Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

If you’re thinking about making a move to the Washington DC area, you’re not alone. The Nation’s Capital is a popular destination for people from all over the country (and even the world). But before you pack your bags and start searching for your new home, it’s important to understand the local housing market.

When it comes to the latest insights into the Washington DC housing market, you’ve come to the right place. In this blog post, we’ll take a look at the current state of the Washington DC housing market using numbers and statistics

We’ll give you a number-based guide to the Washington DC housing market – from mortgage rates, median price, home sales, listings, and demand. We’ll also explore recent trends in pricing, sales volume, and inventory levels to give you a comprehensive picture of what’s going on in this vibrant market.

So whether you’re just curious about the current state of affairs or buying a home for the first time or you’re an experienced investor scouting for business, read on for everything you need to know about the Washington DC housing market!

Table of Contents

An Overview of the Washington DC Housing Market

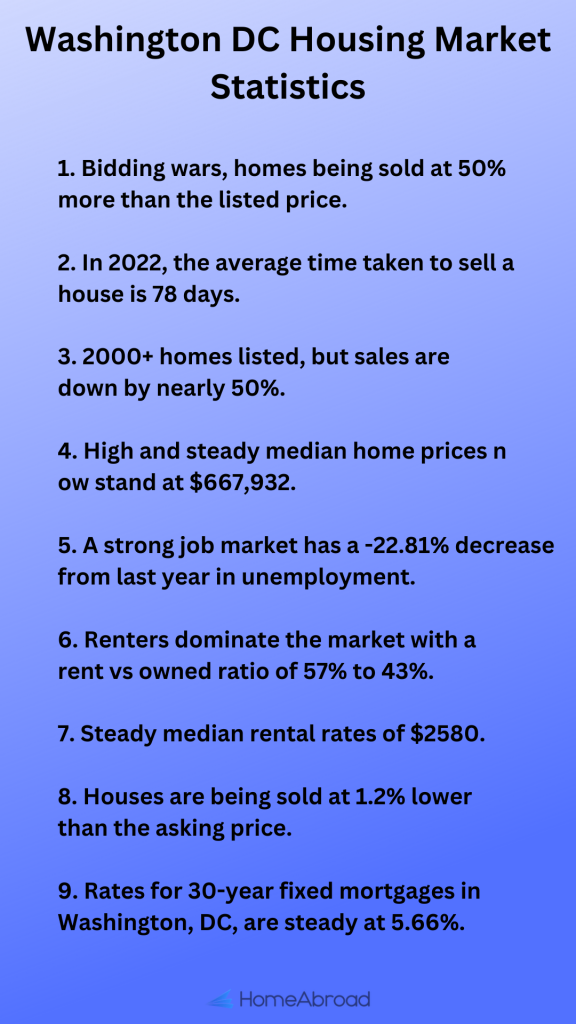

Following are some numbers that will give you a sense of how the Washington DC housing market has evolved in recent years:

1) Bidding wars, homes being sold at 50% more than the listed price.

Right in early 2022, the Washington DC housing market witnessed an unbelievable surge for more than two years. It was subject to more people entering the market both as sellers and buyers, leading to bidding wars and rapidly rising mortgage rates. Homes were being sold at 50% more than the listed price.

2) In 2022, the average time taken to sell a house is 78 days.

However, since that initial boom, the market has balanced more or less. The prices are still rising but at a steady rate. Now, the situation of the market has changed. The high prices have priced out most of the other buyers, and now people are looking for homes that haven’t sold in weeks. Buyers can now take the liberty of picking their house after serious consideration and negotiations.

From listing to closing, the average time to sell a house in Washington, D.C. was around 78 days in 2022. The normal 35-day closing period is added to the 43 days it takes to receive an offer.

3) 2000+ homes listed but sales are down by nearly 50%.

There are more than 2000 homes listed for sale in Washington, DC. The inventory is filled with properties starting at prices of $15K and going all the way up to $19.5 million.

Moreover, the number of home sales has dramatically decreased over the past year, which means there has been much less competition amidst higher rates in 2022. There were 444 homes sold in December 2022, down from 881 the previous year.

The Current State of the Washington DC Housing Market

It is important to note the median home prices, rental yields, job market conditions, etc before jumping into the housing market in Washington DC:

4) High and steady median home prices now stand at $667,932.

The median home price in Washington, DC has seen a swift rise over the past decade as its economy and population have both seen significant growth. Although it has seen fluctuations post-Covid and the prices have very slightly dipped as of January 2023.

According to Zillow, the prices now stand at $667,932. This could be great news for potential buyers who now don’t have to battle against steep median prices and may find themselves with some relief.

The higher mortgage rates may turn away some, but that also means that some of the best properties in the inventory are now freed up to buy, without jumping into bidding wars and exorbitant prices.

5) A strong job market has a -22.81% decrease from last year in unemployment.

The D.C. metropolitan area has a diverse and robust economy, which is driving population growth and demand for housing.

The unemployment rate as of November 2022, is 4.40%, a -22.81% decrease compared to last year, which indicates immense growth and numerous employment opportunities for potential residents.

6) Renters dominate the market with a rent vs owned ratio of 57% to 43%.

The tendency for the housing market in Washington dc is to gravitate towards a market where people prefer to rent their houses instead of buying or living in as homeowners.

The rent versus owned ratio is 57% to 43%. This means that you, as an investor, have lucrative rental opportunities at your disposal f you tap into this market.

7) Steady median rental rates of $2580.

With average rental rates currently sitting steady at $2,580 per month, renters can rest assured knowing that they can still get into a decent living situation relatively easily.

Things to Note as a Buyer

It is important to understand your options when you enter the market. This is why the sale-to-list price and mortgage rates are crucial to know, as they can help you gain the upper hand as a buyer.

8) Houses are being sold at 1.2% lower than the asking price.

The sale-to-list price is important to note because it tells you the selling trend of the market.

In Washington DC the houses are being sold at 1.2% below the asking price on average. The ratio is 98.8% (As of December 2022). This means you can successfully bargain for a cheaper price than one asked for.

9) Rates for 30-year fixed mortgages in Washington, DC, are steady at 5.66%.

In Washington, DC, the average 30-year fixed mortgage rate is currently constant at 5.66%. Mortgage rates in Washington, DC are currently 32 basis points less than the 5.98% national average.

The average Washington, DC mortgage interest rate for the upcoming week is 5.61%, which is a 5 basis point increase from January 23, 2023.

Additionally, the average rate for a 15-year fixed mortgage in Washington, DC is currently 4.67%, and the average rate for a 5-year ARM is currently 5.70%.

Why Should You Buy a House in Washington, DC?

Washington, DC, is an amazing place to buy a house. The city is bustling and people-friendly. The city has something for everyone, from cozy apartments to luxurious single-family homes. And with so many different vibrant neighbourhoods to choose from, you’re sure to find the perfect place to call home.

Now compared to last year, the market is at a stage where the prices are becoming steady and even dipping. The prospects are very positive for the market in 2023 – as mortgage rates continue to fluctuate, this may lead to more buyers entering the enter the market in search of better deals and less competition.

The shifting dynamics of the housing market will give buyers some leverage they haven’t had in a long time. As house sales have slowed, the inventory has become available for sale in the Washington area, giving buyers additional options.

Fewer buyers will be competing, giving buyers more time to decide. They can now request and receive concessions like a home inspection, house appraisal, and even a home sale contingency that were unheard of just a year ago.

At the turn of the year, the prices have started to dip slightly, which means this is the best time to swoop in and get your dream with minimal competition and comparatively lower prices.

Conclusion

To dive into the Washington DC housing market, it is important to do research, know which neighbourhoods fit your needs, and find professional help.

Buying now can also ensure taking advantage of the market before it’s too late; not only will you have a valuable property, but also you’ll be able to enjoy all the city has to offer.

Partnering with experienced professionals such as lawyers and real estate agents can also assist in navigating the process. HomeAbroad can connect you with an expert real estate agent and mortgage lenders to aid you in your home search. Contact us today to get started.

Find the best real estate agent and mortgage lender with international expertise.

Connect with a local international real estate agent and mortgage lender

Frequently Asked Questions

Q1. Is it a good time to buy an apartment in DC?

A1. Yes, now is a great time to buy an apartment in DC, as prices are slowly decreasing and there is less competition.

Q2. Is buying in DC a good investment?

A2. Yes, buying in DC is a great investment as the market is slowly stabilizing, and prices are decreasing. Additionally, you get to enjoy all that the US capital has to offer, making it an attractive option for those looking to buy or rent property in DC.

Q3. Is the Washington housing market slowing down?

A3. Yes, the Washington housing market is slowing down with fewer buyers competing and more options available for sale in the city. This is expected to continue into 2023, giving buyers some leverage they haven’t had in a long time. However, prices are still relatively high so it is important to do your research before investing.

Q4. Will housing prices drop in DC?

A4. Housing prices have already started to drop slightly in DC, and it is expected that they will continue to dip into 2023. With HomeAbroad’s help, you can find an expert agent who can help guide you through the process of buying a home at the best possible price. Additionally, mortgage rates are fluctuating, so it’s important to stay informed about the latest market trends.

Q5. Is DC a good place to buy a home?

A5. Yes, DC is an excellent place to buy a home. With so many vibrant neighbourhoods to choose from, you’re sure to find the perfect place to call home. Plus, with mortgage rates still relatively low and housing prices starting to drop slightly, this is the best time to make your move.

Q6. Is moving to DC worth it?

A6. Absolutely! DC is a great place to live, with so much to do, from the many museums and national monuments to the diverse neighbourhoods and vibrant nightlife. Plus, you’ll have access to one of the best schools in the country and a booming job market. All of these factors make DC an attractive option for those looking to buy or rent a property. So don’t wait – start your search today!

Q7. Is it expensive to buy a house in DC?

A7. Yes, it is expensive. The median home price in DC is 50 times more than that of the national average. The median home price in the US is $428,700, while the median home price in DC is $667,932.v

Q8. How much is a square foot in DC?

A8. The median price per square foot in DC is $514.

![Washington DC Housing Market: 9 Key Statistics [2023]](https://homeabroadinc.com/wp-content/uploads/2023/02/Washington-DC-Housing-Market-500x343.jpg)