Benefits of DSCR Loans in Texas

DSCR loans offer several advantages for foreign nationals investing in Texas:

Qualification focused on rental income, not W2-based underwriting

The biggest advantage is the underwriting lens. If the rent supports the monthly payment, DSCR can be a clean path even when traditional lenders want extensive US income documentation. In our experience, this is the single most important benefit for foreign nationals and visa holders buying Texas rentals.A Clearer Path for Foreign Nationals Building a Rental Portfolio

Faster decision-making for portfolio growth

Because DSCR is property-first, many investors find it easier to repeat the process across multiple acquisitions. The file structure tends to stay consistent, which helps when you are scaling a long-term rental strategy across metros like Dallas, Houston, San Antonio, or Austin.

Useful for markets where taxes and insurance materially affect cash flow

Texas underwriting often comes down to the full PITIA line item, not just rate and rent. DSCR forces a disciplined view of monthly costs, which is especially valuable in Texas where property taxes are local and coastal insurance variables can materially change monthly payments. The benefit is clarity earlier in the buying process, not surprises late in underwriting.

“The reason DSCR works so well in Texas is that it forces the real cost picture up front. When rent, taxes, and insurance are validated early, investors avoid the last-minute surprises that derail timelines.”

How HomeAbroad Helped Rakesh Scale into Austin With DSCR Loan

Rakesh Verma, an experienced investor from India living in California on an H-1B visa, wanted to diversify by purchasing a multifamily rental property in Austin, Texas. Traditional lenders created friction due to visa status and credit profile depth, so he used DSCR qualification based on the property’s rental income.

Property Details:

Location: Austin

Property Value: $500,000

Monthly Rental Income: $4,118

Loan Details:

Loan Amount: $400,000

Down Payment: 25% (100,000)

Interest Rate: 7.25%

Loan Term: 30 years

Monthly Mortgage (PITIA): $3,432

DSCR Calculation:

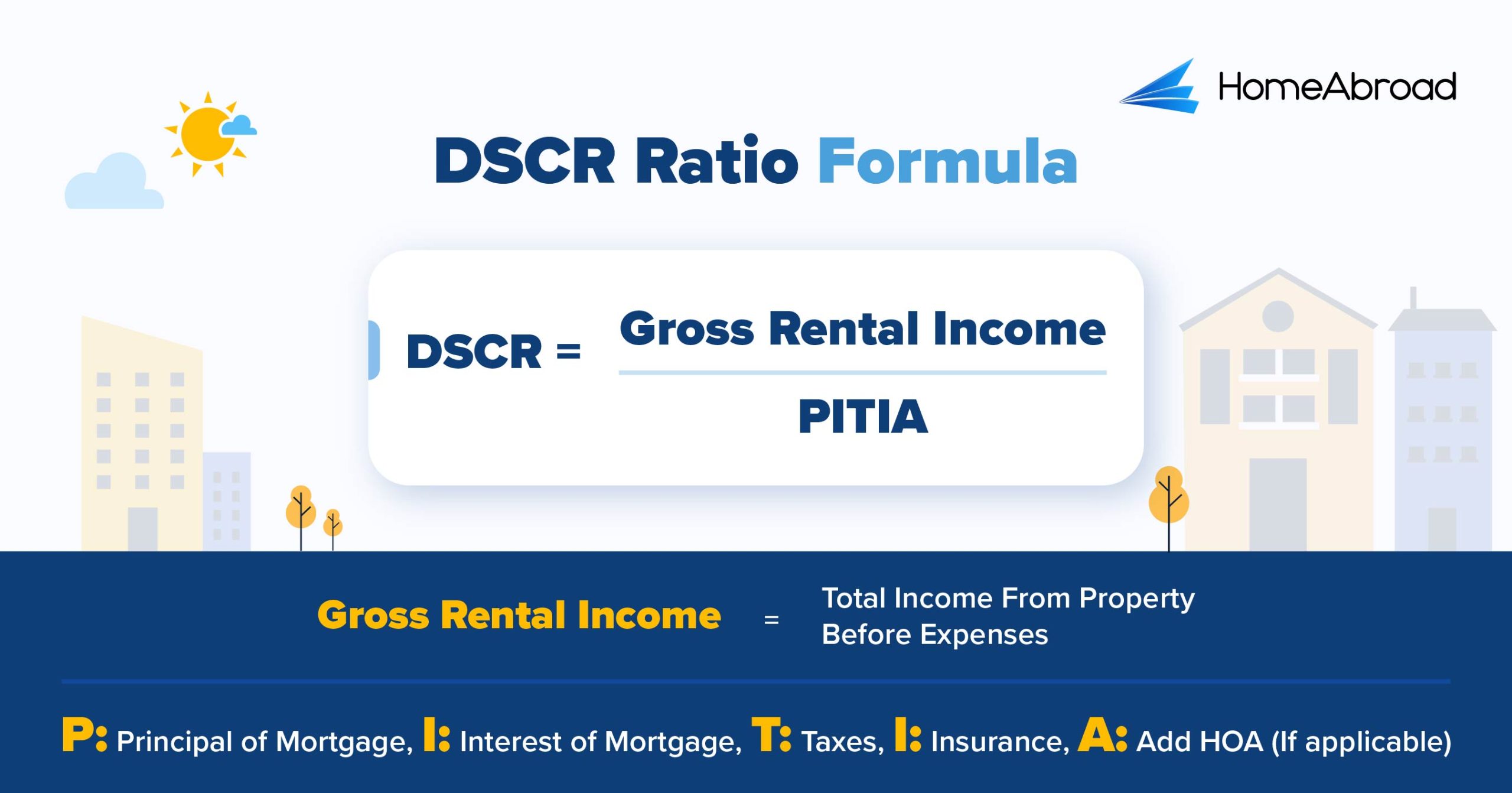

DSCR = Gross Rental Income ÷ PITIA

DSCR = $4,200 ÷ $3,432

DSCR = 1.2

“What most guides do not mention is that the cleanest DSCR closings happen when taxes, insurance, and rent comps are validated early. That is where files either stay smooth or get delayed.”

Thanks to HomeAbroad’s DSCR loan, Rakesh successfully added a cash-flowing Texas property to his US portfolio, without the typical delays and denials faced by foreign national investors.

Texas Rental Market Overview

Texas remains an institutional-grade rental state because it combines scale with multiple deep job hubs.

As per our data, the key market statistics for 2025 are:

-

Median gross rent in Texas: approximately $1,861/month

Median gross rent in Texas: approximately $1,861/month -

House Value: around $296,039

House Value: around $296,039

Where We Lend DSCR Loans in Texas

HomeAbroad offers DSCR loans throughout Texas, with personalized support for real estate investors targeting high-growth cities like Dallas, Houston, San Antonio, and beyond.

Here are some of the top Texas markets where we provide DSCR loans to real estate investors.

- Dallas

- Houston

- Austin

- San Antonio

- El paso

- McAllen

- Fort Worth

- Round Rock

- Frisco

- Brownsville

- Beaumont

- Lubbock

- Plano

- Sugar Land

- Amarillo

- Laredo

Top Places to Invest in Texas with a DSCR Loan

exas offers a wide range of cities that are ideal for both short-term and long-term rental strategies, making it a great fit for international real estate investors using DSCR loans.

Whether you’re targeting steady monthly income or strong vacation rental demand, there’s a city in Texas that aligns with your investment approach.

Here are some of the top-performing cities in Texas for real estate investment:

The investment properties shown below are pulled from the HomeAbroad property-search platform and can change daily. Review each listing’s rent assumptions, cash flow, and DSCR inputs before you underwrite an offer.

Austin: Tech Magnet and Short-Term Rental Powerhouse

Austin isn’t just the Live Music Capital of the World; it’s also one of the fastest-growing tech hubs in the US. With a thriving short-term rental market driven by tourism, events, and remote work, Austin consistently ranks among the top cities for rental yield.

- Median Home Price: $523,769

- Rental Yield: 9.8%

What this means for investors: High nightly rates and year-round demand make Austin ideal for short-term rental strategies. These strong cash flows support DSCR loan qualification even at lower occupancy levels, perfect for international buyers targeting high-yield urban markets.

Investment Properties Listed Today on Sale in Austin

Single Family for sale in Austin, MN

Single Family for sale in Houston, TX

Single Family for sale in Killeen, TX

Houston: Energy Hub with Reliable Long-Term Returns

Houston’s massive economy, anchored by energy, healthcare, and aerospace, attracts a steady influx of professionals. With an affordable cost of living and sprawling suburbs, the city supports strong long-term rental demand across all price points.

- Median Home Price: $269,422

- Rental Yield: 8.2%

What this means for investors: Houston offers a solid balance of affordability and rental income, making it easy to hit DSCR benchmarks. For foreign nationals, this market is ideal for building a stable, income-producing portfolio without relying on US credit history.

Investment Properties Listed Today on Sale in Houston

Single Family for sale in Austin, MN

Single Family for sale in Houston, TX

Single Family for sale in Killeen, TX

El Paso: Stable, Affordable, and Cash Flow Friendly

Bordering Mexico, El Paso offers some of the most affordable real estate in Texas. The city’s economy is fueled by the military, logistics, and healthcare sectors that generate consistent housing demand among long-term tenants.

- Median Home Price: $231,159

- Rental Yield: 8.1%

What this means for investors: Low property prices paired with strong rents make El Paso an ideal entry point for international investors using DSCR loans. With minimal investment, buyers can generate cash flow that easily supports loan qualification.

Investment Properties Listed Today on Sale in El Paso

Single Family for sale in Austin, MN

Single Family for sale in Houston, TX

Single Family for sale in Killeen, TX

San Antonio: Cultural Heritage Meets Rental Strength

With its historic charm, growing job market, and military presence, San Antonio draws renters seeking both affordability and quality of life. It’s a long-term rental favorite with consistent occupancy rates.

- Median Home Price: $256,363

- Rental Yield: 7.9%

What this means for investors: San Antonio’s rent-to-value proxy is competitive, which can help investors maintain DSCR cushion even when taxes vary by local jurisdiction.

Investment Properties Listed Today on Sale in San Antonio

Single Family for sale in Austin, MN

Single Family for sale in Houston, TX

Single Family for sale in Killeen, TX

Dallas: Business-Friendly and Investor-Ready

As a major business and finance hub, Dallas combines economic strength with a growing population. Its diverse rental market spans everything from urban apartments to suburban single-family homes, making it a versatile option for investors.

- Median Home Price: $315,056

- Rental Yield: 7.7%

What this means for investors: Dallas rental properties deliver solid income and appreciation potential. For DSCR financing through HomeAbroad, the city’s strong rent-to-price ratios provide ample room to qualify, even without personal income documentation.

Investment Properties Listed Today on Sale in Dallas

Single Family for sale in Austin, MN

Single Family for sale in Houston, TX

Single Family for sale in Killeen, TX

Texas Specific DSCR Underwriting Factors that Investors Overlook

Texas offers strong rental yields, a pro-business environment, and diverse property markets, making it a strategic choice for international real estate investors. But to maximize returns and qualify smoothly for DSCR loans, it’s important to understand a few state-specific factors that can impact your investment.

Property Taxes Vary by County

Texas has no state income tax, but property taxes are among the highest in the US. Rates differ by county, often ranging from 1.5% to 3.5% of the assessed value. Investors should factor this into their cash flow calculations, as higher property taxes can affect DSCR ratios and overall ROI.

Insurance Costs and Regional Weather Risks

Texas faces a range of weather-related risks, including hailstorms, tornadoes, and flooding in some areas. Coastal cities like Galveston and parts of Houston may have elevated insurance premiums. Choosing newer homes or properties with storm-resistant features can reduce risk and improve insurability.

Localized Short-Term Rental Regulations

Short-term rental rules in Texas are set at the city level. Some cities like Austin and Dallas require permits, impose occupancy limits, or restrict STRs to certain zoning areas. Before investing in a short-term rental strategy, check local ordinances, HOA restrictions, and tax collection obligations.

Landlord-Friendly Legal Framework

Texas is known for its landlord-friendly laws. There’s no statewide rent control, and eviction processes tend to be straightforward. Lease terms, notice periods, and security deposit rules are clearly defined. This legal environment favors rental property owners, especially those operating long-term rentals.

Strategic & Future Considerations for Foreign Nationals Investing in Texas

Texas continues to attract global real estate investors due to its strong economic fundamentals, investor-friendly climate, and absence of state income tax. As major metros expand and infrastructure projects evolve, new investment corridors are opening up beyond the traditional hubs of Dallas, Houston, and Austin.

Here are some key future-focused considerations for international investors:

1. Unrestricted Foreign Ownership

Texas places no limitations on foreign nationals purchasing property. This openness, combined with straightforward title laws and landlord-friendly policies, makes Texas one of the most accessible US states for international buyers.

2. Foreign Investment in Urban vs. Suburban Markets

While international interest is strong in urban cores like Austin and Dallas, there’s growing activity in suburban and exurban areas benefiting from spillover demand, job decentralization, and planned transportation upgrades.

3. Impact of Visa-Linked Investment Trends

Texas sees significant interest from international buyers on E-2, EB-5, and F-1 dependent pathways. Houston and Dallas, in particular, have emerged as hotspots for families seeking real estate near top-rated schools, universities, and international consulates.

4. Statewide Economic and Infrastructure Growth

Major projects like Texas Central’s high-speed rail, the I-35 expansion, and commercial hubs near the Port of Houston are reshaping long-term demand patterns. These developments are creating new pockets of opportunity for early-stage foreign investors.

Texas DSCR Loan FAQs

Can foreign nationals apply for DSCR loans in the state of Texas?

Yes, DSCR loans are available in Texas and are a popular option for international real estate investors looking to finance rental properties. At HomeAbroad, we offer tailored DSCR loan options for a variety of investment properties, including multi-family properties, single-family homes, and short-term rentals.

Can a foreign national apply for HomeAbroad DSCR Loan without a US credit history?

Yes. Unlike traditional loans, DSCR loans do not focus on your personal income or credit score, but instead rely on your debt service coverage ratio (DSCR) to determine eligibility. At HomeAbroad, we offer loans for international real estate investors with DSCR ratios as low as 0.75, and in some instances, no-ratio DSCR loans.

How long does it take to get a DSCR loan in Texas?

At HomeAbroad, we streamline the application process to ensure a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

About the author: Steven Glick is the Director of Mortgage Sales at HomeAbroad and has over a decade of experience in the mortgage industry. As a licensed mortgage originator (NMLS# 1231769), Steven brings deep expertise in loan processing, sales operations, and non-traditional mortgages.