Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. North Carolina’s diverse real estate market, from its tech hubs to mountain towns, offers a wide range of opportunities for international real estate investors to qualify for DSCR loans from HomeAbroad without needing US income or credit history.

2. DSCR loans are underwritten based on the property’s rental income, so foreign nationals don’t need to provide personal tax returns, pay stubs, or employment records.

3. Major North Carolina cities like Charlotte, Raleigh, and Asheville offer strong rental demand driven by economic growth, population influx, and tourism.

4. HomeAbroad is a one-stop shop that makes the entire process simple for international real estate investors, helping you find cash flow deals using our AI-driven investment search property platform, get 75% mortgage financing, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Table of Contents

Welcome to North Carolina—the Tar Heel State, known for its majestic mountains, stunning coastline, and a rich history as the birthplace of flight (the Wright Brothers first flew here).

The state has emerged as a top destination for real estate investors. Its robust economy, fueled by corporate relocations, technological innovation, and advanced manufacturing, drives a steady influx of residents and strong housing demand.

All of this, combined with a variety of investment opportunities from high-yield long-term rentals in Charlotte to profitable short-term vacation rentals in Asheville makes the state an ideal market for foreign nationals leveraging HomeAbroad DSCR loans to grow their portfolios.

What is a DSCR Loan for Foreign Nationals?

A HomeAbroad DSCR loan (Debt-Service Coverage Ratio loan) is a tailored foreign national mortgage designed for international real estate investors that qualifies you based on the property’s rental income, not your personal income or Debt-to-Income (DTI) ratio.

I recently worked with an investor from Germany who wanted to purchase a rental property in Raleigh, NC. As a business owner with no US credit history, he got rejected by traditional banks. With our DSCR loan, we focused on the property’s substantial projected rental income and approved the loan without requiring personal tax returns or employment history. You’ll find the whole story later in the article.

With North Carolina’s average rental yield at 6.9%, foreign real estate investors can leverage DSCR loans to acquire high-performing rental properties and boost returns in markets like Charlotte, Raleigh, and Wilmington.

Since DSCR loans are based on rental income rather than personal income, lenders often set rates a little higher than traditional mortgages. Check the latest DSCR loan interest rates here.

How to Calculate the DSCR Ratio?

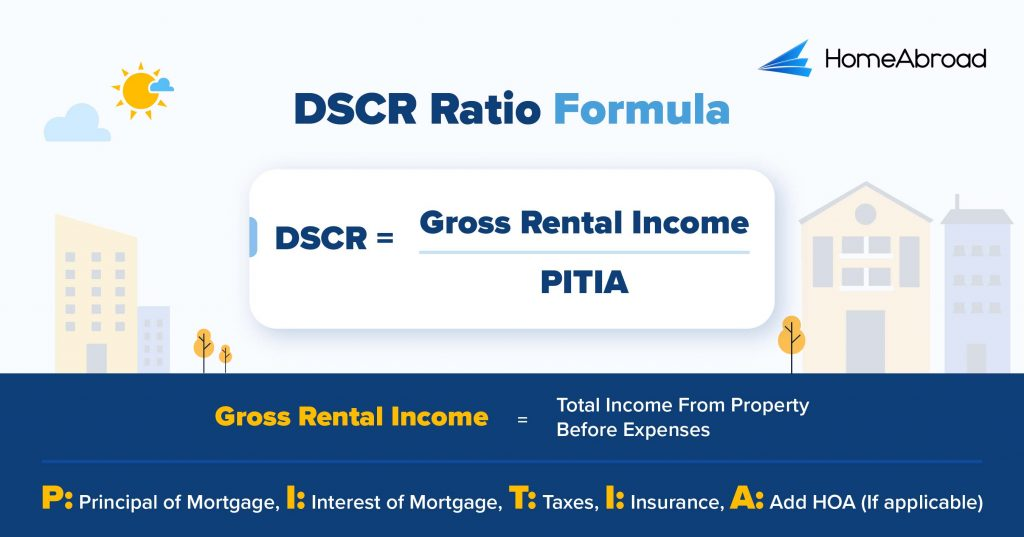

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key metric we use to assess loan eligibility from an investment perspective.

Here is the DSCR formula:

A DSCR of 1.24 indicates that the property generates 24% more income than the mortgage payment, signaling a substantial cash flow investment. If you do not want to do the math, you can use HomeAbroad’s DSCR ratio calculator.

Our DSCR loans are designed to qualify you based on a property’s income potential. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program, for properties with DSCR between 0 - 1. With the No-Ratio program, you can still secure financing, though it will require a slightly larger down payment (a 5% hit to LTV) and a higher interest rate. This option is perfect for investors with a strong long-term strategy who want to acquire properties that may not immediately cash-flow at a 1.0 ratio.

DSCR Loan Requirements in North Carolina for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined DSCR mortgage process for foreign national real estate investors.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For the best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it comes with a 5% LTV hit and a slightly higher interest rate. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25% gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across North Carolina.

Where We Lend DSCR Loans in North Carolina

HomeAbroad offers DSCR loans across North Carolina, with tailored support for investors in top-performing markets like Charlotte, Raleigh, Wilmington, and more.

Here are a few cities where we lend DSCR Loans in North Carolina:

- Charlotte

- Raleigh

- Durham

- Greensboro

- Winston-Salem

- Cary

- Fayetteville

- Asheville

- Wilmington

- Concord

- Greenville

- Chapel Hill

- Hickory

- Burlington

- Boone

Let’s examine a case study of one of our past clients to understand how profitable investing in the North Carolina real estate market can be.

Case Study: Meet Hans Müller, a German Investor

Hans Müller, a German business owner, wanted to expand his real estate portfolio with a long-term rental property in Raleigh, North Carolina. As a self-employed individual with no US credit history, he faced significant hurdles with traditional lenders who required extensive personal income verification and a US credit profile. After several rejections, he discovered HomeAbroad’s DSCR loan program.

The Solution: HomeAbroad’s DSCR Loan

Hans was approved for a DSCR loan by focusing on the property’s projected rental income rather than his personal financials. This allowed him to secure financing for a townhome in a rapidly developing Raleigh suburb. HomeAbroad’s specialized approach enabled him to get a favorable loan with competitive terms, overcoming the barriers of traditional lending.

- Loan Amount: $350,000

- Purpose: Purchase of an investment property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.5%

- Time to Close: 30 days

Why This Worked for Hans:

- No US Credit History Required: His eligibility was based solely on the property’s income potential, bypassing the need for a US credit report.

- Flexible Underwriting: As a business owner, he didn’t have to provide personal tax returns or employment records, which would have been a significant obstacle with other lenders.

- Investment Portfolio Growth: The DSCR loan enabled Hans to finance a property in a stable, growing US market, significantly expanding his real estate portfolio.

Müller’s success shows how DSCR loans simplify financing, allowing investors to secure profitable properties and maintain strong cash flow. With Raleigh’s market poised for growth, now is the time to leverage a DSCR loan and scale your portfolio.

Top Places to Invest in North Carolina with a DSCR Loan

North Carolina’s diverse economy, strong population growth, and job market make it a compelling destination for real estate investors. The state offers an ideal landscape for using DSCR loans, with investment potential driven by a focus on a property’s income rather than the borrower’s personal finances.

Here are some of the top-performing cities in North Carolina to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Asheville | Short-Term | 10.3% |

Wilmington | Short-Term | 9.4% |

Boone | Short-Term | 11.6% |

Charlotte | Long-Term | 8.6% |

Raleigh | Long-Term | 7.6% |

Asheville: The Mountain Retreat for High-Yield Vacation Rentals

Asheville’s reputation as a tourist destination and cultural hotspot makes it an ideal location for short-term rental properties. Its unique appeal can yield significant rental income, with a 10.3% rental yield for investors who can navigate local regulations.

- Median Home Price: $484,020

- Average Rent: $2,107

What this means for investors: The tourism-driven market provides substantial rental income potential, making it a strong contender for DSCR loans, particularly for vacation rentals.

Investment Properties Listed Today on Sale in Asheville

Wilmington: The Coastal Short-Term Rental Hotspot

Wilmington’s stunning coastline and historic downtown make it a highly desirable tourist destination. The city’s thriving short-term rental market, supported by tourism and a growing film industry, offers global investors a 9.4% rental yield. This strong performance makes it a prime location for international real estate investors using DSCR loans to finance vacation properties.

- Median Home Price: $417,310

- Average Rent: $1,953

What this means for investors: The combination of natural beauty and a robust tourism economy offers high rental income potential, ideal for a DSCR-focused loan application.

Investment Properties Listed Today on Sale in Wilmington

Boone: The High-Yield Mountain Getaway

Located in the Blue Ridge Mountains, Boone is a year-round tourist destination known for skiing, hiking, and its university culture. This steady stream of visitors and a robust student population creates a dual market for both short-term vacation rentals and student housing. Boone offers the highest rental yield on this list at 11.6%, making it an attractive target for international real estate investors seeking maximum cash flow.

- Median Home Price: $491,812

- Average Rent: $2,200

What this means for investors: Strong demand from both tourists and students ensures high occupancy and rental income, creating an ideal environment for a favorable DSCR.

Investment Properties Listed Today on Sale in Boone

Charlotte: A Financial & Population Growth Engine

As a significant financial and business hub, Charlotte attracts a steady influx of young professionals and corporate relocations, driving strong demand for long-term rental properties. The city’s robust economic stability and 8.6% rental yield make it an excellent market for cash-flow-focused international real estate investors.

- Median Home Price: $404,626

- Average Rent: $2,019

What this means for investors: High rents and a stable economy make it easy for properties to meet DSCR thresholds, delivering strong cash flow.

Investment Properties Listed Today on Sale in Charlotte

Raleigh: The Research Triangle’s Reliable Hub

Raleigh, a key component of the Research Triangle, boasts a robust job market in technology, healthcare, and education. This ensures a stable and growing tenant base, making it a reliable market for investors seeking consistent income and appreciation. With a rental yield of 7.6%, Raleigh offers a balanced opportunity for portfolio growth.

- Median Home Price: $446,868

- Average Rent: $1,895

What this means for investors: Steady appreciation and strong tenant demand create a perfect environment for DSCR-based qualification.

Investment Properties Listed Today on Sale in Raleigh

Specific Considerations for Investing in North Carolina for Foreign Nationals

North Carolina’s real estate market offers unique opportunities and challenges that demand a strategic approach from international real estate investors. Understanding these state-specific factors is key to protecting your investment.

– Short-Term Rental Regulations

Regulations for short-term rentals (STRs) vary widely by locality. While some cities are STR-friendly, others, such as Asheville, have implemented strict limitations or outright bans on new STRs within city limits. Before purchasing an investment property, investors should thoroughly research local ordinances and HOA rules to confirm eligibility for short-term use.

– Landlord-Tenant Laws

North Carolina landlord-tenant law is unique. While landlords have the right to set rent and enforce lease terms, tenants are protected by an “implied warranty of habitability,” which requires landlords to maintain safe and habitable properties. A key investor-friendly rule is that tenants cannot withhold rent for repairs. Instead, they must follow a legal process that provides greater stability for the landlord’s cash flow.

– Property Tax Reappraisals

North Carolina counties are required to conduct property reappraisals at least every eight years. This can lead to significant changes in assessed property values and, consequently, property tax bills. Investors should factor this into their long-term financial modeling and stay informed about their county’s reappraisal schedule.

Strategic & Future Considerations for Foreign Nationals Investing in North Carolina

North Carolina’s economy is undergoing a massive transformation, creating unique opportunities for savvy global investors. Looking ahead, infrastructure, economic development, and evolving regulations will shape the future of real estate in the state.

1. Massive Economic Development Projects: North Carolina is a hub for significant corporate investments, creating thousands of new jobs that will drive a sustained demand for housing. Examples include a Boom Supersonic manufacturing plant in Greensboro and Amazon’s latest investment in AI infrastructure. International real estate investors should target properties in cities that benefit from these long-term job-creation projects.

2. Adaptive Reuse Opportunities: A growing trend in cities like Winston-Salem is the conversion of vacant office buildings into residential units. This can be a highly profitable, innovative investment strategy that capitalizes on a high-demand rental market and reduces supply-side constraints.

3. Foreign Ownership Legislation: While North Carolina law has traditionally been very open to foreign ownership, recent proposed legislation (e.g., Senate Bill 394) aims to restrict “prohibited foreign parties” from countries like China, Iran, North Korea, and Russia from acquiring agricultural land or land near military installations. While this doesn’t impact most residential investors, it’s a critical detail that highlights the importance of staying informed about evolving state and federal policies.

Get a HomeAbroad DSCR Loan in North Carolina as a Foreign National

Securing financing for your investment property in North Carolina is simple with HomeAbroad. Our DSCR loans are tailored specifically for global real estate investors, offering flexible terms and competitive rates to help you grow a high-performing real estate portfolio.

HomeAbroad streamlines the entire investment journey. With our AI-driven investment property search platform, you can discover cash flow deals across North Carolina. Our expert local agents offer personalized guidance, and we assist with everything from LLC formation to US bank account setup and property management support.

If you already own a rental property in North Carolina, HomeAbroad’s cash-out refinancing option lets you access your property’s built-up equity without needing US income or credit. Use the funds to purchase additional properties, renovate for higher returns, or diversify your investment strategy, all while keeping the approval process rental-income focused.

FAQs

Can foreign nationals apply for DSCR loans in North Carolina?

Foreign nationals can apply for DSCR loans through HomeAbroad without needing a US credit score, making it a flexible financing option for international real estate investors.

How long does it take to get a DSCR loan in North Carolina?

At HomeAbroad, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

Is cash-out refinancing available for DSCR loans in North Carolina?

HomeAbroad offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices