Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Breathtaking canyons, over 300 days of sunshine a year, and some of the fastest-growing cities in the US make Arizona a blend of natural wonder and booming real estate potential.

In fact, according to the National Association of Realtors, 5% of all foreign property purchases in the US occur in Arizona, ranking Arizona 5th among top destinations for international buyers.

The draw? Affordable housing, steady rental demand from population growth and tourism, and year-round appeal. Whether it’s a golf villa in Scottsdale, a student rental in Tempe, or a family home in Mesa, Arizona, it delivers consistent returns, especially for foreign nationals using HomeAbroad’s DSCR loan.

Table of Contents

Key Takeaways:

1. Arizona’s real estate market offers a wide range of opportunities for foreign nationals, from fast-growing cities to top tourist destinations, all accessible through DSCR loans from HomeAbroad without the need for US income or credit history.

2. With HomeAbroad's DSCR loans, qualification is based on a property’s rental income, so investors can skip the hassle of providing personal tax returns, employment records, or a US credit score.

3. Phoenix, Tucson, Mesa, Tempe, and Flagstaff each offer strong rental demand driven by a mix of population growth, tourism, universities, and thriving local economies.

4. HomeAbroad makes investing in Arizona simple for international buyers, offering tools to find cash flow properties, secure up to 75% financing, form a US LLC, open a bank account, and handle every step through closing.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt Service Coverage Ratio loan) from HomeAbroad is a financing option designed for global investors, with approval based on the property’s rental income, not your personal income, US credit score, or employment history. Personal Debt-to-Income (DTI) ratios don’t affect qualification, as approval depends entirely on the property’s ability to generate sufficient cash flow.

Take one of our recent clients, a Canadian investor who wanted to buy a short-term rental near Sedona’s red rock trails. Despite owning multiple properties in Canada, he was declined by several US banks because he had no US tax returns or credit history. With our DSCR loan, we focused on the home’s strong Airbnb income projections, approved his financing, and closed in under a month.

Arizona’s combination of strong tourism markets like Scottsdale, Sedona, and Flagstaff, along with steady long-term demand in Phoenix and Tucson, makes it a prime location for foreign nationals to leverage DSCR loans and build profitable rental portfolios.

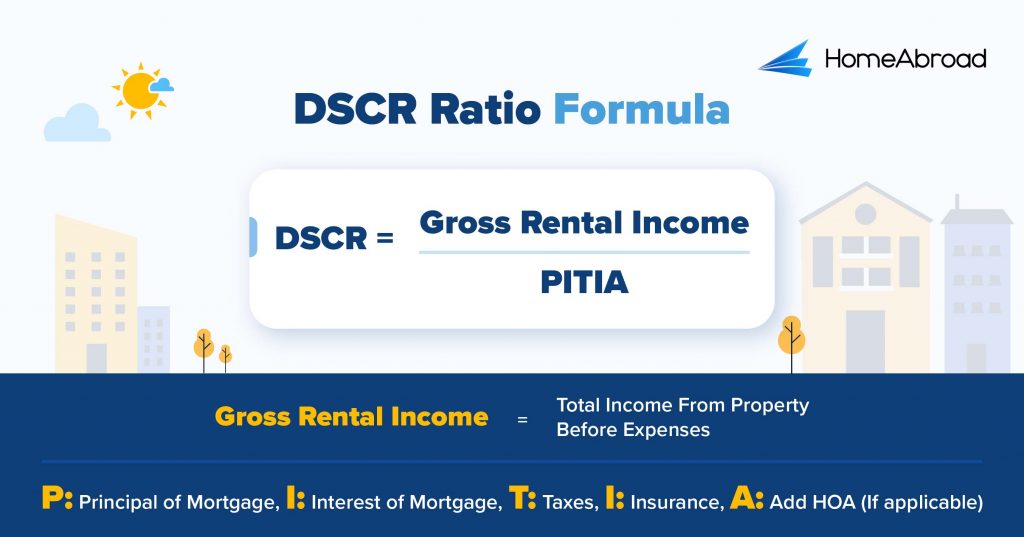

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

Our DSCR loans look at the property’s ability to generate income rather than your personal finances. In a typical DSCR loan, the goal is for the property’s monthly gross rent to at least match, and preferably exceed, the total mortgage payment (PITIA). When the ratio is 1.0 or higher, you’re positioned for the most competitive rates and terms.

But not every high-potential property hits that mark right away. That’s why we also offer a No-Ratio DSCR option for properties with a DSCR between 0 and 1. This program still allows you to secure financing, though it comes with a slightly larger down payment (about a 5% reduction in LTV) and a higher interest rate. It’s a smart choice for investors who see long-term upside even if the property’s initial cash flow is below the 1.0 benchmark

DSCR Loan Requirements in Arizona for Foreign Nationals

Unlike conventional lenders, HomeAbroad’s DSCR loans are designed for international investors, making the process faster and far less paperwork-intensive.

Below is how our lending requirements stack up against traditional lenders when it comes to DSCR loans for foreign nationals:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | For the best terms, we qualify based on rental income where DSCR ≥ 1. Our No-Ratio DSCR Program is available for properties with a lower DSCR, though it carries a 5% LTV hit and a slightly higher interest rate. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25% gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Arizona.

Where We Lend DSCR Loans in Arizona

HomeAbroad provides DSCR loans statewide in Arizona, helping international real estate investors tap into major hubs like Phoenix, Tucson, Scottsdale, and beyond. Here are some of the cities in Arizona where we lend DSCR loans.

- Phoenix

- Scottsdale

- Tucson

- Mesa

- Tempe

- Chandler

- Gilbert

- Peoria

- Buckeye

- Flagstaff

- Surprise

- Avondale

- Goodyear

- Sedona

- Yuma

- Queen Creek

Case Study: Meet Aiden McAllister, a Canadian Investor

Aiden McAllister, a small business owner from Vancouver, wanted a vacation home in Scottsdale, Arizona, that he could rent out during the peak tourist season. While financially solid in Canada, he ran into roadblocks with traditional US lenders who required a US credit score, tax returns, and proof of American income. None of these applied to him. That’s when he found HomeAbroad’s DSCR loan program.

The Solution: HomeAbroad’s DSCR Loan

By qualifying Aiden based on the property’s projected rental income instead of his personal financials, HomeAbroad made it possible for him to purchase a modern 3-bedroom home just minutes from Scottsdale’s Old Town. With competitive terms and a quick approval process, Aiden closed right before the start of Arizona’s busy winter season.

- Loan Amount: $385,000

- Purpose: Purchase of a vacation rental property

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.2%

- Time to Close: 27 days

Why This Worked for Aiden:

- No US Credit History Required: His approval relied entirely on the property’s income potential, bypassing the need for a US credit report.

- Minimal Paperwork: No US tax returns or employment verification needed.

- Positive Cash Flow: A DSCR of 1.2 ensured the rental income covered mortgage payments from the start.

Aiden’s success shows how DSCR loans enable investors to tap into Arizona’s lucrative rental market without the usual barriers to US financing.

Top Places to Invest in Arizona with a DSCR Loan

Arizona offers a dynamic real estate market with strong rental demand driven by population growth, tourism, and a robust job market. The state’s average rental yield and favorable landlord laws make it attractive for foreign investors. With a DSCR loan, you can qualify for financing based on rental income rather than personal income, opening the door to high-potential cities across Arizona.

Here are some of the best places in Arizona to invest using a DSCR loan:

City | Rental Type | Rental Yield |

|---|---|---|

Tempe | Short-Term | 8.16% |

Flagstaff | Short-Term | 8.05% |

Tucson | Long-Term | 5.55% |

Phoenix | Long-Term | 4.87% |

Mesa | Long-Term | 4.53% |

Tempe: University Energy and Year-Round Demand

With Arizona State University and a lively downtown, Tempe draws a constant flow of visitors, from students’ families to sports fans and business travelers. This steady demand makes it one of the most reliable markets in the state for high-performing investment properties.

- Median Home Price: $469,625

- Average Rent: $1,751

What this means for investors: Consistent occupancy and strong nightly rates make Tempe ideal for DSCR-financed properties targeting frequent turnover and strong cash flow.

Investment Properties Listed Today on Sale in Tempe

Flagstaff: Gateway to the Grand Canyon

Flagstaff blends mountain-town charm with easy access to Arizona’s biggest attractions, including the Grand Canyon and Route 66. Seasonal tourism and outdoor recreation keep demand strong year-round.

- Median Home Price: $662,704

- Average Rent: $2,394

What this means for investors: The tourism-driven market supports premium pricing, creating excellent income potential for DSCR-financed properties.

Investment Properties Listed Today on Sale in Flagstaff

Tucson: Affordable Market with Consistent Returns

Known for its desert scenery, growing tech sector, and University of Arizona, Tucson has a dependable tenant base that keeps occupancy high.

- Median Home Price: $330,455

- Average Rent: $1,542

What this means for investors: Lower entry costs paired with stable demand make Tucson a smart pick for building a diversified Arizona real estate portfolio.

Investment Properties Listed Today on Sale in Tucson

Phoenix: Big City Growth and Long-Term Potential

As Arizona’s capital and largest city, Phoenix benefits from rapid population growth, job creation, and a diverse economy. It’s a hub for both residential and commercial activity.

- Median Home Price: $411,916

- Average Rent: $1,689

What this means for investors: A balanced market offering both solid income potential and appreciation, making it well-suited for DSCR loan strategies.

Investment Properties Listed Today on Sale in Phoenix

Mesa: Family-Friendly Growth Hub

Mesa combines suburban comfort with close access to Phoenix’s job market, attracting families and long-term renters alike.

- Median Home Price: $436,600

- Average Rent: $1,675

What this means for investors: Predictable demand and a growing population create a stable environment for investment properties financed through DSCR loans.

Investment Properties Listed Today on Sale in Mesa

Specific Considerations for Investing in Arizona for Foreign Nationals

Arizona’s real estate market combines year-round sunshine, strong population growth, and a steady influx of tourists. For international investors, understanding state-specific factors can help protect your returns and avoid unexpected hurdles.

– Short-Term Rental Regulations

Arizona is generally friendly toward short-term rentals, but individual cities can set their own rules. For example, Scottsdale and Sedona require registration, licensing, and compliance with noise and parking limits. Some HOA communities also prohibit STRs entirely. Always verify local ordinances and HOA guidelines before closing on a property.

– Landlord-Tenant Laws

Arizona law is landlord-friendly in many respects. Leases can include firm payment terms, and eviction processes are relatively quick compared to other states if tenants fail to pay. However, landlords must comply with strict health and safety standards, including timely repairs for essentials like air conditioning, which is critical in Arizona’s extreme heat.

– Property Taxes and Insurance

Arizona’s property tax rates are lower than the national average, which benefits long-term returns. That said, insurance premiums can vary widely based on wildfire risk zones and proximity to flood-prone areas. Factor these costs into your investment projections from the outset.

– Water Availability and Restrictions

Water rights and use regulations are becoming increasingly crucial in Arizona amid ongoing drought concerns. Some municipalities have restrictions on new water hookups or higher water rates in certain areas. Investors should investigate local water policies before committing to a purchase, especially for developments in rural or fast-growing suburbs.

Strategic & Future Considerations for Foreign Nationals Investing in Arizona

Arizona’s housing market shows strong fundamentals, but savvy investors look beyond current trends to anticipate future shifts. Here’s what foreign buyers should keep in mind:

– Population Growth in Key Cities

Phoenix, Mesa, and Tucson continue to attract new residents from high-cost states like California and Washington. This influx supports both long-term rental demand and property value appreciation, making these cities safe bets for buy-and-hold strategies.

– Infrastructure and Development Projects

Significant investments in transportation, education, and healthcare facilities are expanding job opportunities and attracting new residents. Areas near upcoming light rail expansions or large employer campuses can see faster appreciation over time.

– Tourism Resilience

Tourism remains a significant economic driver, with destinations such as Sedona, Scottsdale, and the Grand Canyon consistently attracting millions of visitors each year. Even during broader economic slowdowns, Arizona’s natural attractions help sustain demand for vacation rentals.

Get a HomeAbroad DSCR Loan in Arizona as a Foreign National

Financing your Arizona investment property is straightforward with HomeAbroad. Our DSCR loans are built for international investors, offering flexible terms and competitive rates so you can grow a profitable portfolio in one of the fastest-growing US markets.

We make the entire process seamless. Using our AI-powered investment property search platform, you can uncover cash-flowing opportunities across Arizona. Our local agents provide expert, on-the-ground insight, while we handle essentials like LLC setup, US bank account opening, and connecting you with reliable property managers.

Already own a rental in Arizona? Our cash-out refinancing option lets you tap into your property’s equity without US income or credit requirements. You can use the funds to acquire more properties, upgrade existing ones to improve returns, or diversify, while keeping the approval process focused on rental income potential. Get a DSCR loan with HomeAbroad today and start building your Arizona real estate portfolio with confidence.

FAQs

Can I get a DSCR loan in Arizona without a US credit history?

Yes. DSCR loans focus on the property’s rental income rather than your personal credit. This means you can qualify without a US credit score or income history.

What documents do I need as a foreign national?

Typically, you’ll need a valid passport, proof of funds for the down payment and closing costs, and property-related income estimates. You won’t need US tax returns or pay stubs.

Can I use a DSCR loan for short-term rentals like Airbnb?

Yes, as long as short-term rentals are allowed in the property’s location. Always check local regulations and HOA rules before purchasing.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices

![DSCR Loan Interest Rates Today [December, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)

![DSCR Loans Guide for Foreign Nationals: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)