As of [February, 2025], DSCR loan interest rates range from 6.5% to 8.5%, with variations depending on lender-specific terms and individual borrower profiles.

Interest rates are a significant factor in deciding the overall cost of a DSCR or any other loan. Interest rates can significantly impact profitability if you get a DSCR loan for your investment property.

However, investors need to understand how current rates impact their investments. This article will examine the DSCR Loan interest rates and how they can affect you as an investor.

Let’s start!

Table of Contents

Current DSCR Loan Interest Rates [June, 2025]

As of [February, 2025], the starting average DSCR loan interest rate is 6.5%, given the ideal lending conditions, such as a good DSCR ratio, favorable LTV, and strong credit score. This rate is just the baseline, and your exact interest rate could be higher or lower depending on your financial profile and lender.

Typically, DSCR loan rates are 1%- 1.5% higher than conventional mortgage rates due to the unique nature of DSCR loans and the associated increased risk for the lender.

In October 2023, interest rates were at record highs in the last decade but started to fall after November 2023. Rates have cooled but are still hovering around 7%, leaving many real estate investors debating whether to wait or move forward with their investment plans.

Now, interest rates are lower than last year; as we predicted through our survey last year, property prices will shoot up once rates go down.

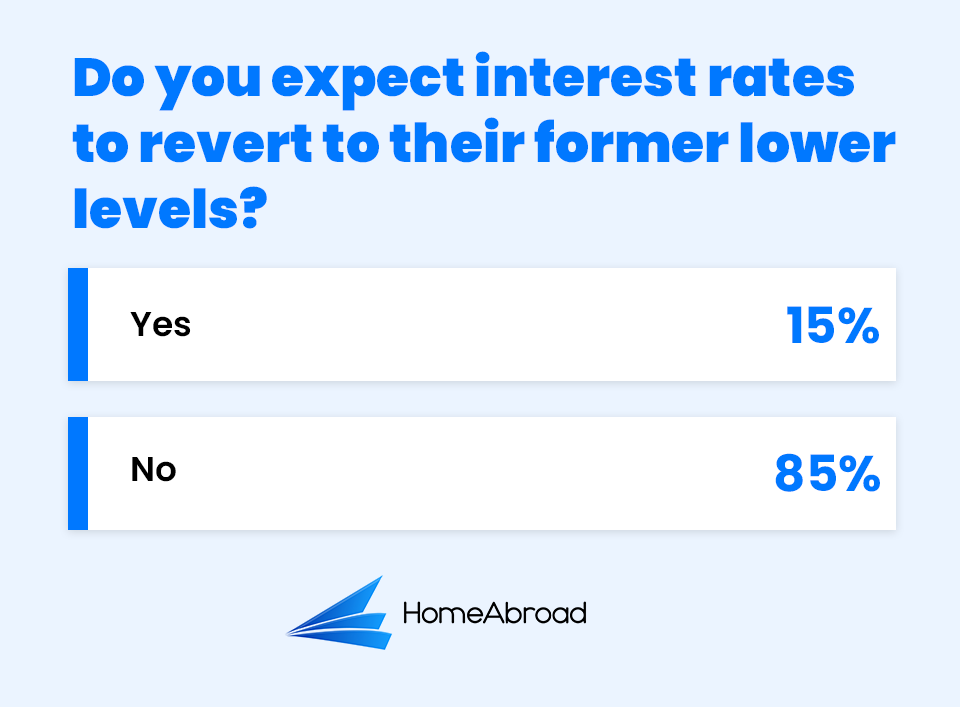

We surveyed our network of real estate experts, agents, and lenders to gauge market sentiment. Here are the results:

43.1% of the respondents said “yes,” i.e., prices will increase when rates drop. 29.8% said “no,” waiting for rates to fall. Lastly, 23.3% said “no,” we are in a recession.

In another poll about future interest rate trends, approximately 85% of respondents do not foresee rates returning to their former lows shortly.

The market experts also say this is the new normal of the housing market, as the Fed will not immediately cut interest rates. (Source: NBC News)

Here’s my advice to help you decide on whether you should wait or buy, given high DSCR loan interest rates:

As they say, “Marry the house, date the rates,” investors should buy to start building equity. Moreover, the high prices and mortgage rates will keep the competition out, and you might land a better deal.

Instead of waiting, you start building the equity in your property, and you can always refinance if rates go further down, which is highly unlikely shortly.

Before making the final call, review the numbers with your investment strategy. If the numbers work for you, go ahead.

Want to know more about the rates? Here is how the DSCR loan interest rate is calculated.

Factors that shape DSCR loan interest rates

Here are the factors that influence the DSCR loan interest rates. Understand these factors to optimize your profile and get better interest rates.

1. DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a metric used to assess the income-generation capability of a property against its debt obligations. To calculate DSCR in real estate financing, you divide the property’s annual/monthly gross rental income by its total yearly/monthly debt obligations, which includes Principal, Interest, Taxes, Insurance, and HOA.

For example, if a property's gross income is $120,000 yearly and the total debt obligation is $100,000, the DSCR will be 1.2. This number means the property generates 20% more income than its total debt obligations.

A DSCR of 1 or higher is required to get a DSCR loan, as it shows sufficient income to pay for its mortgage and other necessary expenses.

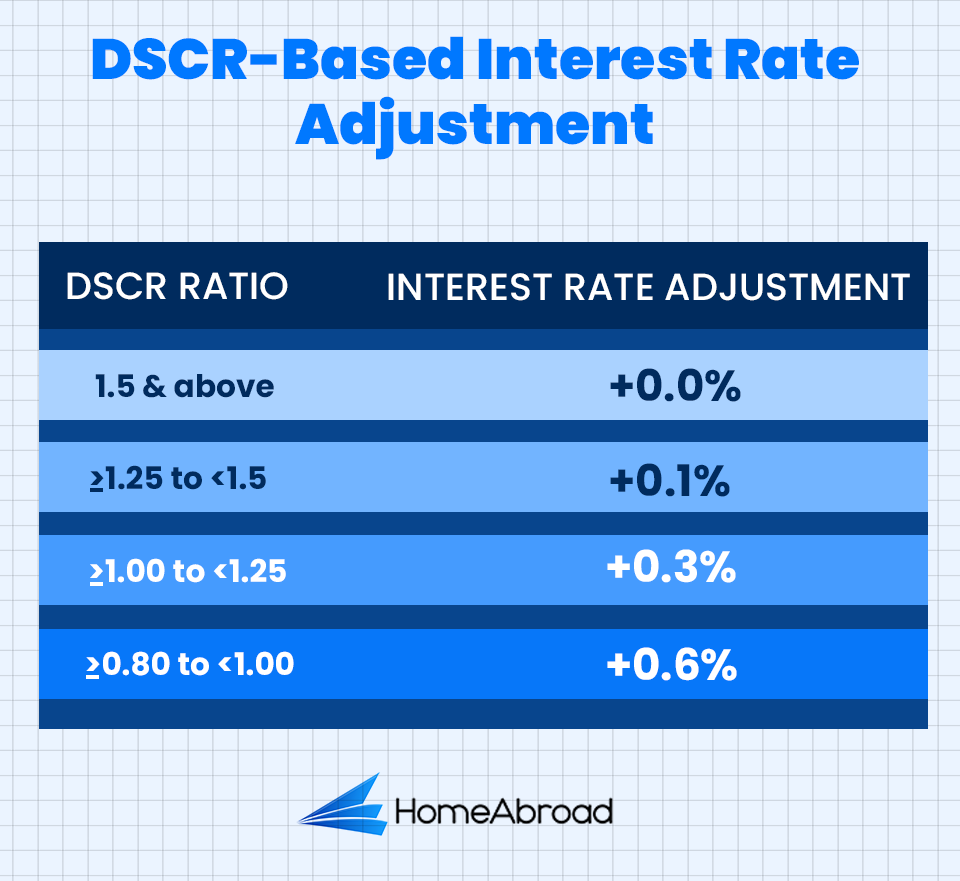

The DSCR ratio impacts interest rates in addition to loan approval. A higher DSCR ratio shows more substantial income potential, which allows lenders to offer lower rates.

On the other hand, a lower DSCR ratio means underperforming property and higher risk for the lender, who must increase the rates to compensate for the risk.

Here is a representation of how DSCR loan rates are adjusted with different DSCR ratios.

2. Credit Score

A DSCR loan is focused on a property’s income capability for loan qualification, and a credit check is necessary to ensure decent loan repayment behavior and reliability in case things go wrong.

A high credit score shows your financial discipline, and you may qualify for a loan with the most competitive terms, including the lowest interest rates.

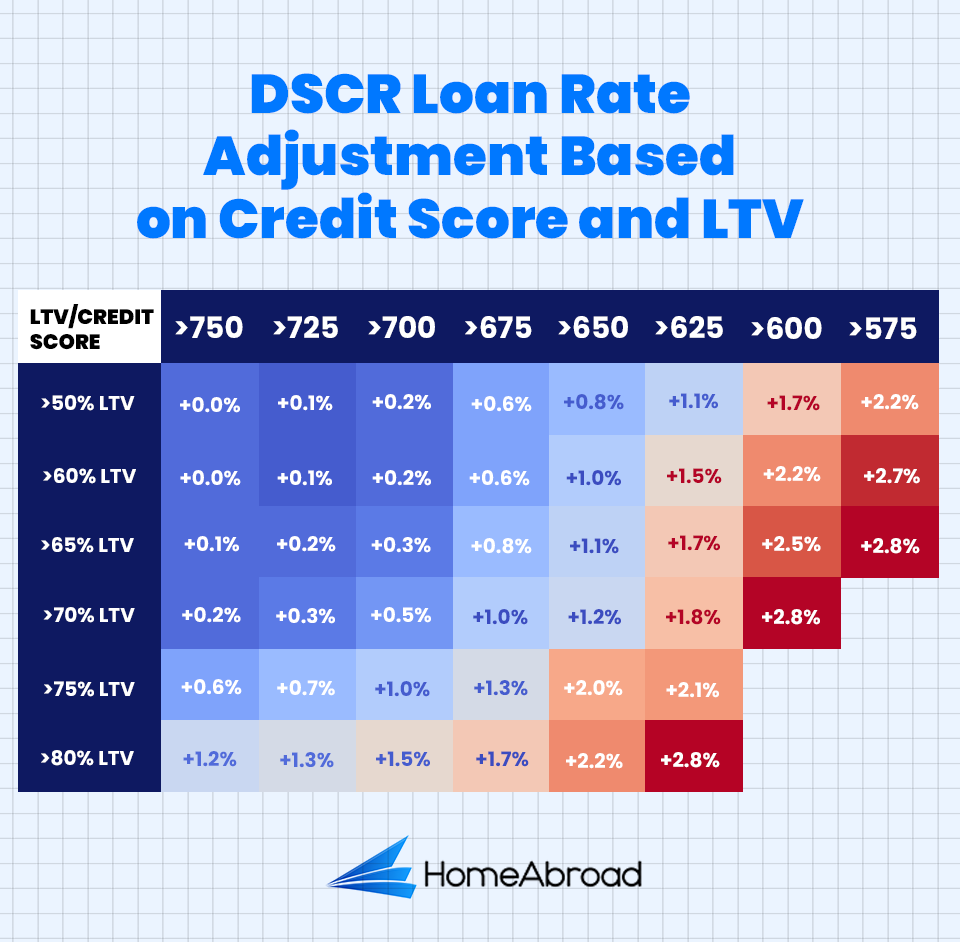

Here is a tabular representation of how different credit score ranges and LTV affect interest rates. The table below shows the rate adjustments based on credit score and LTV. For example, if your credit score is 700 and the LTV is 70%, the lender will increase the base rate by 0.5%.

Note that this table is just an estimate, and the actual adjustment may vary based on your lender’s terms.

While there is a minimum credit score requirement of 620 for DSCR loan qualification, some lenders also work with lower credit scores, given you pay higher down payment and interest rates. Hence, maintain or improve a good credit score to get lower interest rates.

3. LTV (Loan-to-Value)

The Loan-to-Value (LTV) ratio shows how much of a property is financed through borrowing.

For example, an 80% LTV ratio means you borrowed 80% of the property’s purchase price and paid 20% of the down payment.

Lenders consider the LTV ratio for the risk analysis, and a lower LTV ratio is preferred, meaning you paid a higher down payment.

If your LTV is high, it shows that you have less equity in the property, which increases the lender’s risk. Lenders adjust the interest rates accordingly to offset the increased risk.

Refer to the table above to understand how LTV ratios further affect DSCR loan interest rates.

4. Investor Experience

This is no financial metric but an important one that lenders consider during DSCR loan application evaluation. If you have a track record of successful investments, you are more likely to generate potential income from your property than someone just starting.

Generally, DSCR lenders require a minimum of one year of experience, but having more can get you favorable loan terms. However, this is not a mandatory requirement, and new investors can qualify for a loan but with comparatively higher rates.

5. Short-term Rentals/Airbnb

Short-term rental properties have inconsistent income due to various factors like occupancy rates, seasonal demand, competition, etc. This makes the income projection hard for the lender and raises perceived risk.

You must have understood by now that higher risk in lending means higher rates, cash reserves, more down payment, etc.

The DSCR loan interest rate for a short-term rental property might be 0.5% to 1% higher than a similar property rented out long-term.

Investors should weigh the potential for higher revenue against the increased cost of borrowing to determine if short-term rentals align with their investment strategy.

6. Mortgage Type

The most common mortgage types are fixed-rate and adjustable-rate. Fixed-rate mortgages have constant interest for the entire loan term, whereas adjustable-rate mortgages have varying rates according to the lender’s terms and the index they follow.

However, there is also a third type, interest-only. With this type, you only pay the interest on the loan, not the principal, for a pre-decided time. Lenders may increase the rate by about 0.2% to 0.5% if you opt for an interest-only mortgage.

This adjustment compensates for the additional risk, as borrowers are not building equity in the property through principal repayments.

7. Refinance

Lenders charge higher rates when refinancing or cash-out than when providing initial property financing. This adjustment is generally around 0.2%.

This rate increase is mainly due to the higher risk associated with refinancing, particularly cash-out options. In such cases, lenders essentially extend additional credit based on the property’s equity, which can increase their risk exposure.

These factors play a role in shaping your final DSCR loan interest rates. Rethink your borrowing strategy according to these factors to get lower interest rates.

HomeAbroad is an investor-centric, technology-enabled platform offering competitive DSCR loans. We study your case to customize our loan terms and maximize investment returns. The complete process is online, and our mortgage officer will help you throughout your investment journey.

We’re not just bragging. Hear from Liam and Emma Thompson, a Canadian couple who bought a Hawaiian Rental Property, about how we helped them.

Despite having no US credit history, HomeAbroad guided us to the perfect DSCR loan, allowing us to invest in a stunning property in Lahaina. The process was smooth, and the rental income is covering our mortgage. We couldn’t be happier with their expert support and highly recommend them to any foreign national looking to invest in the US. Liam and Emma Thompson,Lahaina, HawaiiReady to get a DSCR loan now? Drop your details below to get a quote.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Have you found another lender offering the lowest interest rates? Don’t rush; look for these red flags to ensure no hidden terms and conditions.

Check these factors when your DSCR lender offers low interest rates

While a lower interest rate is desirable, other aspects of the loan agreement may increase the overall cost or affect its suitability for your investment strategy. Here’s what to carefully consider:

- Hidden fees

- Penalties

- Total loan cost

- Lender’s efficiency

- Lender customer service

HomeAbroad is an investor-centric platform that offers DSCR loans with complete transparency and no hidden fees or penalties. We study your case to provide the best loan terms with optimum returns. Contact us to get a quote.

You’re all set. To summarize, DSCR loan interest rates are generally higher than conventional mortgage rates, but they offer much more flexibility and are often the only financing option for confident investors. DSCR loans are expensive, but investors can still generate significant returns with the right strategy.

Frequently Asked Questions

Is the DSCR loan worth the higher interest rate?

DSCR loans allow investors to qualify based on the property’s income rather than their personal income. These loans offer great flexibility and the ability to finance multiple properties simultaneously, making them worth considering despite the higher rates.

Why are DSCR loan interest rates higher than those of conventional loans?

DSCR loans are considered riskier for lenders because they rely on property income. As a result, lenders charge higher interest rates to compensate for the additional risk.

Can I secure a low interest rate with a poor credit score?

As mentioned in this article, a lower credit score means higher rates. However, you can get a co-signer with a good credit score to get the DSCR loan with better interest rates.

Can I buy down the rate on a DSCR loan?

Yes, you can buy down the rate on a DSCR loan through pay points. You pay an upfront fee to your lender to reduce the interest rates.

![DSCR Loan Interest Rates Today [June, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates-500x325.jpg)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![DSCR Loan Down Payment Requirements [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-loan-program-down-payment.jpeg)