Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

As an H1B visa holder, you’re in a prime position to make one of the most rewarding investments: buying a home in the US. However, many H-1 B visa holders face challenges such as complex mortgage processes, limited credit histories, and restricted financing options. But once you overcome these initial challenges, there is no looking back.

According to the National Association of Realtors, 56% of foreign buyers purchased property in the US in 2025, amounting to around 78,100 homes. Real estate remains a stable and lucrative investment, with annual property values appreciating by 5.4% over the last decade.”

Despite the hurdles, thousands of H-1B visa holders achieve homeownership yearly. With the proper guidance and tailored financing solutions, turning your US homeownership dream into reality is easier than you think.

Key Takeaways:

1. H-1B visa holders don’t have to wait for their green card to buy a house in the US.

2. H1B visa holders don’t need an established US credit history to achieve homeownership in the US.

3. H1B visa holders, even if uncertain about their visa extension, can continue owning and managing their US real estate even if they return to their home country.

4. H1B visa holders have access to long-term investment opportunities that can outweigh potential risks like immigration uncertainties and provide them with financial stability.

Table of Contents

Can H1B Visa Holders Buy a House in the US?

As soon as you step into the US on an H1B visa, the first thought that probably comes to your mind is, “Can I buy a house in the US with my non-immigrant visa status?”

As a real estate and mortgage professional who has worked with many H1B visa holders, I understand your initial challenges. Concerns about visa status, limited US credit history, and mortgage approval can feel overwhelming.

The good news? Yes, H1B visa holders can buy property in the US, just like any US citizen. Homeownership provides stability and is a wise long-term investment. However, the mortgage process can be more complex due to stricter lender requirements and limitations on credit history.

That’s where HomeAbroad comes in. We specialize in helping H1B professionals navigate these challenges. Our team works with lenders who offer tailored mortgage solutions, even for those without an extensive US credit history.

For more details on the requirements and criteria for H-1 B visa holders, refer to our H-1 B visa mortgage guide. Embrace the possibilities of a successful US home-buying process, and let’s look at why owning a house in the US on an H1B visa can be a wiser real estate investment and be profitable for you.

Top 5 Reasons Why You Should Consider Buying a House on an H1B Visa

Many H-1 B visa holders consider buying a house as they search for stability when moving to a new place. Let’s look at these reasons in detail to understand why you should not delay investing in purchasing your home.

Owning a home in the US can offer H1B holders numerous benefits, from improving their quality of life to building wealth and taking advantage of property tax benefits.

If you want to know in detail about other benefits and challenges of buying a house on an H-1B visa, check out the 10 key reasons to buy a home on an H1B visa to get a clear picture of your next significant investment.

Now, let’s discuss why owning is more appealing than renting a property in the US.

Which One Is More Beneficial for You – Buying or Renting?

Foreign national professionals on H-1 B visas often have extended stays in the US, making renting less appealing and unprofitable as they settle into their new lives.

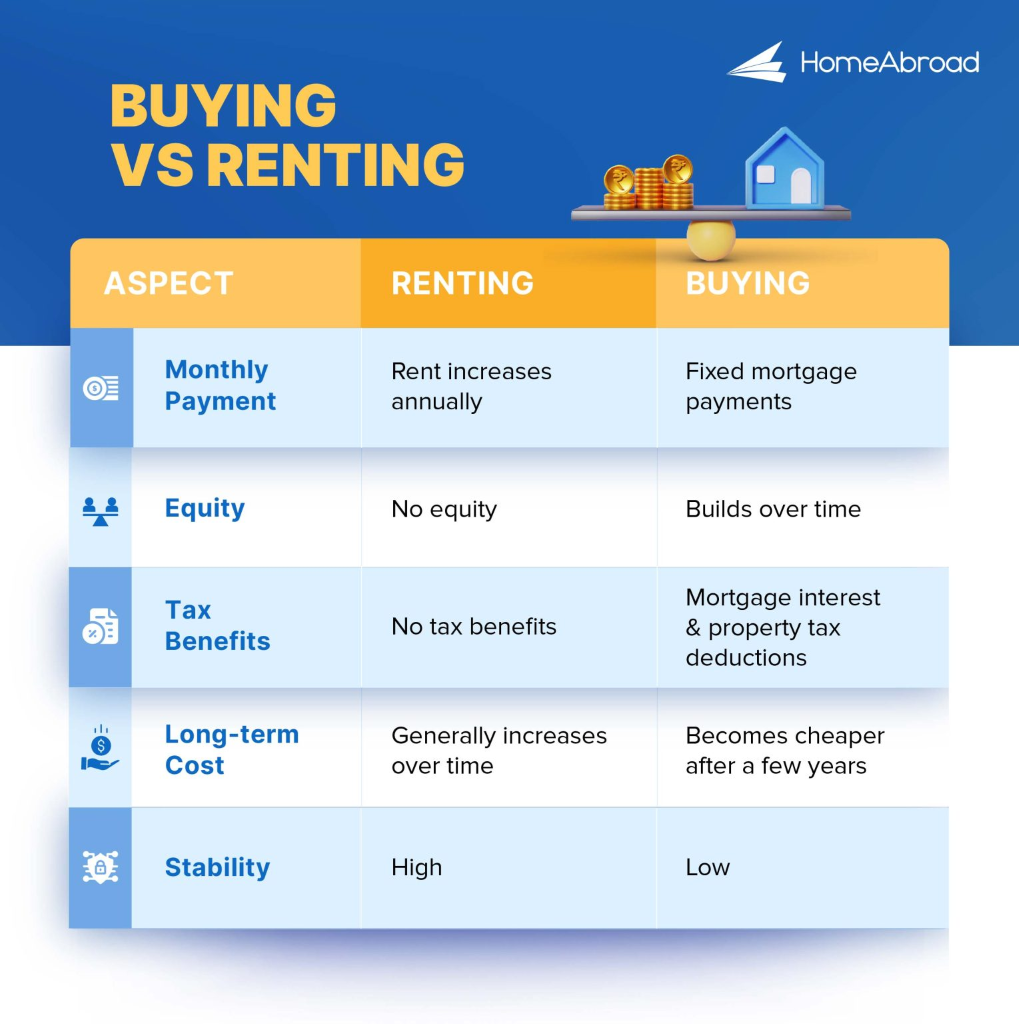

In many areas of the US, the cost of owning a home is lower than renting, especially over the long term. Fixed-rate mortgages provide predictable monthly payments, unlike rent, which can increase annually, giving H1B visa holders a sense of financial stability and independence as they settle into their new lives.

Let us see why buying is a better option compared to renting:

Are you still confused between buying and renting? Here is a video to help you out.

Now, thinking about your visa expiry? No worries; we have your back. Even if you leave the US, you can still maintain and manage your property remotely. Let’s discuss how!

Are you worried about Visa Expiry or an Early Return to Your Native Country?

Are you not buying a property in the US because you have this question? Well! Here are some options for your home if you have to return to your native country.

This option may be ideal if you plan to return to the US after some time. By renting out your home, you can maintain ownership remotely from your home country and potentially generate income to help offset mortgage costs or other expenses.

Selling your home may be a good option if you do not plan on returning to the US shortly, allowing you to cash in on your investment and use the proceeds for other purposes.

It may be a good option if you have friends or family members interested in using your home while you’re away. This could help offset some of the costs associated with owning a house, and you may even be able to negotiate a rent-free arrangement.

Still unsure about buying a home or fearing your visa status? Let’s review a case study of our client who successfully purchased a house while on an H-1 B visa. Let his story inspire you to take your first step towards US homebuying.

How an H1B Visa Holder Turned His US Property into a Successful Investment

Owning a home as an H1B visa holder is a significant achievement, but it’s natural to have concerns about the long-term implications. What happens if your visa status changes? Let’s find the answer to this question.

Case Study: Raj’s Journey to Homeownership on an H1B Visa

Raj, an H1B visa holder from India working in Silicon Valley, secured a $450,000 mortgage within 30 days with HomeAbroad’s H1B visa mortgages and purchased a charming home in a vibrant neighborhood just six months after arriving in the US. Despite his excitement, he worried about the implications of potential visa changes.

Challenges:

Visa Uncertainty: Raj feared losing his home if his visa wasn’t renewed. He learned he could rent the property, leveraging high US rental yields to cover the mortgage and maintenance costs, even generating surplus income.

No Credit History: Obtaining financing seemed daunting without a US credit history. With guidance, Raj successfully secured a competitive loan tailored for foreign nationals.

The HomeAbroad Solution:

High rental yields: Rental income could cover mortgage payments and property maintenance, and generate surplus income. Knowing his investment would continue to work for him gave Raj peace of mind.

“In the past decade, non-resident foreign nationals have invested over $1 trillion in US real estate, attracted by high rental yields, strong cash flow potential, and the absence of restrictions or additional taxes specifically targeting foreign investors.”

Long-Term Financial Planning: By turning his monthly rent into equity, Raj built a growing asset that benefits from property appreciation and potential future profits from renting or selling.

Outcome: Homeownership on an H1B visa

At HomeAbroad, we helped Raj develop a comprehensive financial plan tailored to his unique situation, addressing his questions and concerns. Through this strategic planning, Raj secured his dream property in the US, overcame his fear of visa uncertainty by renting it out, and successfully settled his mortgage payments.

Raj’s story is a testament to how, with the proper guidance, one can turn concerns into confidence and dreams into reality.

Here is what Raj had to say about his experience of homebuying on an H1B Visa with HomeAbroad:

"I was worried about what would happen to my property if my visa status changed. HomeAbroad's team provided me with all the information and options I needed, ensuring my investment was safe and secure. HomeAbroad helped me find the right investment property and secure a mortgage for my investment property. Their customer service is outstanding!" - Raj, Software Engineer, Amazon.

If this story inspires you, check out the H-1 B visa US home-buying guide and contact HomeAbroad today. We help you navigate the process of US homebuying, turning what seems complicated into a seamless journey. You can also check out our video to better understand the process.

We are here to support you every step of the way, ensuring your homeownership journey on an H-1 B visa is smooth and rewarding, whether you have a strong credit history or are a newcomer to the US on a work visa.

Are you clear on all the doubts about US homebuying on an H-1 B visa? Let’s discuss why 2025 is the ideal year to start investing and purchasing a property in the US and why you can’t delay or miss this golden period.

Is 2025 The Year for H1B Visa Holders to Invest in US Real Estate?

The 2025 housing market offers improved conditions for buyers and investors. Based on market insights, here’s why 2025 is the year for H1B visa holders to own property in the US.

Factor | Market Analysis |

|---|---|

Mortgage Rates | Expected to stabilize between 6.0% and 6.5%, offering more predictable financing and reduced monthly payments compared to recent volatility. |

Home Price Growth | Anticipated moderate growth of about 3–5% helps ensure property appreciation while keeping affordability in focus. |

Housing Affordability | Stabilized mortgage rates and increased new construction are set to improve overall affordability, making it easier for buyers to enter the market. |

Job Market Growth | With projections of nearly 2 million new jobs across key sectors such as tech, healthcare, and finance, income stability is expected to improve mortgage approval rates and purchasing power. |

Home Inventory | Increased new construction, especially in affordable regions like the Midwest and Sunbelt states, will expand housing options and provide greater negotiating power. |

Investment & Residency Opportunities | Programs like the EB-5 Investor Visa offer pathways to permanent residency by investing in real estate projects that create US jobs, providing an additional incentive for high-net-worth H1B holders. |

With stabilizing rates, manageable price growth, and rising inventory, 2025 is an opportune time for homebuyers and investors to act. Don’t delay; act fast and start your journey of turning US homeownership into a reality.

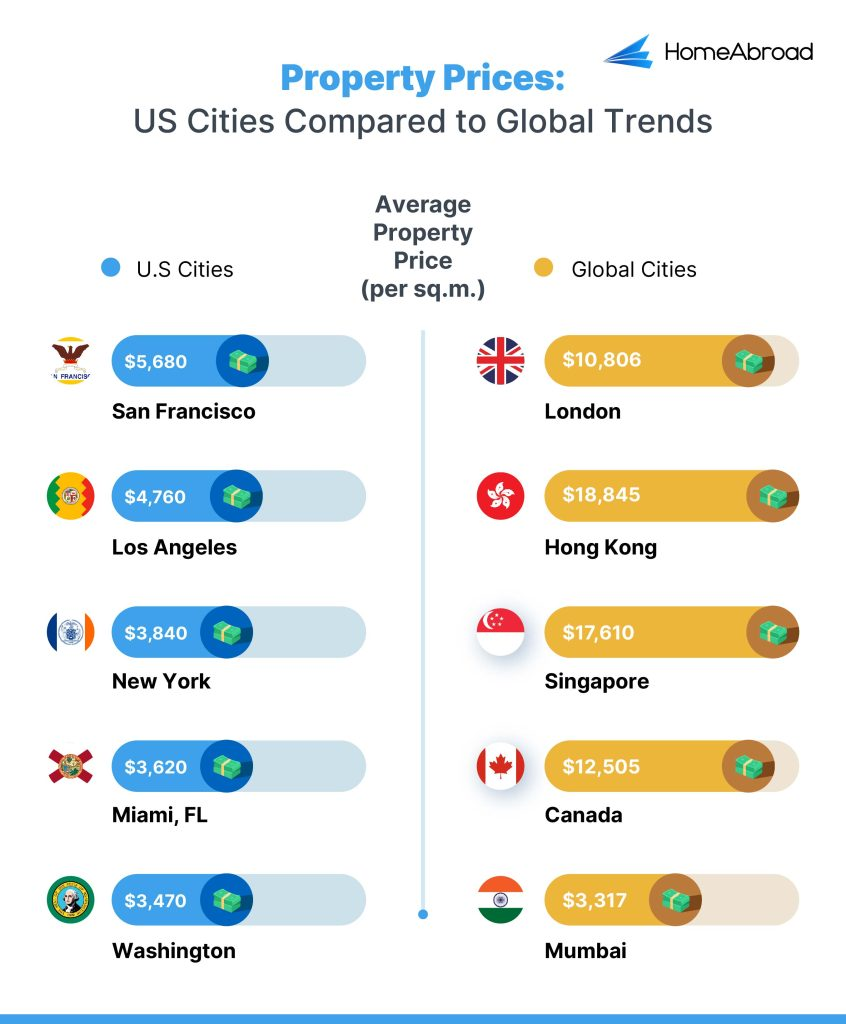

Check out this comparison of US property prices with other global cities and decide why the US real estate market is more profitable for homebuying and ownership.

Start Owning a House in the US with HomeAbroad

We make homebuying for global buyers on an H-1B visa accessible and stress-free. We specialize in H-1B visa mortgages, helping professionals secure financing even without a US credit history.

Our AI-driven investment property search platform connects you with top properties, while our 500+ expert agents guide you every step of the way. Plus, we handle everything, from mortgage approval tailored for H-1B holders to AI-driven investment property searches to match your goals, LLC setup, bank accounts, and insurance, to ongoing support for a seamless experience.

Your US homeownership dream starts here. Get started with HomeAbroad today!

FAQs

What financing options are available to H-1 B visa holders?

H1B holders can access various mortgage options for their primary residence or investment property without a US credit score. For more detailed information on available mortgage programs, eligibility, down payment, interest rates, and other loan terms, check out our H1B visa mortgage guide.

What documents does a first-time buyer need to provide to purchase a property in the US on an H1B visa?

As a first-time buyer, you must provide proof of funds to cover the purchase price of the land and any associated costs of purchasing property in the US on an H1B visa.

Can an H1B visa holder buy a rental property in the US?

Yes, H-1 B visa holders can buy rental and other investment properties in the US to generate passive income, as long as they are not doing so as a business.

Can I own more than one home on an H-1 B visa?

Yes, you can own more than one home on an H1B visa. Your immigration status does not limit the number of properties you can own in the US.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: NAR Statistics

![H1B Visa Mortgages: How to Qualify with No US Credit? [2025]](https://homeabroadinc.com/wp-content/uploads/2024/09/h1b-visa-mortgages.png)