Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. DSCR loan refinancing can improve cash flow, lower interest rates, and unlock property equity for another real estate investment.

2. Strategic refinancing enhances long-term investment potential.

3. HomeAbroad offers tailored DSCR Loan refinancing solutions for international real estate investors.

Table of Contents

Refinancing your mortgage on investment property with a DSCR loan is more than just adjusting mortgage terms; it’s a powerful strategy for real estate investors to unlock hidden potential in their properties.

Whether you’re looking to improve cash flow, lower your interest rates, or tap into property equity, HomeAbroad offers tailored DSCR loan refinance solutions designed to meet the unique needs of both domestic and foreign investors.

In a competitive market, strategic refinancing can be the key to diversifying your portfolio and maximizing long-term returns.

What is DSCR Loan Refinance?

The Debt Service Coverage Ratio (DSCR) measures your property’s ability to cover its loan payments through its rental income, which includes long-term rental or short-term rental. A high DSCR means your property is generating more than enough income to cover your monthly mortgage payment, giving you financial flexibility.

DSCR loan refinancing allows investors to replace their current loan with one offering better terms, such as a lower interest rate, a longer loan term, or access to property equity. By refinancing, you can improve your financial flexibility and overall investment strategy.

At HomeAbroad, we specialize in helping investors like you optimize DSCR loan refinancing, offering tailored solutions that meet the specific needs of your investment strategy.

Why Should You Refinance a DSCR Loan?

Refinancing your DSCR loan offers several compelling advantages that can reshape your investment portfolio. Here’s how it can work for you:

1. Lower Interest Rates = Lower Monthly Payments

With interest rates currently stabilizing, refinancing your DSCR loan could significantly reduce your monthly payments.

For example, if you refinance from an 8.5% interest rate to a 6.5% rate, your payments on a $500,000 loan could drop from $3,846 to $3,160, saving $686 per month.

Loan Amount | Interest Rate | Monthly Payment | Monthly Payment | Monthly Savings |

|---|---|---|---|---|

$500,000 | 8.5% | $3,846 | $3,160 | $686 |

This significant reduction in monthly payments shows the potential benefits of refinancing to secure a lower interest rate.

2. Improve Cash Flow

Improving your cash flow is one of the most immediate benefits of refinancing. Lowering monthly loan payments allows you to reinvest the extra cash into your properties or future acquisitions.

Additionally, by extending your loan term, you can reduce your payments even further, increasing liquidity for future projects.

For example, refinancing a DSCR loan to extend the repayment period can turn a short-term cash flow burden into a long-term financial benefit, enabling you to scale your real estate holdings faster.

3. Access Property’s Equity via Cash-out Refinance

Refinancing also lets you tap into the equity you’ve built up in your property. If your property has appreciated significantly, you can use this equity to reinvest without selling. This “cash-out refinance” strategy enables you to continue using your existing assets to finance new properties.

4. Restructure Your Loan

Another benefit of refinancing is the ability to restructure your loan terms to suit your current needs. You can switch from an adjustable-rate to a fixed-rate loan to gain more predictability, or you can modify your DSCR requirements, giving you greater financial flexibility.

At HomeAbroad, we offer refinancing solutions that let you customize your loan, whether you’re seeking longer repayment terms, lower rates, or more favorable DSCR terms.

How Can DSCR Loan Refinance Benefit Real Estate Investors?

Refinancing a DSCR loan can unlock powerful opportunities for real estate investors looking to optimize their portfolios. By refinancing, investors can access additional equity for new property investments, restructure loans for greater flexibility, and improve cash flow, all while leveraging favorable market conditions.

At HomeAbroad, our DSCR refinancing solutions are designed to meet the needs of diverse investors, offering a streamlined process that minimizes complexity and maximizes value.

To illustrate the potential of DSCR loan refinancing, let’s look at a real example where HomeAbroad helped an Israeli client unlock property equity to expand their US portfolio:

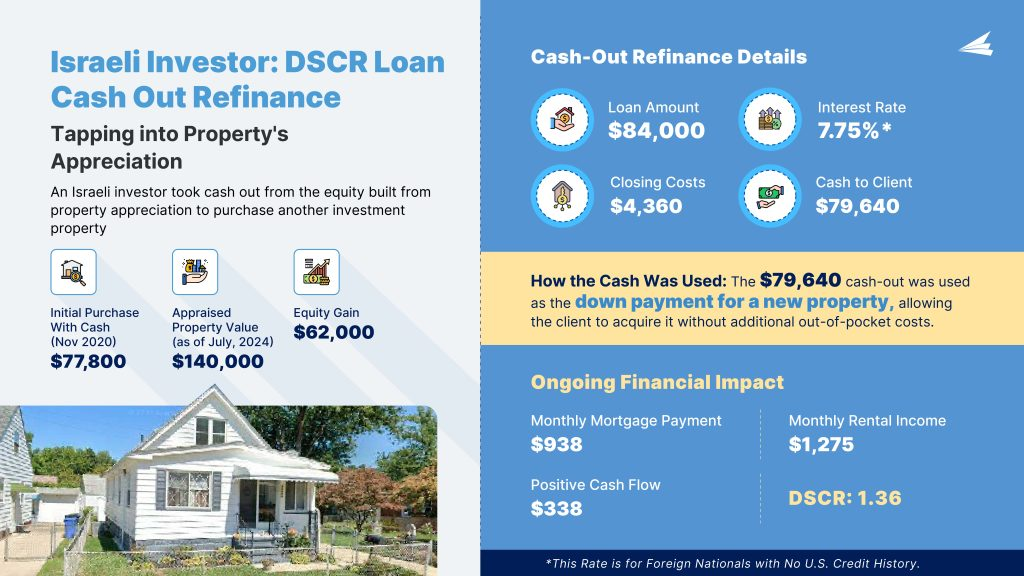

Real-Life Example of Cash-Out Refinance: HomeAbroad’s Client from Israel Who Tapped into Cash-Out Refinance to Expand Portfolio

One of HomeAbroad’s clients, an investor from Israel, successfully utilized a DSCR loan refinance to scale their US real estate portfolio. By tapping into the equity of an existing property, they secured funding for a new investment without relying on out-of-pocket expenses.

Here’s how the process unfolded:

- Property Purchase Price: $77,800 (November 2020)

- Appraised Property Value: $140,000 (July 2024)

- Equity Gained: $62,200

Cash-Out Refinance Details:

- Loan Amount: $84,000

- Interest Rate: 7.75% (fixed)

- Loan Term: 30 years

- Monthly Mortgage Payment: $938

- Cash to Client: $79,640

How the Cash Was Used: The $79,640 obtained from the cash-out refinance was used as a down payment for a new property, enabling the investor to expand their portfolio without additional personal financial input.

Ongoing Financial Impact:

- Monthly Rental Income: $1,275

- Positive Cash Flow: $337 per month

- Debt Service Coverage Ratio (DSCR): 1.36

This case study highlights how HomeAbroad’s tailored DSCR cash-out refinance option allowed the investor to unlock property equity, increase monthly cash flow, and achieve a solid DSCR, enhancing their overall investment strategy. For more detailed information, you can refer to the full case study here.

Here’s the case at a glance:

If you’re ready to take advantage of similar opportunities, here’s how to get started with the DSCR loan refinance process.

How to Apply for a DSCR Loan Refinance?

The application process for a DSCR loan refinance is almost similar to applying for a new DSCR loan.

At HomeAbroad, we strive to make the process as streamlined and straightforward as possible, ensuring you can take advantage of refinancing opportunities without unnecessary complications.

The general application steps for DSCR Loan Refinance include:

Documents Required Specific to DSCR Loan Refinancing

While the application process remains similar to that for a new DSCR loan, the documentation required for a refinance differs in a few key ways.

You’ll need to provide:

For a full breakdown of the DSCR loan process and detailed document requirements, you can refer to our DSCR Loan Guide.

However, before you begin the application process, it’s essential to understand the eligibility criteria for DSCR loan refinancing to ensure you meet the requirements.

Eligibility Criteria for DSCR Loan Refinance

Criteria | Details |

|---|---|

Debt Service Coverage Ratio (DSCR) | >= 1 for best terms, <1 eligible with a higher down payment. We provide DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, meaning you are eligible even if your rental covers just 75% of the mortgage. |

Loan-to-Value (LTV) Ratio | Up to 75% for Purchase/Rate Term Refinance, 70% for Cash Out Refinance. |

Credit Score | No US Credit History required |

Property Eligibility | Eligible properties must generate income, such as rental properties or multi-family units. |

Conclusion

Refinancing a DSCR loan is a powerful tool for real estate investors looking to optimize cash flow, unlock property equity, and expand their portfolios.

For foreign nationals, HomeAbroad offers tailored DSCR loan refinancing solutions designed to fit your unique needs.

By working with our expert team, you’ll benefit from:

With HomeAbroad, you can confidently take the next step in maximizing your real estate investments. Whether you’re aiming to improve your cash flow or leverage equity for new opportunities, our DSCR loan refinance options are here to help you succeed.

FAQs

What is a DSCR loan refinance?

A DSCR loan refinance allows real estate investors to replace their existing loan with a new one that offers better terms, such as a lower interest rate or access to property equity. DSCR refinancing can improve cash flow and unlock funds for further investment.

Why should investors refinance a DSCR loan?

Refinancing a DSCR loan can help investors lower their monthly payments, access property equity, improve cash flow, or extend the loan term to better fit their financial strategy. It’s an excellent way to optimize your real estate investments.

Are foreign nationals eligible for DSCR loan refinancing?

Yes, HomeAbroad offers specialized DSCR loan refinancing solutions for foreign nationals, with flexible requirements tailored to international investors. Foreign investors can access competitive rates and take advantage of refinancing to optimize their US property investments.

Can I do a cash-out refinance with a DSCR loan?

Yes, a cash-out refinance allows you to unlock the equity in your property. This can provide funds for new investments, property improvements, or other financial needs without selling the property.

How long does the DSCR loan refinance process take?

The DSCR loan refinance process typically takes 20-30 days, depending on the transaction’s complexity and the speed of documentation. HomeAbroad works to streamline the process for both domestic and international investors.

![DSCR Loan Refinance: How to Qualify & Maximize Benefits [2026]](https://homeabroadinc.com/wp-content/uploads/2024/11/DSCRLoanRefinance-500x325.jpg)