Key Takeaways:

➡️ DSCR loans rely on the property’s rental income rather than the borrower’s personal income, making them ideal for real estate investors.

➡️ No-ratio DSCR loans, offered by HomeAbroad Loans, allow qualification without meeting the standard DSCR threshold, providing greater accessibility.

➡️ These loans feature flexible terms tailored to the needs of Airbnb investors.

➡️ DSCR loans streamline the approval process, enabling faster financing for high-demand Airbnb markets, maximizing returns for investors.

Table of Contents

Dreaming of owning an Airbnb that generates income while you sleep? Traditional financing can make this feel impossible—but DSCR loans (Debt Service Coverage Ratio loans) offer a smarter way.

Unlike conventional loans, DSCR loans focus on the property’s rental income, not your personal finances. Whether you’re a US-based investor expanding your real estate portfolio or a foreign national entering the booming US short-term rental market, these loans provide the flexibility you need.

With streamlined approvals and income-based qualification, DSCR loans are designed for savvy investors ready to turn their Airbnb and Vrbo dreams into a profitable reality.

Ready to unlock the potential of your next Airbnb? Let’s get started.

What are DSCR Loans?

A DSCR (Debt Service Coverage Ratio) loan is a tailored mortgage option that focuses on a property’s rental income rather than the borrower’s personal income to determine eligibility.

This makes them ideal for real estate investors, especially in short-term rental markets like Airbnb and Vrbo.

Unlike traditional loans, DSCR loans focus on cash flow. If a property’s income can cover its expenses, it qualifies—simplifying financing for domestic and foreign investors alike.

At HomeAbroad Loans, we recognize that successful investors understand the value of cash flow.

Here’s the simple rule: If the property’s income can cover its expenses, it qualifies. This makes DSCR loans ideal for:

✅ Domestic investors who want to scale their portfolios quickly.

✅ Foreign nationals seeking to invest in the thriving US short-term rental market without needing a US credit history.

Now that you understand what DSCR loans are, let’s explore how to calculate DSCR specifically for short-term rental properties like Airbnb.

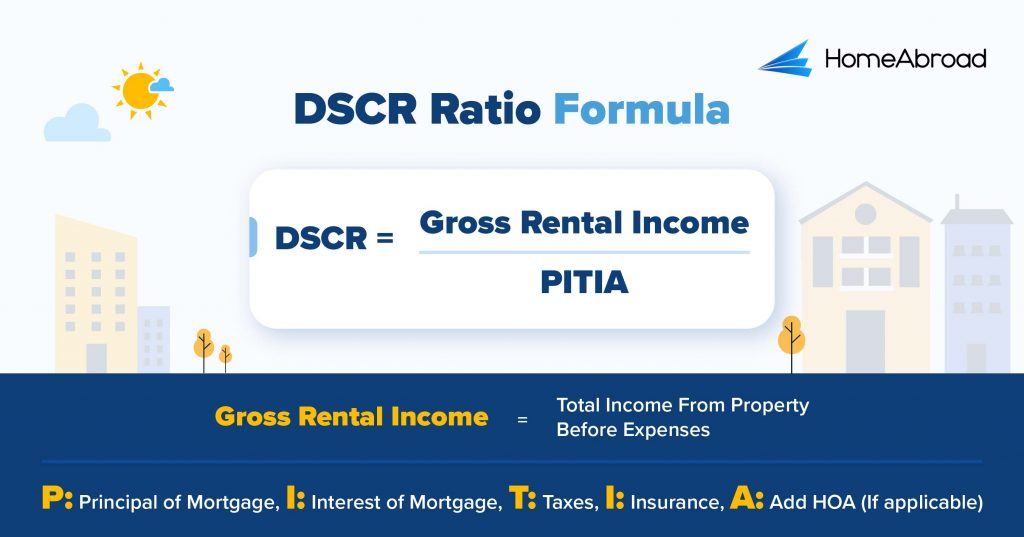

How To Calculate DSCR for Short-Term Rentals?

For short-term rentals like Airbnbs, DSCR is calculated using the property’s gross rental income divided by its total PITIA (Principal, Interest, Taxes, Insurance, and Association fees).

Here is how you can calculate it:

DSCR Calculation Example: Gross Rental Income: $2,000/month PITIA: $1,600/month DSCR = $2,000 ÷ $1,600 = 1.25 This means the property generates 25% more income than required to cover its expenses.

While many lenders require a DSCR of 1 or higher, HomeAbroad offers no-ratio DSCR loans, providing financing even for properties with a DSCR between 0 and 0.99.

This flexible option enables investors to secure funding for properties with growth potential or temporary income limitations.

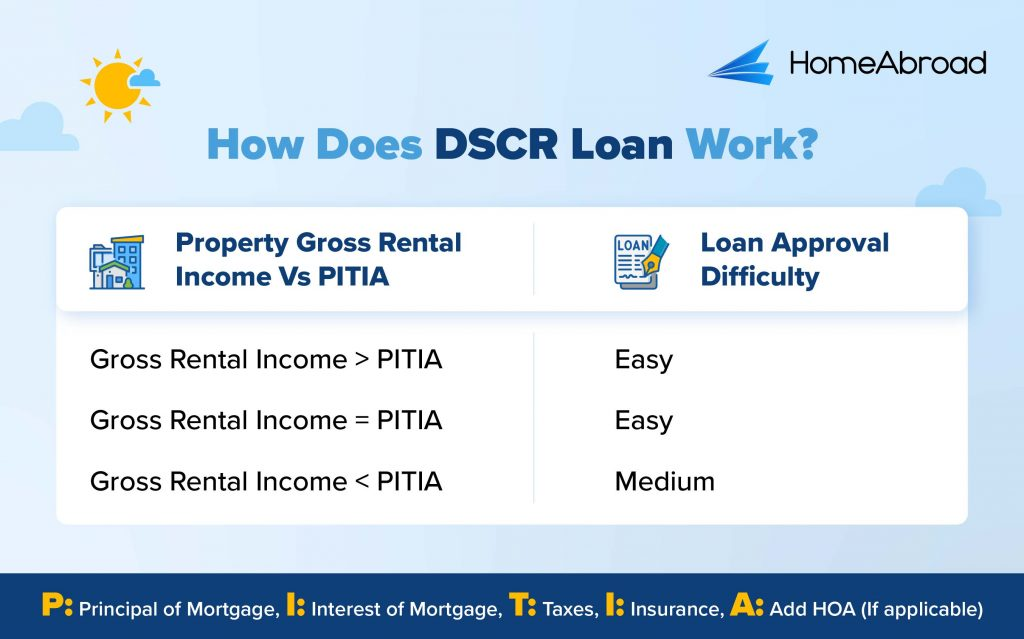

In general, this is how DSCR Loans work:

You can check our comprehensive DSCR Loan guide to understand how DSCR Loans work.

Before we move any further, it’s important to know both the qualification criteria and the documents you’ll need.

How to Qualify for a DSCR Loan for Airbnb?

Qualifying for a DSCR loan is easier than traditional mortgages because the focus is on the property’s income, not personal financials. Here’s what you need:

| Criteria | Domestic Investors | Foreign Investors |

| DSCR Ratio | 1.0 or higher (No-Ratio DSCR* available) | 1 or higher (No-Ratio DSCR* available) |

| Credit Score | Minimum 620 | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% (Purchase/Rate-Term Refinance) | Up to 75% (Purchase/Rate-Term Refinance) |

| Cash Reserves | 2 months | 6 months |

| Loan Amount | $75K – $10M | $75K – $10M |

✅ No-Ratio DSCR: HomeAbroad offers no-ratio DSCR loans, providing financing even for properties with a DSCR between 0 and 0.99. However, you will have to bring in an additional 5% as down payment.

Now that we know how to qualify, let us look at the documents you need to keep ready.

What Are the Key Documents Required for DSCR Loans for STRs?

Below is a detailed breakdown of the required documents and other key criteria for STR financing, presented in a clear, easy-to-read table.

| Requirement Type | Details |

| Rental Income Statements | ➡️ Monthly or annual statements from STR platforms (e.g., Airbnb or Vrbo) showing 12 months of rental revenue. ➡️ Must identify the subject property and gross rental income before management fees. |

| Bank Statements | ➡️ For single-property owners: 12 months of bank statements showing deposits for rental income. ➡️ For multiple-property owners: STR platform statements clearly linking income to the subject property. |

| Appraisal Reports | ➡️ FNMA Forms 1007/1025 Comparable Rent Schedule prepared by a licensed appraiser. ➡️ Includes long-term and short-term rental estimates based on market comparables. |

| AirDNA Reports | ➡️ For purchase transactions, AirDNA reports provide projected STR revenue. ➡️ Must include a minimum 60% occupancy rate, five comparable properties, and a 20% expense adjustment to gross income. |

| Income Utilization | ➡️ 75% of the verified gross rental income is used to offset PITIA (Principal, Interest, Taxes, Insurance, and Association fees). |

| STR Platform Evidence | ➡️ Screenshot showing the property listed as a short-term rental (e.g., Airbnb). |

| Property Eligibility | ➡️ The property must be zoned for STR use and comply with all applicable regulations. ➡️ Appraisals should confirm the property is suitable for short-term rental purposes. |

| Vacant or Non-Rented STRs | ➡️ If the property lacks rental history, market-based projections or appraisals are required to estimate income potential. |

But why are DSCR loans particularly suited for Airbnb properties? Let’s explore what makes them a game-changer for short-term rental investors.

Why are DSCR Loans Popular Among Short-Term Rental Investors?

DSCR loans (Debt Service Coverage Ratio loans) have emerged as the go-to financing option for investors in short-term rentals (STRs) like Airbnb and Vrbo.

These loans provide unmatched flexibility by relying on a property’s rental income, not the borrower’s personal financials, making them ideal for building and scaling real estate portfolios.

Here are some reasons why DSCR Loans are popular for STRs:

✅ No DTI Requirement: Perfect for Portfolio Growth

Unlike traditional loans, DSCR loans bypass personal income verification, meaning investors don’t need to meet strict debt-to-income ratio (DTI) requirements.

This makes them an excellent choice for experienced real estate investors looking to scale quickly, as well as first-time buyers entering the lucrative Airbnb market.

✅ Income-Based Qualification: Tailored for STR Investments

DSCR loans are particularly well-suited for short-term rental properties, as they can be underwritten using the property’s 12-month historical rental income or market-based projections.

This allows investors to leverage the property’s earning potential to secure financing, even if their personal financials are complex.

✅ Build Multiple STR Properties

With each property evaluated on its individual revenue potential, DSCR loans allow investors to secure financing for multiple STR properties without being limited by their personal income.

✅ Confidence in Cash Flow:

Qualifying for a DSCR loan means the lender has verified the property’s cash flow, giving investors peace of mind. For STRs, income is calculated using:

- Historical performance data (e.g., 12 months of Airbnb revenue).

- Independent appraiser projections for expected rental income.

✅ Focus on Property Performance

Unlike traditional loans, DSCR loans assess the property’s ability to generate income. This makes them ideal for Airbnb properties, where rental income is the key driver of investment returns.

No W-2s, tax returns, or extensive financial documents are required—just proof of the property’s performance or projections.

✅ Flexible Loan Terms

DSCR loans offer flexibility that suits the dynamic nature of Airbnb investments. Investors can choose from 30-year fixed-rate loans or other tailored terms.

HomeAbroad Loans even offers no-ratio DSCR loans, making qualification easier for eligible borrowers.

✅ Simplified Approval Process

By eliminating the need for extensive personal documentation, DSCR loans streamline the approval process. This is perfect for investors in competitive Airbnb markets who need financing quickly to secure the best properties.

With unmatched accessibility, flexibility, and efficiency, DSCR loans are a powerful tool for Airbnb investors. But how to apply for one? Let’s break down the steps.

4-Quick Steps to Apply for a DSCR Loan for Airbnb

1️⃣ Connect with HomeAbroad’s Loan Officer

Connect with an expert loan officer at HomeAbroad Loans or Ziffy Mortgage to discuss your investment goals and property details.

2️⃣ Complete Investment Analysis

HomeAbroad’s loan officer will evaluate the property’s potential by analyzing its expected or current rental income, expenses, and market trends.

DSCR Calculation: They will calculate the DSCR by dividing the property’s gross rental income by its total debt obligations (PITIA: Principal, Interest, Taxes, Insurance, HOA fees).

A DSCR of 1 or higher is typically required, but HomeAbroad Loans also offers no-ratio DSCR loans for properties with a DSCR less than. 1.

❗️ Please note that you will be required to bring 5% additional downpayment if the DSCR ratio is less than 1.

3️⃣ Loan Approval

Once eligibility is confirmed, choose from flexible loan terms such as 30-year fixed. Your loan officer will guide you through selecting the best terms for your investment strategy.

4️⃣ Close Your Loan

Finalize the loan agreement and complete the closing process. Your funds will be ready to invest in your Airbnb property.

❗️ Pro Tip: HomeAbroad Loans offers a streamlined process for foreign nationals and domestic investors, ensuring a smooth experience for all borrowers.

To get detailed information on the steps to apply for a DSCR loan, check out our DSCR loan guide.

Conclusion

DSCR loans are a game-changer for Airbnb investors, providing a flexible and efficient way to finance short-term rental properties.

Whether you’re a US-based investor or a foreign national, Ziffy Mortgage and HomeAbroad Loans offer tailored solutions to help you succeed in the thriving short-term rental market.

With benefits like no personal income documentation, simplified approval processes, and customizable loan terms, DSCR loans open the door to profitable Airbnb investments in the US.

Ready to turn your dream of Airbnb ownership into reality?

FAQs

1. What is the minimum DSCR required for a DSCR loan?

Most lenders require a minimum DSCR of 1, which means the property’s income should cover its loan payments. However, HomeAbroad Loans offers no-ratio DSCR loans for properties with a DSCR as low as 0.75, making it easier to qualify for financing.

2. Can I qualify for a DSCR loan as a foreign national?

Yes! HomeAbroad Loans specializes in financing for foreign nationals. You don’t need a US credit history or residency to qualify. The focus is on the property’s rental income, not your personal income.

3. Can projected income from Airbnb bookings be used to qualify?

Absolutely. For Airbnb properties, DSCR loans can consider market-based rental income projections, especially for properties in high-demand areas. HomeAbroad’s loan officer will perform a thorough investment analysis to evaluate eligibility.

4. What are the typical down payment requirements for a DSCR loan?

Down payments typically range between 20% for domestic investors and 25% for foreign nationals.

5. How long does it take to close a DSCR loan?

DSCR loans generally have a faster approval and closing process than traditional loans. At HomeAbroad, we have a speedier process, and you can close your loan within 30 days.

![How to Get DSCR Loans for Airbnb? [A 2025 GUIDE]](https://homeabroadinc.com/wp-content/uploads/2022/10/DSCR-loans-for-airbnb-500x343.png)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![How to Find the Right DSCR Lender – Top 7 Tips [2025]](https://homeabroadinc.com/wp-content/uploads/2022/10/Find-DSCR-loan-lender.jpg)

![DSCR Loan Interest Rates Today [June, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates.jpg)