Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Foreign nationals can buy property in the US regardless of their citizenship, immigration, or residency status.

2. Expats on different visa programs can buy a home in the US even if they do not hold a green card.

3. International real estate investors can purchase real estate in the US from their home countries without a tourist or any other visa and can even close on the property remotely with HomeAbroad.

4. HomeAbroad offers mortgage options for foreign nationals that do not require a US credit history, allowing international buyers to secure US property seamlessly.

Foreign nationals can legally buy property in the United States, regardless of citizenship, residency, or visa status. There are no federal laws restricting non-US residents from owning real estate.

According to the National Association of Realtors, foreign buyers purchased $56 billion worth of US residential property between April 2024 and March 2025, representing over 78,000 home transactions. This confirms that buying property in the US as a foreign national is not only possible, but already widely practiced.

Investors and homebuyers can purchase US real estate directly from their home country, complete transactions remotely, and hold property in one of the world’s most stable and transparent real estate markets. Ownership is not tied to immigration status, and physical presence in the US is not required.

At HomeAbroad, we structure this process specifically for foreign nationals, drawing on real transaction experience to support financing, remote closings, and cross-border coordination.

This guide explains exactly how foreign nationals buy property in the US, from legal eligibility and documentation to financing options and closing remotely, so you can move forward with clarity and confidence.

Table of Contents

Can a Foreigner Buy Property in the US?

Yes. Foreign nationals can legally buy property in the United States. There are no federal restrictions based on citizenship, residency, or immigration status, and non-US citizens have the same property ownership rights as US citizens.

Foreign buyers do not need a Green Card or permanent residency to own real estate. Expats on visas such as H-1B, L-1, F-1, or other non-immigrant visas can purchase property, and international investors can buy US real estate without establishing US residency or living in the country.

However, despite the straightforward process, we understand how overwhelming buying a home in another country can be due to unfamiliarity with the local market, mortgage options, and the purchasing process.

At HomeAbroad, we work exclusively with foreign nationals buying US real estate. Based on hands-on experience across multiple cross-border transactions, we help investors through property purchases, mortgage options that do not require a US credit history, and remote closings with clarity and confidence.

Can Non-Citizens Purchase Investment Property in the US?

Yes, non-citizens can buy investment property in the US without any restrictions or visa requirements. There are no federal restrictions on foreign ownership of investment real estate, including rental properties and vacation homes.

According to a NAR report, in 2025, non-US citizens with permanent residences outside the US purchased a significant portion of US residential real estate. These foreign nationals invested $29.1 billion in real estate, accounting for 44% of the total residential real estate purchases made by foreign buyers.

In comparison, foreign buyers residing in the US on various visas or temporary permits purchased $26.9 billion in real estate, representing 56% of foreign buyer activity.

Many non-resident buyers focused on investment properties, including vacation homes and rental units. Nearly half of their purchases were used for such purposes, and 47% were all-cash transactions, highlighting the strong investment orientation of foreign buyers in the US real estate market.

This highlights the strong investment appeal of the US real estate market due to:

Excited to purchase real estate in the US? Wondering what it takes? Here you go.

Required Documents for Foreigners to Buy Property in the US

The exact document requirements for buying US real estate may vary based on your residency status. In general, you will need the following documents to get started with your home search:

However, suppose you are financing your US real estate. In that case, you must provide income and other relevant documents according to your loan program when the underwriter reviews your loan file for approval.

At HomeAbroad, we help foreign nationals understand documentation requirements upfront based on the specific loan program being used, so there are no surprises later in the process. You can review detailed financing requirements and options in our Foreign National Mortgage Guide.

How can Foreigners Buy Property in the US? (Step-by-Step Guide)

Buying property in the United States as a foreign national follows a structured, well-defined process. Once you understand the documentation, financing, and transaction steps, purchasing US real estate can be completed efficiently even if you live outside the country.

Below is a step-by-step guide outlining how foreign nationals and expats buy property in the US, from choosing a location to closing remotely.

Step 1 – Decide the Location

When buying a primary residence or an investment property in the US, decide where you want to live or invest. If you are in the US on a work or student visa, look for a place near your work or school.

If you are a foreign investor, research the growth potential, rental market, and appreciation trends in various markets.

Use HomeAbroad’s AI-driven investment property search platform to research neighborhoods by cap rate, cash-on-cash return, and growth outlook. This helps you shortlist the best ZIP codes that align with your investment goals.

Step 2 – Get a Pre-Approval Letter from HomeAbroad

Planning your financing early can help you budget more effectively and avoid delays when purchasing a property.

If you’re concerned about a lack of a US credit score, HomeAbroad offers tailored mortgage programs for foreign nationals and international real estate investors.

A pre-approval letter for mortgage financing from HomeAbroad is free of cost and shows sellers that you’re a serious buyer who can afford the house up to the purchase price mentioned in your Pre-approval letter.

For expats with established credit histories, you can have peace of mind knowing that you are working with a mortgage company that understands the needs of visa holders and expats.

To get pre-approved, you’ll need:

We are most reliable when it comes to helping foreigners buy their dream property in the USA, and Yu Li is here to vouch for us. See what she has to say:

As someone new to the US, navigating the housing market was overwhelming. HomeAbroad connected me with a fantastic agent who understood my needs. They even helped me secure financing despite not having a US credit history! Their concierge service took care of everything else, letting me focus on finding the perfect place. HomeAbroad made buying a home in America a dream – highly recommend!

Yu Li - Purchased a primary home in Miami, Florida

Get started today with HomeAbroad to begin your US real estate buying journey.

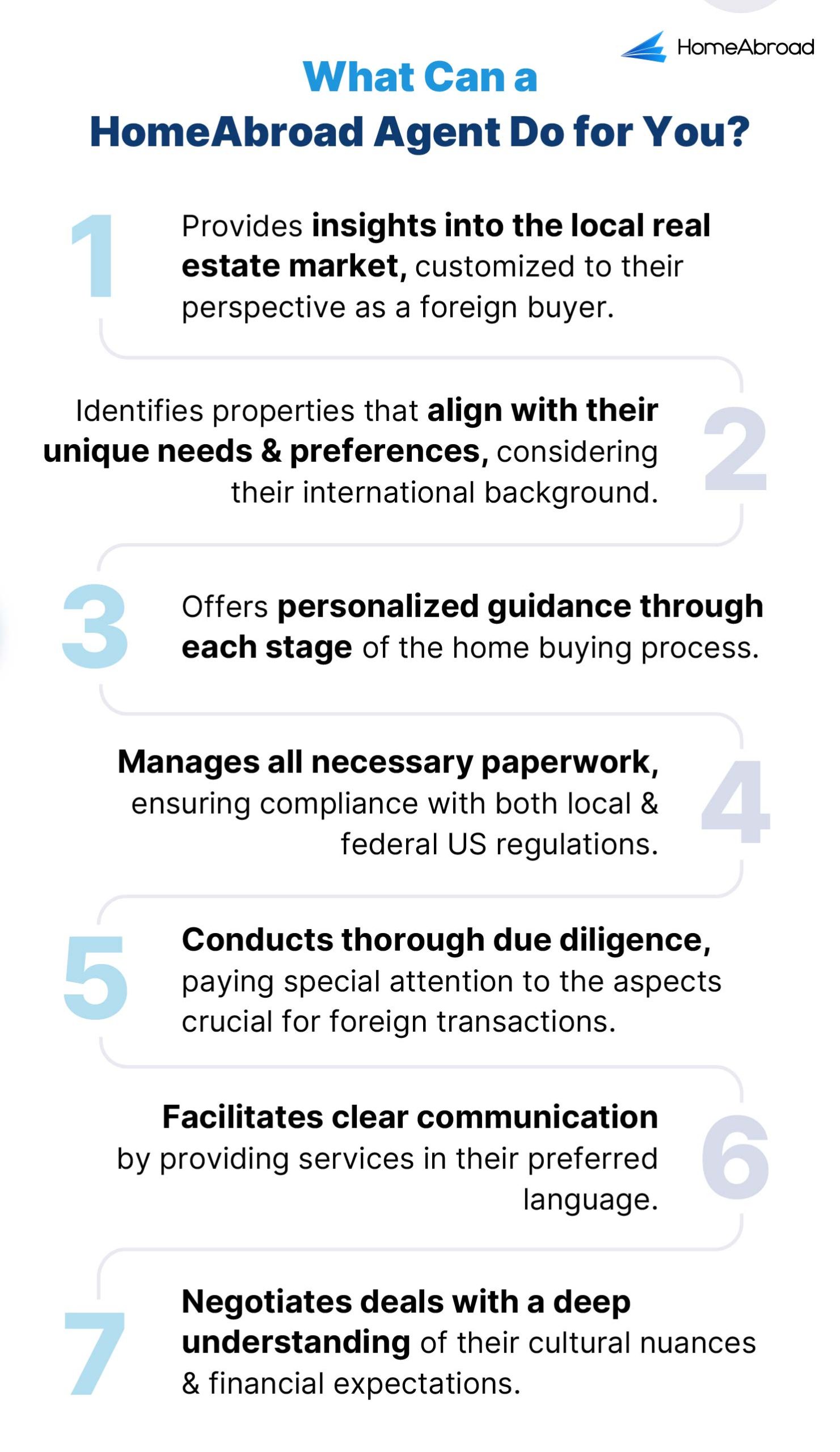

Step 3 – Work with a Local Investor-Friendly Real Estate Agent

Working with an agent experienced in foreign national transactions helps reduce friction and avoid common cross-border issues.

HomeAbroad connects you with licensed agents with the CIPS (Certified International Property Specialist) designation. Our agents have extensive experience working with foreign nationals and understand rental comps, STR regulations, and the paperwork involved in cross-border real estate transactions.

Your agent will help you shortlist suitable properties, schedule virtual or in-person tours, and prepare offers aligned with your goals.

Here are things that a HomeAbroad agent can do for you.

Step 4 – Sign the Purchase Contract & Start the Loan Process

Once your offer is accepted, the next step is to sign the purchase agreement and transfer the earnest money deposit, typically around 1% to 3% of the purchase price.

After that, begin your mortgage application with HomeAbroad by uploading the signed purchase agreement and an updated bank statement to our secure loan portal.

This officially opens your loan file and initiates the financing process.

Step 5 – Order Required Property Reports

After the loan file is opened, it’s time to order the necessary third-party reports that help confirm the property’s value, condition, and legal standing.

Here are the key reports required:

HomeAbroad will coordinate and guide you through each step to ensure a seamless, secure process.

Step 6 – Loan Underwriting & Document Collection

Once your loan application is submitted, the underwriting process begins. A dedicated underwriter will review your file based on foreign national lending guidelines.

During this stage, you may be asked to provide additional documentation, including:

Once all required documents are submitted, underwriting is generally completed within 5–7 business days.

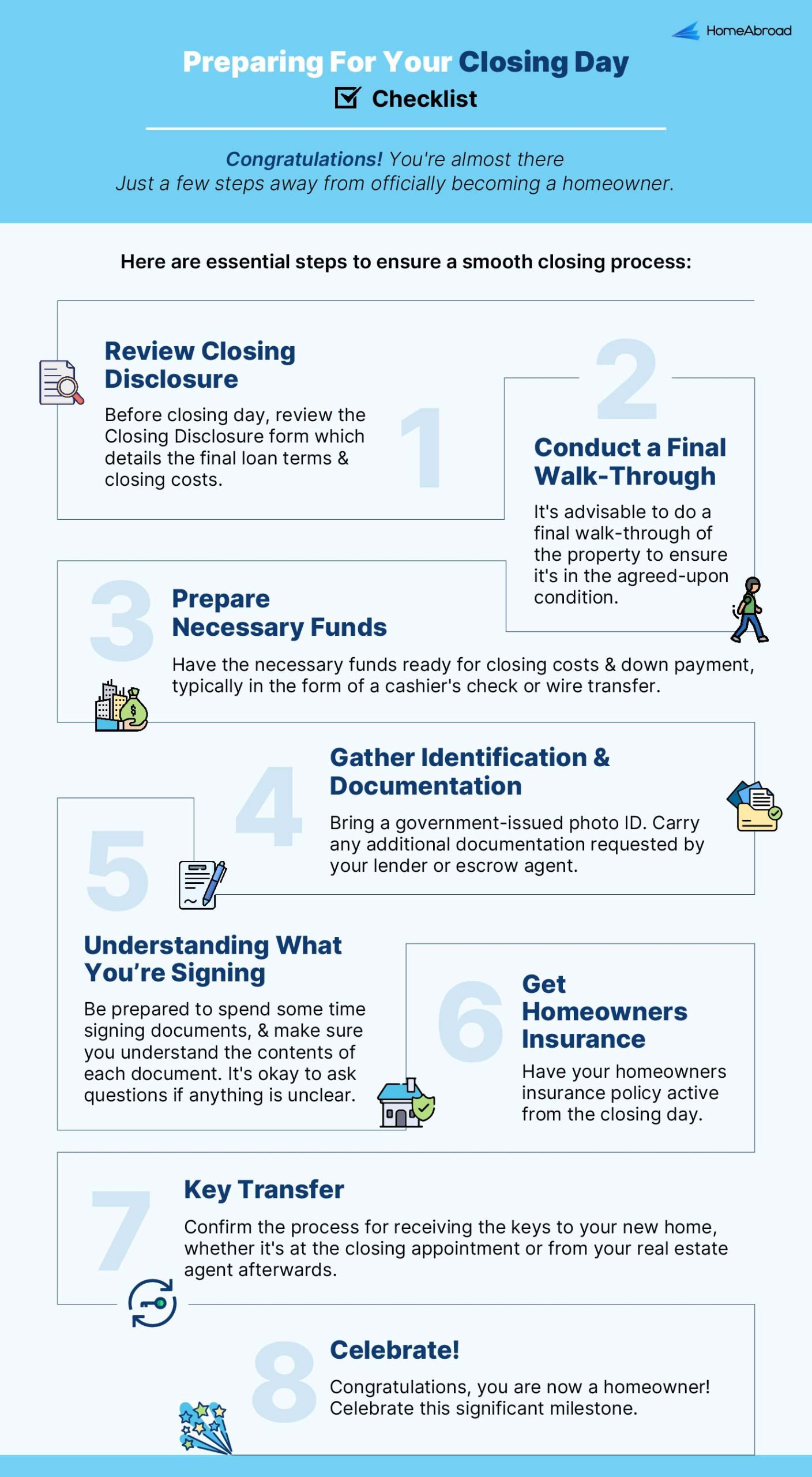

Step 7 – Clear to Close & Final Loan Disclosure

Once all underwriting conditions are met and your documentation is verified, you’ll receive a Clear to Close (CTC), which means your loan is officially approved and ready for closing.

You’ll also receive a Final Closing Disclosure (CD), which outlines the total funds required for the transaction, including the down payment and closing costs.

Please review the disclosure carefully and acknowledge it electronically to move forward with the closing process.

Step 8 – Closing

Once all checks come back clean and you have the mortgage approval, it’s time to take ownership of your property.

On closing day, your HomeAbroad agent will guide you through the final steps. This includes coordinating with the title company, escrow officer, and mortgage officer to ensure all necessary documents are prepared and signed.

Here is a checklist to help you be well-prepared for the day.

You can choose one of the following signing options depending on your location and preference:

Don’t worry, you are not alone! Your agent will assist you in completing all the necessary paperwork and take ownership of the property.

Congratulations, you now own a US property!

If all documents are submitted promptly, the typical timeline from contract to closing is around 30 to 45 days. Speak with a HomeAbroad Loan Officer to learn more about these options and the specific steps involved.

Tax Obligations for Foreign Nationals Buying US Real Estate

The tax implications for foreign real estate buyers are the same as for US citizens, with the same tax rates. There are no additional implications; foreign nationals are even eligible for the same deductions as US citizens.

If you are a foreign investor concerned about paying double taxes on your US real estate income in both the US and your home country, rest assured that the US has tax treaties with many countries to prevent double taxation.

Additionally, foreign buyers are eligible for all the deductions available to US citizens, which can help reduce their tax liabilities.

FIRPTA (Foreign Investment in Real Property Tax Act)

Under FIRTPA (Foreign Investment in Real Property Tax Act), when a non-resident foreigner sells US real estate, a portion of the sale proceeds (usually 10%-15%) must be withheld by the buyer at closing and remitted to the IRS.

This isn’t an additional tax but a prepayment towards any potential capital gains tax liability.

Foreign buyers will be entitled to a refund based on the actual capital gains tax rate (the same as that of US citizens) when they file their tax returns.

You can avoid capital gains tax implications with a 1031 exchange.

Avoid Capital Gains Tax with a 1031 Exchange

A 1031 exchange enables foreign real estate investors in the US to avoid paying capital gains tax on profits from selling a property if they reinvest that money in the purchase of another similar property. This helps them keep more money to invest and grow their property holdings in the US.

You are all set to start your US real estate journey now!

Start Your Home Buying Journey in the US Today

Buying property in the US as a foreign national often comes with practical challenges, from financing without a US credit history to completing transactions remotely while managing cross-border requirements.

That’s where HomeAbroad comes in. We’re a one-stop PropTech and FinTech platform designed to simplify the US home-buying process for international real estate investors. From tailored foreign national mortgages to our AI-driven investment property search platform and a network of 500+ expert agents, we’ve designed everything around your unique needs.

Beyond financing and property selection, HomeAbroad coordinates key setup steps such as LLC structuring guidance, US bank account setup, insurance, and other essentials that help foreign buyers operate smoothly in the US real estate market.

HomeAbroad is here to empower global investors like you with the tools, expertise, and support to succeed in the US real estate market.

Apply to start your US real estate journey with HomeAbroad today and get pre-approved for a foreign national mortgage.

Frequently Asked Questions (FAQs)

Can you buy a house in the US with foreign income?

Yes, you can! There are no restrictions on the source of your funds for purchasing property in the US. Whether your income comes from within the US or abroad, you can use it to buy a house.

Can you purchase a house in the US without a green card?

Yes, you don’t need a green card or specific visa to buy property in the US. Your foreign citizenship and immigration status do not prevent you from owning real estate.

Can I get a green card or residency if I buy property in the US?

Unfortunately, buying property in the US alone won’t directly qualify you for a green card or residency. There are specific investment visa programs (EB-5), but more than buying a house is typically needed.

Can a foreign national buy land in the US?

Yes, foreign investors can purchase US land, such as a house. There are no legal barriers to this.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2025 International Transactions in U.S. Residential Real Estate

IRS: FIRPTA Withholding

![Can Foreigners Buy Property in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS-500x325.jpg)

![How to Buy a House on an H1B Visa [2026]](https://homeabroadinc.com/wp-content/uploads/2021/08/BuyingonH1BVisa-scaled.jpg)