Key Takeaways:

➡️ Researching multiple DSCR loan lenders allows investors to find the most favorable loan terms for their investment strategy.

➡️ Verify that the lender is experienced in handling DSCR ns and your loan officer understands key financial metrics around real estate investment.

➡️ Consider loan programs and products offered by the lender such as interest-only, cash-out refinancing, and maximum Loan to Value (LTV), Cash reserve requirements etc.

Table of Contents

Choosing the right DSCR lender can make or break your real estate investment success. With DSCR loans focusing on rental income instead of personal income, they offer investors a powerful financing option that aligns directly with the cash flow generated by the property.

To maximize your returns and secure the most favorable loan terms, it’s essential to evaluate potential lenders carefully.

From comparing rates to understanding loan programs, the right DSCR lender will ensure your investment strategy thrives without unnecessary financial hurdles.

What is a DSCR Loan Lender?

A DSCR lender offers loans based on the Debt Service Coverage Ratio (DSCR), which focuses on a property’s ability to generate rental income that covers the debt service (monthly mortgage payment) rather than relying on the borrower’s personal income or tax returns.

This makes DSCR loans ideal for real estate investors looking to maximize cash flow.

For mortgage qualification on investment properties, the DSCR (Debt Service Coverage Ratio) is calculated by dividing the Gross Rental Income by PITIA, where:

➡️ P stands for Principal,

➡️ I for Interest,

➡️ T for Property Taxes,

➡️ I for Insurance, and

➡️ A for additional expenses like HOA (Homeowner Association) fees.

This ratio helps assess whether the property’s income sufficiently covers its debt obligations.

A higher DSCR signals that the property’s income not only covers the mortgage payment but also generates additional cash flow, leading to better loan terms. Most lenders require a DSCR of at least 1, though the higher the ratio, the more favorable the terms.

For a detailed breakdown on DSCR Loans and how it can help maximize investment returns, check out our Complete DSCR Loan Guide.

7 Tips for Finding the Right DSCR Lender

Tip 1: Research & Compare Lenders

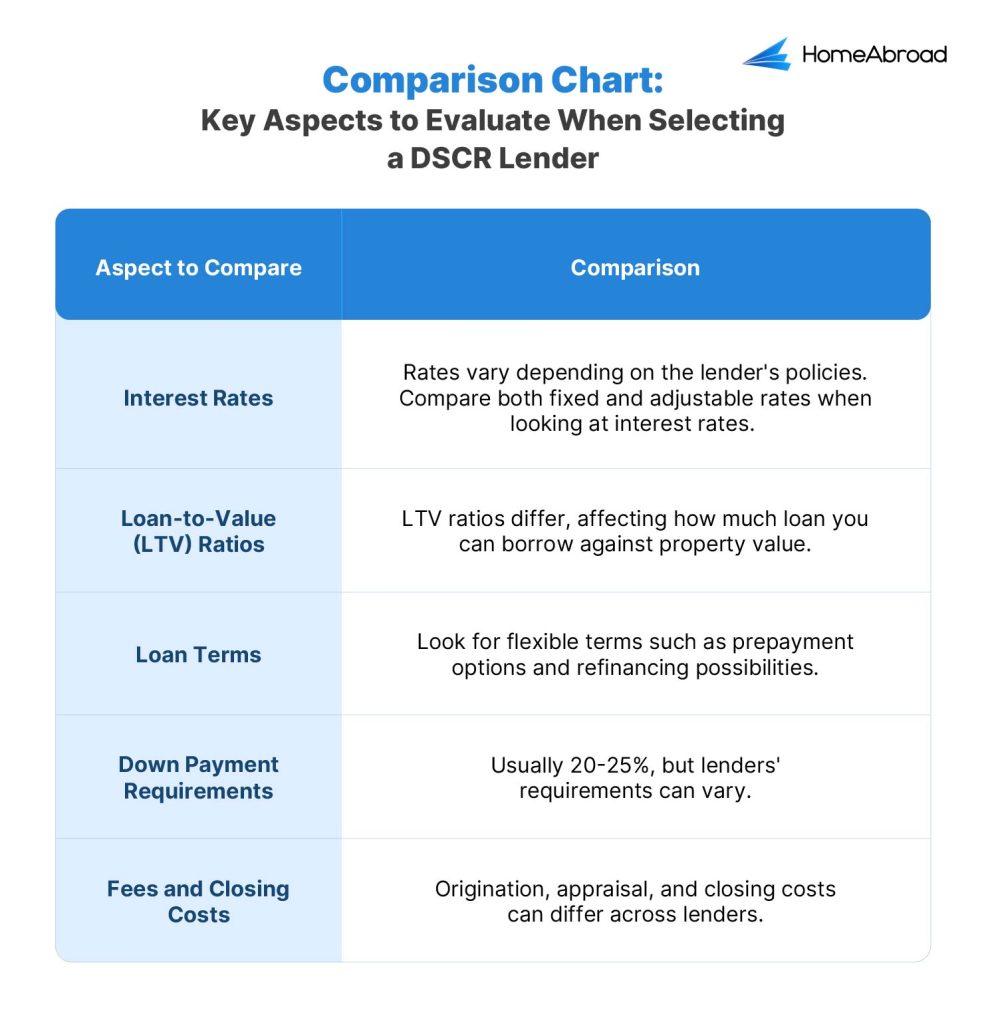

Finding the best DSCR loan for your investment requires comparing loan terms, interest rates, and eligibility requirements. Not all lenders offer the same loan-to-value (LTV) ratios or loan terms.

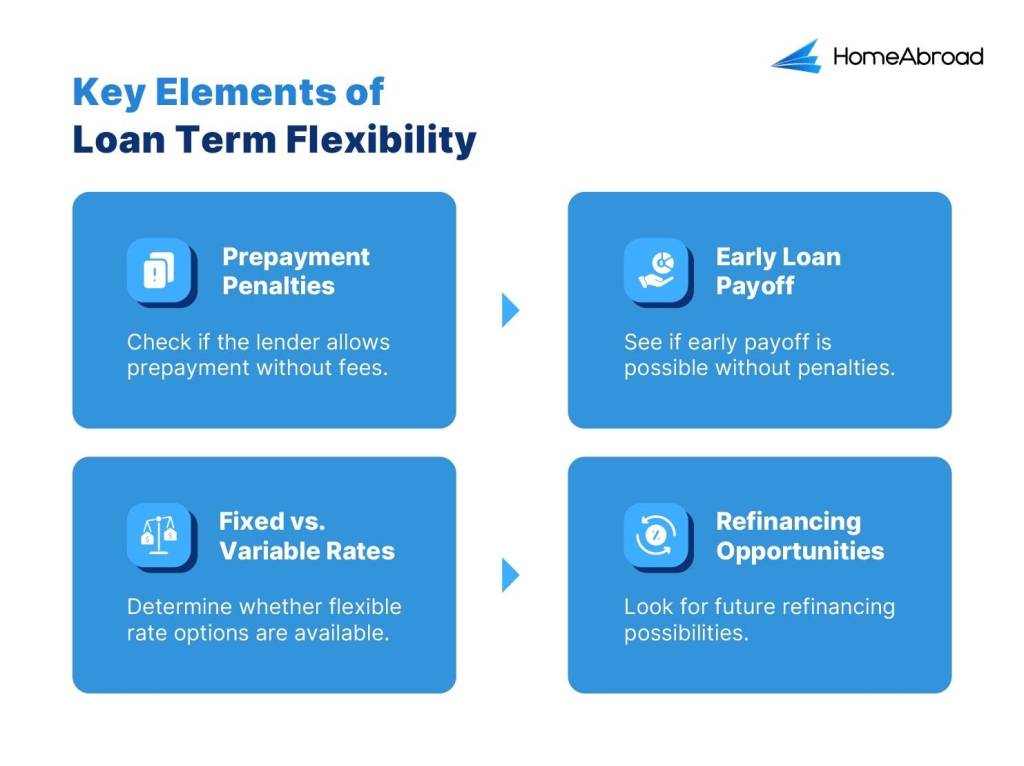

Key factors such as prepayment penalties, rental income evaluation, and property income potential can greatly affect your overall returns.

Be sure to check if the rate quoted includes discount points, which might result in additional fees at closing. It’s best practice to compare Annual Percentage Rate (APR) —which reflects the total cost of borrowing including fees—versus the rate when comparing quotes from various DSCR lenders.

Tip 2: Check Credentials & Experience

When choosing a DSCR lender, it’s essential to work with one that is experienced in working with real estate investors. Lenders accredited by NMLS and with expertise in underwriting DSCR loans understand the unique challenges faced by real estate investors.

Tip 3: Evaluate Loan Products and Programs

Not all DSCR loans are created equal. Some lenders offer higher LTV for purchase transactions, and favorable terms for maximum cash-out refinancing or cash reserve requirements. These programs may vary depending on whether you are dealing with short-term rentals (STRs) or long-term rentals (LTRs).

Pay close attention to the loan program details, which can vary based on the lender and property type.

Tip 4: Request Interviews with Lenders

Before finalizing a DSCR loan, it’s important to speak directly with your loan officer. Key questions to ask include how the DSCR ratio is calculated, down payment requirements, and details about the loan program. These conversations help ensure that the lender’s loan products align with your investment goals.

Below are key questions to guide your conversations:

DSCR Calculation and Flexibility:

1. How do you calculate the Debt Service Coverage Ratio (DSCR)?

2. Can DSCR requirements be flexible, especially if I have strong cash reserves or significant investment experience?

3. What happens if DSCR comes lower than 1?

Loan Product Specifics:

1. Can you provide detailed information about the loan products you offer for investment properties and their requirements?

2. Does your loan terms differ for long-term rentals (LTRs) versus short-term rentals (STRs)?

3. Does your pricing for DSCR differ for Fixed vs. ARM loans? If yes, for adjustable-rate mortgages, which index are they tied to, and how often do the rates adjust?

Credit Score Impact:

1. Beyond the minimum credit score requirement, how does my credit score influence the loan terms and interest rates?

Equity and Down Payment Programs:

1. Are there any special programs or considerations for experienced investors, particularly regarding down payment requirements?

Understanding Fees in Depth:

1. Can you explain specific fees listed in the quote, such as origination or underwriting fees? Are there any discount points charged for the rate?

2. Are there any potential future costs or hidden fees not outlined in the initial quote?

Cash Reserves:

1. Are cash reserves required? If so, for how many months?

2, How do you verify cash reserves, and what types of assets are considered acceptable?

Prepayment and Extra Payments:

1. Can you elaborate on the prepayment penalty terms, if any?

2. Are there specific conditions or fees for making extra payments toward the principal?

Lock-in Rate Details:

1. Can you explain the rate lock-in option, if available?

2. How long does the rate lock-in last, and what happens if interest rates change significantly during this period?

Loan Processing Insights:

1. What common challenges or delays occur during loan processing, and how can they be mitigated?

2. What exact documents are required, and how long does the loan processing typically take?

Investment Experience Evaluation:

1. How do you evaluate a borrower's real estate investment experience, and how does it impact the loan terms or approval process?

Tip 5: Understand Fees & Hidden Costs

DSCR loans often come with various fees, such as origination fees, underwriting fees, prepayment penalties, and discount points for quoted rates. It’s essential to ask for a complete breakdown of all potential costs to avoid surprises later on. Knowing the full cost of your loan helps you make informed decisions.

Tip 6: Evaluate Customer Service & Support

Great customer service is crucial when applying for a DSCR loan. A responsive and knowledgeable lender can make all the difference, particularly when you’re navigating complex financial products or dealing with foreign investment properties.

Let us see what our client had to say about our services:

I’ve worked with several lenders before, but HomeAbroad Loans provided exceptional customer service. They were responsive and knowledgeable, making sure I had everything I needed to close on time. Their personalized support is unmatched!” – Emily R., Multifamily Property Investor

Tip 7: Finalize Your DSCR Lender

After reviewing loan terms, interest rates, fees, and DSCR ratio requirements, it’s time to make a final decision. Select a lender who offers not only favorable loan terms but also strong customer service and transparency throughout the process.

Why Should I Get a DSCR Loan?

DSCR loans are a powerful tool for real estate investors because they focus solely on the income potential of the property, not the borrower’s personal finances.

This makes them ideal for both domestic and foreign investors looking to expand their portfolios without traditional income verification hurdles. DSCR loans provide flexibility in terms of loan eligibility and offer a streamlined process for qualifying based on rental income.

Scenario: How DSCR Affects Loan Requests

Investor Profile:

Name: Sarah Mitchell (Name Changed for Privacy)

Investment Property: 12-unit multifamily rental in Austin, Texas

Gross Rental Income: $180,000

PITIA (Principal, Interest, Taxes, Insurance, Homeowner Association dues): $120,000

Sarah Mitchell, an experienced real estate investor, wanted to purchase a 12-unit multifamily property in Austin, Texas. However, due to her personal income documentation challenges, she struggled to qualify for a conventional loan.

Sarah decided to explore HomeAbroad Loans’s DSCR loans, where the focus is on the property’s cash flow rather than her personal finances.

After reviewing the property’s rental income, she found that the gross annual income from the rental units was $180,000. The combined PITIA—which includes principal, interest, taxes, insurance, and association dues—was $120,000 annually.

To determine whether the property qualifies for a DSCR loan, HomeAbroad Loans calculated the Debt Service Coverage Ratio (DSCR):

So, Sarah’s DSCR is 1.5.

A DSCR of 1.5 means that the property generates 1.5 times the amount required to cover the loan’s debt service, showing strong cash flow.

With a DSCR of 1.5, Sarah was able to secure a DSCR loan from HomeAbroad Loans. Since the focus was on the property’s income, she didn’t need to provide extensive personal income verification or worry about her credit score.

The DSCR loan allowed her to move forward with the investment and increase her portfolio of rental properties.

This case illustrates how DSCR loans can help investors like Sarah, who face challenges with traditional lending, unlock profitable real estate opportunities by focusing on the property’s ability to cover its debt obligations.

Why Choose HomeAbroad Loans for DSCR Loans?

At HomeAbroad Loans, we specialize in providing DSCR loans that are specifically tailored to the needs of real estate investors. Whether you are a domestic investor or a foreign national, our loan products are designed to maximize your investment returns by focusing on property cash flow rather than personal income.

Here’s why HomeAbroad Loans is the right choice for you:

- Flexible Loan Terms: We offer competitive loan-to-value (LTV) ratios, interest-only options, and flexible cash-out refinancing programs to help you build and grow your real estate portfolio.

- Flexible Options for Domestic and Foreign Investors: At HomeAbroad Loans, we offer DSCR loans for both US domestic investors and foreign nationals. While domestic investors’ loan terms are influenced by their credit score, foreign nationals can qualify without a traditional US credit score, focusing instead on the property’s rental income potential. This flexibility ensures that both domestic and international investors can access the financing they need to grow their portfolios.

- Transparent Fee Structure: Our transparent fee structure ensures that there are no hidden costs or surprises during the lending process. You’ll know upfront what to expect.

- Expertise & Support: Our team brings years of experience in DSCR loans and works with investors of all sizes—from first-time investors to those managing large portfolios. We guide you through the process to ensure smooth transactions.

- Personalized Loan Solutions: Every investment is unique, which is why we offer tailored loan programs based on your property type, investment strategy, and financial goals.

If you’re looking for a lender that prioritizes your success and provides comprehensive support throughout the entire loan process, HomeAbroad Loans is here to help you achieve your investment goals with confidence.

FAQs

1. What is a DSCR loan, and how is it different from a traditional mortgage?

A DSCR (Debt Service Coverage Ratio) loan focuses on the property’s ability to generate income rather than the borrower’s personal income or credit score. Unlike traditional mortgages, DSCR loans rely on the property’s cash flow to determine loan eligibility, making them ideal for real estate investors.

2. How is the DSCR calculated for a DSCR loan?

In the context of mortgage, DSCR is calculated by dividing the Gross Rental Income by the PITIA (Principal, Interest, Taxes, Insurance, and Association dues).

For example, if the property’s income is $150,000 and the PITIA is $100,000, the DSCR would be 1.5, indicating that the property generates sufficient income to cover debt obligations.

3. What is the minimum down payment for a DSCR loan?

At HomeAbroad Loans, the minimum down payment for a DSCR loan typically ranges from 20% (Domestic Invetsors) to 25% (Foreign Investors) of the property’s purchase price.

4. Can foreign nationals qualify for a DSCR loan with HomeAbroad Loans?

Yes, HomeAbroad Loans offers DSCR loans specifically tailored to foreign nationals. Since DSCR loans focus on the property’s cash flow rather than personal income or credit score, they provide an excellent financing option for international investors in US real estate.

5. Can I use a DSCR loan to refinance an existing investment property?

Yes, DSCR loans can be used for refinancing existing investment properties. This includes both rate-and-term refinancing to secure better loan terms and cash-out refinancing to access the equity in your property for further investments.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

![How to Find the Right DSCR Lender – Top 7 Tips [2025]](https://homeabroadinc.com/wp-content/uploads/2022/10/Find-DSCR-loan-lender-500x325.jpg)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![How to Get DSCR Loans for Airbnb? [A 2025 GUIDE]](https://homeabroadinc.com/wp-content/uploads/2022/10/DSCR-loans-for-airbnb.png)

![DSCR Loan Interest Rates Today [July, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates.jpg)