Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Markets are pricing roughly a 90%+ chance of a 25 bps Fed cut in September, per the CME FedWatch Tool. At the same time, Mortgage News Daily’s daily index shows the 30-year fixed at 6.29% on Sept 5, putting a “6% handle” in sight. Agents and industry leaders have long flagged ~6% as a psychological threshold and NAR estimates ~5.5 million additional U.S. households could afford a home if rates fell to 6%.

HomeAbroad analyzed 935 U.S. markets using Ziffy.ai’s metro-level August 2025 listing prices, comparing mortgage payments on a 30-year fixed at 6.29% vs. 6.00%, with 20% down. (Details in methodology.)

Table of Contents

Key Highlights

How much Homebuyers can Save if Mortgage Rates Drop to 6%?

1. Homebuyers would save $20,569 over 30 years on average if rates fall to 6.00% from 6.29%.

Based on our analysis of 935 metropolitan areas, the typical homebuyer would save $20,565 over the life of a 30-year mortgage. This represents monthly savings of $57, or $685 annually. While monthly savings may appear modest, the compound effect over 30 years creates substantial long-term value for homeowners.

Amresh Singh

Founder and CEO

HomeAbroad

2. Premium markets see savings exceeding $200,000 while affordable markets save $4,800–$8,500.

The range of savings across our analyzed markets spans from over $200,000 in Nantucket, MA, to approximately $4,800 in Canton, IL. This wide range reflects America’s diverse housing landscape, yet even the smallest savings represent meaningful relief proportional to local market conditions.

3. Monthly payment drops by $57 nationally, ranging from $13 to $750 across markets.

The national average monthly payment reduction of $57 masks significant regional variation. Buyers in Nantucket save $750 monthly, while Canton, IL buyers save $13 monthly. Despite the absolute differences, both markets see approximately 4-5% payment reductions, demonstrating universal proportional impact.

4. Half of U.S. markets would see 30-year savings between $13,680 and $23,400, with a median of $17,640.

This interquartile band captures the “middle 50%” of markets: a typical metro sees $38–$65/month off the mortgage payment (principal & interest), which compounds to $456–$780/year and $13,680–$23,400 over 30 years (median $49/mo → $588/yr → $17,640/30 yrs). Because the same 29 bps rate drop is applied everywhere, the percentage reduction in payments is roughly similar (≈3%).

5. 59 markets would save at least $36,000 over 30 years, including 10 markets at $72,000+ over 30 years.

These outsized reductions are concentrated in high-cost coastal and resort markets (Santa Maria–Santa Barbara, San Luis Obispo–Paso Robles, Napa, Hawaii’s Kahului–Wailuku and Kapaʻa, and Colorado’s Rifle, Breckenridge, and Edwards) where higher prices and loan sizes translate into larger dollar relief. In these metros, buyers commonly see at least $100/month ($1,200/year) lower mortgage payments, and in the top tier $200+/month ($2,400+/year), adding up to about $36,000 to $72,000+ over 30 years.

6. 25 markets would save over $50,000 over 30 years; 3 markets surpass $100,000 in lifetime savings.

Six-figure lifetime relief is common where prices (and thus loan amounts) are high; applying a lower rate for 360 payments multiplies small monthly differences into large totals.

7. California appears eight times in the top-20 lifetime-savings ranking at 6.00%.

The state’s prevalence in the leaderboard reflects larger baseline loan sizes; for example, San Jose–Sunnyvale–Santa Clara saves $206/month ($2,475/year; $74,264 over 30 years), dropping the qualifying income threshold by ~$8,841.

8. Homebuyers need $2,400 less in annual income to qualify at 6% versus 6.29%

Using the standard 28% debt-to-income ratio for mortgage qualification, our analysis shows the average American would need $2,400 less in annual household income to qualify for a median-priced home when rates drop from 6.29% to 6.00%. This calculation is based on the formula: (Monthly Payment × 12) ÷ 0.28 = Required Annual Income.

9. A ~$62,000 teacher salary moves closer to qualifying in more metros as required income falls by ~$2.45K.

BLS (May 2024) reports $61,430 (kindergarten) and $62,340 (elementary) median pay. When the required income line shifts lower by a couple thousand dollars, more teacher households can cross the 28% front-end DTI line for a median-priced home, especially in Sun Belt and Midwest metros. Markets like Charlotte, NC (requiring $2,800 less income) and Phoenix, AZ (requiring $3,100 less) would shift from barely out of reach to more accessible for educators.

10. 67 markets would save under $10,000 over 30 years; 29 markets save under $25/month.

These are primarily lower-price Midwest and Southern metros where smaller balances translate to smaller dollar savings; even though the percentage reduction in the mortgage payment is similar to expensive markets.

Top 20 Metros by Highest 30-Year Savings If Mortgage Rates Drop to 6%

| Rank | Metro Area | 30-Year Savings | Annual Savings | Monthly Savings | Qualifying Income Reduction |

|---|---|---|---|---|---|

| 1 | Nantucket, MA | $270,080 | $9,003 | $750 | $32,143 |

| 2 | Vineyard Haven, MA | $135,148 | $4,505 | $375 | $16,071 |

| 3 | Santa Maria-Santa Barbara, CA | $106,970 | $3,566 | $297 | $12,729 |

| 4 | Rifle, CO | $98,798 | $3,293 | $274 | $11,743 |

| 5 | Jackson, WY-ID | $95,820 | $3,194 | $266 | $11,400 |

| 6 | Hailey, ID | $92,549 | $3,085 | $257 | $11,057 |

| 7 | Heber, UT | $81,814 | $2,727 | $227 | $9,729 |

| 8 | Napa, CA | $78,386 | $2,613 | $218 | $9,343 |

| 9 | Kapaa, HI | $75,602 | $2,520 | $210 | $9,000 |

| 10 | San Jose-Sunnyvale-Santa Clara, CA | $74,264 | $2,475 | $206 | $8,829 |

| 11 | Salinas, CA | $71,291 | $2,376 | $198 | $8,486 |

| 12 | Key West-Key Largo, FL | $69,669 | $2,322 | $194 | $8,314 |

| 13 | Santa Cruz-Watsonville, CA | $67,574 | $2,252 | $188 | $8,014 |

| 14 | Kahului-Wailuku, HI | $64,601 | $2,153 | $179 | $7,671 |

| 15 | Los Angeles-Long Beach-Anaheim, CA | $62,086 | $2,070 | $172 | $7,371 |

| 16 | San Luis Obispo-Paso Robles, CA | $59,871 | $1,996 | $166 | $7,114 |

| 17 | Breckenridge, CO | $56,762 | $1,892 | $158 | $6,771 |

| 18 | Oxnard-Thousand Oaks-Ventura, CA | $54,735 | $1,825 | $152 | $6,514 |

| 19 | Edwards, CO | $54,289 | $1,810 | $151 | $6,471 |

| 20 | Hood River, OR | $53,789 | $1,793 | $149 | $6,429 |

Top 20 Metros by Lowest 30-Year Savings If Mortgage Rates Drop to 6%

| Rank | Metro Area | 30-Year Savings | Annual Savings | Monthly Savings | Qualifying Income Reduction |

|---|---|---|---|---|---|

| 1 | Canton, IL | $4,809 | $160 | $13 | $557 |

| 2 | Carbondale, IL | $5,646 | $188 | $16 | $686 |

| 3 | Danville, IL | $5,942 | $198 | $17 | $729 |

| 4 | Johnstown, PA | $6,322 | $211 | $18 | $771 |

| 5 | Kennett, MO | $6,541 | $218 | $18 | $771 |

| 6 | Macomb, IL | $6,753 | $225 | $19 | $814 |

| 7 | Pine Bluff, AR | $6,893 | $230 | $19 | $814 |

| 8 | Fort Madison, IA | $7,022 | $234 | $20 | $857 |

| 9 | Forrest City, AR | $7,028 | $234 | $20 | $857 |

| 10 | Pampa, TX | $7,244 | $241 | $20 | $857 |

| 11 | Galesburg, IL | $7,428 | $248 | $21 | $900 |

| 12 | Elmira, NY | $7,430 | $248 | $21 | $900 |

| 13 | Jacksonville, IL | $7,564 | $252 | $21 | $900 |

| 14 | Woodward, OK | $7,568 | $252 | $21 | $900 |

| 15 | Selma, AL | $8,106 | $270 | $23 | $986 |

| 16 | Clarksdale, MS | $8,109 | $270 | $23 | $986 |

| 17 | Greenville, MS | $8,176 | $273 | $23 | $986 |

| 18 | Sterling, IL | $8,441 | $281 | $23 | $986 |

| 19 | Altoona, PA | $8,458 | $282 | $23 | $986 |

| 20 | Mexico, MO | $8,460 | $282 | $24 | $1,029 |

Regional Statistics (30-year Mortgage Savings If Mortgage Rates Drop to 6%)

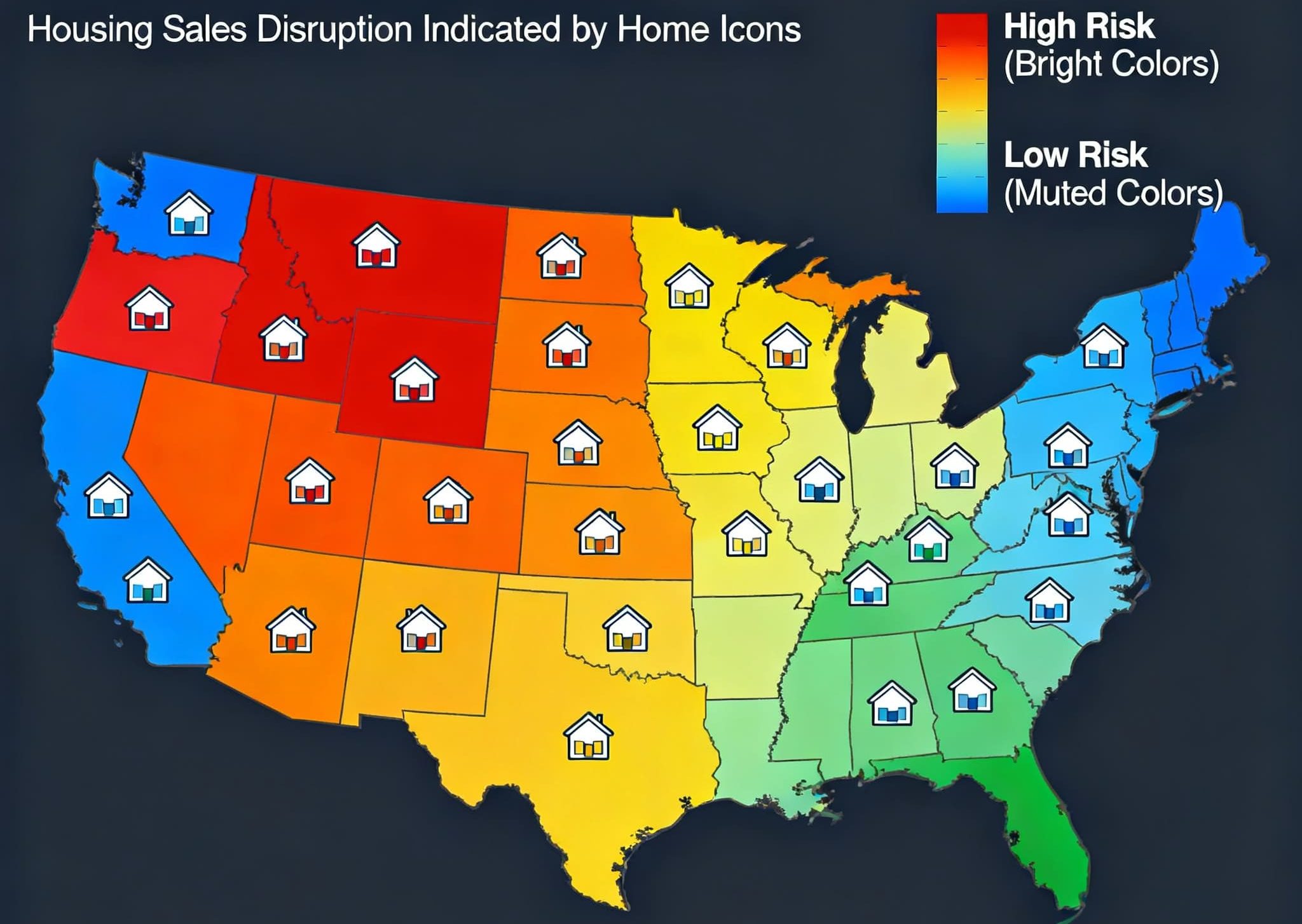

1. West buyers would save $90.69 per month on average; totaling $32,650 over 30 years across 176 markets.

California anchors the region’s largest dollar relief, appearing 8 times in the national top-20; San Jose–Sunnyvale–Santa Clara, CA posts $206/month; $74,264 over 30 years. Hawaii (e.g., Kahului–Wailuku) and Colorado resort counties (e.g., Rifle, Edwards, Breckenridge) also post high six-figure lifetime savings due to large loan balances. Washington and Oregon trend above the national average as metro prices remain elevated in Seattle–Tacoma–Bellevue and Portland–Vancouver–Hillsboro. The average qualifying-income line falls by about $3,887 across the West (28% front-end DTI on the mortgage payment).

Debjit Saha

Co-founder and Real Estate Expert

HomeAbroad

2. Northeast buyers would save $67.92 per month on average or $24,445 over 30 years across 97 markets.

Massachusetts drives the region’s extremes, from Nantucket ($750/month; $270,080 over 30 years) and Vineyard Haven ($375/month; $135,148) to far more modest savings in rural Pennsylvania and Upstate New York. New Jersey and downstate New York metros show above-average dollar savings, while smaller-price markets in Maine and Vermont post lower but still meaningful lifetime totals. The average qualifying-income line drops by roughly $2,910 across the region.

3. South buyers would save $48.70 per month on average or $17,529 over 30 years across 368 markets.

Scale lives here: the South contains the most markets, with Florida, Texas, and North Carolina contributing the bulk of the region’s higher-dollar cases. Examples include Miami–Fort Lauderdale–Pompano Beach, FL (strong lifetime savings), Austin–Round Rock–Georgetown, TX, and Charlotte–Concord–Gastonia, NC-SC. Even in lower-price metros (El Paso, TX; parts of Alabama and Arkansas), the percentage drop in the mortgage payment is similar to other regions. The average qualifying-income line decreases by about $2,087.

4. Midwest buyers would save $43.68 per month on average or $15,720 over 30 years across 284 markets.

The Midwest shows the smallest dollar savings due to lower loan sizes, but the percentage reduction (~3%) mirrors the rest of the country. Illinois (e.g., Chicago–Naperville–Elgin) and Minnesota (Minneapolis–St. Paul–Bloomington) sit above the regional mean, while smaller markets in Iowa, Missouri, and Kansas dominate the “under $25/month” cohort. The average qualifying-income line falls by around $1,871.

Full 935 U.S. Metro Data

Fed rate cut impact (6.29% vs 6%) Excel Download

Methodology

- Prices: Metro-level median list prices (Aug 2025) from Ziffy.ai.

- Loan model: 80% LTV (20% down) on each metro’s median price.

- Payments: 30-year fixed-rate mortgage; we compare the mortgage payment (principal & interest) at 6.29% vs 6.00% and hold prices constant to isolate the rate effect.

- Income needed: 28% front-end DTI applied to the mortgage payment (principal & interest): Required Income = (Monthly Payment × 12) ÷ 0.28.

- Underwriting typically uses PITI; actual qualifying income may be higher.

- Coverage: 935 U.S. markets (as provided in the dataset; includes MSAs and smaller metros).

- Static prices: We hold prices constant across rate scenarios. In reality, prices, inventory and concessions can adjust as rates move.

![Fed Rate Cut Could Save Homebuyers $20,565 [2025]](https://homeabroadinc.com/wp-content/uploads/2025/09/Fed-rate-cut-mortgage-savings-500x325.jpg)