Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Nevada’s rental market, especially in cities like Las Vegas, Henderson, and Reno, offers strong income potential, and DSCR loans from HomeAbroad allow international real estate investors to qualify without needing US income, US credit history, or residency status.

2. DSCR loans are underwritten based on the property’s rental income, so foreign nationals don’t need to undergo personal income verification.

3. Major Nevada cities like Las Vegas and Reno benefit from year-round tourism, population growth, and limited housing supply - factors that drive high rental yields and long-term appreciation opportunities.

4. HomeAbroad is a one-stop shop that makes the entire process simple for international real estate investors, helping you find properties using our AI-driven investment search property platform, get mortgages, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Table of Contents

They say what happens in Vegas stays in Vegas, but for savvy real estate investors, the returns definitely don’t.

Nevada, home to the entertainment capital of the world and one of the fastest-growing states by population, is more than just bright lights and blackjack tables. From booming short-term rental markets in Las Vegas to the steady long-term appeal of cities like Reno and Henderson, Nevada offers a dynamic landscape for international real estate investors looking to build wealth in the US.

I’ve worked with many foreign nationals who were unable to get conventional loans due to a lack of US credit history. This is where HomeAbroad DSCR loans make a difference: they allow global investors to qualify based on the property’s rental income rather than personal income, simplifying financing and enabling faster portfolio growth.

Whether you’re targeting Las Vegas’s vacation rental crowd or Reno’s stable year-round tenants, HomeAbroad DSCR loans help ensure your rental income covers the mortgage, creating positive cash flow and setting you up for long-term success.

What is a DSCR Loan for Foreign Nationals?

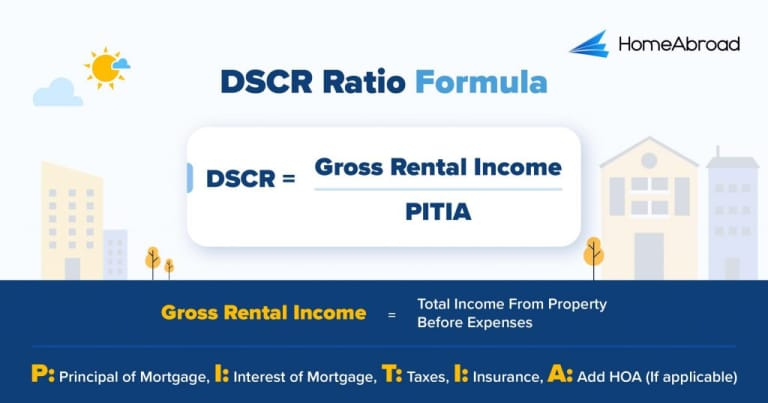

A DSCR (Debt Service Coverage Ratio) loan lets international real estate investors qualify based on their property’s rental income, not their personal earnings. Instead of considering personal Debt-to-Income (DTI) ratios, eligibility is determined by how well the property’s rental income covers its mortgage payments.

Because qualification depends on the property’s income alone, lenders price these loans differently from traditional mortgages. Rates usually fall in a slightly higher range, and they shift with market conditions. You can see the latest DSCR loan interest rates here.

If you want to invest in Nevada’s strong rental markets, a HomeAbroad DSCR loan can help you finance the right property without relying on your income.

How to Calculate the DSCR Ratio?

The Debt Service Coverage Ratio (DSCR) is a crucial metric that we use to assess borrowers’ ability to cover mortgage payments with their rental income. For real estate investors, a higher DSCR indicates more substantial cash flow, improving their chances of securing better loan terms.

Here is how we calculate it:

I recently worked with a client interested in purchasing a rental property in Las Vegas, Nevada. He wasn’t sure if his rental property would generate enough income to qualify for a DSCR loan, so we broke down the numbers together.

Example

Calculating the DSCR Ratio for a Nevada Property:

With a DSCR of 1.16, the property demonstrated strong rental income coverage, making it an excellent candidate for a DSCR loan with competitive loan terms.

While a DSCR of 1.0 or higher is ideal, indicating the property’s rental income fully covers the mortgage, HomeAbroad offers flexible options for investors. For properties with a DSCR between 0 and 1, we offer No-Ratio DSCR loans for situations where the rental income may not cover the mortgage at all.

Just keep in mind: No-Ratio DSCR loans typically require a higher down payment (a 5% hit to LTV) and a higher interest rate to offset the increased risk.

If you hate doing the math, HomeAbroad’s DSCR ratio calculator can help you quickly determine your ratio.

DSCR Loan Requirements in Nevada for Foreign Nationals

Unlike traditional lenders, HomeAbroad offers a simplified DSCR loan process built exclusively for foreign nationals.

Suppose you’re investing in Nevada real estate without a US credit history. In that case, our flexible underwriting, minimal requirements, and remote-friendly closing process make it easy to get started, whether you’re eyeing short-term rentals in Las Vegas or long-term properties in Reno.

Here’s how our DSCR loan criteria for foreign nationals stack up against conventional lenders.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We provide DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, meaning you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25% gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond the DSCR ratio, down payment, and credit score, several other factors can affect your eligibility for a DSCR loan as an international real estate investor.

At HomeAbroad, we specialize in working with international real estate investors and provide end-to-end guidance throughout your investment journey. Our AI-driven investment property search platform makes it easy to find high-yield opportunities in Nevada, and our loan experts tailor DSCR loan solutions to help you succeed in markets like Las Vegas, Reno, and beyond.

Areas We Lend in Nevada

HomeAbroad offers DSCR loans across Nevada, with tailored support for global investors in top-performing markets like Las Vegas, Reno, Henderson, and more.

Here are a few key cities in Nevada where we offer DSCR loans for international real estate investors.

- Las Vegas

- Henderson

- Reno

- North Las Vegas

- Sparks

- Carson City

- Boulder City

- Mesquite

- Fernley

- Fallon

Let’s examine a case study of one of our past clients to understand how profitable investing in the Nevada real estate market can be.

Case Study: Emily Carter from Canada Expands Her Real Estate Portfolio in Nevada

Emily Carter, a Canadian real estate investor, set her sights on acquiring a rental property in Reno, Nevada. However, as a foreign national without a US income or a domestic credit history, she faced roadblocks from traditional lenders that required extensive income verification and tax documentation, resulting in multiple rejections.

The Solution: HomeAbroad DSCR Loan

Emily turned to HomeAbroad and chose a DSCR loan, which allowed her to qualify based solely on the property’s rental income. With a DSCR ratio of 1.12, her rental income was more than enough to cover the mortgage, making it a perfect fit for her portfolio.

HomeAbroad’s mortgage team guided her through a seamless lending process, helping her finance the property without personal income documentation and close the deal remotely from Canada.

- Loan Amount: $360,000

- Purchase Price: $450,000

- Down Payment: 25%

- Loan Type: 30-year fixed-rate DSCR loan

- Monthly PITIA: $2,675

- Gross Monthly Rent: $3,000

- DSCR Ratio: 1.12

- Monthly Positive Cash Flow: $325

- Time to Close: 30 days

Steven Glick highlights the importance of this financing approach:

Emily’s experience shows how DSCR loans remove traditional financing barriers, making it easier for investors to secure properties and generate positive cash flow. HomeAbroad helps investors like Emily scale their portfolios with less hassle and greater financial flexibility by focusing on rental income instead of personal earnings.

Why This Worked for Emily:

- No US Credit or Income Required: Emily didn’t need to undergo personal income verification. Her qualification was based solely on the property’s rental income.

- Strong Rental Income Coverage: With a DSCR of 1.12, the property’s income comfortably covered the monthly mortgage, creating positive cash flow from day one.

- Investor-Focused Flexibility: HomeAbroad’s foreign national mortgage program enabled Emily to close remotely and structure ownership in a way that aligned with her tax strategy.

This case study highlights how HomeAbroad empowers international real estate investors like Emily to overcome financing barriers and grow their US real estate portfolios through tailored DSCR loans, hands-on support, and a process designed for global buyers.

Top Places to Invest in Nevada with a DSCR Loan

Nevada presents a lucrative real estate market with affordable property prices and strong rental income potential. With no state income tax, a growing population driven by job opportunities, and a vibrant tourism sector, especially in cities like Las Vegas and Reno, Nevada offers substantial potential for both short-term and long-term rental income.

For foreign nationals investing in the US, Nevada’s rental market presents an excellent opportunity to leverage DSCR loans, which focus on the property’s rental income rather than the borrower’s personal financials.

Here are some of the top-performing cities in Nevada to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Las Vegas | Short-Term | 12.95% |

Reno | Long-Term | 8.8% |

Boulder City | Short-Term | 9.41% |

Carson City | Short-Term | 8.41% |

Henderson | Long-Term | 13.7% |

Las Vegas: The Entertainment Capital with High Short-Term Rental Yields

Las Vegas isn’t just about casinos and nightlife. It’s a global tourism hotspot attracting millions of visitors each year, making it ideal for short-term rental investments. The city’s vibrant events and conventions keep demand strong year-round, driving impressive rental income.

- Median Home Price: $435,778

- Average Rent: $2,000

What this means for investors: Exceptional short-term rental yields and steady occupancy provide strong cash flow, making DSCR loan qualification smooth and rewarding.

Investment Properties Listed Today on Sale in Las Vegas

Reno: The Growing Tech Hub and Long-Term Rental Market

Reno has transformed from a small casino town to a burgeoning tech and logistics center. This economic diversification attracts long-term residents, ensuring steady rental demand. Investors benefit from stable appreciation and solid rental income.

- Median Home Price: $568,608

- Average Rent: $1,941

What this means for investors: Reliable long-term tenants and moderate prices create a balanced investment with attractive DSCR loan potential.

Investment Properties Listed Today on Sale in Reno

Boulder City: The Tranquil Tourist Getaway with Short-Term Rental Appeal

Boulder City draws visitors seeking peace near Lake Mead and Hoover Dam. This tourism base supports a thriving short-term rental market, ideal for investors targeting vacation stays with healthy rental returns.

- Median Home Price: $477,049

- Average Rent: $1,450

What this means for investors: Strong vacation rental demand and steady yields make it a promising choice for DSCR-backed short-term rental investments.

Investment Properties Listed Today on Sale in Boulder City

Carson City: The State Capital with Balanced Rental Opportunities

Carson City offers a mix of government employment and small-town charm. Its rental market includes both short-term visitors and longer-term tenants, giving investors versatile options for income generation.

- Median Home Price: $497,575

- Average Rent: $2,150

What this means for investors: A diverse tenant pool and consistent demand support solid rental income and DSCR loan qualification.

Investment Properties Listed Today on Sale in Carson City

Henderson: The Fast-Growing Suburb with Top Long-Term Rental Yields

Henderson’s family-friendly neighborhoods and proximity to Las Vegas have spurred rapid population growth. The city’s long-term rental market benefits from strong demand and high yields, making it a hotspot for investors.

- Median Home Price: $496,982

- Average Rent: $2,297

What this means for investors: High rental yields combined with strong tenant demand create excellent conditions for DSCR loan success and portfolio growth.

Investment Properties Listed Today on Sale in Henderson

Specific Considerations for Investing in Nevada for Foreign Nationals

Nevada’s real estate market offers attractive opportunities, but international real estate investors should understand local nuances to maximize success. From regulatory frameworks to environmental factors and tenant laws, here’s what foreign nationals need to know before investing.

Here are key factors to keep in mind:

– Water Usage and Environmental Regulations

Nevada faces ongoing drought and water scarcity challenges. Many areas enforce water-use restrictions that can affect landscaping and property maintenance costs. Global investors should consider the sustainability of outdoor amenities and potential regulatory changes that could affect utility expenses.

– Short-Term Rental Licensing and Restrictions

Cities like Las Vegas and Reno regulate short-term rentals through mandatory licensing and zoning rules. Some neighborhoods restrict short-term rentals entirely, while others limit rental durations or require owner occupancy. It’s critical to research local ordinances and maintain compliance to avoid penalties or license loss.

– Property Tax Structure

Nevada’s property taxes are relatively low compared to many states, with rates set by counties and capped by state law. However, investors should budget for annual assessments and potential increases in rapidly appreciating markets, especially in growing metro areas like Las Vegas and Henderson.

– Landlord-Tenant Law Overview

Nevada law provides a balanced framework favoring both landlords and tenants. There is no statewide rent control, but landlords must adhere to specific notice periods for rent increases (45 days if the increase is more than 10%) and evictions. Security deposits must be returned within 30 days of lease termination, and landlords must maintain safe and habitable living conditions.

– Economic Growth and Population Trends

Nevada’s expanding economy, fueled by tourism, tech, and manufacturing, drives population growth, particularly in Southern Nevada. This demographic trend supports strong rental demand but also means international real estate investors should stay updated on local developments, infrastructure projects, and market shifts that can affect property values.

Strategic & Future Considerations for Foreign Nationals Investing in Nevada

Nevada’s real estate market is evolving rapidly, presenting unique opportunities and challenges for foreign investors. Beyond the well-known appeal of Las Vegas and Reno, emerging trends in tourism diversification, regulatory shifts, and sustainability will influence investment strategies as we move forward.

Here are some forward-looking considerations international investors should factor in:

1. Tourism Diversification Beyond Casinos: Nevada is broadening its economic base beyond gaming, with growth in entertainment, conventions, outdoor recreation, and tech sectors. This diversification is driving longer tourist stays and increased demand for a mix of short- and long-term rentals.

2. Sustainability and Water Resource Management: Ongoing drought and water restrictions are prompting new building codes and sustainability requirements. Properties that incorporate water-efficient landscaping and green technologies may have stronger long-term appeal and regulatory advantages.

3. Changing Short-Term Rental Regulations: Cities like Las Vegas and Reno are actively updating short-term rental rules to balance neighborhood concerns with economic benefits. Expect more stringent licensing requirements, caps on rental days, and enforcement measures that could affect investment returns and operational flexibility.

4. Infrastructure Expansion and Transit Developments: Nevada is investing in expanding public transit options and highway improvements, particularly around the Las Vegas Valley and Reno. These projects improve accessibility, support population growth, and enhance property values in emerging suburban neighborhoods.

5. Potential Tax Policy Changes: While Nevada currently benefits from no state income tax, ongoing debates and fiscal pressures at the state level could lead to changes in tax policies affecting real estate investors. Staying informed on local and state government plans will be critical for long-term investment planning.

Get a HomeAbroad DSCR Loan in Florida as a Foreign National

Securing financing for your investment property in Nevada is seamless with HomeAbroad. Our DSCR loans are tailored specifically for global real estate investors, offering flexible terms and competitive rates to help you grow a high-performing real estate portfolio in markets like Las Vegas, Reno, and beyond.

HomeAbroad simplifies your entire investment journey. With our AI-driven investment property search platform, you can uncover top-yield rental opportunities across Nevada. Our expert local agents provide personalized support, and we assist with everything from LLC formation to US bank account setup and connecting with property management professionals.

Already own a rental in Nevada? HomeAbroad’s cash-out refinancing option lets you tap into your property’s equity, no US income or credit history required. Use the funds to scale your portfolio, upgrade existing units, or expand into high-demand neighborhoods, all with a rental-income-based approval process.

Get a DSCR loan with HomeAbroad today and take the next step in building your Nevada real estate portfolio with confidence.

FAQs

Can a foreign national apply for a DSCR loan in Nevada?

Yes, foreign nationals are eligible for DSCR loans in Nevada. At HomeAbroad, we specialize in helping foreign nationals invest in US real estate without requiring a US credit score or personal income documentation. Your loan approval is based on the property’s rental income potential, not your personal income.

What types of properties are eligible for DSCR loans in Nevada?

DSCR loans in Nevada are for various properties, including single-family homes, condos, townhomes, and multi-family units. They can finance new construction projects and investment properties.

Can I refinance a property in Nevada using a DSCR loan?

Yes, foreign nationals who already own a rental property in Nevada can refinance with a DSCR loan. This includes both rate-term and cash-out refinancing. With HomeAbroad, you can tap into your property’s equity, even without US income or credit history, and reinvest in additional properties or improve existing assets.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices