Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. H-1B visa holders don’t have to wait for their green card to buy a house in the US.

2. H1B visa holders also do not need to wait for 2 years to build their US credit history to be eligible for mortgage financing.

3. H1B visa holders, even if uncertain about their visa extension, can continue owning their US real estate even if they return to their home country.

As an H1B visa holder, you’re in a prime position to make one of the most rewarding investments of your life, buying property in the United States.

In 2025, 56% of foreign buyers purchased property in the US, amounting to around 78,100 homes. Many of these buyers are professionals just like you, drawn by the stability and wealth-building potential of US real estate.

With property values appreciating by an impressive 5.4% annually over the last ten years, now is the perfect time to consider planting roots and building your financial future.

At HomeAbroad, we understand your unique journey and are here to guide you through every step. Our expert team is dedicated to making this significant milestone smooth and fulfilling, transforming your immigration status into a key to your American dream home.

Embrace the possibilities, and let us guide you to your new home in the US.

Table of Contents

Can H1B Visa Holders Buy a House in the US?

Absolutely! H1B visa holders are fully entitled to purchase property in the US, just like any US citizen. Homeownership offers a sense of stability and a significant investment opportunity.

The primary difference lies in the financing options and documentation required. H-1 B visa holders can secure a mortgage, but they may need to provide additional documents to demonstrate their employment stability and visa status.

At HomeAbroad, we specialize in tailored mortgage options for H-1 B visa holders. Our experienced team understands your unique circumstances and is dedicated to making the home-buying process smooth and efficient. For more details, refer to our H-1 B visa mortgage guide.

Still unsure due to uncertainty around your visa renewal or extension?

Is it Risky to Buy a House on an H1B Visa?

Owning a home as an H1B visa holder is a significant achievement, but it’s natural to have concerns about the long-term implications. What happens if your visa status changes?

How can you ensure your investment remains secure and beneficial? Let’s explore these questions with the example of one of our clients.

Raj, an H-1 B visa holder from India working in Silicon Valley, bought a charming house in a vibrant neighborhood as a primary residence while in the United States for just 6 months.

He was excited about his new home, but also worried about the future. What if his visa status changed? Raj wanted to ensure his investment was protected, no matter what.

What Happens If Your Visa Status Changes?

Raj faced this very concern. Should his visa status change — i.e., if it is not renewed or extended — he wanted to know his options.

Owning a home can provide a stable foundation, regardless of changes in visa status. Raj learned that he could rent out his property, turning it into a valuable source of rental income.

Due to high rental yields in the US, rental income could cover mortgage payments and property maintenance, and even generate surplus income.

The knowledge and awareness that you can continue to own your house in the US, should you have to leave the country in the worst-case scenario, and cover the mortgage payment by renting out your home, gave Raj peace of mind, knowing his investment would continue to work for him.

In the past decade, non-resident foreign nationals have invested over $1 trillion in US real estate, attracted by high rental yields, strong cash flow potential, and the absence of restrictions or additional taxes specifically targeting foreign investors.

Options for Renting Out or Selling Your Property on an H1B visa

If Raj decided to leave the US, he had another option: selling his property. Given the appreciation in property values over time, selling could be a profitable move. Raj could liquidate his assets and potentially reinvest in other opportunities. This flexibility allowed Raj to secure his financial future, no matter where he lived.

Long-term Financial Planning and Homeownership on an H1B visa

Long-term financial planning was crucial for Raj. Homeownership isn’t just about having a place to live; it’s a significant step toward wealth building.

By owning property, the money that would have been spent on monthly rent went towards creating equity in his house. Raj made an asset that appreciated over time, providing financial security and growth.

At HomeAbroad, we helped Raj develop a comprehensive financial plan tailored to his unique situation, addressing his questions and concerns.

Our experienced team guided him through obtaining a mortgage loan financing without a US credit history and planning for potential future changes in his visa status.

Raj’s story is a testament to how you can turn concerns into confidence and dreams into reality with the proper guidance.

At HomeAbroad, we are here to support you every step of the way, ensuring your homeownership journey on an H1B visa is smooth and rewarding, whether you have an established credit history or are a newcomer to the US on a work visa.

Here is what another of our clients who bought an investment property on an H1B visa had to say about his experience:

I was worried about what would happen to my property if my visa status changed. HomeAbroad’s team provided me with all the information and options I needed, ensuring my investment was safe and secure. HomeAbroad helped me find the right investment property and secure a mortgage for my investment property. Their customer service is outstanding!”

Raj K., Software Engineer, Amazon

Top 5 Reasons Why You Should Consider Buying a House on an H1B Visa

Foreign workers on H-1 B visas often have extended stays in the US, making renting less appealing as they settle into their new lives. Many H-1 B visa holders explore buying a house, and for good reasons. Here are the top benefits of buying a house in the US as an H1B visa holder:

Now, let us look at these reasons in detail and understand why you should not delay investing in your own home:

1. Improves Quality of Life in the US

Buying a home significantly enhances your quality of life and sense of belonging in America, especially if you plan to live here for an extended period. Homeownership provides stability, particularly if you are raising a family or planning to start one.

It also allows you to create a personalized and comfortable living environment, contributing to overall well-being.

2. A safe and secure way to build wealth for H1B visa holders

Investing in real estate is one of the safest ways to build wealth over time. According to the US Department of Labor, the average annual salary for H1B visa holders is significantly higher than the national average, providing more disposable income for investment.

According to the latest data, the average salary for H-1 B visa holders is around $139,800, compared to the national average of $59,428.

Real estate values in the US have also shown a steady appreciation, with the Zillow Home Value Index indicating a 42% increase in the average home value over the past five years. This makes homeownership a reliable and lucrative investment.

3. Growing Interest from Non-Resident Investors

US housing market has become increasingly attractive to international investors. In the last 10 years, $1 trillion plus in US real estate was purchased by non-resident investors (Source: NAR).

This trend highlights the appeal and practicality of US real estate as a sound investment, even for those who are not physically present in the country.

4. Significant Purchases by Recent Immigrants and Non-Immigrant Visa Holders

It’s not just non-resident investors who are seizing the opportunity. $26.9 billion was spent in 2024-25 by non-US citizens who are recent immigrants (less than 2 years at the time of the transaction) or non-immigrant visa holders residing in the US for more than 6 months, including H-1 B visa holders.

This reflects the confidence that new arrivals have in the US real estate market and their desire to establish roots here.

5. Tax Benefits of Owning a Home on an H1B Visa

H1B visa holders can benefit from several tax deductions available to homeowners. The IRS allows deductions on mortgage interest, property taxes, and private mortgage insurance (PMI).

These tax benefits can significantly reduce your overall tax liability, making homeownership financially advantageous.

6. Home Prices are Affordable in the US

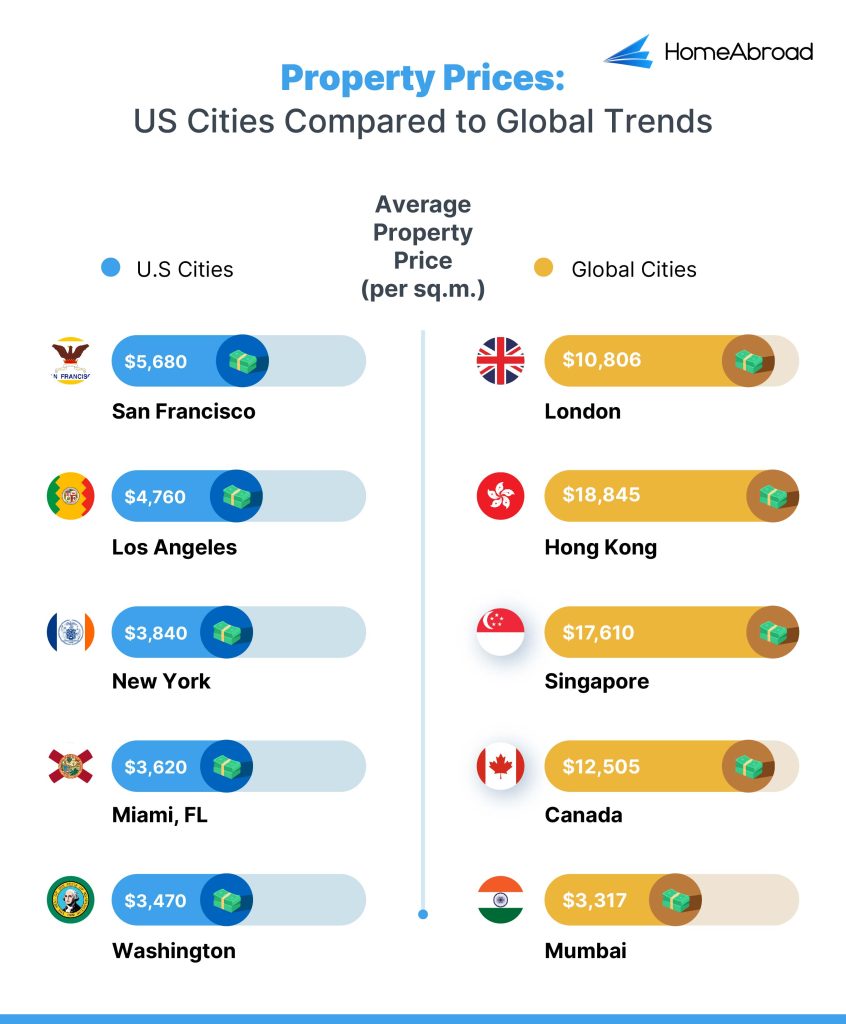

Compared with many other global cities, US home prices are relatively affordable.

Let us see how home prices (per square meter) of some major US cities are affordable compared to global cities:

As you can see, home prices are affordable compared to those in some of the most popular global cities. This affordability, coupled with lower mortgage rates, makes buying a home in the US an attractive option for H1B visa holders.

According to Zillow, the median home price in the US is around $368,581, making real estate accessible for many H-1 B workers to invest in without excessive financial strain.

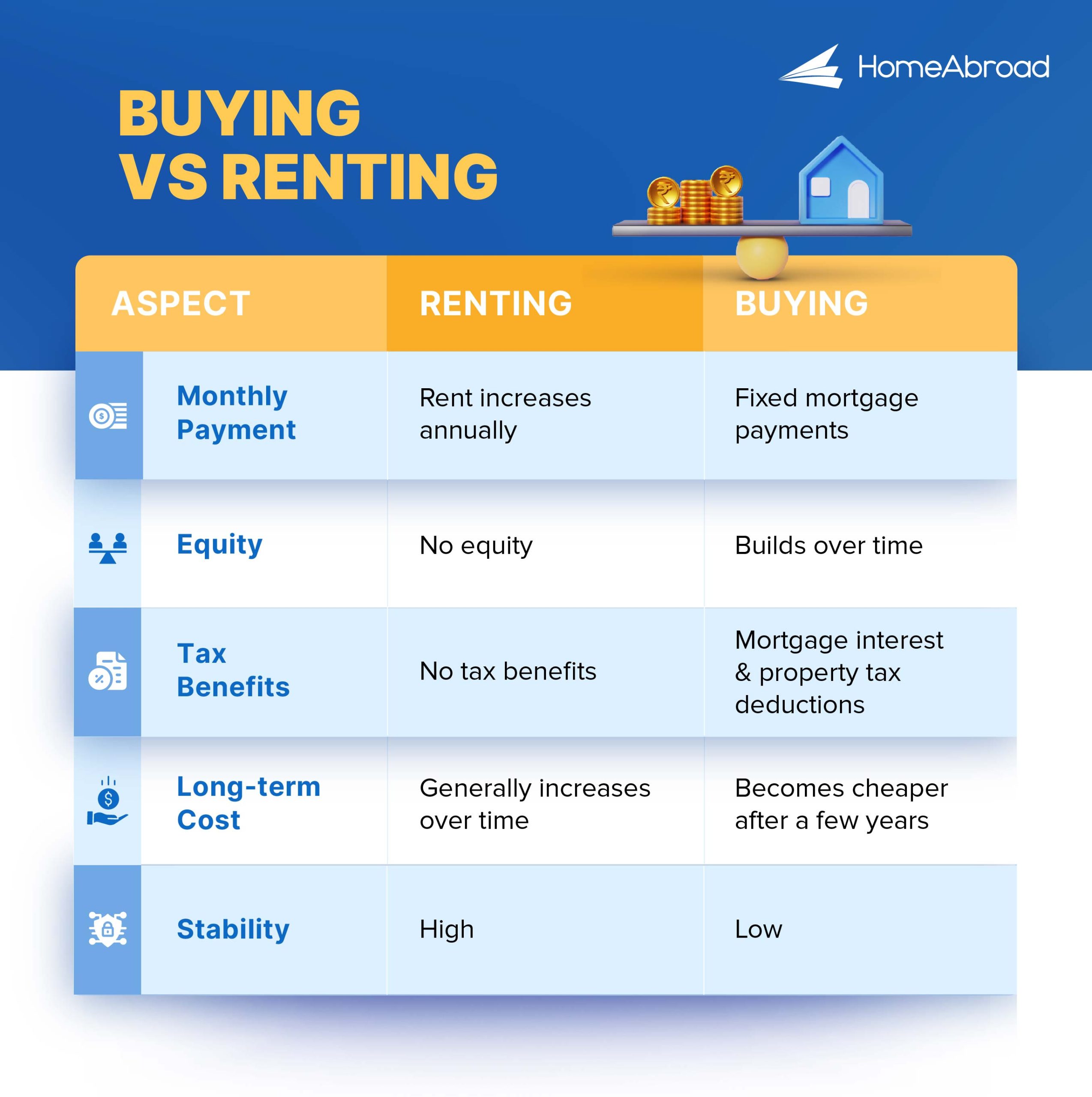

7. Owning a Home is Generally Cheaper vs. Renting on an H1B Visa

In many areas, the cost of owning a home is lower than renting, especially over the long term. Fixed-rate mortgages provide predictable monthly payments, unlike rent, which can increase annually.

Let us see why buying is a better option compared to renting:

Still confused between buying vs renting? Here is a video to help you out.

Owning a home can offer H1B holders numerous benefits, from improving quality of life to building wealth and enjoying tax advantages.

If you’re considering buying a house in the US, HomeAbroad’s expert team is here to guide you through the process, ensuring a smooth and rewarding journey to homeownership.

Decided that you want to get into the homebuying process? Let us now break down the step-by-step process for buying a home on an H-1 B visa.

How to Buy a House on an H1B Visa?

Buying a house in the US is similar for H1B visa holders and US citizens. Below are the steps you’ll go through to complete your purchase. You can also check out our “How Can Foreigners Buy Property in the US?” guide to know the whole process in detail.

Step 1 – Decide the Location

Step 2 – Work with an Internationally Minded Real Estate Agent from HomeAbroad

Step 3 – Get a Pre-Approval Letter from HomeAbroad

Step 4 – Search for a Suitable Property

Step 5 – Make an Offer

Step 6 – Sign the Purchase Contract

Step 7 – Get a Title Report

Step 8 – Schedule a Home Inspection

Step 9 – Closing

You can also check out our video to understand the process better:

Feeling overwhelmed by all these steps? Fret not!

At HomeAbroad, we are dedicated to making your home-buying journey seamless and successful. Our team of experts is here to guide you every step of the way, ensuring that you can confidently navigate the complexities of buying a home in the US.

Now that you have decided to buy your dream house, here are the tax implications for buying a home.

Tax Implications for Buying US Real Estate on an H1B Visa

There are no additional taxes for H1B visa holders or other foreign nationals buying US real estate. You’ll pay the same taxes at the same rates as US citizens.

Tax/ Property Type | Property Tax | Income Tax |

|---|---|---|

Primary Residence | Yes | No |

Investment Property | Yes | Yes |

H-1 B visa holders are eligible to claim tax deductions for these taxes, further reducing their tax liabilities.

FIRPTA: H-1 B visa holders are exempt from FIRPTA withholding but remain liable for capital gains tax when they sell the property.

Understand all tax implications with our comprehensive tax guide for foreign real estate buyers in the US.

You are now ready to buy a home or investment property in the US on an H-1 B visa.

HomeAbroad is a one-stop shop for foreign nationals buying US real estate, offering internationally minded real estate agents, tailored foreign national mortgages, an AI-powered investment property search platform, and a tech-enabled platform to complete the entire process online.

We are committed to democratizing US real estate for everyone, ensuring your home-buying journey is effortless.

Get started today!

FAQs About Home Buying on an H1B Visa

What financing options are available to H-1 B visa holders?

H-1 B visa holders have access to various mortgage options, including conventional loans. For more detailed information on available mortgage programs, eligibility, down payment, interest rates, and other loan terms, check out our H1B visa mortgage guide.

Are there any specific tax benefits for H1B visa holders who own a home?

Yes, H-1 B visa holders can take advantage of several tax benefits, including deductions available to homeowners in the US. Refer to the tax implication section in this guide to know more.

How does owning a home compare to renting for H1B visa holders?

Owning a home can often be more cost-effective than renting, especially over the long term. Monthly mortgage payments build equity in an appreciating asset, whereas rent payments do not. Additionally, fixed-rate mortgages offer predictable monthly payments, unlike rent, which can increase annually.

What happens to my property if my H1B visa status changes?

If your H1B visa status changes, you still have several options for your property. You can continue to own the property and even rent it out through a property manager to generate income. If you need to leave the US, you can sell the property, often benefiting from an appreciation in property value.

Can an H1B visa holder buy a rental property?

Yes, H-1B visa holders can buy rental and other investment properties to generate passive income, as long as they are not actively doing so as a business.

Can I own more than one home on an H-1 B visa?

Yes, you can own more than one home on an H1B visa. There is no limit to the number of properties that you can own in the United States.

Can I buy land in the USA on an H-1 B visa?

Yes, you can buy land in the United States on an H1B visa. You will need to provide proof of funds to cover the purchase price of the land and any associated costs.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

H1B Grader: H1B Salaries of Visa USA INC for FY* 2024

U.S. Bureau of Labor Statistics: Current Employment Statistics

Zillow: Home Values

![How to Buy a House on an H1B Visa [2026]](https://homeabroadinc.com/wp-content/uploads/2021/08/BuyingonH1BVisa-500x325.jpg)

![Can Foreigners Buy Property in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)