Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Kentucky’s rental market is emerging as a strong opportunity in the US, and DSCR loans from HomeAbroad enable international real estate investors to qualify without requiring US income, credit history, or residency status.

2. DSCR loans are based on the property’s rental income, so foreign nationals don’t have to submit personal tax returns, pay stubs, or employment records to qualify for these loans.

3. Key Kentucky cities like Louisville, Lexington, and Bowling Green offer attractive rental yields, steady tenant demand driven by universities and local industries, and promising long-term appreciation potential.

4. HomeAbroad provides a seamless experience for international real estate investors, helping you locate properties through our AI-driven investment property search platform, secure mortgages, establish a US-based LLC, open a local bank account, and manage all closing paperwork remotely.

Table of Contents

Welcome to Kentucky – The Bluegrass State, where rolling hills meet world-famous bourbon distilleries, and the Kentucky Derby puts Louisville in the global spotlight. But today, it’s not just horse lovers who are drawn here; international real estate investors are noticing Kentucky for its affordable housing, steady rental demand, and investor-friendly taxes.

Whether you’re looking at a duplex in Lexington, a single-family home in Louisville, or a multi-unit investment in Bowling Green, Kentucky, these properties offer strong long-term growth potential and positive cash flow.

Foreign nationals can now take advantage of DSCR loans from HomeAbroad to access these opportunities without requiring US income, credit history, or permanent US residency.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad DSCR loan (Debt-Service Coverage Ratio loan) is a mortgage designed for foreign nationals and global investors that qualifies you based on the property’s rental income, not your personal income.

Kentucky offers strong rental yields of around 6%, making it an attractive market for steady cash flow and long-term appreciation. From Lexington to Louisville, and Bowling Green to smaller towns, global investors can tap into a variety of property types, from single-family homes to multi-unit rentals.

HomeAbroad’s DSCR loans offer flexibility for international real estate investors, including multiple DSCR loans, cash-out refinancing, and access for all types of investors, whether you’re buying your first property or expanding an extensive portfolio. The focus remains on the property’s income potential, eliminating the need for US credit history, personal tax returns, or employment documentation.

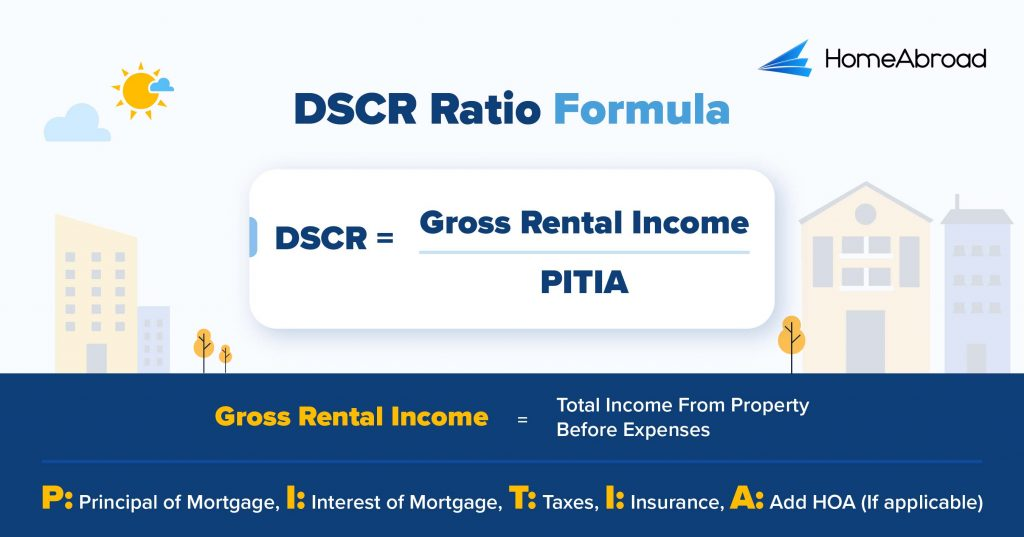

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income is sufficient to cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

A DSCR of 1.17 indicates that the property generates 17% more income than the mortgage payment, signaling strong cash flow. If you find the calculation complex, you can use HomeAbroad’s DSCR ratio calculator to calculate your rental property’s DSCR ratio.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements in Kentucky for Foreign Nationals

Compared to conventional lenders, HomeAbroad offers a streamlined foreign national mortgage DSCR loan process explicitly tailored for global investors.

Whether you’re investing from abroad or don’t have a US credit history, our flexible terms, lower barriers to entry, and remote-closing support make Kentucky real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, several factors can affect your eligibility for a DSCR loan in Kentucky as a foreign national investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Kentucky.

Where We Lend DSCR Loans in Kentucky

HomeAbroad offers DSCR loans across Kentucky, providing tailored support for investors in top-performing cities, including Louisville, Lexington, Covington, Somerset, and more. Here are a few cities in Kentucky where we offer DSCR Loans.

- Louisville

- Lexington

- Somerset

- Bowling Green

- Williamstown

- Bardstown

- Frankfort

- Stanton

- West Liberty

- Tompkinsville

- Clay City

- Greenville

- Middlesboro

- Williamsburg

- Owensboro

- Newport

- Covington

To see how a DSCR loan works in real life, let’s look at a case study of an international real estate investor who secured financing for a Kentucky rental property with the help of HomeAbroad.

Case Study: DSCR Loan Success for a UK Investor in Louisville, Kentucky

James Turner, a UK-based investor who had recently relocated to the US on an E2 visa, set his sights on purchasing a rental duplex in Louisville, Kentucky. His plans, however, hit a roadblock when traditional lenders turned him down due to his short time in the country and the absence of a US credit profile. Multiple applications were rejected, delaying his investment plans.

The Solution: HomeAbroad Loans’ DSCR Loan

James decided to explore alternative financing and connected with HomeAbroad Loans. Through a DSCR loan, he qualified based on projected rental income from the duplex rather than his personal income or US credit history.

HomeAbroad’s mortgage specialist worked closely with him to negotiate a DSCR interest rate of 7.25%, which improved the property’s Debt Service Coverage Ratio (DSCR) and made the numbers work in his favor. This strategic adjustment helped James secure a $285,000 loan that met all lender requirements while maintaining a positive cash flow from the investment.

- Loan Amount: $285,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.25%

- Time to Close: 29 days

Why This Worked for James:

- No US Credit History Required: The loan approval was based on rental income projections, bypassing the need for an established US credit history or traditional loan requirements.

- Customized Loan Terms: The rental property’s income covered his mortgage payments, meeting DSCR approval standards and allowing the loan to close within just over a month.

- Portfolio Expansion: With the DSCR loan, James acquired a $400,000 duplex in a high-demand Louisville neighborhood, securing consistent rental income and growing his US real estate portfolio.

This case illustrates how HomeAbroad Loans helps foreign nationals tap into high-potential US markets, such as Kentucky, by offering tailored mortgage solutions that remove the typical barriers of income documentation and US credit history.

Top Places to Invest in Kentucky with a DSCR Loan

Kentucky is becoming an increasingly attractive market for real estate investors due to its affordable home prices, steady population growth, and rising demand for rental properties. The state offers a mix of urban centers and suburban neighborhoods, creating opportunities for both long-term rentals and short-term vacation stays.

For international real estate investors, DSCR loans simplify financing properties in Kentucky. These loans focus on the property’s rental income rather than the borrower’s income, eliminating the need for a US credit history while highlighting the investment’s profitability. This approach offers strong rental demand and the potential for positive cash flow across all rental properties in Kentucky.

Here are the top-performing cities in Kentucky to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Louisville | Short-Term | 23% |

Lexington | Short-Term | 13.06% |

Somerset | Short-Term | 14.37% |

Newport | Long-Term | 6.45% |

Covington | Long-Term | 8.07% |

Louisville: Kentucky’s Urban Powerhouse for Short-Term Gains

Louisville is the beating heart of Kentucky’s economy and culture – home to the Kentucky Derby, a thriving bourbon scene, and year-round tourism. Its short-term rental market is one of the strongest in the state, delivering an impressive 23% yield thanks to high occupancy rates, strong ADR, and demand that extends well beyond peak events.

- Median Home Price: $253,333

- Average Rent: $1,290/month

What this means for investors: With one of the highest STR yields in the region, Louisville is a magnet for investors seeking robust cash flow and quick DSCR qualification. Neighborhoods like Old Louisville, NuLu, and Highlands command premium nightly rates while maintaining high booking activity, creating a steady income stream for well-managed properties.

Investment Properties Listed Today on Sale in Louisville

Lexington: Bluegrass Tourism Meets University Stability

Lexington blends the charm of horse country with the economic stability of a major university city. Visitors are drawn by the Kentucky Horse Park, bourbon trails, and the University of Kentucky, ensuring a year-round short-term rental audience and supporting a 13.06% yield for STR investors.

- Median Home Price: $325,667

- Average Rent: $1,750/month

What this means for investors: Lexington’s combination of steady tourism and a large student population supports healthy occupancy and predictable cash flow. While its STR yields aren’t the highest in Kentucky, the market offers low volatility and excellent tenant diversity, making it ideal for hybrid short- and long-term strategies.

Investment Properties Listed Today on Sale in Lexington

Somerset: Lake Cumberland’s Vacation Rental Goldmine

Perched on the shores of Lake Cumberland, Somerset is a growing hotspot for vacation rentals. Boating, fishing, and outdoor festivals draw a loyal base of seasonal travelers, and the short-term rental market here produces a strong 14.37% yield – among the most competitive in the state’s secondary markets.

- Median Home Price: $256,650

- Average Rent: $1,095/month

What this means for investors: Somerset’s yields rival those of larger cities, thanks to high seasonal demand and competitive nightly rates. Investors targeting lake-view or waterfront properties often see above-average revenue, especially during the summer peak, while off-season rentals maintain steady occupancy from weekend getaway traffic.

Investment Properties Listed Today on Sale in Somerset

Newport: Cincinnati’s Gateway with Strong Long-Term Demand

Situated just across the river from downtown Cincinnati, Newport offers urban convenience with Kentucky’s affordability. Its long-term rental market delivers a healthy 8.84% yield, supported by steady commuter demand and quick leasing cycles.

- Median Sold Price: $ 295,333

- Average Rent: $1,558/month

What this means for investors: Newport’s proximity to Cincinnati ensures a steady pool of tenants, ranging from young professionals to families, who are willing to pay premium rents for the location and amenities. The long-term rental market sees low vacancy rates, making it a reliable play for consistent monthly cash flow and property appreciation.

Investment Properties Listed Today on Sale in Newport

Covington: Historic Charm Meets Rental Stability

Covington combines walkable historic districts with a strategic location near downtown Cincinnati. The long-term rental market here yields an 8.07% return, with demand fueled by a mix of local workers, remote professionals, and cross-river commuters.

- Median Home Price: $215,667

- Average Rent: $1,450/month

What this means for investors: Long-term rentals in Covington benefit from high demand and quick leasing cycles. Historic properties and renovated multifamily units are desirable to renters seeking character and location, and to investors seeking both cash flow stability and long-term appreciation potential.

Investment Properties Listed Today on Sale in Covington

Specific Considerations for Investing in Kentucky for Foreign Nationals

Kentucky’s real estate market offers a balance of affordability, stable rental yields, and growing economic sectors. For overseas buyers, the state’s mix of urban hubs, such as Louisville and Lexington, and fast-growing secondary markets creates opportunities for both cash flow and long-term appreciation. But success depends on understanding Kentucky’s specific legal, economic, and market dynamics.

Here are the most critical factors to keep in mind:

– Property Tax Stability & Local Variations

Kentucky’s property tax rates are relatively low compared to the US average (around 0.83%), but rates vary significantly by county. For example, Fayette County (near Lexington) can have a higher rate than rural counties. Investors should research local millage rates and understand how school district taxes may impact total holding costs.

– Insurance & Natural Disaster Risk

While Kentucky doesn’t face coastal hurricane threats, parts of the state are prone to tornadoes, flooding, and occasional severe winter storms. Flood-prone areas, particularly near the Ohio River, may require additional insurance, which can affect ROI. FEMA flood maps should be checked before purchase.

– Short-Term Rental Regulations

Major cities, such as Louisville, require short-term rental operators to register and comply with zoning regulations. Some neighborhoods may limit STRs entirely. Understanding local ordinances is crucial before planning Airbnb or vacation rental strategies.

– Landlord–Tenant Laws

Kentucky is generally considered landlord-friendly. There are no statewide rent control measures, and eviction timelines are shorter than those in many states. However, certain cities have additional tenant protections, so local rules still matter.

– Economic Drivers & Tenant Demand

Key industries, including logistics (such as UPS Worldport in Louisville), bourbon distilleries, advanced manufacturing, and healthcare, create stable employment, driving rental demand in both urban and suburban markets. Investors can target housing near major employers for higher occupancy rates.

Strategic & Future Considerations for Foreign Nationals Investing in Kentucky

Kentucky’s future growth is tied to its position as a logistics hub, emerging tech investment, and expanding healthcare infrastructure. For international real estate investors, these trends can help identify high-performing submarkets.

Here are some future considerations that international real estate investors need to pay heed to:

1. Foreign Ownership Access: Kentucky has no restrictions on foreign nationals owning property. This legal openness makes it easy for overseas investors to enter the market without complex ownership structures.

2. Growth of Logistics & Industrial Markets: Louisville’s UPS Worldport, the world’s most extensive automated package handling facility, continues to attract related businesses, thereby increasing housing demand. This growth is expected to expand outward to suburbs like Shepherdsville and Elizabethtown.

3. Rising Interest in Secondary Cities: Markets like Bowling Green and Owensboro are seeing population growth and rising rental rates, offering entry points with lower acquisition costs and higher yield potential than major metros.

4. Infrastructure & Transport Expansion: Projects like the I-69 corridor and Ohio River bridge improvements will enhance connectivity, potentially increasing property values in previously overlooked areas.

5. Targeted Investment Strategies: For buy-and-hold investors, focusing on workforce housing near logistics hubs, universities, or medical centers may yield stable returns. Short-term rentals can be effective in tourism-driven areas, such as horse country and bourbon trail towns, but only where permitted.

Get a HomeAbroad DSCR Loan in Kentucky as a Foreign National

Securing financing for your Kentucky investment property is now easier with HomeAbroad. Our DSCR loans are designed for international real estate investors, offering adaptable terms and competitive rates to help you build a strong, income-generating portfolio.

HomeAbroad makes your investing experience seamless. Using our AI-powered investment property search platform, you can find high-yield rental opportunities across Kentucky, from Louisville’s vibrant urban neighborhoods to Lexington’s stable suburban markets. Our local real estate experts provide step-by-step guidance, and we assist with essentials such as LLC formation, setting up a US bank account, and connecting you with reliable property management services.

For global investors seeking to expand their holdings, we also support multi-property DSCR financing, allowing you to acquire additional Kentucky rentals while maintaining a focus on projected rental income rather than personal income or credit history.

Get started with a DSCR loan through HomeAbroad and unlock Kentucky’s potential for consistent cash flow and long-term value growth.

Frequently Asked Questions

What are the interest rates for DSCR loans in Kentucky?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

Is cash-out refinancing available for DSCR loans in the state of Kentucky?

Yes, HomeAbroad offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

What is the minimum DSCR ratio required for a DSCR loan in Kentucky?

To get qualified, a DSCR ratio of 1 or higher is generally required. The higher your ratio, the more likely you are to get approved for your loan. However, HomeAbroad offers No-Ratio DSCR loans for properties with lower coverage, provided a higher down payment is made to mitigate the additional risk.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data