Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Missouri has more than 6,000 caves tucked beneath its surface, earning it the nickname “The Cave State.” But it’s not just what’s underground that’s worth exploring. Above ground, Missouri offers some of the most overlooked real estate opportunities in the country.

Whether it’s the vibrant rental markets of Kansas City, the historic neighborhoods of St. Louis, or the vacation appeal of Lake of the Ozarks, this state delivers a mix of affordability, demand, and strong rental yields for international investors.

Many foreign nationals I’ve worked with get stuck trying to qualify for traditional loans due to a lack of US credit history. That’s where HomeAbroad’s DSCR loans come in. These loans don’t rely on personal income or tax returns. We approve them based entirely on the property’s rental income.

So whether you’re buying a cozy duplex in a college town or a lakefront short-term rental, DSCR loans from HomeAbroad give you a clear, straightforward path to building a profitable portfolio in Missouri.

Table of Contents

Key Takeaways:

1. Missouri’s mix of affordable home prices and stable rental demand makes it a strong entry point for international investors to qualify for DSCR loans from HomeAbroad, with no US credit history, income verification, or visa requirement needed.

2. DSCR loans evaluate the property's income stream, so foreign nationals can skip traditional documentation like pay slips, or US tax returns

3. Cities like Kansas City, St. Louis, and Springfield offer steady tenant demand, supported by local industries, universities, and medical hubs, ideal for generating consistent rental income.

4. HomeAbroad gives global investors an edge with AI-powered investment property search to find cash-flowing deals, expert guidance on structuring a tailored DSCR loan, LLC, and US bank account setup, and complete support through start and end.

What is a DSCR loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a financing solution built specifically for foreign nationals investing in US real estate. Unlike traditional loans, it doesn’t rely on your personal income, or DTI ratio. Instead, approval is based on how much income the property can generate.

For international real estate investors targeting stable, cash-flowing markets in the US, DSCR loans provide a practical path to ownership, especially in cities like Kansas City, St. Louis, and Branson, where rental demand is strong and entry costs are relatively low.

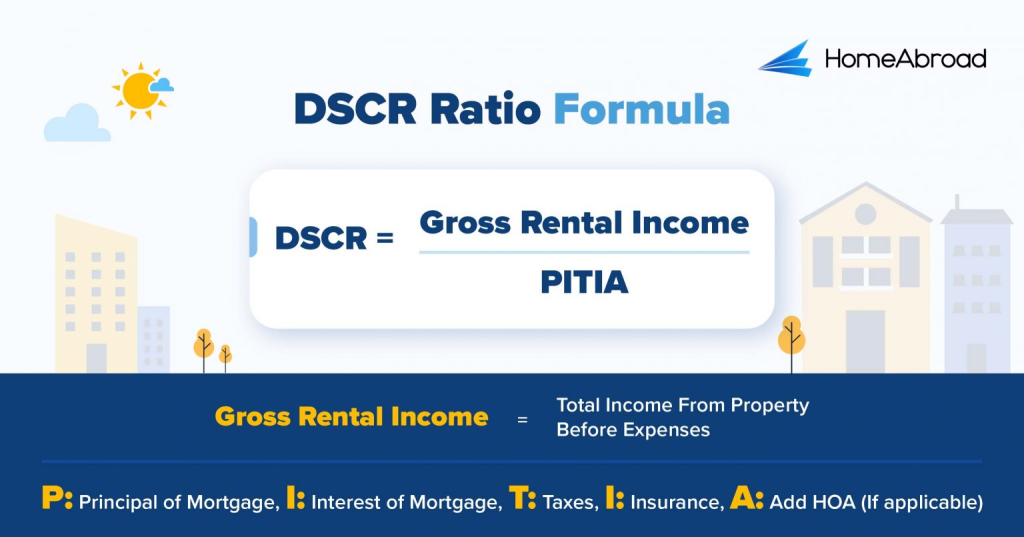

How to Calculate Your DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a key metric used to determine whether a property’s rental income is sufficient to cover mortgage payments. A higher DSCR indicates strong cash flow, improving your chances of securing better loan terms and interest rates.

DSCR Loan Formula:

HomeAbroad offers a user-friendly DSCR Calculator to simplify your loan eligibility process in Missouri. I recently helped a client calculate the Debt Service Coverage Ratio (DSCR) for a property in Missouri. Here’s how we broke it down:

Example

Calculating the DSCR Ratio for a Missouri Property:

With this, the property generates 1.36 times its debt obligations, indicating positive cash flow, which is a great sign for future financial stability.

In this case, the monthly positive cash flow was $400, meaning my client is covering their mortgage and making extra income from the rental property.

HomeAbroad requires a minimum DSCR of 1.0 for standard financing, but we also offer flexible options for clients needing a bit more leeway. If the DSCR is between 0 - 1, we offer "No Ratio DSCR Loans" for those who still need funding, although it will require a slightly larger down payment (a 5% hit to LTV) and a higher interest rate.

Requirements for DSCR loans in Missouri for Foreign Nationals

Compared to conventional lenders, HomeAbroad offers a simplified DSCR loan process designed specifically for visa holders and foreign nationals looking to invest in US real estate.

Here’s how HomeAbroad’s DSCR loan criteria stack up against traditional lenders:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it comes with a 5% hit to LTV and a slightly higher interest rate. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With deep expertise in helping visa holders and foreign nationals invest in US real estate, HomeAbroad offers end-to-end support throughout the process. From finding high-yield properties through our AI-powered Investment property search platform to structuring DSCR loan terms that align with your investment strategy, our team ensures a seamless experience across Missouri.

Areas We Lend in Missouri

With HomeAbroad, international real estate investors can access DSCR loans throughout Missouri, covering key markets such as St. Louis, Kansas City, Springfield, and others. Below are some of the cities we serve.

- Branson

- Osage Beach

- Lake Ozark

- Columbia

- Camdenton

- Sunrise Beach

- Hollister

- Kimberling City

- Springfield

- Columbia

- Kansas City

- St. Louis

- Chesterfield

- Springfield

- Wentzville

Let’s examine a case study of one of our past clients to understand how profitable investing in the Missouri real estate market can be.

Case Study: H1B Visa Holder Invests in St. Louis Rental with a DSCR Loan

Aarav Mehta, an Indian professional working in the US on an H1B visa, wanted to invest in a rental property to generate passive income. He identified a cash-flowing duplex in Kansas City, Missouri, but couldn’t qualify for a conventional loan due to his short US credit history and temporary visa status.

The Solution: HomeAbroad’s DSCR Loan

Aarav turned to HomeAbroad for a DSCR loan, which allowed him to qualify based entirely on the property’s projected rental income no US credit score or long-term visa requirement needed.

HomeAbroad’s mortgage team secured a 7.25% interest rate, which brought the property’s debt-service ratio into an acceptable range and enabled him to qualify for a $349,000 loan. The loan closed in under 30 days, and the rental income now fully covers his monthly mortgage payments, turning it into a stable, income-generating investment.

- Loan Amount: $341,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.25%

- Time to Close: 27 days

Why This Worked for Aarav:

- No US Credit History Required: Aarav was evaluated based on the property’s income, not his limited US credit profile perfect for a recent visa holder.

- Tailored Loan Terms: HomeAbroad structured the loan to meet the required DSCR, locking in a favorable interest rate and closing within a month.

- Strong Rental Income: With a DSCR of 1.23, the property’s income more than covered the mortgage payments, ensuring positive cash flow from day one.

Top Places to Invest in Missouri with a DSCR Loan

Missouri offers a strong real estate market with attractive rental yields, making it a prime investment opportunity. With an average home price of around $250,000, which is well below the national average of $355,328, investors can enter the market at a lower cost while still benefiting from steady property appreciation and strong rental demand.

Thanks to top universities and growing industries, cities like Branson and Hollister attract long-term demand from students and professionals. Meanwhile, Osage Beach and Kimberling thrive on tourism, creating excellent opportunities for short-term rentals.

With Missouri’s solid rental yields and access to DSCR loans, investors can secure properties that cover their mortgage and generate positive cash flow.

City | Rental Type | Rental Yield |

|---|---|---|

Branson | Short-Term | 16.7% |

Columbia | Short-Term | 11.6% |

St. Louis | Long-Term | 8.8% |

Kansas City | Long-Term | 6.9% |

Springfield | Long-Term | 6.4% |

Branson: Missouri’s Tourism-Driven Gem

Branson thrives on tourism, known for its theaters, lakes, and attractions that draw millions of visitors annually. This steady stream of travelers creates strong demand for vacation rentals in key neighborhoods close to entertainment zones.

- Median Home Price: $262,087

- Average Rent: $1,491

What this means for investors: Branson’s consistent visitor volume and solid nightly rates make it an excellent choice for investors aiming to generate strong income and meet DSCR loan requirements comfortably.

Investment Properties Listed Today on Sale in Branson

Columbia: The University-Fueled Hotspot

Columbia, home to the University of Missouri, blends small-city charm with a lively cultural and academic scene. Events, sports, and a growing healthcare sector support a healthy rental market throughout the year.

- Median Home Price: $317,506

- Average Rent: $1,350

What this means for investors: Columbia’s steady event-driven rental activity and affordable home prices offer a practical entry point for investors looking for reliable income to qualify for DSCR financing.

Investment Properties Listed Today on Sale in Columbia

St. Louis: Big City Opportunity with Stability

St. Louis offers a diverse economy backed by healthcare, education, and logistics, making it a resilient rental market. The city’s mix of urban and suburban neighborhoods attracts a broad range of tenants year-round.

- Median Home Price: $317,506

- Average Rent: $1,350

What this means for investors: St. Louis offers dependable cash flow opportunities with relatively low home prices, helping investors easily align with DSCR loan requirements.

Investment Properties Listed Today on Sale in St. Louis

Kansas City: A Metro on the Rise

Kansas City combines cultural vibrancy with economic growth, driven by strong employment sectors and an expanding downtown. The city’s ongoing development and infrastructure projects continue to support tenant demand.

- Median Home Price: $251,923

- Average Rent: $1,465

What this means for investors: Kansas City’s balanced mix of affordability and strong rental demand makes it a solid option for investors focused on cash flow and long-term value.

Investment Properties Listed Today on Sale in Kansas City

Springfield: Affordable and Consistent

Springfield stands out for its affordability and stable rental activity. A strong healthcare presence, educational institutions, and tourism contribute to its steady housing market.

- Median Home Price: $240,998

- Average Rent: $1,291

What this means for investors: With accessible price points and dependable rental income, Springfield offers a low-barrier path for investors seeking to qualify for DSCR loans.

Investment Properties Listed Today on Sale in Springfield

Specific Considerations for Investing in Missouri for Foreign Nationals

Missouri’s real estate market has solid investment potential, but success here means understanding local nuances from weather risks and taxes to landlord rules and short-term rental restrictions. These details can shape both your returns and day-to-day operations, especially if you’re investing from overseas.

Here are the key factors foreign nationals should consider:

– Tornado Risk and Insurance Gaps

Missouri sits in the heart of “Tornado Alley,” and while insurance is generally affordable, tornado-related damage isn’t always fully covered under standard policies. Investors should review coverage closely and consider additional windstorm protection, especially in high-risk areas like Kansas City and St. Louis suburbs.

– Property Taxes and Local Levy Variations

Missouri’s overall property tax rates are moderate, but rates can swing dramatically between counties and school districts. Investors should evaluate local millage rates when choosing a location, as they directly impact rental income and DSCR ratios. Foreign buyers should also factor in non-resident filing requirements.

– Short-Term Rental Restrictions

Cities like St. Louis and Kansas City are tightening rules around Airbnb-style rentals. Many areas now require a permit, safety inspections, or neighbor notifications. Some neighborhoods and HOAs have outright bans. If you’re targeting vacation or short-stay markets like the Ozarks, make sure short-term rentals are allowed year-round.

– Title Ownership and LLC Setup

Foreign nationals often choose to buy through a US-based LLC to reduce personal liability and simplify estate planning. Missouri makes LLC formation affordable and straightforward, with low annual fees and minimal reporting requirements, making it an attractive option for international investors.

Strategic & Future Considerations for Foreign Nationals Investing in Missouri

Missouri’s real estate market is stable, affordable, and poised for long-term growth, but to make the most of it, foreign investors should think beyond the immediate purchase. Strategic planning and an eye on future trends can help you build a resilient, profitable portfolio.

Here are key future-focused considerations for international real estate investors:

1. Economic Development in Key Cities:

St. Louis, Kansas City, and Springfield are attracting investment in tech, manufacturing, logistics, and healthcare. These sectors are boosting job growth, population stability, and rental demand. Properties near major development corridors or universities often offer better long-term returns and lower vacancy rates.

2. Infrastructure & Transportation Investments

Missouri is a central logistics hub, with billions being invested in highway expansions, freight rail, and airport upgrades. These improvements will increase accessibility and boost property values in nearby areas, especially suburbs along I-70 and I-44. Consider targeting these growth corridors early.

3. Favorable Rental Regulations

Missouri is generally landlord-friendly, with no rent control and minimal regulatory burdens. This provides foreign landlords more flexibility when managing tenants, setting rents, and handling evictions, crucial for absentee or out-of-country property owners.

4. Affordability Compared to Coastal Markets

Missouri offers significantly lower entry costs for real estate compared to cities like New York, Miami, or LA. This makes it an ideal market for first-time foreign investors or those looking to diversify their US holdings without overextending financially.

Get a DSCR Loan in Missouri with HomeAbraod as a Foreign National

Financing your real estate investment in Missouri is straightforward with HomeAbroad. Our DSCR loans are designed for international investors, focusing on the property’s income rather than your personal finances. We offer competitive rates and flexible terms to help you build a profitable rental portfolio.

HomeAbroad simplifies every step of the process. Use our AI-powered investment property search to find high-yield opportunities across Missouri. Our local experts provide hands-on support, and we help you form a US-based LLC, open a US bank account, and connect with trusted professionals for insurance and property management.

Already own a rental property in Missouri? Our cash-out refinancing option lets you tap into your property’s equity, no US credit or income needed. Use the funds to expand your portfolio, renovate for better returns, or reinvest elsewhere, all while qualifying based on rental income.

FAQs

Can foreign nationals apply for DSCR loans in Missouri?

Foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

Can self-employed borrowers apply for a DSCR loan in Missouri?

Yes, DSCR loans are ideal for self-employed borrowers who may not have consistent personal income or tax returns. The loan qualification is based on the property’s income rather than the borrower’s personal financial history.

How long does it take to get a DSCR loan in Missouri?

At HomeAbroad Loans, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Price