Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

The government shutdown threatening the National Flood Insurance Program (NFIP) could disrupt 3,619 home closings daily across the United States, jeopardizing $1.6 billion in daily real estate transactions and affecting nearly 40% of the national housing market, according to a new analysis of county-level housing data.

The shutdown would create an unprecedented crisis in the real estate sector, with 108,092 monthly home closings at risk nationwide, representing $47.5 billion in monthly transaction volume based on current median home prices of $439,278.

Table of Contents

Key Highlights

Shutdown Impact Modeling: Projected Home Closings and Economic Loss

The analysis estimates that during an NFIP shutdown, 3,619 daily home closings are at risk nationwide, with a median home price of $439,278 used to calculate economic impact.

| Shutdown Length | Home Closings at Risk | Estimated Economic Loss ($) |

|---|---|---|

| 1 Day | 3,619 | $1.59 billion |

| 1 Week (7 days) | 25,333 | $11.13 billion |

| 2 Weeks (14 days) | 50,658 | $22.27 billion |

| 1 Month (30 days) | 108,570 | $47.68 billion |

| 2 Months (60 days) | 217,140 | $95.36 billion |

The record-longest US federal government shutdown lasted 35 days from December 22, 2018, to January 25, 2019. A shutdown of similar length today could potentially delay over 126,000 home closings, threatening more than $55 billion in housing market transactions, illustrating the high stakes involved.

NFIP Shutdown Home Sales Impact Statistics

1. Nearly 4,000 Daily Home Closings Hang in the Balance Nationwide

If NFIP operations cease during a government shutdown, 3,619 home closings would be at risk daily across 633 counties nationwide. This represents the largest potential disruption to the US housing market from a single policy intervention in recent history.

2. $47.5 Billion in Monthly Real Estate Transactions Face Immediate Threat

The economic scale of this shutdown extends far beyond individual homebuyers, with $47.5 billion in monthly transaction volume at risk. This calculation uses the current national median home price of $439,278, representing a significant portion of the $150+ billion monthly US housing market.

3. Eight States Could See More Than Half Their Home Sales Disrupted

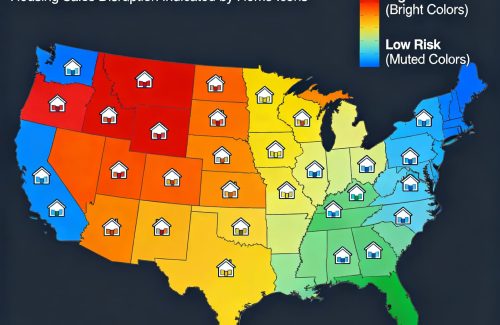

Maryland leads with 63.8% of sales at risk, followed by Virginia (61.1%), North Carolina (55.8%), New Jersey (57.0%), South Carolina (57.6%), Georgia (53.8%), Massachusetts (54.8%), and Florida (54.3%). These states show the highest vulnerability due to elevated flood insurance penetration rates.

4. Florida’s Statewide Impact Dwarfs All Other States Combined

With 534 daily closings at risk, Florida’s exposure exceeds the next four states combined. The state’s 39 counties in the analysis show consistently high NFIP penetration rates, reflecting extensive coastal and inland flood risk areas that depend heavily on federal flood insurance.

5. Top Five States Account for Nearly Half (40.6%) of All National Risk

Florida, Texas, California, North Carolina, and Virginia together represent 40.6% of total daily impact, demonstrating significant geographic concentration of risk in high-population coastal and flood-prone areas.

6. Harris County, Texas Leads Individual County Risk with 70 Daily Closings

The Houston metropolitan area faces the highest individual county impact, with 70 daily closings at risk out of 4,159 total monthly home sales. This represents a 50.7% NFIP penetration rate and reflects the region’s extensive flood risk following major flooding events.

7. Thirteen States Face More Than 100 Daily Closings at Risk Each

The analysis reveals 13 states with more than 100 daily closings at risk: Florida (534), Texas (329), California (228), North Carolina (204), Virginia (175), New York (174), New Jersey (159), Georgia (142), Pennsylvania (131), Maryland (115), South Carolina (114), Illinois (112), and Massachusetts (112). This widespread geographic distribution extends well beyond traditional coastal flood zones to include major inland metropolitan areas and states not typically associated with flood risk, such as Illinois and Pennsylvania.

8. High-Risk Counties Show Extreme Flood Insurance Dependency

47 counties have NFIP penetration rates exceeding 75%, led by Fairfax County, Virginia (140% penetration, 37 daily closings), Morris County, New Jersey (133% penetration, 17 daily closings), and Miami-Dade County, Florida (76% penetration, 50 daily closings). Virginia dominates with 12 high-penetration counties, followed by Florida with 6 counties. These areas would face near-complete shutdown of real estate activity during an NFIP suspension, with notable concentrations in the Washington D.C. metro area (Fairfax, Prince George’s, Anne Arundel), South Florida (Miami-Dade, St. Johns), and the Louisiana Gulf Coast (Jefferson Parish, Orleans Parish, St. Tammany Parish).

9. Top Ten Counties Alone Control 12.5% of Total National Risk

The concentration of risk in major metropolitan areas is evident, with the top 10 most impacted counties accounting for 452 daily closings, or 12.5% of national risk. This includes major metros like Houston, Chicago, Phoenix, and Los Angeles.

10. Average National NFIP Penetration Reaches 45% Across Analyzed Counties

The 45% average penetration rate across 633 counties demonstrates the extensive reach of federal flood insurance beyond traditionally recognized flood zones, indicating broader vulnerability than many policymakers may realize.

11. Cook County, Illinois Faces 53 Daily Closings at Risk.

Chicago’s Cook County could see 53 home closings halted every day (out of 4,887 August sales) reflecting a 32.4% NFIP penetration rate in one of the nation’s largest housing markets.

12. Maricopa County, Arizona Sees 52 Daily Transactions Threatened

The Phoenix metro’s Maricopa County has 52 daily closings at risk, from 4,529 total sales, driven by a 34.3% flood insurance penetration, underscoring growing flood exposure in desert urban areas.

13. Los Angeles County, California at 51 Daily Closings Vulnerable

With 51 transactions per day potentially disrupted out of 4,269 August home sales, LA County’s 36.1% penetration rate highlights vulnerable coastal and river-adjacent communities.

14. Miami-Dade County, Florida Risks 50 Daily Closings

South Florida’s Miami-Dade County could lose 50 closings daily, representing 76.3% of its 1,973 monthly sales; one of the highest penetration rates among major metros.

15. Philadelphia County, Pennsylvania Faces 28 Daily Closings Halt

Philadelphia’s county could lose 28 daily home closings, from 1,166 sales, reflecting a 70.9% flood insurance penetration in a major inland urban market.

NFIP Shutdown Home Sales Impact Rankings (by Counties)

Govt Shutdown Impact on Home Sales (by States)

Methodology

This analysis combines August 2025 home sales data from Redfin with NFIP residential penetration rates from FEMA’s OpenFEMA database to estimate county-level impact of potential flood insurance program suspension.

Data Sources:

- Home sales: Redfin Data Center county time series (August 2025)

- NFIP penetration: FEMA OpenFEMA NFIP Residential Penetration Rates

- Economic impact: Calculated using Redfin’s August 2025 national median home price of $439,278

Data Filtering and Quality Controls:

- Sales volume threshold: Counties with fewer than 101 home sales in August 2025 were excluded to ensure statistical stability and prevent small-market volatility from skewing national trends

- NFIP data availability: Counties without available NFIP penetration data were removed from the analysis to maintain data integrity

- Final dataset: 633 counties met both criteria and form the basis of this analysis

Calculation Method:

- Monthly affected closings = Home sales × NFIP penetration rate (capped at 100%)

- Daily affected closings = Monthly impact ÷ 30 days

- Economic impact = Affected closings × Median home price

Geographic Coverage:

633 US counties across all 50 states with robust housing markets (≥101 monthly sales)

![U.S. Home Construction Permits Declined 32% in Top 100 Metros [2025]](https://homeabroadinc.com/wp-content/uploads/2025/09/USHomeConstruction.jpg)

![Fed Rate Cut Could Save Homebuyers $20,565 [2025]](https://homeabroadinc.com/wp-content/uploads/2025/09/Fed-rate-cut-mortgage-savings-scaled.jpg)