Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Massachusetts has a robust and resilient rental market, and DSCR loans from HomeAbroad enable international real estate investors to qualify without requiring US income, credit history, or residency status.

2. These loans are underwritten based on the property’s rental income, meaning foreign nationals don’t need to provide personal tax returns, pay stubs, or employment records.

3. Major Massachusetts cities like Boston, Cambridge, and Worcester offer strong rental yields, consistent demand fueled by universities, tech, and healthcare sectors, and excellent long-term appreciation potential.

4. HomeAbroad simplifies the entire investment journey for global investors, helping you find properties via our AI-driven investment property search platform, get financing, set up a US-based LLC, open a local bank account, and handle all closing requirements.

Table of Contents

Welcome to Massachusetts – The Bay State, where history, innovation, and world-class universities shape the landscape. International real estate investors are drawn here for its resilient rental market, strong tenant demand, and high appreciation potential.

From a Boston condo near tech hubs to a family home in Cambridge or an income property in Worcester, Massachusetts, the state offers diverse investment opportunities.

Foreign nationals can easily invest in any of these properties using DSCR loans from HomeAbroad, making it simple to enter one of the US’s most competitive real estate markets.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad DSCR loan (Debt-Service Coverage Ratio loan) is a foreign national mortgage designed for international real estate investors that qualifies you based on the property’s rental income, your personal income or Debt-to-Income (DTI) ratio will not affect your qualification.

I recently worked with an investor from Germany who wanted to purchase a two-bedroom condominium in Boston, near the city’s tech and innovation hubs. With no US credit history and no local income documentation, traditional banks declined his application. Using our DSCR loan, we focused solely on the property’s projected rental income and approved his financing. He was able to secure a property in one of the most competitive markets in the US, without providing personal tax returns or employment history.

From Boston, Cambridge, and Worcester, this state offers global investors opportunities for strong tenant demand, competitive rental yields of around 6%, and excellent long-term appreciation potential. HomeAbroad’s DSCR loans support multiple property acquisitions, portfolio expansion, and cash-out refinancing, making it easy for international real estate investors to grow their real estate holdings in one of America’s most dynamic markets.

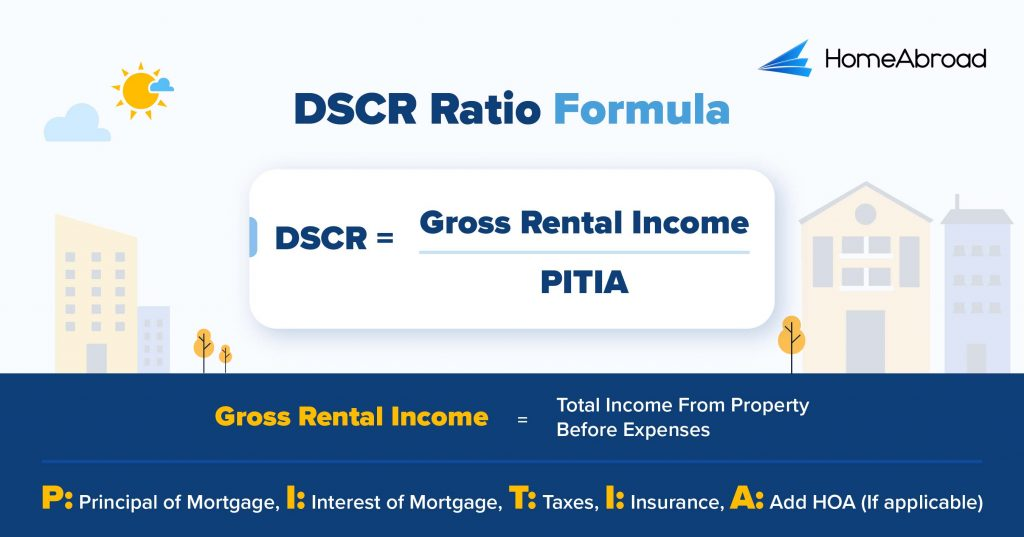

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income is sufficient to cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

A DSCR of 1.16 indicates that the property generates 16% more income than the mortgage payment, signaling strong cash flow. You can use HomeAbroad’s DSCR ratio calculator if you prefer not to calculate it yourself.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements in Massachusetts for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined DSCR mortgage process for foreign national investors.

Whether you’re investing from abroad or don’t have a US credit history, our flexible terms, lower barriers to entry, and remote-closing support make Massachusetts real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and criteria that can significantly impact your ability to qualify for a DSCR Loan as a global investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Massachusetts.

Where We Lend DSCR Loans in Massachusetts

HomeAbroad offers DSCR loans across Massachusetts, providing tailored support for investors in top-performing cities, including Somerset, Worcester, Springfield, and more. Here are a few towns in Massachusetts where we offer DSCR Loans.

- Harwich

- New Bedford

- Somerset

- Worcester/li>

- Springfield

- Boston

- Cambridge

- Lowell

- Fitchburg

- Chicopee

- Brockton

- Holyoke

- Easthampton

- Northampton

To see how a DSCR loan works in real life, let’s look at a case study of an international real estate investor who secured financing for a Massachusetts rental property with the help of HomeAbroad.

Case Study: DSCR Loan Success for a German Investor in Boston, Massachusetts

Markus Weber, a German investor who recently arrived in the US on an L1 visa, had his sights set on purchasing a two-bedroom condo in Boston’s innovation district. Despite having substantial investment capital, his lack of a US credit history and the absence of local income documentation led to multiple rejections from traditional lenders.

The Solution: HomeAbroad Loans’ DSCR Loan

Markus turned to HomeAbroad Loans, where eligibility was determined solely by the property’s projected rental income rather than his personal income or US credit history. This approach removed the barriers that had stalled his investment plans.

HomeAbroad’s mortgage team negotiated a 7.15% DSCR interest rate, which improved the property’s Debt Service Coverage Ratio (DSCR) and secured Markus a $460,000 loan for the Boston condo. With strong rental demand in the area, the numbers supported a healthy cash flow from the outset.

- Loan Amount: $460,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.15%

- Time to Close: 28 days

Why This Worked for James:

- No US Credit History Required: Approval was based solely on the property’s income potential, eliminating the need for a domestic credit report or US tax returns.

- Tailored Terms: A competitive interest rate ensured the DSCR met lender requirements for quick approval.

- Prime Location Investment: Markus secured a property in one of Boston’s most sought-after neighborhoods, benefiting from both strong occupancy rates and long-term appreciation.

This case highlights HomeAbroad Loans’ ability to help global investors successfully finance properties in high-demand US markets, such as Boston, even when traditional financing routes are unavailable.

Top Places to Invest in Massachusetts with a DSCR Loan

Massachusetts remains a strong choice for international real estate investors, thanks to its robust economy, high rental demand, and diverse communities. From bustling urban areas to charming suburban towns, the state offers opportunities for both long-term and short-term rental investments.

DSCR loans are an ideal solution for foreign national investors in Massachusetts, as approval is based on the property’s rental income rather than personal financial history, making it easier to enter a competitive market. DSCR loans help you fund properties throughout Massachusetts, which are known for their consistent rental demand and strong investment potential.

Here are the top-performing cities in Massachusetts to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Worcester | Long-Term | 6.5% |

Springfield | Long-Term | 7.7% |

Hawrich | Short-Term | 15.3% |

Somerset | Short-Term | 6.5% |

New Bedford | Short-Term | 9.8% |

Worcester: Affordable Long-Term Rental Hub with Steady Yield

Worcester delivers a strong long-term rental yield of 6.5%, making it one of Massachusetts’ most reliable markets for steady cash flow. As the state’s second-largest city, Worcester benefits from diverse economic drivers, including healthcare, education, technology, and manufacturing, which create a broad tenant base. The presence of institutions like UMass Medical School and Worcester Polytechnic Institute ensures year-round rental demand from students, staff, and young professionals.

- Median Home Price: $400,300

- Average Rent: $2,175/month

What this means for investors: Worcester’s affordability relative to Boston allows investors to build long-term rental portfolios without over-leveraging. Low vacancy rates and stable rent growth provide predictable DSCR-focused financing opportunities. Neighborhoods near the city center and university corridors show strong potential for both appreciation and rental stability, making it ideal for foreign nationals seeking low-risk, long-term income streams.

Investment Properties Listed Today on Sale in Worcester

Springfield: High-Yield Long-Term Investment Potential

Springfield offers a rental yield of 7.7%, one of the highest among Massachusetts’ major cities for long-term rental investments. Its status as the Pioneer Valley’s economic hub attracts tenants in healthcare, education, government, and manufacturing sectors. The city’s revitalization efforts, including downtown redevelopment and public transportation improvements, are enhancing property values and tenant demand.

- Median Home Price: $279,127

- Average Rent: $1,800/month

What this means for investors: Springfield’s affordability allows investors to achieve strong cash-on-cash returns with relatively low entry costs. Long-term tenants are abundant due to employment stability and regional demand, which is particularly appealing for DSCR loan approval. The combination of below-average property prices and consistent rent growth makes Springfield an excellent choice for building scalable, low-risk rental portfolios.

Investment Properties Listed Today on Sale in Springfield

Harwich: Profitable Short-Term Rental Destination

Harwich stands out for short-term rental investors, offering a 15.3% yield that reflects Cape Cod’s enduring appeal to vacationers. Seasonal tourism drives high occupancy and premium nightly rates, particularly during summer months. Its charming coastal neighborhoods, beaches, and proximity to popular Cape Cod attractions ensure consistent demand.

- Median Home Price: $745,256

- Average Rent: $2,550/month

What this means for investors: STR investors in Harwich can benefit from high seasonal cash flow, often surpassing long-term rental income. Strategic property selection, favoring proximity to beaches and recreational hubs, maximizes occupancy and nightly rates. Leveraging DSCR loans, even foreign investors without a US credit history can secure financing while capitalizing on Cape Cod’s strong tourism trends.

Investment Properties Listed Today on Sale in Harwich

Somerset: Stable Coastal Short-Term Rental Market

Somerset provides a coastal short-term rental yield of 6.5%, with strong seasonal appeal due to waterfront access and proximity to Providence, RI. The town combines suburban calm with tourism-driven income, making it an attractive destination for investors seeking a blend of lifestyle and rental returns.

- Median Sold Price: $532,867

- Average Rent: $1,909/month

What this means for investors: Investors can generate predictable STR income while diversifying their portfolios with coastal properties. Somerset’s manageable occupancy fluctuations and extended tourist season enable reliable DSCR-driven financing. Waterfront and historic neighborhoods tend to see the highest demand, providing opportunities for property appreciation and premium nightly rates.

Investment Properties Listed Today on Sale in Somerset

New Bedford: Thriving Maritime Short-Term Rental Market

New Bedford achieves a 9.8% STR yield, driven by tourism, cultural heritage, and waterfront revitalization. Its growing appeal as a vacation destination, combined with lower property prices than neighboring coastal towns, attracts both budget-conscious and premium travelers. The city’s infrastructure and historic districts further enhance its rental attractiveness.

- Median Home Price: $420,500

- Average Rent: $1,750/month

What this means for investors: STR investors can capture strong cash flow while benefiting from long-term property appreciation. Neighborhoods near the waterfront, museums, and downtown areas typically enjoy the highest occupancy rates. For foreign investors, New Bedford offers an accessible entry point into Massachusetts real estate with a clear path to DSCR loan approval based on rental income rather than US credit history.

Investment Properties Listed Today on Sale in New Bedford

Specific Considerations for Investing in Massachusetts for Foreign Nationals

Massachusetts offers a robust, knowledge-economy-anchored real estate market, but foreign national investors must navigate unique insurance challenges, municipal regulations, multifaceted tax rules, and evolving infrastructure. Understanding these state-specific nuances is crucial for making strategic, high-return decisions and preserving long-term investment value.

Here are the most critical factors to keep in mind:

– Federal Review & Ownership Sensitivities

While Massachusetts imposes no restrictions on property ownership by foreign nationals, the recent expansion of CFIUS authority means that any acquisition near military installations, such as Joint Base Cape Cod, may now trigger a national security review. The US Treasury’s final rule adds dozens of installations under scrutiny, extending the scrutiny to within 1 mile for 40 sites and up to 100 miles for others; deals in sensitive zones may face delays or require mitigation, so investors should conduct proximity due diligence early.

– Transit-Driven Growth Corridors

The long-awaited South Coast Rail project, now moving into active phases, is poised to connect Boston with cities like Fall River and New Bedford, unlocking pent-up value in these transit-oriented markets. These emerging corridors are experiencing healthy cap rates (e.g., ~6.4% in Fall River), attractive home-price-to-rent dynamics, and investment momentum tied to improved accessibility.

– Tax Strategy & Estate-Planning Implications

Massachusetts doubled its estate-tax exemption from $1 million to $2 million, effective retroactively from January 1, 2023, removing the “cliff effect” and reducing filing burdens for estates under that threshold. Estates above it are taxed on the excess, with rates up to 16%. Meanwhile, the federal estate exemption remains significantly higher, now at $15 million for individuals under the recently enacted “One Big Beautiful Bill.” Understanding the distinction between state and federal regimes and leveraging entities such as trusts or corporations can save substantial sums at the time of exit or succession.

-Zoning & Rental Restrictions in a Fragmented Market

Massachusetts municipalities exercise considerable latitude in regulating short-term rentals, ranging from mandatory registration in Boston to outright bans or caps in towns such as Cambridge and Brookline. These local requirements directly impact the feasibility of vacation or student housing strategies, so investors must underwrite rental models with conservative occupancy assumptions and confirm regulatory paths before closing to preserve net operating income.

Strategic & Future Considerations for Foreign Nationals Investing in Massachusetts

Massachusetts’ real estate market is shaped by its globally recognized education, healthcare, and technology sectors, creating long-term stability and rental demand. For foreign national investors, the state’s growth is being reinforced by infrastructure expansion, sector-driven job creation, and policy shifts that can influence both acquisition strategy and exit planning.

Here are some future considerations that international real estate investors need to pay heed to:

1. Foreign Ownership Accessibility: Massachusetts does not impose restrictions on foreign nationals purchasing real estate, offering direct entry to residential and commercial markets. This open policy has made the Boston metro area a consistent target for international capital, particularly from Europe, Asia, and the Middle East, fueling competition in both luxury urban condos and high-demand suburban assets.

2. Influence on Academic and Innovation Hubs: International real estate buyers play a significant role in property markets surrounding Massachusetts’ academic powerhouses and biotech clusters, including Cambridge, Boston’s Seaport District, and Worcester’s growing research corridor. The steady influx of foreign students, visiting scholars, and multinational life sciences professionals supports both rental income stability and property value appreciation in these submarkets.

3. Climate Resilience Shaping Demand: As awareness of coastal flood risks grows, high-net-worth buyers are increasingly gravitating toward newer, inland developments that incorporate climate-resilient design, such as elevated structures and advanced stormwater management. This shift is gradually diversifying foreign investment beyond traditional waterfront luxury into well-planned urban and suburban communities with lower long-term insurance exposure.

4. Infrastructure-Driven Market Expansion: Major transportation upgrades, including the South Coast Rail connection and planned MBTA modernization projects, are set to open new commuter markets with lower entry costs and attractive yields. Early foreign investors in these growth corridors can benefit from price appreciation as improved transit access drives tenant demand and compresses cap rates over time.

Get a HomeAbroad DSCR Loan in Massachusetts as a Foreign National

Our DSCR loans empower global investors like you to access financing based solely on rental income with no US credit history, income verification, or tax returns needed. With loans from $75K to $10M, and closing timelines under 30 days, it’s never been easier to seize opportunities in Boston’s urban core, Worcester’s growing suburbs, or Cape Cod’s lucrative short-term rental market.

Our AI-powered investment property search platform and CIPS-certified agents help you discover yield-rich properties. Our end-to-end support, including LLC formation, US banking, and property management, ensures you’re set up for success.

If you’re already invested, our cash-out refinancing allows you to tap your equity without requiring a US income history, enabling you to reinvest in additional properties, use them for renovations to boost rental returns, or diversify into other promising US markets, all with an approval process centered on the property’s income potential.

Get your DSCR loan with HomeAbroad today and start building a high-performing Massachusetts real estate portfolio confidently and quickly.

Frequently Asked Questions

Can foreign nationals apply for DSCR loans in the state of Massachusetts?

Yes, foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international real estate investors.

What are the interest rates for DSCR loans in Massachusetts?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

How long does it take to close a DSCR loan in Massachusetts?

At HomeAbroad Loans, we streamline the application process to ensure a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loan Interest Rates Today [December, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)