Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways

1. H1B visa holders can legally buy and own rental property in the US.

2. H1B visa holders are eligible to secure a Mortgage even without a US credit history.

3. HomeAbroad simplifies the process by offering tailored mortgage options for the unique needs of H1B visa Holders.

Non-immigrant visa holders accounted for 56% of foreign buyers in the US real estate market in 2025. (Source: NAR)

This highlights that investing in US real estate is not only possible but also a powerful way to build wealth and generate passive income, thanks to strong property appreciation and rental yields.

This guide covers the feasibility of real estate investment on an H-1B visa, mortgage options, tax implications, and a case study of an H-1B visa holder earning $800 per month after mortgage payments.

Table of Contents

Why Should an H1B Visa Holder Buy a Rental Property?

Investing in rental property can be a smart financial move for H1B visa holders, offering long-term wealth-building opportunities and passive income. Here’s why:

Real estate typically appreciates over time. Even though H-1 B visa holders might be unsure about their long-term plans in the US, this property appreciation can lead to significant capital gains, benefiting their long-term wealth-building.

Real estate ownership offers several tax advantages, including deductions for mortgage interest, property taxes, and depreciation. These tax benefits are beneficial for non-resident investors, as they can help offset US tax liability.

Rental properties provide a reliable source of income. With proper management, H-1B visa holders can generate a steady cash flow from tenants, adding a consistent income stream to their portfolio.

The US real estate market continues to grow, with strong demand across various regions. Over the past five years, rent has increased by approximately 6% annually (source: Zillow), reflecting the continued demand for rental properties. Expanding markets can offer excellent long-term returns as property values appreciate and demand for rental units rises.

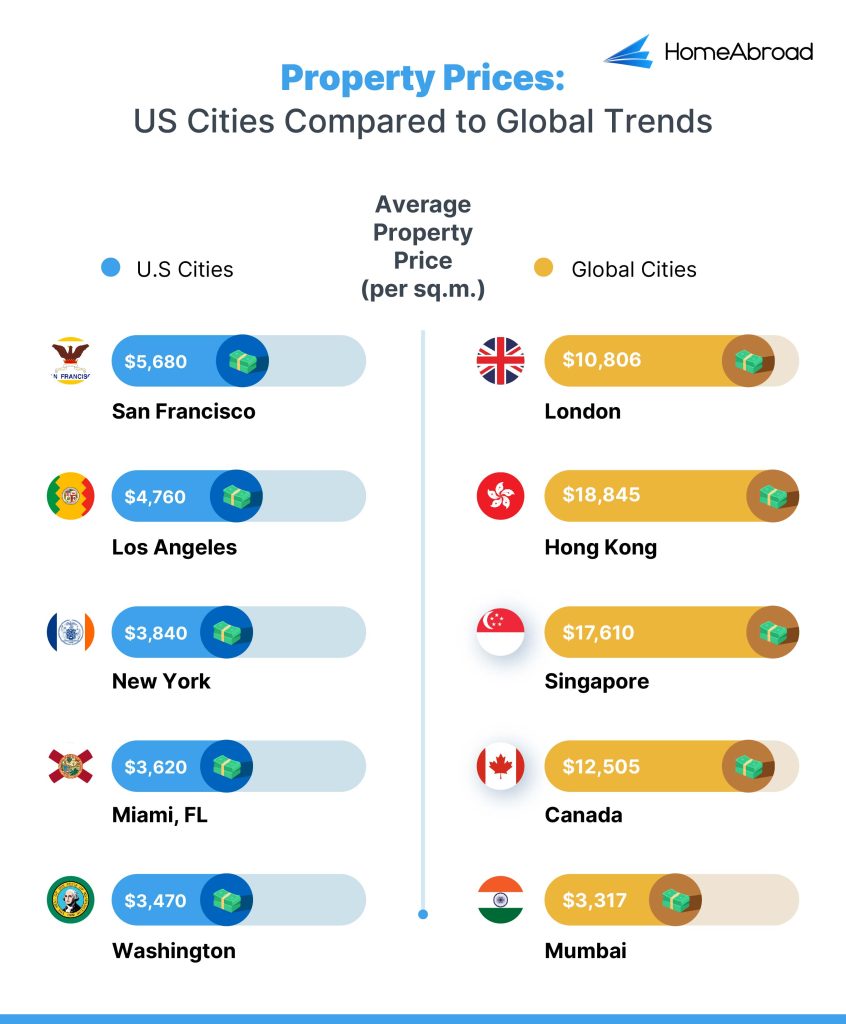

Compared to many other countries, the US offers relatively affordable housing, making real estate investment more accessible.

Here’s a comparison of major US cities with global cities:

At HomeAbroad, we help H1B visa holders maximize these benefits by offering tailored mortgage options and expert guidance to ensure a seamless investment process.

I recently worked with an H1B visa holder who wanted to generate passive income while working in the US. He found a high-rental-yield property but wasn’t sure how to secure financing as a visa holder. I guided him through the mortgage process and helped him secure a loan. Now, he is earning steady rental income while building equity in his own property.

Whether you want to buy a long-term or short-term rental on Airbnb or HomeAbroad, securing a mortgage for real estate investment in the US is easy and accessible.

Buying rental property is one of the most innovative ways to build long-term wealth. If you’d like to learn about smart moves that can help you score your first million, check out this podcast episode:

Mortgage Options for H1B Visa Holders

H-1 B visa holders can finance rental property purchases in the US through various H-1 B visa mortgage options. Whether or not you have a US credit history, there are loan programs designed to meet your investment goals. Here’s a breakdown of mortgage options based on your credit profile.

Mortgage Options without US Credit History

One of the best mortgage options for rental properties is the DSCR (Debt Service Coverage Ratio) Loan. This loan is approved based on the property’s rental income rather than the borrower’s personal income, making it ideal for H1B visa holders.

Here are the Key Requirements of a DSCR Loan:

Features | Requirements |

|---|---|

DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage |

Credit Score | No US credit needed |

Down Payment | 25% |

LTV Ratio | Up to 75% for Purchase and Rate/Term Refinance, up to 70% for Cash Out Refinance |

Cash Reserves | 6 months |

Property Use | Investment properties (residential and commercial) |

Loan Amount | >=$100K – $10M |

With years of experience assisting H1B visa holders and global investors, HomeAbroad specializes in tailored DSCR loans. Our expertise ensures a seamless mortgage process without requiring a US credit history, making property investment more accessible.

We also offer other mortgage options, including Full Documentation Loan, Fix-and-Flip Loan, and Bridge Loan. You can explore all Foreign National Mortgage options here.

Mortgage Option with US Credit History

If you have an established US credit history, you may also qualify for:

1. Conventional Loans:

These loans usually require a minimum credit score of 620 and proof of stable income. Conventional loan offers competitive interest rates and lower down payments. Best suited for borrowers with a strong financial profile.

FHA loans used to be accessible for H1B visa holders because of their lower down payment and more flexible credit score requirements. Many investors also used them for “house hacking” by purchasing a multi-unit property, living in one unit, and renting out the others.

However, under new regulations effective May 25, 2025, FHA has removed eligibility for non-permanent resident borrowers. Unless your case number was issued before this date, H1B visa holders can no longer apply for new FHA loans.

Conventional loans are a solid choice if you have a substantial personal income to qualify. But if you already have a home loan, a higher debt-to-income (DTI) ratio can make approval challenging. This is where DSCR loans help, as they qualify you based on your property’s rental income rather than your personal income.

Tax Implications for H1B Visa Holders

As an H1B visa holder, you will be subject to the same tax laws as US citizens when it comes to owning and renting out property. There are no additional taxes or special requirements for H1B holders investing in US real estate.

You can take advantage of tax deductions on rental property expenses such as mortgage interest, property taxes, and maintenance costs, which can help reduce your taxable rental income.

If you sell the property for a profit, then you may have to pay capital gain tax on the difference between the sale price and your purchase price.

Understand all the tax implications with our complete tax guide for foreign real estate investors.

Case Study: How an H1B Visa Holder Successfully Purchased a Rental Property

Andrew, a software engineer from the UK, moved to the US on an H1B visa and wanted to invest in US rental properties. Like many H1B visa holders, he was initially unsure about his eligibility and the process of buying property in the US.

While exploring his options, he connected with HomeAbroad, which guided him through the mortgage process and helped him secure a DSCR loan. Let’s see how his investment worked out.

Property details:

Location: Florida

Property Value: $350,000

Monthly Rent: $2,958

Loan Details:

Loan Amount: $ 262,500

Down Payment: $87,500 (25%)

Monthly PITIA: $2,100

DSCR Calculation:

DSCR = Gross Rental Income / PITIA

DSCR = $2,958 / $2,100

DSCR = 1.41

With a DSCR of 1.41, this investment is profitable. The monthly rental income not only covers the mortgage payment but also generates a positive cash flow of $858 for Andrew.

With HomeAbroad’s tailored mortgage solutions and expert guidance, H1B visa holders like Andrew can easily finance their real estate investments. Let’s see how you can secure a mortgage and start your real estate investment journey with HomeAbroad.

Steps to Apply for an H1B Visa Mortgage

At HomeAbroad, we’ve streamlined the H1B visa mortgage application process to ensure a smooth, hassle-free experience, guiding you every step of the way.

Follow these steps to apply for an H1B visa mortgage and move closer to owning your investment property:

With HomeAbroad’s support, the journey to owning rental property as an H1B visa holder is transparent and manageable. Our goal is to make your real estate investment dreams a reality.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Managing Your Investment Property as an H1B Visa Holder

Owning a rental property as an H-1 B visa holder offers exciting opportunities, but effective management is key to ensuring a smooth, profitable investment.

Suppose you’re wondering how to manage a rental property while on an H1B visa. The good news is that property management companies can handle everything for you. This allows you to enjoy passive income without worrying about day-to-day operations.

What Does a Property Management Company Do?

A professional property management company takes care of:

- Tenant screening

- lease agreement

- Rent collection

- financial reporting

- Property maintenance and repairs

- Legal compliance and eviction handling

Why Use a Property Manager?

As an H-1 B visa holder, you may have work restrictions that prevent you from directly participating in rental operations. Hiring a property manager ensures that your investment remains legally compliant while maximizing returns.

With professional management in place, you can build wealth through real estate without adding extra responsibilities to your already busy schedule.

Buy a Rental Property on an H-1B Visa with HomeAbroad

H-1B visa holders can easily buy an investment property, but finding a high-yield property, securing financing, and managing it can be challenging.

HomeAbroad simplifies the process with a one-stop solution tailored for H-1B visa holders. We offer specialized mortgage programs, an AI-driven investment property search platform, expert guidance, and property management services, all under one roof.

Start your investment journey with HomeAbroad and secure the best opportunities today!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

Frequently Asked Questions

Can an H1B invest in Airbnb?

A: Yes, an H1B visa holder can invest in an Airbnb property. No restrictions prevent H-1 B visa holders from owning and renting properties on platforms like Airbnb.

Can an H1B own an LLC?

A. Yes, H1B visa holders are eligible to form an LLC and can be owned by one or more individuals who are either citizens of the United States or foreign nationals living in the US.

Guide: Buying a House with an LLC

What happens to my property if my H1B visa status changes?

A. If your H1B visa status changes or expires, it doesn’t affect your ownership of the property. You can still retain ownership, rent it out, or sell it.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024-international-transactions-in-us-residential-real-estate-report

![How to Buy a House on an H1B Visa [2026]](https://homeabroadinc.com/wp-content/uploads/2021/08/BuyingonH1BVisa-scaled.jpg)

![H1B Visa Mortgages: How to Qualify with No US Credit? [2026]](https://homeabroadinc.com/wp-content/uploads/2024/09/h1b-visa-mortgages.png)