A DSCR loan offers a smarter way to finance investment properties by qualifying based on a property’s rental income instead of personal income. This means no W-2s or tax returns just a focus on the property’s earning potential.

With this approach, the property can cover its own mortgage, and a well-performing rental can even generate positive cash flow, helping you expand your portfolio faster.

Many investors assume they need traditional employment to qualify for a loan. But I’ve helped self-employed entrepreneurs, freelancers, and even digital nomads secure DSCR loan simply by using their rental income as proof of ability to pay.

Whether you’re targeting high-yield rentals in Cleveland or stable long-term investments in Columbus, DSCR loans provide a flexible financing solution to grow your portfolio.

Get a quote for a DSCR loan today with HomeAbroad and secure your next investment property in Ohio with ease!

Table of Contents

Key Takeaways:

1. DSCR loans allow real estate investors to qualify based on rental income rather than relying on personal income.

2. Investors can finance various property types with DSCR Loans, including single-family homes, multi-units, condos, etc.

3. With affordable property prices and high demand for rental housing, Ohio offers an excellent environment to maximize the benefits of a DSCR loan.

What is a DSCR Loan?

A DSCR loan(Debt Service Coverage Ratio loan) is a type of loan designed for real estate investors. Unlike traditional loans, which rely heavily on your personal income and borrower’s credit score, DSCR loans evaluate the income potential of the property you’re purchasing.

Lenders use DSCR Ratio to determine whether the property is self-sustaining, ensuring that the income generated is sufficient to cover expenses like the mortgage payments, property taxes, and insurance.

One investor I worked with was ready to buy their next rental property, but their bank wouldn’t approve another loan because their debt-to-income ratio was too high. With our DSCR loan, we focused on the property’s income instead of their personal finances, allowing them to scale their portfolio without limitations.

With Ohio’s average rental yield at 6.8%, the state offers strong cash flow potential, making DSCR loans an excellent choice for investors looking to scale their portfolios without traditional income verification.

Since DSCR loans prioritize rental income over personal financials, interest rates are typically 1-2% higher than traditional mortgages to account for the flexibility they offer in qualification. Check the latest DSCR loan interest rates here.

How to Calculate the DSCR Ratio?

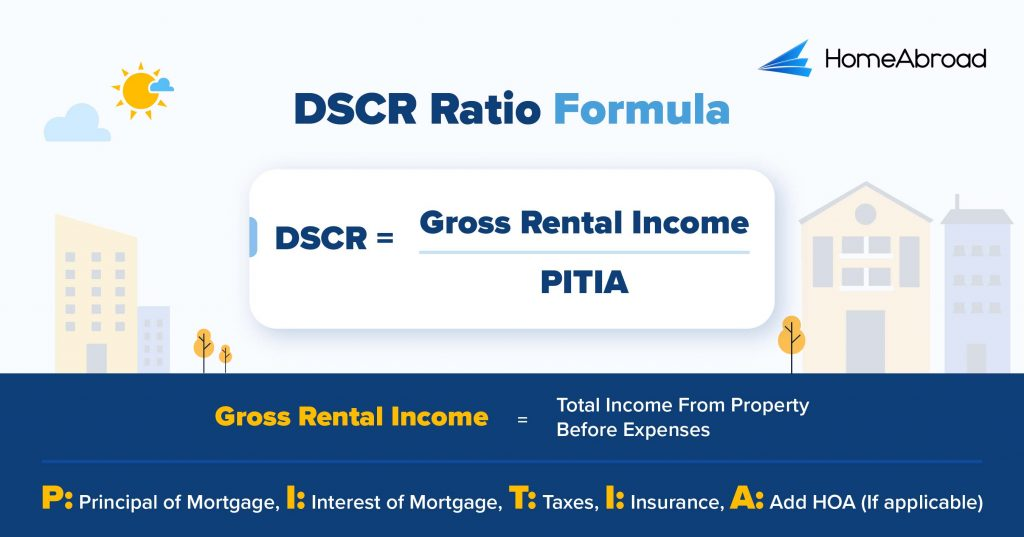

The Debt Service Coverage Ratio (DSCR) is a key metric lenders use to determine if a rental property’s income is sufficient to cover its mortgage payments.

It’s calculated using this formula:

Example

At HomeAbroad, we look for a minimum DSCR of 1.0, ensuring the property earns enough rental income to cover mortgage payments. However, for investors whose properties don’t meet this requirement, we offer a No-Ratio DSCR Program, allowing qualification with a DSCR as low as 0.75, providing more flexibility for unique investment scenarios.

Requirements of DSCR Loan in Ohio

HomeAbroad offers DSCR Loans tailored to unique need of both domestic and foreign investors. here are the requirements for each:

| Features | Domestic Investors | Global Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | Minimum 620 | No US credit needed |

| Down Payment | 20% | 25% |

| LTV Ratio | Up to 80% for Purchase and Rate/Term Refinance, up to 75% for Cash Out Refinance | Up to 75% for Purchase and Rate/Term Refinance, up to 70% for Cash Out Refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

With years of experience assisting both domestic and international investors, HomeAbroad ensures investors get the right loan options, expert insights, and seamless support to maximize their investment potential.

Where We Lend DSCR Loan in Ohio

- Columbus

- Cleveland

- Cincinnati

- Toledo

- Dayton

- Akron

- Youngstown

- Parma

- Dublin

- Middletown

- Mentor

- Lakewood

- Canton

- Lorain

- Avon

- Hilliard

To illustrate how we help investors achieve their goals, let’s look at a real-life example of our client a South African investor who successfully secured a DSCR loan in Ohio.

Case Study: How a South African Investor Secured a DSCR Loan in Ohio

Sarah Williams, a South African investor, was seeking an opportunity to diversify her portfolio with a high-yield rental property in Ohio. However, as a foreign national, she faced several challenges like no US credit history, limited market knowledge and difficulty securing financing.

That’s when she turned to HomeAbroad, where Steven Glick, an expert loan officer, helped her find the right property and secure a tailored DSCR loan that aligned with her investment goals.

Property Details:

Location: 1863 E 30th St, Lorain, OH 44055

Property Value: $140,000

Monthly Rent: $2,656

Rental Yield: 22.77%

Loan Details:

Loan Amount: $105,000

Down Payment: $35,000

Interest Rate: 7.25%

Term: 30 Years

Monthly Mortgage (PITIA): $914

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $2,656 ÷ $914

DSCR= 2.9

Using HomeAbroad’s AI Property Search Platform, Sarah identified the perfect property that aligned with her cash flow goals. HomeAbroad also facilitated LLC setup, a US bank account, and concierge support, making the entire process smooth and hassle-free.

With years of experience helping investors overcome financing barriers, I can confidently say that DSCR loans stand out as a powerful option. By leveraging rental income instead of personal income, investors can expand their portfolios with fewer restrictions and greater flexibility.

Steven Glick, (Director of Mortgage Sales, HomeAbroad)

Top Places to Invest in Ohio with a DSCR Loan

Ohio offers a strong real estate market with affordable home prices and high rental demand. Over the past five years, property values in Ohio have appreciated by an impressive 9.6% annually,making it a prime location for investors

With Ohio’s high rental yields and DSCR loans, investors can secure financing based on rental income and scale their portfolios without traditional income verification.

Here are some top investment cities in Ohio:

City | Rental Type | Rental Yield |

|---|---|---|

Cleveland | Short-Term | 26.3% |

Cincinnati | Short-Term | 13.5% |

Akron | Long-Term | 10.5% |

Dayton | Long-Term | 9.7% |

Columbus | Long-Term | 6.9% |

Need help finding the right investment property? Our AI-powered investment property search platform can help you discover high-performing rentals in Ohio or anywhere in the US!

Get a HomeAbroad DSCR Loan in Ohio

Securing financing for your investment property in Ohio is simple with HomeAbroad. Our DSCR loans are tailored for both US and international investors, offering flexible terms and competitive rates to help you build a profitable portfolio.

HomeAbroad simplifies the entire investment process. With our AI-powered property search, you can easily find high-yield rental properties, and our expert local agents provide guidance at every step. We also assist with LLC formation, US bank account setup, and property management, giving you everything you need to invest confidently.

Get a DSCR loan with HomeAbroad today and start growing your real estate portfolio!

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

FAQs

Can an LLC get a DSCR loan in Ohio?

Yes! DSCR loans can be taken under an LLC in Ohio, making them ideal for real estate investors looking to separate personal and business assets. At HomeAbroad, we assist investors in setting up an LLC and securing financing tailored to their investment strategy.

Are DSCR loans in Ohio available for Airbnb or rental properties?

Yes, HomeAbroad offers DSCR loans in Ohio are for both Airbnb short-term rental properties and traditional long-term rental properties. Our loans are based on the property’s rental income, making them ideal for investors in short-term rental markets like Airbnb.

What happens if my property’s income doesn’t meet the required DSCR?

If your property’s income doesn’t meet the typical DSCR requirements, HomeAbroad offers “No Ratio DSCR loans”. However, this option requires a larger down payment to reduce the additional risk.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

AirDNA: https://www.airdna.co/vacation-rental-data/app/us/illinois

Zillow: Housing Data – Zillow Research

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)