Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

➡️ Indians can purchase US real estate without requiring US citizenship or residency.

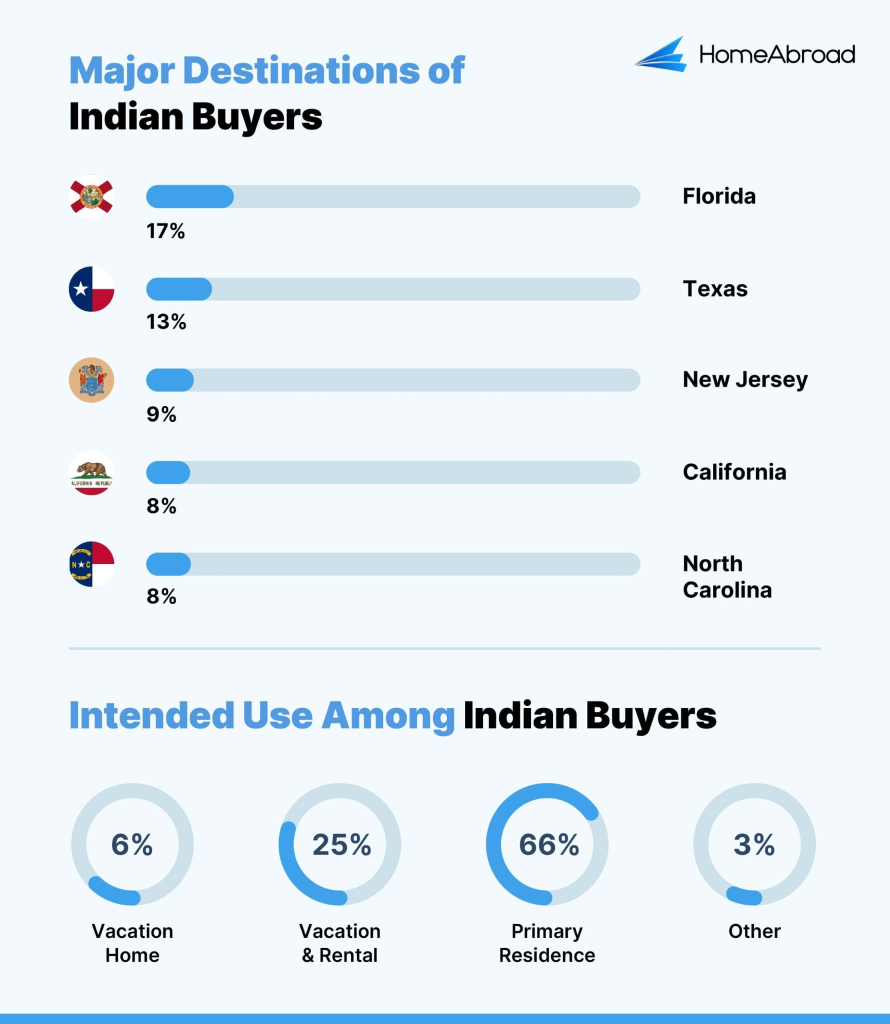

➡️ A majority—66% of Indian buyers are expats who purchase primary residences, often while on visas like H1B or L1.

➡️ Indians can also invest in US real estate without US residency and generate cash flow with mortgage financing without needing US credit score.

➡️ HomeAbroad Loans simplifies the process for Indian buyers, offering foreign national mortgage solutions, including 30-year fixed-rate loans—ideal for expats and non-residents alike.

Table of Contents

Priya, an IT professional from Hyderabad, recently relocated to the US on an L1 visa and purchased a home in Dallas, Texas. She aimed for a primary residence close to her workplace with the potential for future appreciation.

Priya discovered that her mortgage payment would be marginally less than her monthly rent for the same house due to high rental yields in the US. Therefore, purchasing a home, which is an appreciating asset, made more sense than renting.

With the help of HomeAbroad Loans, Priya secured a mortgage despite having no US credit history. Today, she enjoys the stability of homeownership and is exploring renting out a portion of her home for additional income.

This story highlights the journey of many Indian buyers in the US—starting with a primary residence but often branching into investment opportunities.

Are you curious how Indians can invest in US real estate and what makes this market so attractive? Let’s see how you, too, can do it!

Are Indians Buying Property in the US?

Yes!! Indian buyers have firmly established themselves as key players in the US real estate market.

According to the National Association of Realtors (NAR), Indians ranked among the top five foreign investors in 2024, contributing a staggering $4.1 billion to home purchases, with 66% buying primary residences.

From my experience working with Indian buyers, their motivations range from securing family homes near top universities to capitalizing on rental yields in high-demand cities. Their impact isn’t just limited to purchasing homes—they’re reshaping the market with strategic investments as well.

Why Are Indians Buying?

✅ Primary Residences: Expatriate Indians on visas, such as H1B or L1, to secure a stable living environment. Homeownership often proves more cost-effective than renting, especially in areas with high rental yields.

✅ Educational Needs: Investing in property near prestigious universities has become a strategic move for Indian parents, providing accommodation for their children while gaining a long-term appreciating asset.

✅ Portfolio Diversification: Non-resident Indians invest in US real estate to secure passive income and capital growth in USD. This also offers stability and acts as a hedge against currency fluctuations risks.

✅ Rental Income: High rental yields coupled with availability of 30 year fixed rate mortgages in the US make US real estate investment attractive for both Indian expats residing in the US and non-resident Indians.

Indian buyers are not just entering the market—they’re reshaping it with their strategic investments.

With Indian buyers already making significant strides in the US real estate market, the question isn’t just whether Indians are buying property in the US—it’s why the US is such an attractive destination for Indian investors.

Let’s see the compelling reasons that make US real estate a top choice for Indian buyers.

Why Should Indians Invest in US Real Estate?

Indian investors are increasingly turning to US real estate to achieve financial growth, diversify their portfolios, and capitalize on lucrative rental yields.

With over 10 years of experience in helping foreign nationals, including Indian investors, I’ve seen firsthand how these investments create lasting wealth.

Let’s break down why the US is becoming a hotspot for Indian real estate investors, backed by data and trends.

1. Homeownership Stability: Buying vs Renting

Purchasing a home in the US, particularly as a primary residence, offers significant security and financial advantages compared to renting. For Indian buyers on work visas or planning migration, buying often makes more sense due to several factors.

Unlike renting, where payments go toward a landlord’s income, buying a home builds equity in an appreciating asset over time. Additionally, mortgage payments can often be comparable—or even lower—than monthly rents, especially in areas with high rental yields.

Owning a home also provides stability and freedom, allowing buyers to customize their living space while avoiding the uncertainty of lease renewals or rental increases.

You can check out this video to see why you should buy and not rent:

For many, homeownership is not just about finding a place to live but also a strategic financial decision that lays the foundation for long-term growth and stability.

2. High Rental Yields

The US real estate market consistently outperforms Indian metros in rental income, making it highly attractive for non-resident Indian investors.

- Top Performers in Rental Yields: Cities in the US deliver rental yields ranging between 8% and 10%, with other cities showcasing an even higher yield. This is significantly higher than India’s 4% -5% in cities like Mumbai and Delhi.

- Surging Demand: High-demand areas such as Florida and Texas have seen rental yields spike to 15% or more in recent years.

- Comparison Advantage: Indian investors can earn steady income by tapping into these high-yield markets.

3. Wealth Diversification

US real estate offers a stable and secure avenue to diversify wealth globally.

- Global Stability: As the world’s largest economy, with a GDP of over $27 trillion, the US provides unmatched investment stability.

- Economic Contrast: The Indian market often faces volatility due to policy changes and demand shifts, whereas the US real estate market is more predictable.

- Hedge Against Rupee Depreciation: US real estate allows Indian investors to secure wealth in a stronger currency, protecting against the rupee’s fluctuations.

4. Favorable Mortgage Terms

Indian buyers can access long-term mortgages at competitive rates through HomeAbroad Loans:

- 30-Year Fixed Loans: Affordable monthly payments.

- Foreign National Mortgages: Tailored options that don’t require a US credit history.

5. Home Price Appreciation

US real estate has a proven track record of long-term value appreciation.

- Historical Trends: Over the past 5 years, US home prices have grown by an average of 49% [Source: Zillow].

- Emerging Markets: Tech hubs and cities with infrastructure booms are seeing rapid growth.

5. Lifestyle and Prestige

Owning US property offers lifestyle upgrades and global prestige.

- Premium Living: Cities like Los Angeles and Miami provide access to luxury living and cultural hubs.

- Education and Family: Many Indians purchase homes for children studying in the US or for future family migration.

- Community Appeal: A growing Indian community in the US makes the transition smoother and more welcoming.

Events like IREX 2024 reflect this growing trend, where Indian investors showed significant interest in US real estate for its diversification potential, high rental yields, and wealth stability.

At the event, HomeAbroad presented key insights on why US real estate is a top choice for Indian investors. From high rental yields to portfolio diversification, learn how you can tap into this lucrative market.

Watch the full presentation here:

With such compelling advantages, it’s no surprise that Indian buyers are increasingly buying US real estate. But how can you, as an Indian buyer, go through the process?

Let’s break it down step by step.

Quick Steps to Invest in US Real Estate for Indians

Investing in US real estate as an Indian buyer is a straightforward process when you follow these steps:

✅ Set Your Goals

Decide whether you’re buying for personal use, rental income, or both. In my experience, most Indian buyers prioritize properties in cities with strong rental demand or close proximity to workplaces and schools, ensuring both financial returns and convenience.

✅ Secure Financing

One of the biggest challenges for Indian buyers is obtaining financing without a US credit history. Fortunately, HomeAbroad Loans offers tailored foreign national mortgages with competitive terms, including 30-year fixed-rate options.

✅ Research and Choose a Location

Analyze cities based on factors like affordability, appreciation potential, rental demand, and proximity to schools or universities.

✅ Work with HomeAbroad’s Real Estate Agents

An experienced agent understands the unique challenges foreign buyers face, such as understanding local regulations or conducting virtual tours. Work with HomeAbroad’s network of experienced real estate agents with international expertise to go through the process smoothly.

✅ Find the Right Property

Visit or virtually explore properties to identify those that meet your goals.

✅ Make an Offer and Negotiate

Submit an offer and negotiate the purchase price with the help of your agent.

✅ Conduct Inspections and Appraisals

Ensure the property is in good condition and aligns with its market value. Based on my experience, this step is critical for foreign buyers unfamiliar with US property standards.

✅ Close the Deal

Finalize the paperwork, pay the required amount, and officially own your property. With HomeAbroad’s guidance, you can rest assured that every detail is handled professionally and transparently.

For a detailed, step-by-step breakdown, visit our comprehensive guide: Can Foreigners Buy Property in the US?

You can also check out this video for a visual understanding of the process:

With the steps outlined, the next critical step is knowing about the mortgage options available to you. Let us look at the options available with HomeAbroad Loans.

Foreign National Mortgage Options for Indian Buyers

Indian buyers can easily access foreign national mortgage solutions through HomeAbroad Loans, simplifying the financing of US real estate investments without requiring a US credit history.

Whether purchasing a primary residence or an investment property, these tailored options cater specifically to the needs of Indian buyers.

For more information on eligibility and the application process, explore our foreign national mortgage guide.

With a clear understanding that you are eligible for foreign national mortgages, it is also important to understand the tax considerations that come with investing in US real estate as an Indian buyer. Let’s explore these in detail.

The Tax Implications for Indians Buying Property in the US

Indian buyers enjoy the same property ownership rights as US residents and must comply with US tax obligations, including taxes on rental income, capital gains, and property ownership.

Thanks to the US-India Tax Treaty, taxes paid in the US can be credited against Indian tax liabilities, ensuring no double taxation. Proper compliance with tax laws ensures a seamless investment experience.

For a detailed overview of tax compliance, deductions, and filing requirements, refer to our Taxes guide.

Conclusion

For Indians, purchasing property in the US is more than an opportunity—it’s a strategic move toward stability, wealth building, and global living.

Whether you’re on a visa looking for a primary residence or an investor aiming for high rental yields, the US real estate market offers unparalleled advantages.

With HomeAbroad Loans and expert real estate agents, owning property in the US has never been easier. Ready to start your journey? Let HomeAbroad guide you every step of the way.

FAQs

1. Can Indians buy property in the US without visiting the country?

Yes, Indians can purchase US property remotely through virtual tours, online transactions, and trusted agents. However, visiting the property before purchase is always recommended for a better understanding.

2. Do Indians need a US credit history to get a mortgage?

No, Indian buyers can secure foreign national mortgages through HomeAbroad Loans, which do not require a US credit history.

3. Are there restrictions on the type of property Indians can buy in the US?

Indians can purchase residential, commercial, or investment properties in the US without restrictions.

4. How does the US-India tax treaty benefit Indian property owners?

The treaty prevents double taxation by allowing Indian buyers to offset US taxes paid on rental income or capital gains against their Indian tax liabilities.

![How can Indians Buy a House in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2022/03/naveed-ahmed-9Dt4WutvwDs-unsplash-500x331.jpg)

![Can Foreigners Buy Property in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)