Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Minnesota, the Land of 10,000 Lakes, is home to major employers like Target, 3M, and General Mills, along with world-class healthcare and education hubs. The state’s economy stays strong year-round, supported by a mix of corporate growth and a skilled workforce.

From Minneapolis’ thriving arts and music scene to the Mall of America’s millions of annual visitors, Minnesota draws steady tourism. Outdoor lovers flock here, too, whether for summer lake escapes or winter sports in the north.

This steady demand makes Minnesota’s housing market attractive for international investors. Whether you’re eyeing a lakefront short-term rental, a multifamily property near the University of Minnesota, or a suburban home in Rochester, DSCR loans from HomeAbroad can help you secure the right property without relying on personal income verification.

Table of Contents

Key Takeaways:

1. Minnesota’s real estate market offers strong rental demand in both major cities, like Minneapolis and St. Paul, and smaller stable markets such as Rochester and Duluth, making it attractive for foreign investors.

2. With DSCR loans from HomeAbroad, foreign nationals can qualify for financing based solely on the property’s rental income, no US credit history, income proof, or residency required.

3. Investors can tap into both long-term and short-term rental opportunities across Minnesota, supported by a diverse economy and consistent occupancy rates.

4. HomeAbroad streamlines the entire investment journey from AI-powered property search to financing, LLC formation, US bank account setup, remote closing, and property management support.

What is a DSCR Loan for Foreign Nationals?

A Debt Service Coverage Ratio (DSCR) loan is a type of real estate financing that focuses on a property’s rental income rather than the borrower’s income. Instead of reviewing your DTI ratio, we look at whether the property can generate enough revenue to cover its mortgage and related expenses.

For foreign nationals investing in Minnesota, this is especially valuable. You can qualify for a DSCR loan without a US credit score, green card, or visa, making it a practical option for buying everything from Minneapolis condos to vacation cabins in the north. HomeAbroad specializes in helping global investors tap into Minnesota’s market by offering DSCR loans with flexible terms and quick approvals.

How to Calculate the DSCR Ratio?

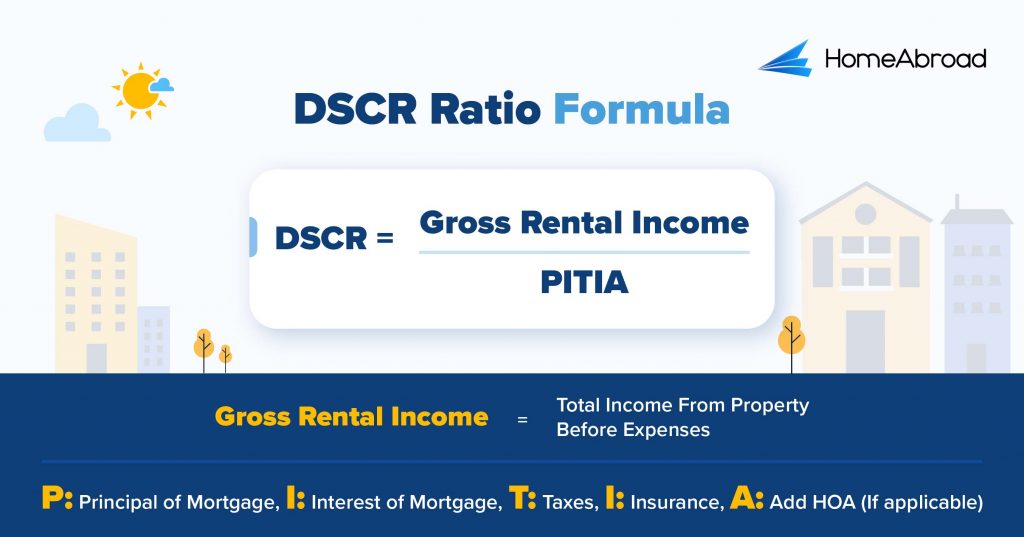

The Debt Service Coverage Ratio (DSCR) measures a property’s ability to generate enough rental income to cover its mortgage payments and related expenses. we use it to assess whether the investment can sustain itself financially.

DSCR formula:

At HomeAbroad, a DSCR of 1.0 is the benchmark for securing the most competitive loan terms. This means the property’s rental income matches the total monthly mortgage costs, creating a balanced and sustainable investment that’s set up for long-term success.

One of my clients recently explored buying a duplex in Minnesota, but the projected DSCR came in at 0.79, just shy of the ideal mark. Instead of letting the deal fall through, I guided him toward our no-ratio DSCR program, which allowed him to secure financing without meeting the standard DSCR requirement. That property is now generating steady returns, showing that the right strategy can turn near-misses into profitable wins.

At HomeAbroad, we understand that some promising properties can fall just short of this target. That’s why we offer a No-Ratio DSCR program for deals with a DSCR between 0 and 1. While it requires a slightly larger down payment (about a 5% reduction in LTV) and higher interest rates, it gives investors the flexibility to move forward on opportunities with strong long-term potential.

DSCR Loan Requirements in Minnesota for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined DSCR loan process designed specifically for foreign nationals investing in Minnesota.

Whether you’re purchasing from abroad or don’t have a US credit score, our flexible guidelines, reduced documentation requirements, and fully remote process make it easy to invest in Minnesota real estate from anywhere in the world.

Here’s how our DSCR loan requirements for foreign nationals stack up against conventional lenders:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it comes with a 5% hit to LTV and a slightly higher interest rate. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Minnesota.

Where We Lend DSCR Loans in Minnesota

Looking to invest in Minnesota? HomeAbroad offers DSCR loan solutions across major cities such as Minneapolis, Duluth, and St. Cloud. Below are some cities where we offer DSCR loans in Minnesota.

- Saint Paul

- Minneapolis

- Rochester

- Duluth

- Bloomington

- Plymouth

- Eden Prairie

- Woodbury

- Brooklyn Park

- Maple Grove

- Eagan

- Edina

- Minnetonka

- Blaine

- Coon Rapids

- Burnsville

Case Study: UK Investor Expanding into Minnesota with a DSCR Loan

Sophie, a London-based investor, wanted to diversify her portfolio by adding a high-demand rental property in Minneapolis. With the help of Rachel Spaccarotelli Sr. Customer Loan Manager at HomeAbroad, she secured a DSCR loan tailored to her needs without the usual hurdles of US credit checks or income verification.

- Loan Amount: $212,000

- Interest Rate: 7.4%

- Loan Term: 30 years fixed

- Monthly Rent: $2,255

- Time to Close: 29 days

With a DSCR of 1.26, Sophie’s investment generated a steady monthly cash flow of $475 after covering all debt obligations. The quick process allowed her to close before peak rental season, locking in premium tenant rates.

Why This Worked for Sophie

- No US Credit or Income Proof Needed: The loan was approved purely on the rental income potential of the Minneapolis property, eliminating the need for US credit history or traditional income documentation.

- Efficient, Remote-Friendly Process: HomeAbroad handled the entire transaction digitally, enabling Sophie to invest from the UK without travel.

- Strong Returns in a Growing Market: With a DSCR of 1.26 and fixed loan terms, Sophie secured predictable payments, consistent cash flow, and a foothold in a city with rising rental demand.

Top Places to Invest in Minnesota with a DSCR Loan

Minnesota presents a solid investment opportunity, with diverse markets offering both strong short-term rental returns and steady long-term income potential. A DSCR loan makes it easier for investors to tap into these opportunities by qualifying based on the property’s rental income rather than personal income or credit history.

Here are some of the top cities in Minnesota for real estate investors using a DSCR loan:

City | Rental Type | Rental yield |

|---|---|---|

Duluth | Short-Term | 18.6% |

Minneapolis | Short-Term | 12.2% |

Rochester | Long-Term | 6.2% |

St. Paul | Long-Term | 6.1% |

Bloomington | Long-Term | 5.4% |

Duluth: Tourism-Fueled Rental Potential

With its stunning Lake Superior views and year-round tourism, Duluth thrives on short-term rental demand from vacationers, event visitors, and outdoor enthusiasts. The city offers a unique niche in Minnesota’s rental market.

- Median Home Price: $293,069

- Average Rent: $1,366/month

What this means for investors: High tourism demand and seasonal appeal make Duluth ideal for short-term rental strategies with DSCR loans.

Investment Properties Listed Today on Sale in Duluth

Minneapolis: Thriving Urban Rental Market

As Minnesota’s largest city, Minneapolis boasts a strong economy, cultural attractions, and a growing population. The city’s diverse housing demand and high occupancy rates create excellent opportunities for consistent rental income.

- Median Home Price: $335,148

- Average Rent: $1,652/month

What this means for investors: Minneapolis offers a reliable rental market with strong income potential, making it a solid choice for DSCR loan-backed investments.

Investment Properties Listed Today on Sale in Minneapolis

Rochester: Medical and Tech-Driven Rental Demand

Home to the Mayo Clinic and a growing tech sector, Rochester attracts medical professionals, researchers, and corporate tenants. The city’s rental market benefits from high-quality job opportunities and steady population growth.

Median Home Price: $336,942

Average Rent: $1,750/month

What this means for investors: The medical hub status ensures consistent occupancy, making Rochester an attractive choice for DSCR loan financing.

Investment Properties Listed Today on Sale in Rochester

St. Paul: Stable Government and Healthcare Hub

Minnesota’s capital city is anchored by government offices, hospitals, and universities, which ensure a steady stream of tenants. St. Paul’s historic charm and strong community appeal attract long-term renters seeking stability.

- Median Home Price: $297,918

- Average Rent: $1,535/month

What this means for investors: The combination of stable employment sectors and consistent rental demand makes St. Paul well-suited for dependable DSCR loan returns.

Investment Properties Listed Today on Sale in St. Paul

Bloomington: Shopping, Corporate, and Leisure Appeal

Home to the Mall of America, Bloomington draws millions of visitors annually, as well as corporate travelers and long-term residents working in the area. Its location near the Twin Cities and the airport boosts rental appeal.

Median Home Price: $368,261

Average Rent: $1,678/month

What this means for investors: A mix of tourism and corporate housing demand provides flexibility, making Bloomington a versatile market for DSCR loan-backed investments.

Investment Properties Listed Today on Sale in Bloomington

Specific Considerations for Investing in Minnesota for Foreign Nationals

Minnesota combines strong rental demand in growing metro areas with seasonal tourism markets that attract short-term tenants year-round. However, investing here successfully requires an understanding of the state’s unique climate, economic drivers, and local regulations.

Here are the most critical factors to keep in mind:

– Property Taxes and County-Level Differences

While Minnesota’s property tax rates are moderate compared to the national average, they vary by county and school district. Hennepin and Ramsey Counties, home to Minneapolis and St. Paul, tend to have higher rates, which can affect ROI for high-value properties.

– Diverse Market Types

Urban hubs like Minneapolis and Rochester offer year-round rental stability driven by healthcare, education, and corporate employers. In contrast, areas like Brainerd Lakes or Duluth see strong seasonal demand but require careful cash flow planning between peak and off-peak months.

– Harsh Winters and Heating Costs

Minnesota winters are long and severe, leading to high heating expenses, potential snow damage, and the need for winterization. Absentee owners should factor in reliable property management for snow removal and emergency maintenance.

– Short-Term Rental Regulations

Several cities and counties in Minnesota, including Minneapolis, have implemented permits, inspection requirements, and limits for short-term rentals. Compliance is essential to avoid penalties and maintain occupancy rates.

Strategic & Future Considerations for Foreign Nationals Investing in Minnesota

Minnesota’s economic resilience, growing healthcare and tech sectors, and appeal as both a residential and recreational destination make it a promising long-term play for foreign investors. But the state’s trajectory depends on shifts in infrastructure, regulations, and demographic trends that could influence returns over time.

Here are the main factors to watch:

– Population Growth Concentrated in Metro Areas

While the state’s overall population growth is steady, most of it is concentrated in the Twin Cities metro. This supports long-term rental demand in urban markets but may limit appreciation potential in rural areas unless driven by tourism or niche industries.

– Infrastructure Investments and Transit Expansion

Projects like the Southwest Light Rail Transit expansion and highway improvements in the Twin Cities will improve connectivity, potentially boosting property values in previously overlooked neighborhoods.

– Evolving Short-Term Rental and Landlord Regulations

Several municipalities are revisiting rental ordinances to balance housing availability with investor activity. Staying ahead of legislative changes will be key for foreign owners who rely on consistent occupancy.

Get a DSCR Loan in Minnesota with HomeAbroad

HomeAbroad is a one-stop solution for foreign nationals investing in Minnesota, offering tailored DSCR loans with competitive rates and flexible terms to help you maximize returns in the US market.

Here’s what sets us apart:

- No US Credit History Required – Qualify based on rental income, not US credit scores.

- AI-Driven Investment Property Search Platform – Find Minnesota properties that cash flow from day one.

- Expert Guidance – Our team simplifies US real estate financing for international investors.

- End-to-End Support – From LLC formation and US bank account setup to property management support.

- Fast Processing – Quick approvals and closings so you don’t miss opportunities.

- Remote Closing Option – Complete the entire purchase process from your home country.

With HomeAbroad, you get the right financing, expert guidance, and smart tools to grow your Minnesota real estate portfolio from anywhere in the world.

Get a DSCR loan with HomeAbroad today and start your US investment journey!

FAQs

Can I buy property in Minnesota remotely?

Absolutely. HomeAbroad supports remote closing, so you can complete the entire process from your home country.

Can I refinance my Minnesota property with a DSCR loan?

Yes. HomeAbroad offers DSCR cash-out refinancing so you can tap into equity for portfolio expansion, renovations, or new investments, without a US credit history or income proof.

How long does it take to get a DSCR loan in Minnesota?

With HomeAbroad, most DSCR loans for foreign nationals are closed in 30 to 45 days, depending on how quickly the necessary documents and property details are provided.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)