Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Texas boasts one of the strongest rental markets and alndlord-friendly laws in the US, and HomeAbroad’s DSCR loans enable international real estate investors to qualify without requiring US income, US credit history, or residency status.

2. DSCR loans are evaluated using the property’s rental income, allowing foreign nationals to finance Texas real estate with no personal income verification.

3. Major Texas cities like Austin, Houston, and Dallas offer high rental yields, strong demand, and diverse property options.

4. HomeAbroad is a one-stop shop that makes the entire process simple for foreign real estate investors, helping you find properties using our AI-driven investment property platform, secure loans, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Table of Contents

Texas is full of surprises and pride – it gave us Dr Pepper, hosts the largest rose garden in the US, and Austin claims the title of Live Music Capital of the World. But for real estate investors, its biggest perk is serious cash flow.

With an average home value of $306,682 and a 7.4% average rental yield, Texas offers strong returns for real estate investors. Cities like Houston, San Antonio, and Dallas provide consistent rental demand and diverse property options.

HomeAbroad DSCR loans make it even better, letting you qualify based on the property’s rental income, and not your personal income, so you can invest smarter in cities like Dallas, Houston, and San Antonio.

Get started today and take the first step toward building your real estate portfolio in Texas.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad Debt Service Coverage Ratio (DSCR) loan is a foreign national mortgage option for global real estate investors investing in US real estate. Instead of relying on personal income or Debt-to-Income (DTI) ratios, qualification is based entirely on the property’s rental income and cash flow strength.

This means your loan approval depends more on the property’s financial performance than your personal income or employment history, making it ideal for foreign nationals who can qualify without a US credit history or personal income verification.

With Texas offering an average rental yield of 7.4%, foreign real estate investors can leverage DSCR loans to acquire high-performing rental properties and boost returns in markets like Dallas, Houston, and San Antonio.

How to Calculate the DSCR Ratio?

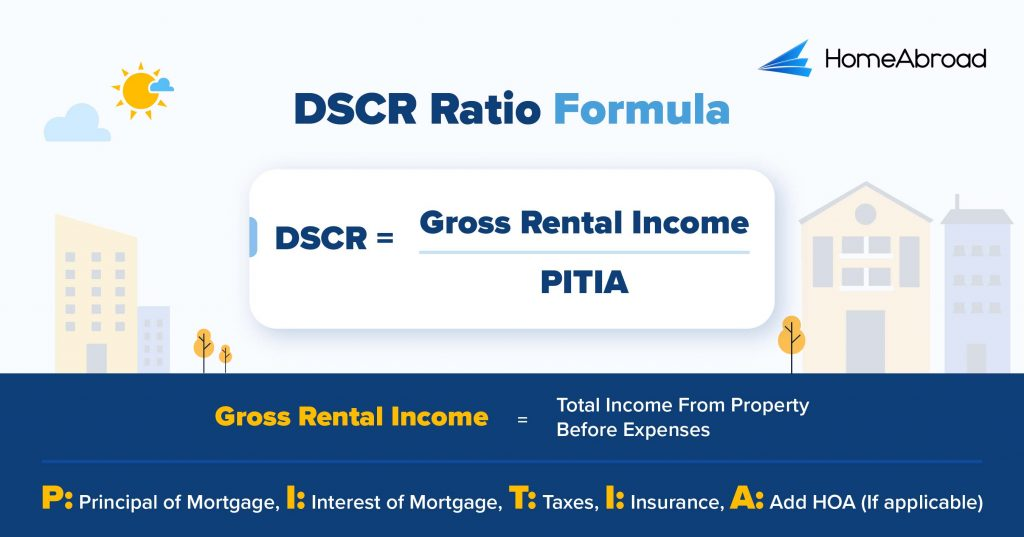

Understanding how to calculate the Debt Service Coverage Ratio (DSCR) is essential when applying for a DSCR loan. This key metric helps lenders determine if a rental property generates enough income to cover its loan obligations.

The DSCR formula is simple:

Example

Calculating the DSCR Ratio for a Texas Property:

A DSCR of 1.27 means the property generates 27% more income than its monthly mortgage obligations, making it a strong candidate for DSCR financing.

Over the years, I’ve helped many investors successfully secure DSCR loans, even in cases where their properties didn’t meet the standard 1.0 ratio. One investor I recently worked with had a DSCR of just 0.86. I helped him secure our No-Ratio DSCR option.

HomeAbroad's “No Ratio DSCR loans” are for properties with a DSCR between 0 - 1, allowing you to secure financing even if your rental income doesn’t fully cover debt obligations. However, this option requires a larger down payment (a 5% hit to LTV) and comes with higher interest rates to mitigate the additional risk.

DSCR Loan Requirements in Texas for Foreign Nationals

Unlike traditional lenders, HomeAbroad offers a simplified DSCR loan process tailored specifically for foreign nationals investing in US real estate.

If you’re applying from abroad and lack a US credit history, our flexible requirements, minimal documentation, and remote closing options make financing Texas properties more straightforward and accessible.

Here’s how our foreign national DSCR loan criteria stack up against conventional lenders.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more essential factors that can affect your eligibility for a DSCR loan as a foreign national investor:

At HomeAbroad, we bring extensive experience working with global real estate investors. Our AI-driven investment property search platform helps you discover high-performing investment opportunities in Texas, while our expert team delivers tailored DSCR loan solutions to fit your goals.

Where We Lend DSCR Loans in Texas

HomeAbroad offers DSCR loans throughout Texas, with personalized support for real estate investors targeting high-growth cities like Dallas, Houston, San Antonio, and beyond.

Here are some of the top Texas markets where we provide DSCR loans to real estate investors.

- Dallas

- Houston

- Austin

- San Antonio

- El paso

- McAllen

- Fort Worth

- Round Rock

- Frisco

- Brownsville

- Beaumont

- Lubbock

- Plano

- Sugar Land

- Amarillo

- Laredo

Nothing simplifies the investment process like witnessing it in action. Here’s how we helped one of our clients successfully grow his rental portfolio in Texas using DSCR loans from HomeAbroad Loans.

Case Study: Meet Rakesh Verma, an Indian Investor on an H-1B Visa

Rakesh Verma, an experienced investor from India currently living in California on an H-1B visa, was looking to diversify his portfolio by purchasing a multi-family rental property in Austin, Texas.

Despite his strong financial background, he encountered several roadblocks with traditional lenders due to his visa status and lack of long-term US credit history.

The Solution: HomeAbroad Loans’ DSCR Loan

Rakesh turned to HomeAbroad, where he was able to qualify for a DSCR loan based solely on the projected rental income of the property – tax returns, or US credit history required.

Working closely with HomeAbroad’s foreign national mortgage team, Rakesh secured financing with favorable terms, including an interest-only option to boost his cash flow.

His property generated enough rental income to meet a DSCR of 1.2, making him eligible for a $400,000 loan.

- Loan Amount: $400,000

- Purchase Price: $500,000

- Monthly Rent: $4,118

- Annual Rent: $49,414

- Loan Type: 30-year-fixed rate DSCR loan

- Time to Close: 26 days

Why This Worked for Rakesh:

- No US Credit History Required: HomeAbroad qualified Rakesh based on rental income potential, bypassing the usual credit and income documentation barriers.

- Visa-Friendly Lending: The H-1B visa status posed no issue — HomeAbroad specializes in lending to foreign nationals on work visas.

- Flexible Loan Terms: The interest-only option helped Rakesh lower monthly expenses and boost net returns.

- Fast, Remote-Friendly Process: The entire transaction was completed remotely with support from HomeAbroad’s dedicated lending team.

Thanks to HomeAbroad’s DSCR loan, Rakesh successfully added a cash-flowing Texas property to his US portfolio, without the typical delays and denials faced by foreign national investors.

Top Places to Invest in Texas with a DSCR Loan

Texas offers a wide range of cities that are ideal for both short-term and long-term rental strategies, making it a great fit for international real estate investors using DSCR loans.

Whether you’re targeting steady monthly income or strong vacation rental demand, there’s a city in Texas that aligns with your investment approach.

Here are some of the top-performing cities in Texas for real estate investment:

City | Rental Type | Rental Yield |

|---|---|---|

Austin | Short-term | 9.8% |

Houston | Long-term | 8.2% |

El Paso | Long-term | 8.1% |

San Antonio | Long-term | 7.9% |

Dallas | Long-term | 7.7% |

Austin: Tech Magnet and Short-Term Rental Powerhouse

Austin isn’t just the Live Music Capital of the World; it’s also one of the fastest-growing tech hubs in the US. With a thriving short-term rental market driven by tourism, events, and remote work, Austin consistently ranks among the top cities for rental yield.

Median Home Price: $523,769

Rental Yield: 9.8%

What this means for investors: High nightly rates and year-round demand make Austin ideal for short-term rental strategies. These strong cash flows support DSCR loan qualification even at lower occupancy levels — perfect for international buyers targeting high-yield urban markets.

Investment Properties Listed Today on Sale in Austin

Houston: Energy Hub with Reliable Long-Term Returns

Houston’s massive economy, anchored by energy, healthcare, and aerospace, attracts a steady influx of professionals. With an affordable cost of living and sprawling suburbs, the city supports strong long-term rental demand across all price points.

Median Home Price: $269,422

Rental Yield: 8.2%

What this means for investors: Houston offers a solid balance of affordability and rental income, making it easy to hit DSCR benchmarks. For foreign nationals, this market is ideal for building a stable, income-producing portfolio without relying on US credit history.

Investment Properties Listed Today on Sale in Houston

El Paso: Stable, Affordable, and Cash Flow Friendly

Bordering Mexico, El Paso offers some of the most affordable real estate in Texas. The city’s economy is fueled by the military, logistics, and healthcare sectors that generate consistent housing demand among long-term tenants.

Median Home Price: $231,159

Rental Yield: 8.1%

What this means for investors: Low property prices paired with strong rents make El Paso an ideal entry point for international investors using DSCR loans. With minimal investment, buyers can generate cash flow that easily supports loan qualification.

Investment Properties Listed Today on Sale in El Paso

San Antonio: Cultural Heritage Meets Rental Strength

With its historic charm, growing job market, and military presence, San Antonio draws renters seeking both affordability and quality of life. It’s a long-term rental favorite with consistent occupancy rates.

Median Home Price: $256,363

Rental Yield: 7.9%

What this means for investors: San Antonio’s balanced market offers steady income and price stability — ideal for meeting DSCR requirements and securing favorable loan terms, especially for foreign nationals seeking low-risk investments.

Investment Properties Listed Today on Sale in San Antonio

Dallas: Business-Friendly and Investor-Ready

As a major business and finance hub, Dallas combines economic strength with a growing population. Its diverse rental market spans everything from urban apartments to suburban single-family homes, making it a versatile option for investors.

Median Home Price: $315,056

Rental Yield: 7.7%

What this means for investors: Dallas rental properties deliver solid income and appreciation potential. For DSCR financing, especially through HomeAbroad, the city’s strong rent-to-price ratios provide ample room to qualify, even without personal income documentation.

Investment Properties Listed Today on Sale in Dallas

Specific Considerations for Investing in Texas for Foreign Nationals

Texas offers strong rental yields, a pro-business environment, and diverse property markets, making it a strategic choice for international real estate investors. But to maximize returns and qualify smoothly for DSCR loans, it’s important to understand a few state-specific factors that can impact your investment.

– Property Taxes Vary by County

Texas has no state income tax, but property taxes are among the highest in the US. Rates differ by county, often ranging from 1.5% to 3.5% of the assessed value. Investors should factor this into their cash flow calculations, as higher property taxes can affect DSCR ratios and overall ROI.

– Insurance Costs and Regional Weather Risks

Texas faces a range of weather-related risks, including hailstorms, tornadoes, and flooding in some areas. Coastal cities like Galveston and parts of Houston may have elevated insurance premiums. Choosing newer homes or properties with storm-resistant features can reduce risk and improve insurability.

– Localized Short-Term Rental Regulations

Short-term rental rules in Texas are set at the city level. Some cities like Austin and Dallas require permits, impose occupancy limits, or restrict STRs to certain zoning areas. Before investing in a short-term rental strategy, check local ordinances, HOA restrictions, and tax collection obligations.

– Landlord-Friendly Legal Framework

Texas is known for its landlord-friendly laws. There’s no statewide rent control, and eviction processes tend to be straightforward. Lease terms, notice periods, and security deposit rules are clearly defined. This legal environment favors rental property owners, especially those operating long-term rentals.

Strategic & Future Considerations for Foreign Nationals Investing in Texas

Texas continues to attract global real estate investors due to its strong economic fundamentals, investor-friendly climate, and absence of state income tax. As major metros expand and infrastructure projects evolve, new investment corridors are opening up beyond the traditional hubs of Dallas, Houston, and Austin.

Here are some key future-focused considerations for international investors:

1. Unrestricted Foreign Ownership: Texas places no limitations on foreign nationals purchasing property. This openness, combined with straightforward title laws and landlord-friendly policies, makes Texas one of the most accessible US states for international buyers.

2. Foreign Investment in Urban vs. Suburban Markets: While international interest is strong in urban cores like Austin and Dallas, there’s growing activity in suburban and exurban areas benefiting from spillover demand, job decentralization, and planned transportation upgrades.

3. Impact of Visa-Linked Investment Trends: Texas sees significant interest from international buyers on E-2, EB-5, and F-1 dependent pathways. Houston and Dallas, in particular, have emerged as hotspots for families seeking real estate near top-rated schools, universities, and international consulates.

4. Statewide Economic and Infrastructure Growth: Major projects like Texas Central’s high-speed rail, the I-35 expansion, and commercial hubs near the Port of Houston are reshaping long-term demand patterns. These developments are creating new pockets of opportunity for early-stage foreign investors.

Get a HomeAbroad DSCR Loan in Texas as a Foreign National

At HomeAbroad, we make it easy for real estate investors to secure DSCR loans in Texas. Whether you’re buying your first rental or scaling your portfolio, our loan programs are designed to match your unique goals, with no personal income verification and no US credit history required.

Why Investors Choose HomeAbroad:

- AI-driven Investment Property Search platform

- Tailored Foreign National Mortgages

- No US Credit History Required

- LLC and US Bank Account Setup

- Expert Guidance From Start to End

- Remote Closing Option

Already own investment property in Texas? You can also cash-out refinance your existing DSCR loan with HomeAbroad to lower your interest rate, access equity, or switch to better loan terms. Our streamlined process is designed for foreign nationals and ensures a smooth refinancing experience without traditional income documentation.

Get a DSCR loan with HomeAbroad today and start building your Texas real estate portfolio with confidence.

FAQs

Can foreign nationals get a DSCR loan in Texas?

Yes, DSCR loans are available in Texas and are a popular option for international real estate investors looking to finance rental properties. At HomeAbroad Loans, we offer tailored DSCR loan options for a variety of investment properties, including multi-family properties, single-family homes, and short-term rentals.

Can a foreign national apply for HomeAbroad DSCR Loan without a US credit history?

Yes. Unlike traditional loans, DSCR loans do not focus on your personal income or credit score, but instead rely on your debt service coverage ratio (DSCR) to determine eligibility. At HomeAbroad Loans, we offer loans for international real estate investors with DSCR ratios as low as 0.75, and in some instances, no-ratio DSCR loans.

How long does it take to get a DSCR loan in Texas for foreign nationals?

At HomeAbroad, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

Zillow: https://www.zillow.com/home-values/10221/austin-tx/

![DSCR Loans Guide for Foreign Nationals: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)