Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. California's real estate market offers strong rental opportunities, particularly in cities such as Los Angeles, San Diego, and Sacramento. With DSCR loans from HomeAbroad, international real estate investors can qualify without needing US income, US credit history, or even permanent residency.

2. DSCR (Debt Service Coverage Ratio) loans help you qualify based on your property's rental income, rather than your personal income, so foreign nationals don't need to provide tax returns, pay stubs, income verification or proof of employment, making financing more accessible and efficient.

3. California's mix of stable rental demand, economic diversity, and long-term property appreciation makes it a top choice for global investors. From tech hubs to university towns, the rental market is consistently strong over here.

4. HomeAbroad is a one-stop shop for global investors that makes it simpler for them to invest in real estate using our AI-powered investment property search platform, helping you find high-yield rental properties in California, getting a DSCR mortgage, setting up a US-based LLC, opening a US bank account, securing insurance, and managing all paperwork for closing, making cross-border investing seamless and stress-free.

Table of Contents

Welcome to California – the Golden State, where startups are born in Silicon Valley, movies are made in Hollywood, and sunsets light up the Pacific coastline.

But California isn’t just for techies and celebrities; it’s quickly becoming a prime hotspot for international real estate investors. From the high-rent neighborhoods of Los Angeles to the steady appreciation in Sacramento and the booming rental demand near San Diego’s military and medical hubs, California combines economic strength, population growth, and rental demand like few other states.

And now with DSCR loans from HomeAbroad, foreign nationals can invest in California real estate without needing US credit, income, or residency. Whether you’re looking to buy a rental property near a major university or invest in long-term growth areas outside the Bay, California offers diverse opportunities with long-term payoff, and HomeAbroad makes the process seamless from start to close.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a tailored mortgage solution for foreign national investors, allowing qualification based on a property’s rental income rather than personal income. Unlike traditional loans that require tax returns, W-2s, or other employment documentation, DSCR loans emphasize the income-generating potential of the property itself.

California’s dynamic rental market, especially in cities like Los Angeles, San Diego, and San Jose, offers attractive investment opportunities. With rental yields remaining competitive, international real estate investors can use DSCR loans to finance high-performing properties without the usual documentation barriers, making it easier to build or expand a US real estate portfolio.

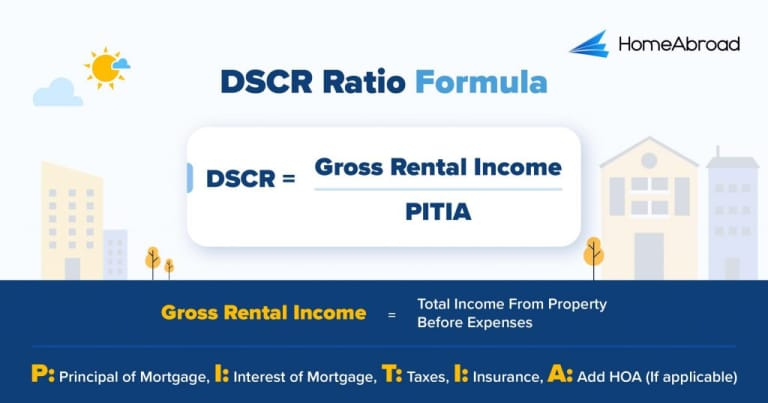

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio is used to determine if a property’s rental income is sufficient to cover its mortgage payments. A higher DSCR indicates a lower risk for lenders, making it easier for investors to secure financing.

Here is the DSCR Formula:

A DSCR of 1.4 means the property generates more income than required to cover the loan’s debt obligations, creating positive cash flow and serving as a strong indicator of financial stability for DSCR lenders.

Our DSCR loans are designed to qualify you based on a property's income potential. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. With the No-Ratio program, you can still secure financing, although it will require a slightly larger down payment (a 5% reduction in LTV) and a higher interest rate. This option is ideal for investors with a strong long-term strategy who want to acquire properties that may not immediately generate a 1.0 cash flow ratio.

Determining your DSCR ratio is now easier with our handy DSCR calculator. Just enter your financial details, and get instant results!

DSCR Loan Requirements in California for Foreign Nationals

Unlike traditional lenders, HomeAbroad simplifies the DSCR loan process with a streamlined approach designed specifically for international real estate investors.

Whether you’re investing from overseas or don’t have an established US credit profile, our flexible lending terms, minimal documentation requirements, and remote closing support make it easier than ever to access California’s real estate market.

Here’s how our foreign national DSCR loan guidelines compare to those of conventional lenders.

| Features | DSCR Loan From HomeAbroad | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know:

In addition to the standard requirements like DSCR ratio, down payment, and credit score, here are some unique advantages that set us apart when securing a DSCR loan as an international real estate investor:

Where We Lend DSCR Loans in California

HomeAbroad offers DSCR loans across California, providing tailored support for global investors in top-performing cities, including San Diego, Madera, Oceanside, and more. Here are a few cities where we lend DSCR Loans in California.

- Los Angeles

- San Francisco

- San Diego

- San Jose

- Sacramento

- Fresno

- Oakland

- Long Beach

- Bakersfield

- Riverside

- Santa Ana

- Stockton

- Palm Springs

- Oceanside

- Madera

Let’s explore a real-life example of how HomeAbroad helped an investor to secure financing in the California real estate market to see how the DSCR loan works.

Case Study: How Alex Secured a DSCR Loan to Start Investing in California

Alex, a self-employed investor based in California, set out to begin his real estate investment journey but faced challenges with traditional mortgages. Most lenders require complete income verification, which can often be a hurdle for self-employed individuals like him who lack conventional documentation.

The Solution: HomeAbroad’s DSCR Loan

With the help of Steven Glick, Director of Mortgage Sales at HomeAbroad, Alex qualified for a DSCR (Debt Service Coverage Ratio) loan. This flexible financing option allowed him to qualify based on the property’s rental income, rather than his personal income statements or tax returns.

Steven worked closely with Alex to secure favorable loan terms for him. The DSCR interest rate was successfully brought down to 7.7%, which improved the property’s DSCR and made the monthly cash flow more sustainable. This tailored approach ensured the loan structure aligned with Alex’s investment goals.

Property Details:

- Location: San Francisco, California

- Property Value: $437,500

- Monthly Rental Income: $4,918

Loan Details:

- Loan Amount: $328,125

- Down Payment: $109,375 (25%)

- Interest Rate: 7.7% (30-year fixed)

- Loan Term: 30 years

- Time to Close: 27 days

DSCR Calculation:

- DSCR = Gross Rental Income ÷ PITIA

- DSCR = $4,918 ÷ $3,500 = 1.40

With a DSCR of 1.40, the property’s income was more than sufficient to cover loan obligations, making Alex a strong candidate for approval.

Why This Worked for Alex

- No Personal Income Verification: As a self-employed investor, Alex was able to qualify based solely on rental income, thereby avoiding the challenges of proving traditional income.

- Tailored Loan Terms: The HomeAbroad team worked to secure a competitive interest rate of 7.7%, which helped strengthen the property’s DSCR and made the loan terms more favorable.

- Market Expertise: HomeAbroad’s deep understanding of the California market helped Alex identify the right investment opportunity in a high-demand rental area.

- Quick Turnaround: The loan closed in just 27 days, giving Alex a competitive edge in the fast-moving San Francisco market.

Outcome:

Alex secured a strong start in California’s investment market with the help of HomeAbroad. Alex successfully financed a $437,500 investment property in San Francisco using a DSCR loan, without the need for personal income verification. This marks the beginning of his journey to building a profitable real estate portfolio in California.

Top Places to Invest in California with a DSCR Loan

California’s real estate market has seen steady appreciation, averaging 8.36% annually over the past five years. That kind of growth, paired with constant demand, makes it a reliable choice for long-term investors.

Whether it’s short-term rentals by the coast or income properties in high-demand cities, the state offers flexibility and potential. With a DSCR loan, you can easily get financing based on rental income, not personal income, making it easier to invest in one of the country’s most competitive markets.

Here are some top cities in California for international real estate investors to consider for their next successful DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

San Diego | Short-Term | 8.04% |

Palm Springs | Short-Term | 12.94% |

Bakersfield | Long-Term | 6.11% |

Oceanside | Short-Term | 10.9% |

Madera | Long-Term | 6.66% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in California or anywhere in the US!

San Diego: Coastal Sophistication with Short-Term Rental Power

San Diego blends a laid-back coastal lifestyle with a booming tourism and biotech economy. The vacation rental market remains strong, especially in beachside neighborhoods.

- Median Home Price: $959,833

- Average Rent: $3119/month

What this means for investors: San Diego’s high nightly rates and tourism volume make it ideal for DSCR-backed short-term rental strategies, even at higher property prices.

Investment Properties Listed Today on Sale in San Diego

Palm Springs: The Desert’s STR Goldmine

Palm Springs is a premier vacation hotspot with year-round appeal. Its design-forward homes and resort culture draw consistent short-term rental demand.

- Median Home Price: $719,167Median sale price

- Average Rent: $2875/month

What this means for investors: With one of the highest STR cap rates in the state, Palm Springs offers excellent income potential, making it ideal for maximizing DSCR leverage.

Investment Properties Listed Today on Sale in Palm Springs

Bakersfield: The Underrated Long-Term Performer

Bakersfield isn’t flashy, but its affordability and rental demand driven by energy, agriculture, and logistics make it a reliable cash-flow market.

- Median Home Price: $348,000

- Average Rent: $1970/month

What this means for investors: Ideal for long-term DSCR plays. Low entry costs and stable rent returns make it accessible for investors focused on yield over appreciation.

Investment Properties Listed Today on Sale in Bakersfield

Oceanside: Surf Town with STR Upside

Just north of San Diego, Oceanside offers beachside living, with a growing popularity in short-term rentals. Tourism and military presence consistently boost occupancy rates throughout the year.

- Median Home Price: $838,000

- Average Rent: $3399/month

What this means for investors: Strong short-term rental income and consistent tourist flow make Oceanside a solid option for DSCR qualification in coastal Southern California.

Investment Properties Listed Today on Sale in Oceanside

Madera: Affordable Entry with Regional Growth

Located in Central California, Madera is benefiting from Fresno’s spillover growth. It’s a low-cost market with increasing demand for long-term rentals.

- Median Home Price: $431,249

- Average Rent: $2395/month

What this means for investors: For cash-flow-focused investors, Madera offers affordable homes with decent rents, which help meet DSCR thresholds with minimal upfront capital.

Investment Properties Listed Today on Sale in Madera

Specific Considerations for Investing in California for Foreign Nationals

California’s real estate market is globally recognized, but behind the glamour of coastal properties and booming tech corridors lies a highly regulated, climate-sensitive environment. For foreign national investors, understanding the intricacies of this market is crucial, not just for compliance but for preserving value and long-term stability. From wildfire zones to rent control laws, California demands a uniquely strategic approach.

Here are the most critical factors to keep in mind:

1. California’s Property Insurance Landscape

Wildfire exposure drives some of the highest insurance premiums in the US, especially in hillside, canyon, and inland zones. Major insurers have withdrawn from high-risk areas, forcing many homeowners to rely on the limited California FAIR Plan. Legislative changes are in motion to stabilize the market, but premiums remain unpredictable, particularly for older homes or high-value properties.

2. Wildfire Risk, Climate Resilience & Long-Term Value

Wildfire seasons have become longer and more destructive. Buyers increasingly prioritize properties with fire-resistant materials, cleared defensible zones, and up-to-date safety infrastructure. Without resilience upgrades, homes in high-risk zones may experience reduced resale value or become ineligible for insurance over time.

3. Short-Term Rental Regulations

Unlike Florida, California does not offer a unified statewide licensing system for short-term rentals. Instead, local rules dominate, and they’re strict. Cities like San Francisco, Santa Monica, and Los Angeles require permits, often restrict rentals to primary residences, and enforce rules regarding noise, guest limits, and parking. Transient Occupancy Tax (TOT) collection is mandatory, and non-compliance can result in hefty fines.

4. Landlord-Tenant Laws and Rental Management

California enforces strong tenant protections. Statewide rent control (AB 1482) caps annual increases at 5% plus inflation (up to a maximum of 10%), and evictions must follow detailed procedures. Security deposits are now capped at one month’s rent (as of July 2024). Lease agreements must include compliance disclosures, and landlords are legally bound to maintain habitable conditions. Foreign landlords should strongly consider hiring a property manager familiar with California’s legal landscape.

Strategic & Future Considerations for Foreign Nationals Investing in California

California remains a global real estate magnet, but international real estate investors need to think beyond the glamour of Los Angeles skylines or San Francisco tech hubs. The state’s evolving legal landscape, environmental realities, and shifting buyer demographics necessitate the development of nuanced investment strategies. Whether you’re eyeing luxury estates or stable rental income, understanding California’s direction is key to staying competitive and compliant.

Here are some future considerations that international real estate investors need to pay heed to:

1. Foreign Ownership-Friendly Policies

California has no restrictions on foreign nationals owning residential real estate. Investors can freely purchase single-family homes, condos, and multifamily properties. However, recent legislative proposals, such as SB 1084, aim to restrict purchases by foreign governments or state-linked entities, particularly in agricultural and strategic zones. While residential assets remain open to individuals and corporations, increased scrutiny is likely to be applied in specific land-use categories moving forward.

2. Foreign Buyer Impact on Luxury and Coastal Markets

Foreign national buyers have long shaped California’s luxury housing scene. Chinese and Middle Eastern investors, in particular, continue to influence pricing and development in areas such as Beverly Hills, Palo Alto, Newport Beach, and La Jolla. Their preference for high-end, amenity-rich homes, often paid for in cash, drives new construction and pricing trends. However, wildfire risk and insurance volatility are leading some global buyers to favor newer, better-insulated developments in less fire-prone regions.

3. Foreign Buyers’ Visa and Residency Trends

California is a preferred destination for real estate-linked immigration. The EB-5 visa program, which requires job-creating investments, continues to fund significant commercial and multifamily developments in cities like Los Angeles and San Francisco. Meanwhile, E-2 and L-1 visa holders often seek homes in top-performing school districts or near business hubs, creating niche demand in places like Cupertino, Irvine, and Walnut Creek. Understanding visa timelines and tax implications is crucial for structuring acquisitions and exits effectively.

4. Growth of Secondary Cities

While Los Angeles, San Francisco, and San Diego dominate global attention, international buyers are increasingly turning to smaller markets, such as Irvine, Sacramento, Santa Barbara, and Riverside. These areas offer a mix of affordability, strong rental demand, and livability, with access to education, healthcare, and growing job centers. Orange County, in particular, has seen a rise in foreign interest due to its master-planned communities, high safety ratings, and proximity to both beaches and business districts.

Get a HomeAbroad DSCR Loan in California as a Foreign National

Expanding your investment property portfolio in California has never been easier. At HomeAbroad, we offer DSCR (Debt Service Coverage Ratio) loans specifically designed for international real estate investors. These loans provide investor-friendly terms and competitive rates, enabling you to invest in California’s dynamic rental market with ease.

HomeAbroad simplifies the entire investment process. Our AI-driven investment property search platform helps you identify high-potential rental homes throughout California’s top-performing cities. You’ll receive hands-on support from experienced local real estate agents, and we guide you through key steps such as forming an LLC, opening a US bank account, and connecting with reliable property management services.

Already own property in California? Tap into your rental property’s equity with our cash-out refinance options, which require no US credit history or income verification. Use the capital to expand your portfolio, upgrade existing assets, or pivot into new markets, all through a loan process that focuses on your property’s rental performance, not your personal finances.

Apply to secure a HomeAbroad DSCR loan today and take the next step toward scaling your real estate investments across California with confidence.

Frequently Asked Questions

Can foreign nationals apply for DSCR loans in the state of California?

Yes, foreign nationals can apply for DSCR loans in California through HomeAbroad Loans, eliminating the need for a US credit score, making it a flexible financing option for global investors.

What are the interest rates for DSCR loans in California?

DSCR loan interest rates vary depending on market conditions, borrower profiles, and property types, but they are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that allow investors to leverage property cash flow for better returns.

How long does it take to get a DSCR loan in California?

At HomeAbroad Loans, we streamline the application process to ensure a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![DSCR Loan Down Payment Requirements [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-loan-program-down-payment.jpeg)