Unlock the potential of your real estate investments in Georgia with a DSCR (Debt Service Coverage Ratio) loan. These loans are designed for investors, making it easier to secure financing without needing W2s, pay stubs, or tax returns.

Instead of personal income, you qualify based on the property’s rental income, allowing for a smoother and more flexible approval process. Whether you’re looking to invest in single-family homes, multi-family units, or condos, DSCR loans provide the financial freedom you need.

Take the hassle out of real estate financing and quickly grow your investment portfolio. Apply for a DSCR loan in Georgia today!

Key Takeaways:

➡️DSCR loans focus on property cash flow rather than personal income, making them ideal for both seasoned and new investors, including U.S. and foreign buyers.

➡️With DSCR Loans, investors can finance multiple properties without traditional income verification and leverage cash-out refinancing to reinvest or improve cash flow.

➡️With DSCR loans, you can avail a wide range of properties, including single-family homes, multi-family units, and both short-term vacation rentals and high-yield long-term vacation rentals without personal income verification or US credit history.

Table of Contents

What is a DSCR Loan?

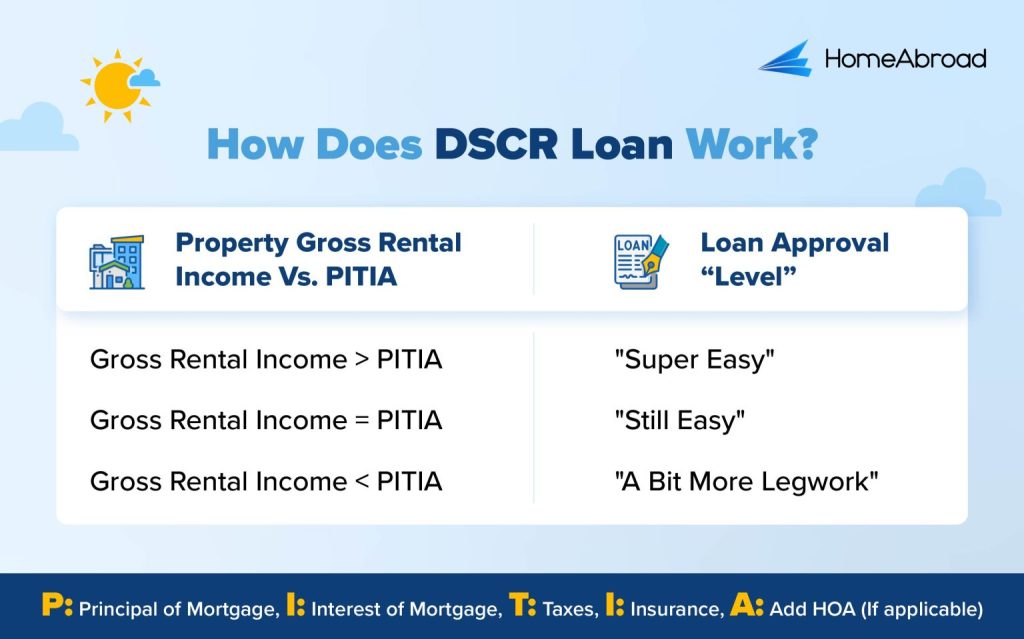

A DSCR (Debt Service Coverage Ratio) loan is a specialized mortgage program designed for U.S. and foreign real estate investors who may not qualify for traditional loans. Unlike conventional financing, DSCR loans focus solely on the rental income generated by the investment property rather than the borrower’s personal income.

Georgia’s strong rental yields, averaging 6-8% in key markets, make DSCR loans an excellent financing option. With the rising demand for short-term and long-term rentals, investors can benefit from positive cash flow and significant property appreciation in Georgia’s thriving real estate market.

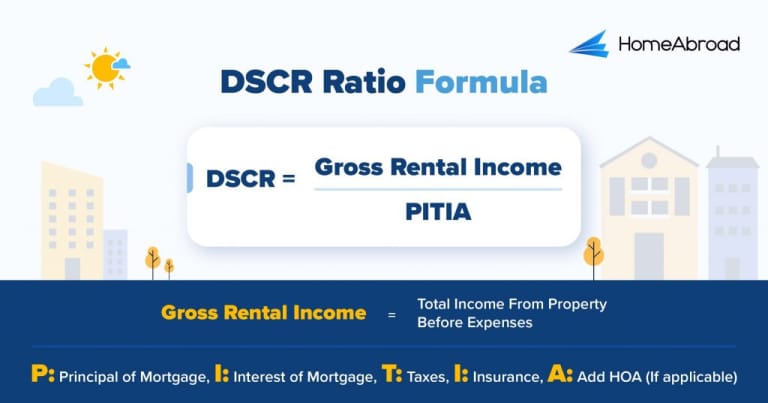

How to Calculate Your DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a crucial metric that lenders use to assess borrowers’ ability to cover mortgage payments with their rental income. For real estate investors, a higher DSCR indicates strong cash flow, which improves your chances of securing better loan terms.

Here’s the formula to calculate your DSCR:

Example

Calculating the DSCR Ratio for a Georgia Property:

This example reflects positive cash flow, but HomeAbroad Loans specializes in providing DSCR loans tailored to real estate investors, even with low DSCR ratios. While many lenders require a minimum DSCR of 1 and above, we offer flexibility, with loans available for DSCR ratios as low as 0.75.

With “No Ratio DSCR loans” for properties with a DSCR below 0.75, you can secure financing even if your rental income doesn’t fully cover debt obligations. However, this option requires a larger down payment and higher interest rates to mitigate the additional risk.

DSCR Loan Interest Rates

Due to the unique nature of DSCR loans and the associated increased risk for lenders, these rates are typically 1% to 1.5% higher than conventional mortgage rates.

Understanding these rates is crucial for investors as they significantly impact the profitability of investment properties. Before investing, follow our DSCR loan interest rate guide to learn about current DSCR loan interest rates and their influencing factors. For more details on DSCR loans and how they work, visit HomeAbroad’s DSCR loan hub.

How to Qualify for a DSCR Loan in Georgia

At HomeAbroad, we make qualifying for a DSCR loan simple and flexible, whether you’re a domestic investor or a foreign national. Now, let’s learn about our tailored DSCR loan requirements to provide domestic and foreign investors with flexible financing solutions.

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | 620 or higher | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% for purchase/refinance Up to 75% for cash-out refinance | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

Areas We Lend in Georgia

Investing in Georgia’s real estate market offers promising opportunities for high rental yields and property appreciation. Here are some top areas to consider:

- Atlanta

- Alpharetta

- Athens

- Savannah

- Augusta

- Columbus

- Macon

- Sandy Springs

- Roswell

- Marietta

Let’s evaluate a case study of our past client to understand how profitable investing in the Georgia real estate market is.

Case Study: Sarah Thompson Expands Her Real Estate Portfolio in Georgia

Property Details:

Location: Atlanta, Georgia

Property Price: $600,000

Monthly Rent: $5,000

Loan Details:

Loan Amount: $450,000

Down Payment: 25%

Monthly PITIA: $3667

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $5000/ $3667

DSCR = 1.36

Outcome:

HomeAbroad’s DSCR loan made the process seamless by evaluating Sarah’s eligibility based on property income rather than personal tax returns.

With HomeAbroad Loans’ DSCR loan, Sarah leveraged the property’s rental income to cover debt service, expanding her portfolio and increasing returns with minimal financial strain. With a DSCR of 1.36, Sarah’s property has a positive cash flow, ensuring a steady return.

If you wish to maximize your profit and investment returns like Sarah, don’t waste a moment; apply for a DSCR loan today!

Why does This matter?

Steven Glick highlights the importance of this financing approach:

At HomeAbroad Loans, we empower investors like Sarah to scale their portfolios with strategic financing solutions. Our DSCR loans focus on rental income rather than personal income, making it easier to secure funding and maximize cash flow. With flexible terms and minimal documentation, investors can capitalize on high-growth markets like Atlanta without unnecessary financial hurdles.

Steven Glick, Director of Mortgage Sales, HomeAbroad

Top Places to Invest in Georgia with DSCR Loan

Georgia offers affordable real estate and strong rental demand, making it an excellent market for investors. With an average home price of around $320,000—still below the national average of $355,328—investors can acquire properties at competitive prices while generating substantial rental income.

Atlanta, Savannah, and Augusta provide steady, long-term demand from professionals, students, and military personnel, ensuring consistent occupancy rates. Meanwhile, cities like Athens and Macon and coastal areas like Tybee Island thrive on tourism, making them ideal for short-term rental investments.

With Georgia’s strong rental yields and DSCR loan financing, investors can secure income-generating properties that cover their mortgage while maximizing cash flow and long-term appreciation.

Here are some top investment cities in Georgia:

City | Rental Type | Rental Yield |

|---|---|---|

Athens | Long-Term | 13.69% |

Augusta | Long-Term | 12.39% |

Blairsville | Short-Term | 11.24% |

Columbus | Long-Term | 14.86% |

Jasper | Short-Term | 11.02% |

Savannah | Long-Term | 10.8% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Georgia or anywhere in the US!

Get a DSCR Loan in Georgia with HomeAbroad

HomeAbroad simplifies real estate investment for US and foreign investors with tailored DSCR loans. Whether targeting Atlanta, Savannah, or Augusta, our flexible financing helps you invest confidently.

As a leading PropTech & FinTech platform, we make US property purchases seamless—offering foreign national mortgages, AI-powered property searches, and expert guidance. Our 500+ agent network ensures you find the right investment, while our concierge services assist with:

✔ LLC formation & US bank accounts

✔ Homeowner’s insurance & property management

✔ Ongoing investment support

Seize Georgia’s Real Estate Potential

With HomeAbroad’s DSCR loan solutions, investing in Georgia’s thriving markets has never been easier. Apply for a DSCR loan today and start building your portfolio!

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

FAQs

Are DSCR loans suitable for short-term rental properties like Airbnb in Georgia?

DSCR loans can be suitable for short-term rentals in Georgia, as they assess the property’s income potential rather than the borrower’s. However, lender requirements on rental income and property type may vary.

Is cash-out refinancing available for DSCR loans in Georgia?

HomeAbroad Loans offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

Can self-employed borrowers apply for a DSCR loan in Georgia?

Yes, DSCR loans are ideal for self-employed borrowers who may not have consistent personal income or tax returns, as the loan qualification is based on the property’s income rather than the borrower’s personal financial history.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices

How Does HomeAbroad Help?

"Unlocking US real estate for the world with our tailored offerings."