Key Takeaways:

➡️ A higher down payment can result in lower interest rates, reduced monthly payments, and better loan terms.

➡️ Factors like DSCR ratio, credit score, and property type directly impact the required down payment.

➡️ Foreign investors do not need a US credit history but may need a larger down payment to reduce lender risk.

➡️ HomeAbroad Loans requires a minimum down payment of 20% for domestic investors and 25% for foreign investors.

A down payment can make or break your success with a DSCR loan program. For real estate investors, the size of the down payment directly impacts everything from interest rates to cash flow potential.

For instance, an investor putting down 30% on an investment property can secure lower interest rates, reducing monthly payments and boosting rental income.

Whether you’re looking to lower monthly payments or secure better loan terms, understanding the requirements and benefits of a larger down payment is crucial to maximizing your investment returns.

At HomeAbroad Loans, we make DSCR loans accessible to all, offering competitive terms tailored to your needs.

In this guide, we will walk you through everything you need to know about DSCR loan down payments, from requirements to maximizing your investment returns.

Table of Contents

What is a DSCR Loan?

A DSCR (Debt Service Coverage Ratio) loan is a mortgage designed for borrowers who want to invest in investment properties.

Unlike conventional loans, DSCR loans allow investors to qualify based on the income generated by the property, rather than their personal income.

The key metrics for a DSCR loan is the DSCR ratio, which shows how well a property’s income covers its debt obligations. A DSCR above 1.0 indicates that the property’s cash flow is sufficient to cover the loan payments.

Note: At HomeAbroad Loans, we offer DSCR loans for real estate investors with a minimum DSCR of 0.75. This flexibility allows you to qualify even if your property’s cash flow doesn’t fully cover the loan payments, giving you more opportunities to invest and grow your portfolio.

Let us understand DSCR Loan with the help of an example:

Investor: Emily Parker, an experienced real estate investor (Name changed for privacy)

Property: Single-family rental home

Monthly rental income: $5,000

Monthly payment (PITIA): $4,000

DSCR Calculation: Gross Rental Income ÷ PITIA*

DSCR: $5,000 ÷ $4,000 = 1.25

*PITIA: Principal of Mortgage, Interest, Taxes, Insurance, HOA

With a DSCR of 1.25, Emily’s property generates 25% more income than her debt obligations, making her eligible for a DSCR loan. This allowed her to secure the loan without personal income verification, giving her flexibility to invest in more properties.

At HomeAbroad Loans, we offer tailored DSCR loans to help real estate investors like Eily grow their portfolios with competitive loan terms. Learn more about the DSCR loan and application process in our DSCR Loan Guide.

DSCR Loan Down Payment Requirements Explained

At HomeAbroad Loans, the down payment plays a crucial role in qualifying for a DSCR loan and determining the loan terms.

We typically require a down payment of 20% for domestic investors and 25% for foreign investors. This ensures that both domestic and international investors have access to competitive loan options based on their financial profiles and investment goals.

To fully understand the importance of down payments with DSCR loans, it’s essential to consider how they impact various financing aspects.

At HomeAbroad Loans, we evaluate several key factors that determine your loan terms and refinancing options, all of which are influenced by the size of your down payment:

1. Loan-to-Value (LTV):

Our loan officers at HomeAbroad Loans evaluates risk through the loan-to-value (LTV) ratio, which compares the loan amount to the property’s purchase price or appraised value. A larger down payment lowers the LTV, reducing risk and helping you secure better loan terms, including lower interest rates.

2. Rate-Term Refinance:

For those looking to lower monthly payments or secure a better interest rate, we offer rate-term refinance options, allowing you to refinance your DSCR loan without increasing your loan balance. In this scenario, maintaining a favorable LTV ratio is key, often based on your initial down payment and current property equity.

3. Cash-Out Refinance:

Our cash-out refinance option lets you tap into your property’s equity, allowing you to refinance for a larger amount than the current loan balance. To maintain favorable loan conditions, HomeAbroad Loans generally requires a higher down payment or greater equity to ensure a strong LTV ratio.

At HomeAbroad Loans, we tailor our loan products and down payment requirements to support both domestic and foreign investors, ensuring you have the flexibility and financing options to maximize your investment returns.

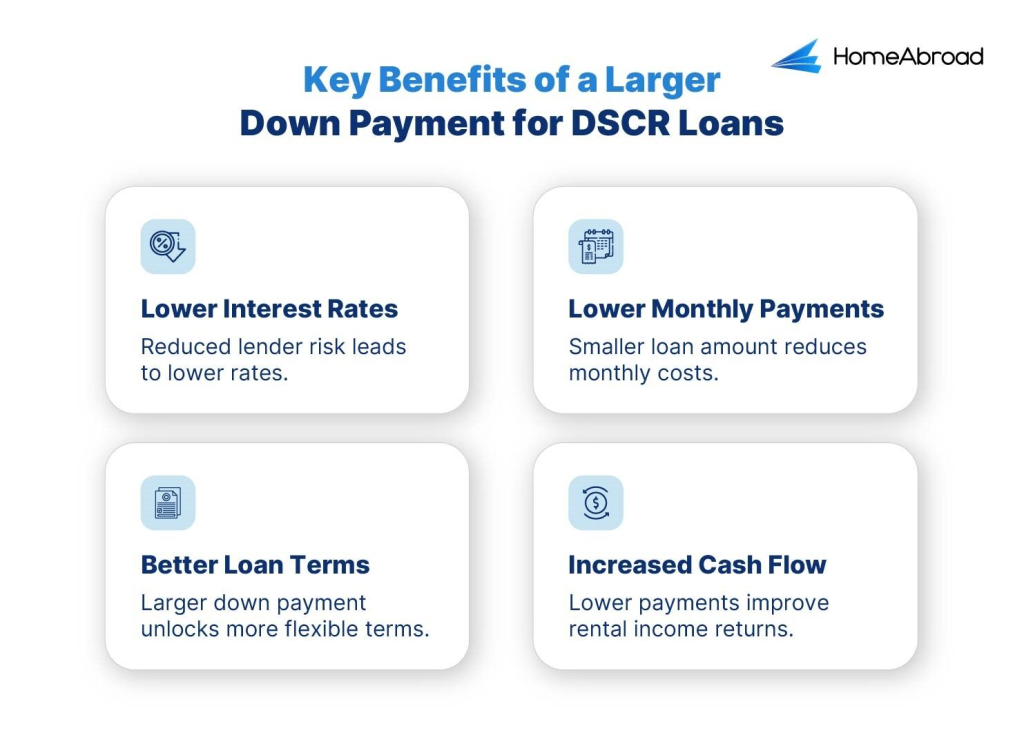

Benefits of a Larger Down Payment for DSCR Loans

Making a larger down payment on a DSCR mortgage loan offers several key advantages for real estate investors. By committing more upfront, you not only reduce risk but also unlock better loan conditions that can enhance your long-term investment strategy.

Here’s how a larger down payment works to your benefit:

1. Lower Interest Rates

A larger down payment can significantly reduce the interest rate on your DSCR loan. Since the risk to HomeAbroad Loans is lower when more money is put down upfront, we’re able to offer more competitive interest rates.

Let us look at the example of Emily to understand this better:

Emily, a real estate investor, purchased a multi-family rental property with a 30% down payment. By opting for a higher down payment, Emily was able to secure a lower interest rate of 4.5% compared to the 5.2% she would have received with a 20% down payment. Over the life of her loan, this resulted in significant savings on interest.

2. Lower Monthly Payments

A higher down payment also reduces your loan amount, leading to smaller monthly payments. With lower monthly debt obligations, you can maintain stronger cash flow from rental income, making the investment more sustainable in the long run.

In Emily’s case, her 30% down payment not only secured a better interest rate but also reduced her monthly mortgage payment by $500. This freed up more of her rental income to cover property expenses, boosting her property’s cash flow.

3. Better Loan Terms

At HomeAbroad Loans, we reward larger down payments with improved loan terms. This might include more flexible repayment options, fewer prepayment penalties, or even faster loan approval. A higher down payment reduces risk, giving you leverage to negotiate terms that align with your investment goals.

With her 30% down payment, Emily also qualified for better loan terms, including a more flexible repayment schedule that allowed her to pay off her loan early without prepayment penalties. This gave her more control over her investment strategy.

Emily’s story highlights the clear advantages of making a larger down payment when securing a DSCR loan. By reducing interest rates, lowering monthly payments, and securing better loan terms, she was able to maximize her investment returns.

At HomeAbroad Loans, we help investors like Emily leverage their down payments to unlock better opportunities and long-term success.

What Factors Influence DSCR Loan Down Payment?

Several factors influence the size of your down payment for a DSCR loan, and at HomeAbroad Loans, we tailor our DSCR loan requirements to suit your unique investment goals.

Let’s break down the key variables that impact your down payment:

1. Debt Service Coverage Ratio (DSCR)

Your DSCR plays a crucial role in determining your down payment and overall eligibility. A higher DSCR indicates that the property’s income covers its debt obligations well, reducing the risk associated with the loan.

For instance, if your property has a DSCR of 1.5, this shows strong cash flow, potentially allowing for a lower down payment.

However, if your DSCR is closer to our minimum requirement of 0.75, a larger down payment may be necessary to mitigate the risk.

2. Credit Score

For debt service coverage ratio loans, domestic investors need a minimum credit score of 620 to qualify, ensuring they can meet payments even if the property underperforms. A higher credit score can lead to more favorable loan terms and potentially lower down payment requirements.

Foreign investors, on the other hand, do not need a US credit history, making DSCR loans more accessible. However, due to the absence of a US credit history, foreign investors are considered higher risk, resulting in a higher down payment requirement.

This larger down payment reduces risk by ensuring significant equity in the property and demonstrating the investor’s financial stability.

3. Short-Term Rental Properties

If you’re investing in short-term rental properties, your down payment may be higher due to potential fluctuations in income.

At HomeAbroad Loans, we consider the seasonal nature of short-term rentals and may require a larger upfront payment to ensure the loan remains stable even during periods of lower occupancy.

4. Cash-Out Refinance Considerations

If you’re opting for a cash-out refinance, your down payment or existing equity becomes even more important.

HomeAbroad Loans typically requires you to have more equity in the property to maintain a favorable loan-to-value (LTV) ratio. The more equity or the larger the original down payment, the better terms you can secure on the refinance, giving you access to more cash while maintaining a healthy financial position.

5. Lender-Specific Requirements

At HomeAbroad Loans, we understand that each investment is unique. That’s why our down payment requirements are designed to be flexible. For domestic investors, we generally require 20%, and for foreign investors, 25%.

However, we assess factors like property type, investment strategy, and financial profile to ensure we offer terms that fit your goals. Whether you’re purchasing a new property or refinancing, we work with you to tailor down payment options that best suit your needs.

Understanding these factors can help you plan your investment more effectively. At HomeAbroad Loans, we strive to offer down payment solutions that align with your strategy, ensuring that you get the best possible terms for your DSCR loan.

Final Thoughts on DSCR Loan Down Payments

Understanding the down payment requirements for DSCR loans is essential for maximizing your investment opportunities. At HomeAbroad Loans, we prioritize flexibility and tailor our down payment options to meet the unique needs of both domestic and foreign investors.

Whether you’re aiming for better interest rates, lower monthly payments, or more favorable loan terms, the right down payment can make all the difference in securing the best financing for your property.

By considering factors like your DSCR, credit score, and investment strategy, you can ensure that you’re setting yourself up for long-term success.

HomeAbroad Loans is here to guide you through every step of the process, helping you unlock the full potential of your real estate investments with competitive and accessible DSCR loans.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Frequently Asked Questions

1. What is the minimum down payment required for a DSCR loan at HomeAbroad Loans?

At HomeAbroad Loans, domestic investors typically need a minimum down payment of 20%, while foreign investors are required to put down 25%. This ensures a solid equity position for both types of investors.

2. Can I qualify for a DSCR loan with no US credit history?

Yes, foreign investors can qualify for a DSCR loan without a US credit history. HomeAbroad Loans focuses on the property’s income potential rather than your personal credit score, though a larger down payment (25%) is required to reduce the risk.

3. How does my DSCR ratio impact the size of my down payment?

A higher DSCR ratio, which shows the property’s income exceeds its debt obligations, can potentially result in a lower down payment at HomeAbroad Loans. A DSCR closer to our minimum of 0.75 may require a larger down payment to mitigate risk.

4. Can I lower my interest rate with a larger down payment?

Yes, at HomeAbroad Loans, a larger down payment can often lead to lower interest rates. By reducing the loan-to-value (LTV) ratio, you present less risk, allowing for more favorable loan terms.

5. Are short-term rental properties eligible for DSCR loans?

Yes, HomeAbroad Loans provides DSCR loans for short-term rental properties. However, due to the potential income fluctuations, we may require a higher down payment to ensure stability.

![DSCR Loan Down Payment Requirements [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-loan-program-down-payment-500x250.jpeg)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![DSCR Loan in Texas: Qualify with Rental Income [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-Loans-Texas.jpeg)