Investing in California real estate is easier than ever with a DSCR loan, designed for investors who want to qualify based on rental income rather than personal income. With this approach, the property’s rental income covers the mortgage payments, and a strong-performing rental can even generate positive cash flow after loan payments.

Whether you’re eyeing long-term rentals in Los Angeles or short-term vacation homes in San Diego, a DSCR loan offers a streamlined financing solution without traditional income verification.

Get started with a HomeAbroad DSCR loan and Start your Investment journey today!

Table of Contents

Key Takeaways

1. DSCR loans allow investors to secure financing without relying on personal income verification.

2. Unlike conventional loans, DSCR loans focus on a property's income potential rather than the borrower’s debt-to-income ratio.

3. DSCR loans are available for all property types, including single-family homes, multi-family units, condos, and other investment properties.

What is a DSCR Loan?

A Debt Service Coverage Ratio loan is a financing option designed for real estate investors who want to qualify based on their property’s rental income rather than personal income. Unlike traditional mortgages, DSCR loans don’t require W-2s, tax returns, or pay stubs, making them an ideal choice for self-employed investors and those with non-traditional income sources.

With home prices in California appreciating by an average of 8.36% annually, the market presents strong opportunities for long-term equity growth. A DSCR loan allows investors to capitalize on this appreciation while securing financing without any traditional hurdles.

Since these loans offer more flexibility in qualification, interest rates are typically 1-2% higher than traditional mortgages. You can check the latest DSCR loan interest rates here.

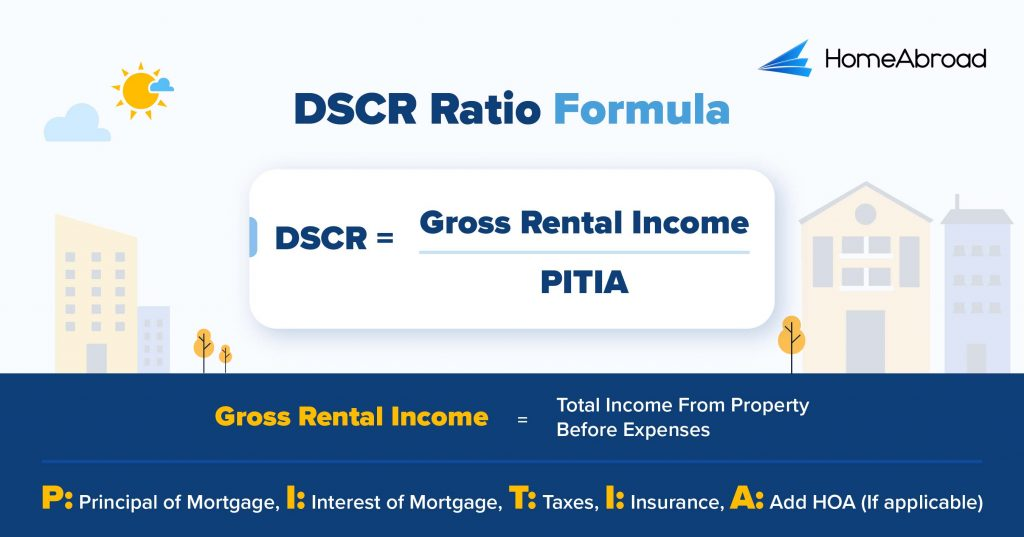

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio is used to determine if a property’s rental income is sufficient to cover its loan payments. A higher DSCR indicates a lower risk for lenders, making it easier for investors to secure financing.

Here is the DSCR Formula:

A DSCR of 1.4 means the property generates more income than needed to cover its debt obligations, resulting in positive cash flow. HomeAbroad looks for a minimum DSCR of 1 or higher to qualify, ensuring the rental income is sufficient to cover the loan payments.

One of my clients from Oakland wanted to invest in a rental property but struggled to qualify for a DSCR loan because the property’s DSCR was 0.86, just below the standard requirement. Despite this, I helped him secure our DSCR loan, allowing him to move forward with his investment.

For unique scenarios like this, HomeAbroad offers No-Ratio DSCR loans, allowing investors to qualify with a DSCR as low as 0.75. This flexibility makes it easier to secure financing and grow your real estate portfolio.

DSCR Loan Requirements in California

HomeAbroad provides tailored DSCR loans for both domestic and global investors, offering flexible financing solutions to meet diverse investment needs, Here are the requirements for each:

| Features | Domestic Investors | Global Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | Minimum 620 | No US credit needed |

| Down Payment | 20% | 25% |

| LTV Ratio | Up to 80% for Purchase and Rate/Term Refinance, Up to 75% for Cash Out Refinance | Up to 75% for Purchase and Rate/Term Refinance, Up to 70% for Cash Out Refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

Over the past decade, HomeAbroad has built a strong reputation for helping investors secure the right financing solutions. With deep industry expertise and a commitment to investor success, we provide tailored DSCR loans, expert guidance, and seamless support to ensure a smooth and profitable real estate investment journey.

Where We Lend DSCR Loan in California

- Los Angeles

- San Francisco

- San Diego

- San Jose

- Sacramento

- Fresno

- Oakland

- Long Beach

- Bakersfield

- Riverside

- Santa Ana

- Stockton

Let’s explore a real-life example of how HomeAbroad helped an investor succeed in the California real estate market.

Case Study: How Alex Secured a DSCR Loan to Start Investing in California

Alex, a self-employed investor in California, wanted to start his real estate investment journey but faced challenges with traditional loans that required personal income verification.

With the help of Steven Glick, an experienced mortgage loan officer at HomeAbroad, he secured a DSCR loan, qualifying based on his property’s rental income rather than his personal earnings.

Property Details:

Location: San Francisco

Property Value: $437,500

Monthly Rental Income: $4,918

Loan Details:

Loan Amount: $328,125

Down Payment: 25% ($109,375 )

Interest Rate: 6.9%

Loan Term: 30 years

Monthly Mortgage(PITIA): $3,500

DSCR Calculation:

DSCR: Gross Rental Income ÷ PITIA

DSCR: $4,918 ÷ $3,500

DSCR: 1.40

With a DSCR of 1.40 Alex is easily qualified for the DSCR loan, ensuring the property could generate sufficient cash flow to cover loan repayments.

In Alex’s case, HomeAbroad’s deep understanding of the California market helped him to identify the ideal property and secure the perfect DSCR Loan tailored to his investment goals.

One of the biggest challenges investors face is qualifying for financing without extensive income documentation. DSCR loans eliminate that hurdle by focusing on a property’s ability to generate rental income, making it easier to scale an investment portfolio.

Steven Glick, (Director of Mortgage Sales, HomeAbroad)

Top Places to Invest in California with a DSCR Loan

California’s real estate market has experienced steady growth, with home values appreciating at an average rate of 8.36% annually over the past five years. This consistent upward trend makes it an attractive destination for investors looking to build wealth.

California offers lucrative opportunities with a strong rental market and high-demand locations. Whether you’re targeting short-term vacation rentals or long-term income properties, a DSCR loan can help you secure financing based on rental income.

Here are some top cities in California for real estate investors:

City | Rental Type | Rental Yield |

|---|---|---|

San Diego | Short-Term | 7.1% |

Los Angeles | Short-Term | 5.6% |

Sacramento | Short-Term | 5.24% |

San Francisco | Short-Term | 4.2% |

Riverside | Long-Term | 4.4% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in California or anywhere in the US!

Get a HomeAbroad DSCR Loan in California

Finding the right financing for your investment property in California is easy with HomeAbroad. We specialize in DSCR loans tailored for both US and global investors, offering competitive rates and flexible terms to help you maximize returns.

HomeAbroad is a complete solution for real estate investors. Our AI-powered property search helps you find high-yield investments while our expert local agents guide you through every step of the process. We also assist with LLC formation, US bank account setup, and property management, ensuring a seamless investment experience from start to finish.

Get a DSCR loan with HomeAbroad today and start building your real estate portfolio in California!

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Frequently Asked Questions

Is it hard to get a DSCR loan in California?

No, getting a DSCR loan in California is easier than traditional financing because it doesn’t require personal income verification. Approval is based on your property’s rental income, making it a great option for investors.

How long does it take to get approved for a DSCR loan in California?

At HomeAbroad, we provide a fast and streamlined approval process in California. Our team works efficiently to close your DSCR loan within 30 days.

Can you get a DSCR loan without a job?

Yes, you can get a DSCR loan without a job since these loans don’t require personal income verification

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

AirDNA: https://www.airdna.co/vacation-rental-data/app/us/california

Zillow: Housing Data – Zillow Research

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![DSCR Loan Interest Rates Today [May, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates.jpg)