Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

The US real estate market has experienced significant growth in recent years, with home prices steadily rising and showing no signs of slowing down. Despite being a vast market, the US still offers relatively lower house prices compared to other countries like the UK, India, China, and Canada. This presents a compelling reason for foreign investors to consider investing in US real estate.

When buying a home in the USA as a foreign investor, one crucial factor that takes precedence is the location. It is essential to choose a location that promises decent value appreciation, ensuring substantial profits whether you decide to reside in the property or rent it out. To guide you in making a well-informed investment decision, we have meticulously compiled a list of the top 10 places to buy a house in the US in 2023.

Table of Contents

Unveil the latest trends and shifts in the housing market with our comprehensive table. Get a clear breakdown of data points and year-over-year comparisons, empowering you to make informed decisions whether you’re an investor or a first-time buyer.

Top 10 Places to Buy a House in the USA for Foreign Investors!

1. Atlanta, Georgia

Atlanta, Georgia, has secured its position as one of the prime locations for real estate investment in the United States. The city is experiencing significant population growth, creating a robust demand for housing. As a result of various factors, Atlanta stands out as the top choice for investors in the current market.

- In Atlanta, real estate market displays some interesting trends. In Atlanta, the median home price is $439,000, and the average home price is $388,434. There’s been a slight 2.2% YoY decrease in the median listing price, but active listings have increased by 9.5%, indicating a healthy market activity.

- The data reveals that homes in Atlanta have been spending an average of 40 days on the market before getting sold, and there have been short median days on the market year over year, indicating a quicker pace of sales compared to the previous period, with a difference of 13 days.

- Additional data suggests that on May 31, 2023, the median sale-to-list ratio was 0.997, indicating that homes were selling close to their listed prices.

- Overall, Atlanta’s real estate market appears to be dynamic and active, with a mix of opportunities for both buyers and sellers. Although there was a slight dip in median listing price YoY, the increasing active listing count and short median days on market indicate a resilient and potentially lucrative market for investors and home – buyers alike.

Atlanta’s Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Midtown, Buck Head, Old Fourth Ward, Pine Hills, East Atlanta, Vine City

Reasons to Invest:

- Booming job market with major corporations and tech startups.

- Affordable cost of living compared to other major cities.

- Diverse cultural scene and vibrant entertainment options.

- Atlanta’s market with a predicted population of 8 million by 2040, making it one of the 10 most productive states in GDP contribution.

2. Austin, Texas

Austin’s housing market is on a promising upswing, driven by limited supply, high demand, and rising property prices. Major corporations like Tesla, Samsung, and Apple are fueling the boom by taking advantage of tax cuts and establishing offices in the city.

- Over the past decade, Austin has expanded by a remarkable 30%, partly thanks to the infusion of tech firms and the flourishing semiconductor and software industries in the region. This progressive and eccentric city has become a hub of innovation and opportunity.

- A testament to Austin’s economic strength is its unemployment rate, standing at an impressive 4.2%, significantly lower than the national average.

- In Austin, the median home price is $580,000, with a $567,225 average price, and a 6.8% YoY decrease in median listing price; active listings increased by 47.8% YoY, while new listings declined by 31.1% YoY. Properties spend 45 days on the market on average, with a slight increase Y-Y, taking 25 days longer to sell.

- In conclusion, Austin’s housing market is an attractive and promising investment opportunity, driven by robust economic factors, corporate interest, and a thriving tech ecosystem. Despite some fluctuations in specific metrics, the overall trajectory points to a favorable outlook for the city’s real estate market.

Austin Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Taylor, Buda, Downtown, Zilker, East Austin and South Congress

Reasons to Invest:

- Strong tech industry presence and a hub for innovation.

- Lively music and arts scene, attracting young professionals.

- Attractive climate and outdoor activities.

- Tax-friendly city, ideal for foreign investors to establish or expand ventures.

3. Charlotte, North Carolina

Charlotte’s flourishing financial and tech sectors have spurred significant job growth. Low property taxes also make it a more accessible and attractive option compared to other IT clusters, solidifying Charlotte’s position as one of the best places to buy a house in the US.

- The Charlotte region is projected to experience a remarkable 50% growth by 2050, with the suburban York and Lancaster counties expected to witness the most substantial surge in real estate sales

- In the last 12 months, the Charlotte region added 75,491 jobs, with the fastest growth in transportation, finance, insurance, and real estate. North Carolina is projected to generate 300,000 new jobs by 2028, with Charlotte and Raleigh leading the way.

- Charlotte’s housing market is showing signs of stability and growth, with a median home price of $441,000 and an average home price of $383,460.

- Over the past year, there has been a slight increase of 0.1% in the median listing price, while the active listing count has seen a notable YoY rise of 10.4%.

- Charlotte’s housing market is highly competitive, with a median day on market of 38 days (down by 12 days YoY) and homes going pending in just six days, showcasing strong demand despite a marginal 1.2% decrease in average home value over the past year and a 34.9% decline in new listings compared to the previous year.

Overall, Charlotte’s housing market appears to be on a positive trajectory with strong demand and quick turnover of properties. The balance between sale prices and listing prices, along with the decreasing days on market, makes it an attractive destination for real estate investors and homebuyers alike.

Charlotte Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Uptown, Dilworth, North Davidson, Myers Park, Ballantyne, SouthPark, Elizabeth

Reasons to Invest:

- Rapid economic growth and job opportunities.

- Favorable business environment for startups and entrepreneurs.

- High quality of life with good schools and healthcare facilities.

- Lucrative investment opportunity.

4. Dallas / Fort Worth, Texas

Dallas has a diverse economy with job opportunities for all income levels, making it economically robust. Renting is more affordable than buying, and the demand for rental properties has surged, resulting in a lower rate of home ownership in the city.

- The new report reinforces the earlier survey’s prediction that DFW has the potential to become the largest metro area by the year 2100.

- Dallas’ housing market experiences fluctuations with a median home price of $473,000 and an average home price of $311,880, showing a 3.5% decrease in median listing price YoY, but active listings increase by 30.1%; homes sell quickly with a median of 36 days on the market, 14 days less YoY.

- Dallas’ average home value is $311,880, with a 1.7% decrease over the past year. Homes go pending in just nine days, reflecting high demand, with a median sale-to-list ratio of 0.997, offering competitive pricing and opportunities for buyers with 32.2% of sales over the list price and 48.4% under.

Dallas’s real estate market is vibrant and diverse, presenting both challenges and advantages for buyers and sellers. Despite slight decreases in home value and listing prices, the swift sales pace and increasing active listings make it a competitive and attractive market for investors and home buyers.

Dallas Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Uptown Dallas, Highland Park, Southlake, Oak Lawn, Deep Ellum

Reasons to Invest:

- Diverse economy with strong sectors like energy, finance, and technology.

- Low cost of living and affordable real estate options.

- Great shopping, dining, and cultural attractions.

- Business-Friendly Environment with Low Taxes.

5. Denver, Colorado

Denver, Colorado, ranks among the top 10 cities in the nation to live in, offering diverse attractions for all ages throughout the year. It’s an ideal destination for locals, tourists, and newcomers, with plenty of family-friendly activities to enjoy.

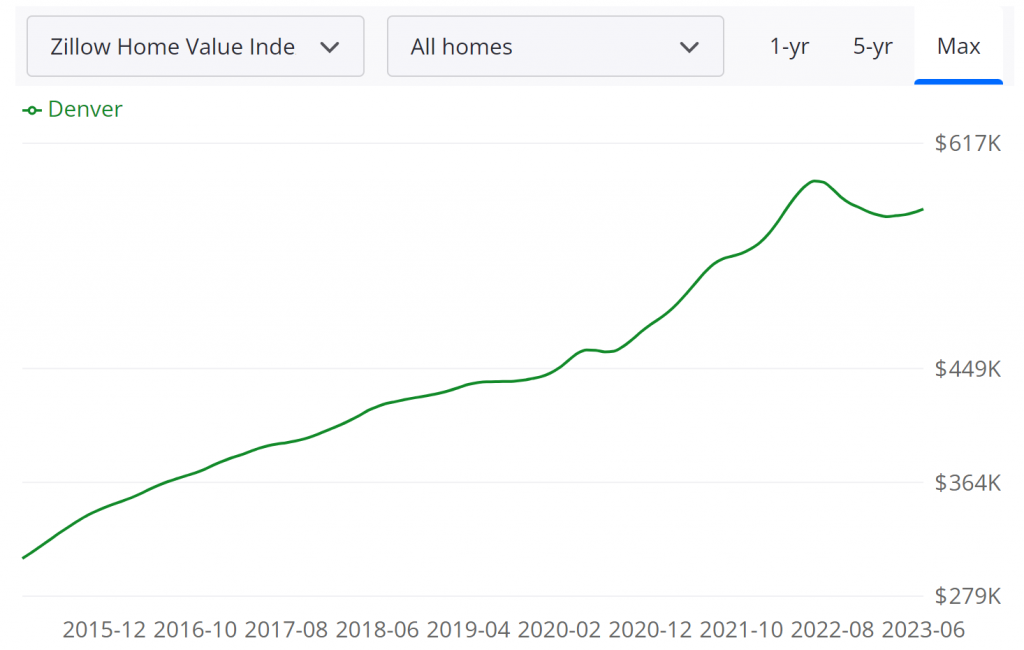

- Denver’s real estate market reflects stability and moderate fluctuations, with a median home price of $680,000 and an average home price of $568,728. Over the past year, there has been no significant change in the median listing price, while active listings have seen a healthy YoY increase of 6.1%, albeit new listings have decreased by 26.1%.

- In Denver, homes sell swiftly, with a median of 29 days on the market (improved by 13 days YoY), and despite a 3.5% decline in average home price over the past year, they go pending in just seven days, demonstrating strong demand and buyer competition.

- The median sale-to-list ratio of 1.000 suggests that homes are typically selling for their listed prices. Moreover, approximately 43.0% of sales were made over the list price, indicating a competitive market, while 36.8% of sales were under the list price, providing opportunities for buyers to find favorable deals.

In conclusion, Denver’s housing market showcases stability, with a mix of positive trends such as increasing active listings and swift sales pace, despite slight declines in home value and new listings. The competitive market and attractive median sale-to-list ratio make it an appealing destination for both investors and home buyers alike.

Denver Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

LoDo (Lower Downtown), Cherry Creek, Highlands, Capitol Hill, Highlands, Washington Park,

Reasons to Invest:

- Strong Real Estate Market with Appreciation Potential.

- Thriving outdoor culture with access to skiing, hiking, and biking.

- Growing tech and aerospace industries.

- High demand for rental properties due to a young population.

- Business-Friendly Environment and Low Taxes.

6. Houston, Texas

Houston, Texas, the largest city in the state and fourth largest in the US, boasts a multicultural community and strong economy, driven by key sectors like energy, healthcare, and transportation.

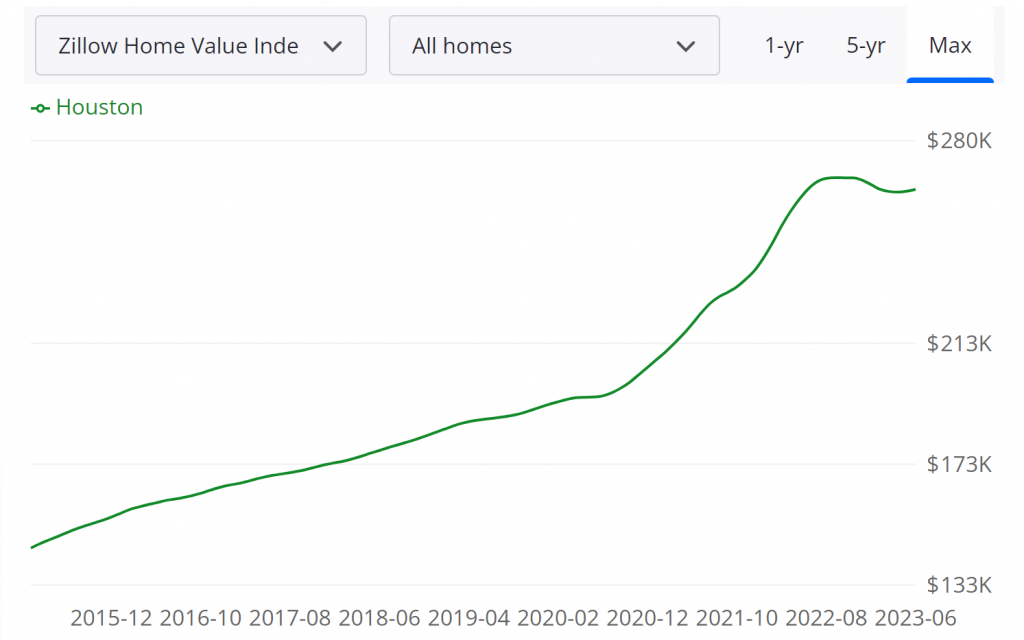

- Houston’s real estate market reflects a mix of fluctuations, with a median home price of $379,000 and an average home price of $264,540. Compared to the previous year, there has been a slight decline of 5.1% in the median listing price, while active listings have notably increased by 23.6%, though new listings decreased by 20.9%.

- Houston homes sell swiftly with a median of 40 days on the market (down 9 days YoY), and the average value is $264,540, slightly declining by 0.1% over the year. Homes go pending in just 13 days, demonstrating high demand and buyer competition.

- The median sale-to-list ratio of 0.989 indicates homes selling close to their listed prices, with approximately 23.9% above and 56.4% below, offering favorable deals for buyers.

- Overall, Houston’s housing market exhibits a dynamic landscape, with varied trends in pricing and sales activity. Despite slight declines in home value and listing prices, the swift pace of sales and increasing active listings point to a market that remains competitive and appealing for investors and home buyers.

Houston Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Montrose, The Heights, Rice Village, River Oaks, Memorial, West University

Reasons to Invest:

- Strong job market in oil and gas, healthcare, and aerospace.

- Affordable real estate and no state income tax.

- Rich culinary and cultural scene.

- Pro-Business Environment

- Diverse and Growing Population.

7. Las Vegas, Nevada

Las Vegas’ market has experienced turbulence, facing one of the country’s most severe downturns during the Great Recession. Nevertheless, its resurgence has been rapid, fueled by various factors such as a low cost of living, no state taxes, and a diverse economic landscape.

- Las Vegas’ housing market showcases a mixed trend, with a median home price of $410,000 and an average home price of $395,715. Compared to the previous year, there has been a slight decline of 2.7% in the median listing price, while active listings decreased by 5.71%, and new listings saw a significant drop of 44.0%.

- Homes in Las Vegas spend a median of 30 days on the market, showing a YoY increase of 16 days, reflecting a relatively steady sales pace.

- The average home value currently stands at $395,715, experiencing a notable decrease of 7.0% over the past year, yet homes are going pending in just 16 days, indicating strong demand and competition among buyers.

- The median sale-to-list ratio of 0.988 suggests that homes are generally selling close to their listed prices. Furthermore, approximately 21.5% of sales were made over the list price, highlighting a competitive market, while 59.0% of sales were under the list price, providing opportunities for buyers to find favorable deals.

In conclusion, Las Vegas’ real estate market presents a diverse landscape with fluctuations in pricing and sales activity. Despite a decline in average home value and new listings, the market remains competitive, offering opportunities for both buyers and sellers to navigate the real estate landscape.

Las Vegas Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Summerlin, Green Valley, Downtown Las Vegas, Henderson, The Lakes, Centennial Hills

Reasons to Invest:

- Booming tourism industry with a constant influx of visitors.

- No state income tax and affordable cost of living.

- Growing economy with diverse sectors.

- Real Estate Market with Potential Appreciation.

8. Orlando, Florida

Orlando, Florida’s largest inland city, is at the center of the Orlando metropolitan area with around 2.5 million residents. Known for Disneyworld, it’s conveniently located for travel to major cities like Miami and Daytona Beach, appealing to budget-conscious families and renters.

- Orlando’s diverse housing market features a median home price of $459,000 and an average home price of $371,300

- Although the median listing price declined by 1.2% YoY, active listings increased by 21.4%, while new listings decreased by 29.0%.

- Orlando homes spend a median of 46 days on the market, with a YoY increase of 18 days, showing a steady sales pace.

- The average home value is $371,300, rising modestly by 1.1% over the past year, and homes go pending in just 9 days, highlighting strong demand and buyer competition.

- The median sale-to-list ratio of 0.990 shows homes sell close to their listed prices. About 23.7% of sales were above the list price, highlighting a competitive market, while 55.7% were below, providing opportunities for favorable deals.

- In conclusion, Orlando’s real estate market demonstrates a dynamic environment with fluctuations in pricing and sales activity. Despite a slight decline in the median listing price, the market remains competitive, providing opportunities for both buyers and sellers to navigate the real estate landscape.

Orlando Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Lake Nona, Winter Park, Thornton Park, Baldwin Park, Dr. Phillips, College Park

Reasons to Invest:

- Tourism hotspot with world-renowned theme parks and attractions.

- Growing healthcare and tech industries.

- Warm climate and recreational opportunities.

- Favorable Real Estate Market for Investors.

- No State Income Tax in Florida.

- Family-Friendly Environment with Attractions.

9. Phoenix, Arizona

Phoenix, Arizona’s capital and largest city, known as the Valley of the Sun, offers diverse activities, from urban buzz to suburban tranquility, with sports, museums, and performing arts centers.

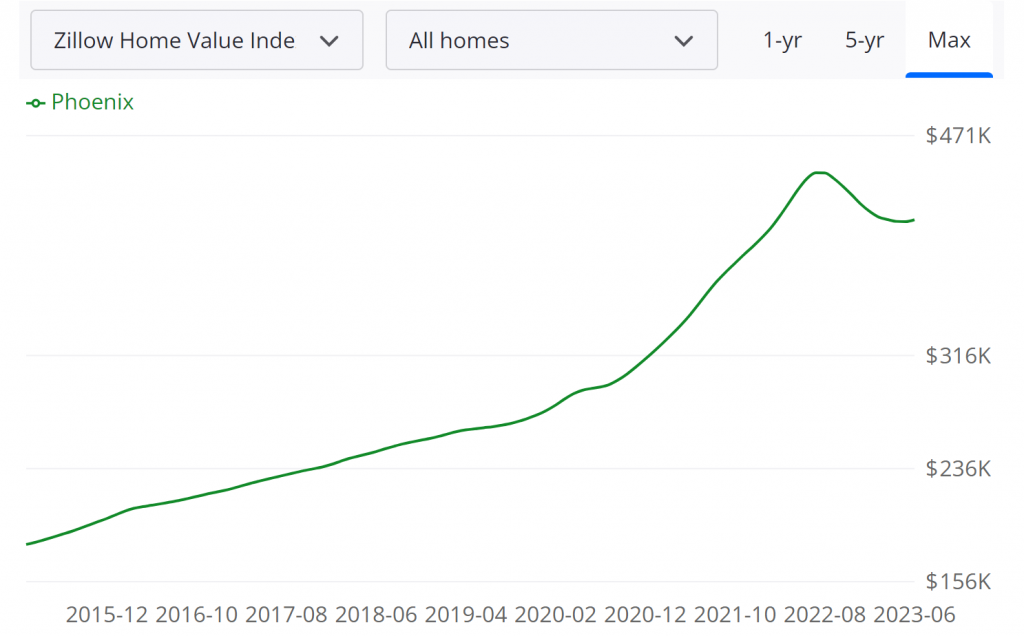

- Phoenix’s housing market has a median home price of $540,000 and an average home price of $412,402. Compared to the previous year, there’s been a slight 1.4% decline in the median listing price, a significant 16.0% decrease in active listings, and a substantial 47.8% drop in new listings.

- Phoenix homes spend 44 median days on market, with 21-day YoY increase. Avg. home value: $412,402, down 6.6% over a year, pending in 20 days—strong demand, buyer competition.

- The median sale-to-list ratio: 0.993, indicating close-to-list price sales. 22.3% sold above list, showcasing competitiveness, while 53.7% sold below, offering favorable deals.

In conclusion, Phoenix’s housing market presents fluctuations in pricing and sales activity. Despite a slight decline in the median listing price and average home value, the market remains competitive, offering potential opportunities for both buyers and sellers to navigate the real estate landscape.

Phoenix Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Scottsdale, Downtown Phoenix, Arcadia, Biltmore, North Central Phoenix, Ahwatukee Foothills, Encanto-Palm Croft, Roosevelt Row

Reasons to Invest:

- Rapid population growth and a strong real estate market.

- Sunny weather and a wide range of outdoor activities.

- Affordable housing compared to other major cities.

- Business-Friendly Environment with Tax Incentives.

- Diverse Cultural Scene and Outdoor Activities.

Check out Buying a Home In The U.S. Online – Step by Step Guide!

10. Portland, Oregon

Portland, Oregon, is drawing in young professionals who seek proximity to urban centers. With a thriving arts scene, delectable cuisine, and a plethora of outdoor activities, the city has become an enticing destination for those looking for an exciting and vibrant lifestyle.

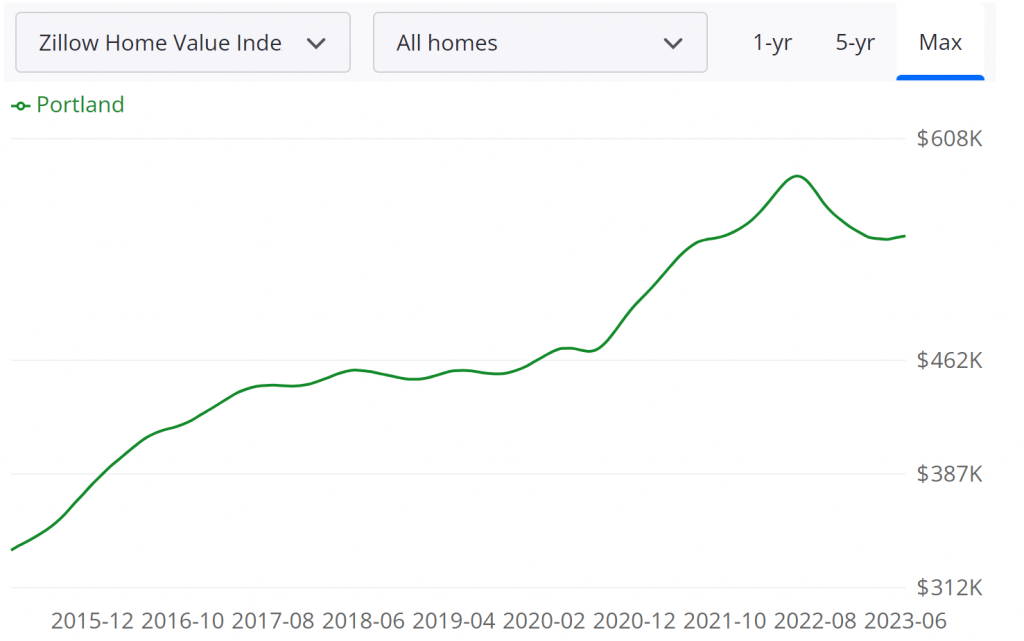

- In Portland, the real estate market has shown some interesting trends over the past year. The median home price currently stands at $640,000, with an average home price of $544,317. While the median listing price has experienced a year-on-year increase of 6.7%, the number of new listings has seen a significant decline of 25.1%. However, there has been a positive 8.1% year-on-year growth in active listings.

- When it comes to the pace of transactions, properties in Portland are selling relatively quickly, with a median days on market of 34. This figure has seen a 10-day decrease compared to the previous year, indicating a higher demand in the housing market.

- Looking at the sales dynamics, the median sale-to-list ratio on May 31, 2023, was 1.000, indicating that homes are selling at their list price. Furthermore, 48.5% of sales during the same period were made over the list price, demonstrating strong demand and potential bidding wars. On the other hand, 33.3% of sales were under the list price.

As of June 30, 2023, the median days to pending remained relatively low at 8 days, further emphasizing the speed at which properties are being snatched up by eager buyers in Portland’s real estate market.

Portland Top Neighborhoods and reasons to invest for Foreign Investors:

Popular Neighborhoods:

Pearl District, Alberta Arts District, Hawthorne, Northwest District, Mississippi, Sellwood-Moreland, Belmont

Reasons to Invest:

- Eco-friendly and progressive city attracting a diverse population.

- Strong tech industry and creative scene.

- Abundance of outdoor activities and beautiful scenery.

- Flourishing Tech Industry and Employment Opportunities.

- Thriving Arts and Culture Scene.

If you’re looking to invest in real estate, these are ten of the best places to do so in the United States. All of these cities are experiencing population and economic growth, which is driving up housing prices and making them excellent markets for sellers. So if you’re thinking of investing in real estate, keep these cities in mind.

What factors to consider when buying a home in the USA!

Real Estate Appreciation Potential

Real estate appreciation potential: Likelihood of property values increasing over time. High appreciation potential market attracts investors seeking significant returns. Factors contributing to appreciation potential:

- Location desirability

- Economic growth

- Development projects in the area.

Robust Job Market

- Robust job market indicates a healthy local economy with ample employment opportunities.

- Cities or regions with diverse industries and low unemployment rates are attractive to real estate investors.

- Track record of job growth enhances the appeal for investors.

- Strong job market creates stability and increases demand for housing, benefiting homeowners and renters alike.

Affordable Housing Options

Affordable housing options are vital for a thriving real estate market. Increased affordability enables a larger portion of the population to buy or rent homes. Leads to higher occupancy rates and a more stable market. Factors influencing affordable housing availability:

- Median income levels

- Housing supply

- Local housing policies.

Growing Population

- Rising population indicates higher demand for housing.

- An increased influx of people leads to higher demand for both home – ownership and rentals.

- Elevated demand drives up property values and rental rates.

- Attractive market for real estate investors seeking growth and potential profits.

Stable Real Estate Market Conditions

- Stable real estate market: Consistent and predictable price trends, moderate fluctuations, balanced supply, and demand.

- Instills confidence in investors, reducing the risk of drastic value drops or market crashes.

- Stability associated with well-regulated markets, sustainable growth, and prudent planning.

Tax Advantages

Tax advantages in real estate market:

- Tax breaks, incentives, or lower tax rates on property ownership, rental income, or capital gains.

Benefits impact an investor’s bottom line, increasing net income and overall returns on investment. Investors seek markets with favorable tax conditions to maximize profitability.

Business-Friendly Environment

- Business-friendly environment: Encourages and supports starting and operating businesses.

- Includes favorable regulations, access to resources, skilled workforce, and supportive infrastructure for commerce.

- A thriving business sector attracts job seekers and stimulates economic growth.

- Increased demand for real estate driven by economic growth and business activities

High Rental Demand

High rental demand: Significant need for rental properties in the market. Factors contributing to high rental demand:

- Large transient population

- Limited housing supply

- Strong job market attracting renters who prefer flexibility over homeownership.

Investors find markets with high rental demand appealing:

- Ensures a steady income stream

- Potentially higher rental rates.

Infrastructure Investment

- Infrastructure investment: Development and improvement of public facilities and services.

- Includes transportation systems, utilities, schools, healthcare facilities, and recreational amenities.

- Markets investing in infrastructure improvements signal growth and increased livability.

- Attracts residents and investors seeking areas with promising futures.

Appeal as a Tourist Destination

- The market’s appeal as a tourist destination indicates attractiveness to domestic and international visitors.

- Factors like natural beauty, historical significance, cultural events, or tourist attractions contribute to its allure.

- Creates opportunities for vacation rentals or short-term rentals.

- Investors may find potential in markets thriving with tourism, leading to higher rental income and property appreciation.

Considering these factors and their explanations can help investors and homebuyers assess and identify real estate markets that align with their goals and offer the potential for long-term growth and profitability.

Tips to Keep in Mind Before Investing in Real Estate.

1. Create a budget.

- Knowing your budget is crucial for buying the perfect property.

- Have a general concept of the final cost and the source of funds for the transaction (e.g., down payment or mortgage refinancing).

2. Recognize the intended use of the property.

- Real estate investment in the US offers reliable income and capital growth.

- Historically, real estate has been one of America’s best assets, making it a popular choice for international property buyers.

- Local economy and culture support a healthy work-life balance and are cost-effective.

- Pocket-friendly options attract investors and relocators looking for new homes.

3. Apply for a mortgage.

- If not purchasing the house outright with cash, foreign buyers will need to obtain a mortgage from a lending company.

- Mortgage application process may differ for foreign buyers compared to local buyers.

- Follow specific procedures and submit required paperwork to the lender and US authorities.

If you don’t have any US credit history, then refer to this guide to get a mortgage with a thin or no US credit.

4. Subtract expenses to pay U.S. taxes from income.

- File a tax return each tax year if you purchase property in the US.

- Real estate investors must decide whether to deduct expenses from revenue for favorable tax treatment from the IRS.

- Make the election selection on your tax return to benefit from deductions.

- Not filing tax returns or making the election results in automatic 30% charge on gross rental revenue.

- This can significantly lower profits as essential costs like depreciation, property taxes, repairs, and interest won’t be tax-deductible.

- Keep in mind that depreciation is a non-cash expense that can be written off, resulting in initial tax losses from your investment.

- Despite tax losses, filing the tax return is necessary to make the choice.

5 Avoid Paying Death Tax (Estate Tax)

- Total federal and state taxes in the US on inheritance may reach up to 46%.

- Foreign buyers only receive a $60,000 exemption, leading to a significant tax burden for heirs.

- Options to mitigate estate tax include purchasing property directly, using an LLC, or foreign corporation (with limitations).

- Another approach is acquiring affordable term life insurance to cover tax liabilities for heirs if needed.

- Estate tax avoidance is achievable with proper planning, allowing foreign nationals to invest in US real estate.

- Planning is crucial, and HomeAbroad can assist overseas clients in organizing transactions to reduce taxes.

6. CIPS Licensed Representatives

- Find an agent that has completed the Certified International Property Specialist (CIPS) program if you need assistance with your purchase.

- CIPS representatives are highly qualified for international real estate transactions due to their extensive training.

- HomeAbroad can help in selecting the best mortgage lender and connect you with CIPS Certified Real Estate Agents.

- Our team includes several CIPS-certified agents to streamline financing and buying processes.

- We are here to assist you at every step, from property selection to navigating overseas transaction complexities.

.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Still, Confused about Where to Buy?

- The US offers numerous real estate options for living or investment, each with distinct benefits.

- HomeAbroad’s team of professionals has extensive experience in assisting foreign buyers with US real estate purchases.

- Our CIPS Certified Professionals can handle every detail, considering your case, goals, and budget to find the best property.

- We can also connect you with the right lender for your US property mortgage.

Frequently Asked Questions

What is the best time to buy property in the USA?

The best time to buy property in the US varies depending on the market conditions in each city. For example, if you’re looking to buy in Miami, you might want to wait until the winter, when prices are typically lower.

Where is the cheapest state to buy a house in the USA?

The cheapest state to buy a house in the US is West Virginia, where the median home price is just $129,000. Other cheap affordable areas to buy a home include Arkansas, Ohio, and Oklahoma.

I’m not a US citizen. Can I still buy property in the US?

Yes, you can still buy property in the US as a foreigner. There are a few extra steps involved in the process, but our team of experts at HomeAbroad can help you navigate the process and find the perfect property for your needs.

What are the prospects for rental properties in the USA?

The prospects for rental properties in the USA are positive due to factors like changing preferences, economic growth, urbanization, and investment opportunities. However, market conditions can vary by location, and thorough research is necessary for successful rental property ownership.