Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Virginia’s rental markets, from Northern Virginia to cities like Richmond and Virginia Beach, offer steady demand, attractive rental yields, and long-term investment potential.

2. With HomeAbroad’s DSCR loans, foreign nationals can invest in Virginia real estate without needing a US credit history, US income, or residency. Loan approval is based entirely on the property’s rental income.

3. No personal tax returns, pay stubs, or employment records are required, making DSCR loans ideal for international real estate investors seeking a hassle-free path to US real estate ownership.

4. HomeAbroad simplifies the entire process for international investors, helping you search for properties with our AI-driven platform, get financing, set up a US-based LLC, open a local bank account, and manage closing requirements from abroad.

Table of Contents

From the Blue Ridge Mountains to the Chesapeake Bay, Virginia isn’t just for lovers; it’s for international real estate investors, too.

With a growing population, strong rental demand in cities like Richmond, Virginia Beach, and Arlington, and proximity to major economic hubs such as Washington, D.C., the state offers significant long-term investment potential.

And that’s where the right financing can make all the difference. HomeAbroad offers a DSCR loan tailored specifically for foreign nationals that doesn’t rely on personal income verification or Debt-to-Income (DTI) ratios. Instead, we qualify you based on the property’s rental income, making it easier for international real estate investors to break into the Virginia real estate market..

Whether you’re buying your next cash-flowing rental or refinancing a property in your portfolio, HomeAbroad makes getting a DSCR loan in Virginia smooth and stress-free.

What is a DSCR Loan for Foreign Nationals?

A Debt Service Coverage Ratio (DSCR) loan is a foreign national mortgage tailored for international real estate investors. Unlike conventional loans that rely on personal income, DSCR loans assess a property’s ability to generate enough rental income to cover monthly mortgage payments.

Over the years, many international real estate investors I’ve worked with have faced similar challenges: solid investment plans but limited access to traditional financing and multiple rejections. DSCR loans have consistently opened the door for them.

Virginia’s average rental yield is 7.3%, offering strong opportunities to generate steady cash flow. Whether you’re looking at established markets like Arlington or emerging hubs like Richmond, DSCR loans allow you to act quickly and confidently.

Since DSCR loans rely on the property’s income instead of your personal financials, lenders usually place them in a slightly higher rate range than conventional mortgages. Check the latest DSCR loan interest rates here.

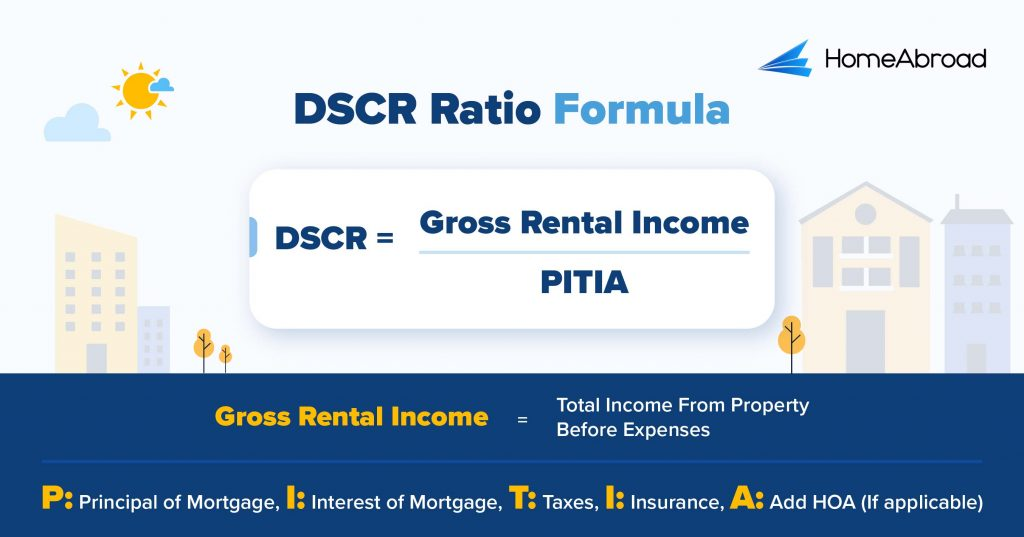

How to Calculate the DSCR Ratio?

The Debt Service Coverage Ratio is calculated by dividing a property’s gross rental income by its total monthly debt obligations, including principal, interest, taxes, insurance, and association fees (PITIA).

This ratio helps lenders determine if a property’s rental income is enough to cover its mortgage payments.

Here is the DSCR Formula:

A DSCR of 1.54 means the property earns 54% more than its total monthly loan obligations, showing strong cash flow and making it a great candidate for a DSCR Loan. If you hate doing the math, you can check our DSCR Ratio Calculator. Just enter your financial details, and you are good to go!

At HomeAbroad, we offer DSCR loans for foreign nationals based on a property’s rental income covering the mortgage payment. Properties with a DSCR of 1.0 or higher receive the best loan terms, while those below 1.0 remain eligible but require a slightly larger down payment (a 5% hit to LTV) and higher interest rates.

For cases where the DSCR falls below 1, we provide our specialized No-Ratio DSCR Program. This option offers additional flexibility but comes with higher down payment requirements and interest rates to manage the increased risk.

Requirements of DSCR Loans in Virginia

HomeAbroad offers a simplified DSCR loan process designed exclusively for foreign real estate investors. Unlike traditional lenders, we do not require US income or credit history. Our flexible approach, along with remote-closing support, helps international investors confidently access the Virginia real estate market.

The table below shows how our lending standards differ from conventional lenders.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We provide DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, meaning you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25% gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR loan as an international real estate investor.

HomeAbroad provides end-to-end support to international real estate investors, combining expert guidance with an AI-driven property search platform that surfaces top rental property options across Virginia. In contrast, our experts tailor the best DSCR loan solutions to fit your goals.

Where We Lend DSCR Loans in Virginia

HomeAbroad offers DSCR loans across Virginia, with tailored support for investors in top-performing cities like Virginia Beach, Richmond, Arlington, and more.

Here are a few cities in Virginia where we lend DSCR loans.

- Norfolk

- Virginia Beach

- Richmond

- Alexandria

- Danville

- Chesapeake

- Newport News

- Lynchburg

- Hampton

- Portsmouth

- Harrisonburg

- Suffolk

- Manassas

- Arlington

- Winchester

- Roanoke

Let’s see how a Canadian investor secured a DSCR loan in Virginia without income verification with HomeAbroad’s expert support.

Case Study: Meet Daniel Roy, a Canadian Investor on an L-1 Visa

Daniel Roy, a real estate investor from Canada, recently relocated to the US on an L-1 visa and set his sights on purchasing a rental property in Richmond, Virginia. However, he faced a significant roadblock: he lacked a US credit history or long-term residency, leading to multiple rejections from conventional lenders.

The Solution: HomeAbroad Loans’ DSCR Loan

Daniel turned to HomeAbroad and opted for a DSCR loan, which allowed him to qualify based solely on the property’s rental income, no US credit history or tax documents required.

HomeAbroad’s mortgage officer, Rachel Spaccarotelli, worked closely with Daniel to secure competitive terms. She successfully reduced the interest rate to 6.8%, improving the Debt Service Coverage Ratio (DSCR) and making the loan viable.

- Loan Amount: $269,925

- Purpose: Purchase

- Loan Type: 30-year fixed-rate

- Interest Rate: 6.8%

- Time to Close: 28 days

Why This Worked for Daniel:

- No US Credit History Required: Daniel qualified based solely on the property’s rental income, eliminating the need for a US credit score or tax returns.

- Optimized Loan Terms: The adjusted interest rate yielded a strong DSCR of 1.36, securing loan approval.

- Positive Cash Flow Investment: With a rental income of $3,552/month and a mortgage payment of $2,605, Daniel secured a positive cash flow of $947/month on a $359,900 property.

This case study highlights how HomeAbroad Loans empowers international real estate investors like Daniel to access the US real estate market with flexible financing options designed around the property’s rental income, not personal income.

Top Places to Invest in Virginia with a DSCR Loan

Virginia offers strong investment potential with a 7.3% annual rental yield, making it an excellent choice for international real estate investors seeking steady returns. The state’s diverse economy and high rental demand create opportunities for both short-term and long-term rentals.

With DSCR loans, global investors can qualify for financing based on the property’s rental income, making it easier to scale their portfolios without traditional income verification.

Here are some top investment cities in Virginia:

City | Rental Type | Rental Yield |

|---|---|---|

Virginia Beach | Short-Term | 18.6% |

Richmond | Short-Term | 9.4% |

Norfolk | Long-Term | 6.5% |

Arlington | Short-Term | 6% |

Chesapeake | Long-Term | 5.8% |

Virginia Beach: Coastal Energy and Tourist Magnet

Virginia Beach blends vibrant tourism with a strong military and port economy. It’s a top vacation destination with oceanfront rentals in high demand, especially in summer. With short-term rental yields among the highest in the state, investors find solid returns backed by consistent visitor traffic.

- Median Home Price: $418,362

- Average Rent: $2,216

What this means for investors: High occupancy rates, substantial seasonal income, and a resilient local economy that supports both vacation and long-term tenants.

Investment Properties Listed Today on Sale in Virginia Beach

Richmond: Historic Charm Meets Urban Growth

The capital city offers a unique mix of colonial architecture, trendy neighborhoods, and a growing job market. Richmond’s economy is driven by government, healthcare, and finance, creating demand for both short-term and mid-term rentals.

- Median Home Price: $371,213

- Average Rent: $1,623

What this means for investors: A balance of affordability and income potential, with strong appreciation trends and room for growth in the short-term rental space.

Investment Properties Listed Today on Sale in Richmond

Norfolk: Navy Base and Rental Stability

Home to the world’s largest naval station, Norfolk has a steady demand for rentals from military families and contractors. The city’s affordability and access to maritime industries support year-round occupancy in long-term rentals.

- Median Home Price: $306,295

- Average Rent: $1,700

What this means for investors: Predictable rental income, a stable tenant base, and excellent cash flow potential with low property entry points.

Investment Properties Listed Today on Sale in Norfolk

Arlington: High-Income Tenants and Urban Appeal

Just across the river from Washington, DC, Arlington offers a premium rental market fueled by tech professionals, diplomats, and federal workers. The area’s strong job market and limited housing supply make it ideal for short-term executive rentals.

- Median Home Price: $831,634

- Average Rent: $2,909

What this means for investors: High rental rates and low vacancy risk in a top-tier urban environment, though upfront property costs are significantly higher.

Investment Properties Listed Today on Sale in Arlington

Chesapeake: Suburban Comfort with Growth Potential

Chesapeake is one of Virginia’s fastest-growing cities, appealing to families and commuters seeking space and convenience. Its location near Virginia Beach and Norfolk makes it ideal for long-term renters working in the region.

- Median Home Price: $416,193

- Average Rent: $2,061

What this means for investors: Long-term stability, a growing tenant base, and consistent appreciation in a suburban setting with strong demand

Investment Properties Listed Today on Sale in Chesapeake

Specific Considerations for Investing in Virginia for Foreign Nationals

Virginia offers a balanced real estate environment with access to government-backed employment hubs, historic cities, and growing suburban demand. However, investors need to account for regional differences, regulatory factors, and financing nuances when entering this East Coast market.

Here are the key factors to consider:

– Property Taxes and Transfer Costs

Virginia has relatively moderate property tax rates, but international real estate investors should budget for additional costs, such as grantor and grantee transfer taxes, particularly in Northern Virginia. Some cities (like Alexandria or Arlington) may also levy local add-on rates, which can affect overall transaction costs.

– Tenant-Friendly Localities and Eviction Laws

While Virginia is generally landlord-friendly, some counties and cities lean more toward tenants, especially those near Washington, D.C. The state requires landlords to follow detailed notice periods and provide written documentation before evictions. The Virginia Residential Landlord and Tenant Act outlines strict procedures, especially for properties with more than four units.

– Short-Term Rental Restrictions by County

Virginia does not regulate short-term rentals at the state level. Instead, localities like Fairfax County and Virginia Beach enforce their own licensing, zoning, and occupancy laws. Some areas allow owner-occupied rentals only, while others require conditional-use permits. Understanding local ordinances is essential before launching a short-term rental operation.

– Historic Property Regulations

Many homes in Virginia are located in historic preservation zones, especially in older cities like Richmond and Williamsburg. Renovations or modifications to these properties may require special permits or be subject to architectural review boards, which can limit investor flexibility.

Strategic & Future Considerations for Foreign Nationals Investing in Virginia

Virginia continues to appeal to international buyers through its mix of economic stability, educational hubs, and proximity to Washington, DC. Looking ahead, tech-driven expansion, new infrastructure, and population growth are creating investment opportunities in both metro and mid-tier markets.

Here are some future considerations that international real estate investors need to pay heed to:

1. Accessible Ownership for Foreign Nationals: Virginia imposes no restrictions on foreign real estate ownership, allowing direct purchase of residential, rental, or multifamily properties. This flexibility makes it easy for international real estate investors to participate in both urban and suburban markets.

2. Tech and Government Growth in Northern Virginia: Arlington, Fairfax, and Alexandria continue to expand as tech corridors and government contracting centers. High-earning renters and urban professionals drive consistent demand for mid and long-term rentals in these locations.

3. Universities and Healthcare Anchor Markets: Richmond, Charlottesville, and Norfolk benefit from strong rental demand linked to universities, hospitals, and research institutions. These markets are ideal for global investors targeting steady rental yields with lower vacancy risks.

4. Infrastructure-Driven Suburban Growth: Transit extensions, highway improvements, and remote-work migration are pushing more buyers and renters into outer suburbs and secondary metros, such as Roanoke and Newport News, where rental demand is rising alongside development.

Get a HomeAbroad DSCR Loan in Virginia as a Foreign National

With HomeAbroad, financing your real estate investment in Virginia is straightforward and tailored for international real estate investors. Our DSCR loans help you qualify based on rental income, not personal income or US credit, making it easier to invest in high-potential cities across the state.

From short-term hotspots like Virginia Beach and Richmond to long-term growth cities like Chesapeake and Norfolk, our AI-driven investment search platform helps you find top-performing properties. Our expert team supports you throughout the process, from LLC setup and banking to property management solutions.

If you already own rental property in Virginia, HomeAbroad also offers refinancing options to help you access your property’s equity. You can use these funds to buy another rental, improve your existing property, or diversify into other markets, all with a simple rental-income-based approval process.

Choose HomeAbroad to grow your real estate investments in Virginia with clarity, flexibility, and full foreign national support.

FAQs

How do DSCR loans work for foreign nationals in Virginia?

HomeAbroad qualifies you based on the property’s rental income instead of your personal income. You also do not need to have a US credit history.

Is Virginia a good state for foreign nationals to invest in real estate?

Yes. Cities like Virginia Beach, Richmond, and Arlington offer strong rental demand and appreciation potential, making Virginia a strategic choice for international investors.

Can I refinance my Virginia investment property with HomeAbroad?

HomeAbroad offers DSCR loans up to $10 million, depending on the property’s rental income and eligibility criteria. This allows investors to finance high-value properties with ease.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

AirDNA: https://www.airdna.co/vacation-rental-data/app/us/illinois

Zillow: Housing Data – Zillow Research