad agent in your area today!

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Step 7 – Lock in Your Interest Rate

Interest rates can fluctuate, so it’s crucial to lock in your rate to secure favorable terms. Your mortgage officer will guide you through this process to get you the best possible rate available at that time.

This step protects you from potential rate increases before closing and provides financial stability.

Step 8 – Underwriting & Appraisal

After processing your loan application, we will send it to an underwriter for review. The underwriter will assess your application to ensure that you meet all the loan requirements.

The underwriter will also order an appraisal to determine the current market value of the property. If the underwriter has any questions or needs additional information, they’ll reach out.

After complete analysis, the underwriter can approve, reject, or approve with conditions.

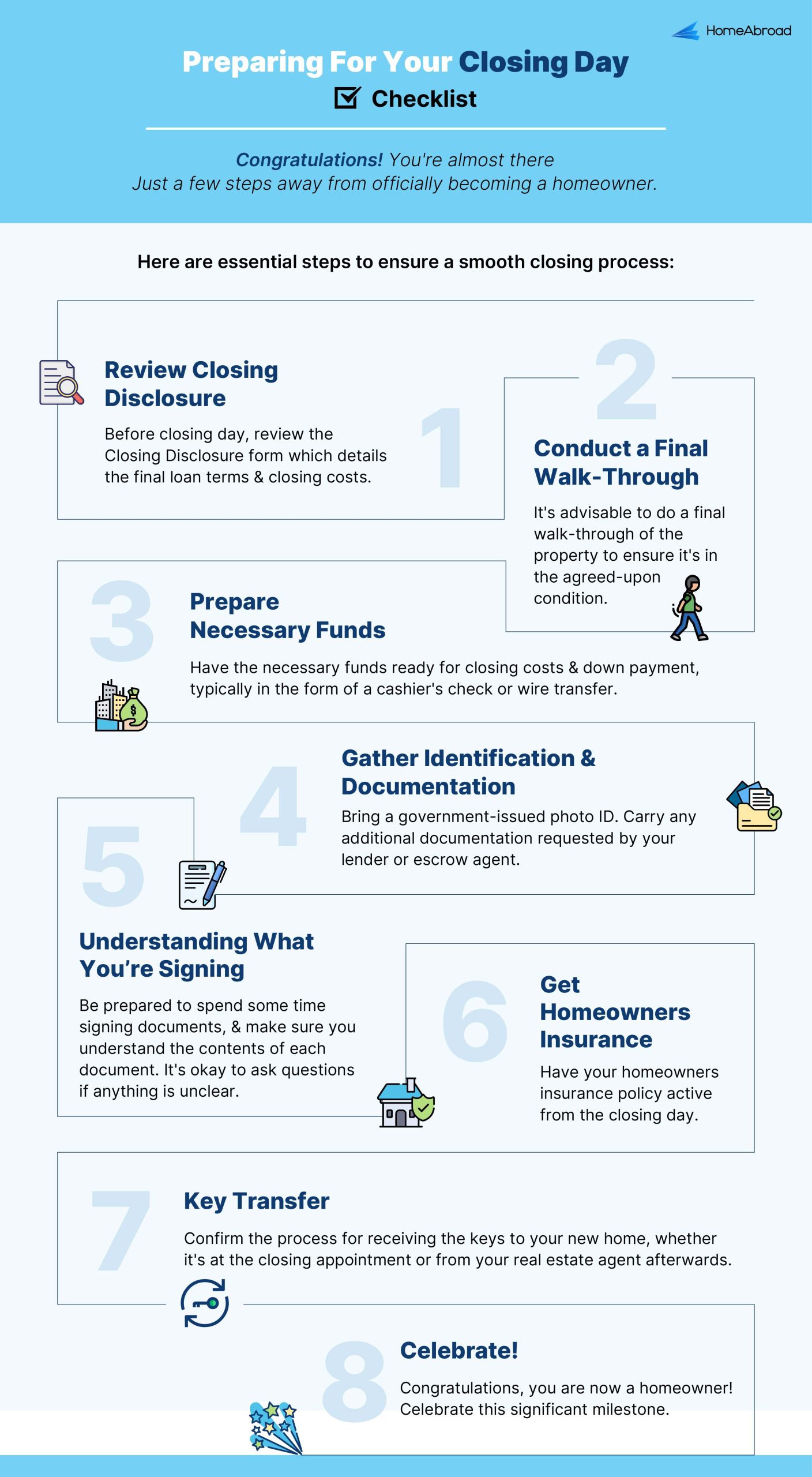

Step 9 – Closing

Once your loan has been approved and all the conditions have been met, including the completion of the title report and home inspection, you’ll attend a closing meeting.

At the closing, you’ll review and sign all the final paperwork, including the loan documents and any other closing documents.

You will also be paying closing costs, which may include costs for title search and appraisal, among other services.

Once everything is signed and you have paid the closing costs, you will receive the keys to your new home!

Here is a closing day checklist to be well-prepared for the big day.

Our expert foreign national mortgage officers at HomeAbroad understand the complexities of getting US mortgage loans for foreigners.

We strive to make the process simple and smooth for you. We follow a streamlined, technology-enabled platform that helps you qualify for a mortgage without the need to show a US credit history.

What’s more?

We also offer remote closing services for foreigners and investors. You can be anywhere in the world and still close on the property using our services. Talk to us to know more.

Additionally, if you’re an expat with a good credit score, we can help you qualify for a conventional mortgage, ensuring a smooth and hassle-free journey toward homeownership.

Now, you are ready to buy your dream house in the US!

Congratulations! You Got a US Mortgage.

Lenders are crucial for foreign investors and US newcomers to secure foreign national mortgages with little to no credit history. Working with knowledgeable and specialized lenders is therefore essential.

At HomeAbroad, we understand the challenges and are dedicated to helping you invest and purchase confidently.

Our expertise in foreign national mortgages ensures you receive the best terms and guidance to achieve your dream of owning US real estate.

Get started with your US real estate journey today!

Foreign National Loans: FAQs

Can foreign nationals close on a US mortgage from overseas?

Yes, it is possible. At HomeAbroad, we offer remote closing options, allowing you to complete the process from anywhere in the world.

What are the interest rates for foreign national mortgage loans?

Foreign national mortgage loans rates are generally higher. However, HomeAbroad Loans offers the most competitive loan terms to enable foreign nationals to buy real estate in the US. Check the latest foreign national mortgage rates here.

Do I need a US credit history to buy a house?

Foreign national loans are tailored for foreign buyers without a US credit history. We use credit reports from your home country and other assessment methods to bypass the traditional credit check.

What types of properties can I buy with a non-US citizen mortgage?

Foreign nationals can buy various types of properties, including single-family homes, condos, townhouses, and investment properties. The type of property you can purchase may depend on the specific loan program and lender requirements.

How do I improve my chances of getting approved for a foreign national mortgage?

To improve your chances of getting approved, ensure you have all the necessary documentation and maintain a strong financial profile. We can help you get all your documents in order so you can get your loan quickly and smoothly.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

![Foreign National Mortgage Rates in [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/FNMortgageRates.jpg)

![How to Buy a House on an H1B Visa [2025]](https://homeabroadinc.com/wp-content/uploads/2021/08/BuyingonH1BVisa-scaled.jpg)