Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. UK citizens can secure US mortgages with favorable terms through HomeAbroad, enabling smooth entry into the American real estate market.

2. Tailored mortgage options are available for both investment properties and primary residences, catering to diverse buyer needs.

3. HomeAbroad's streamlined application support ensures UK citizens can access the US mortgage process with ease and confidence.

“Every hundred feet the world changes.” ― Roberto Bolaño, 2666

In life and in real estate, this couldn’t be truer. Each country has its own unique real estate market and financial opportunities, and crossing the Atlantic takes that change to a whole new level.

For UK citizens, the US real estate market offers not just new horizons but also the chance to own a piece of the American dream.

Yet, the journey can seem daunting at first. Having worked with UK investors, we’ve seen the initial hesitations: “How do I get a mortgage to buy a house without a US credit history?” or “What’s the process even like?”

But with the right guidance and expertise from HomeAbroad, those doubts quickly transform into confidence.

This guide is your roadmap to going through those hundred feet and beyond, helping you secure a US mortgage with ease and invest like a pro.

Table of Contents

Can UK Citizens Get a Mortgage in the US?

Absolutely! UK citizens can secure a mortgage in the US to invest in US real estate, whether it’s a luxurious vacation home or an income-generating property.

You don’t need to be a US resident or have a green card to qualify for a mortgage. By using years of experience in foreign national mortgages, HomeAbroad ensures you get access to competitive mortgage products that align perfectly with your goals.

Now you know that getting a US mortgage as a UK citizen is entirely within reach, the next step is exploring the available loan options. Whether your goal is to invest in a rental property or purchase a primary residence, understanding your choices is key to making the right financial decision.

Investment or Primary Residence? Foreign Mortgage Options for UK Buyers

For UK citizens, US mortgage options are categorized based on the purpose of the property investment or primary residence. Each option is tailored to meet the unique needs of foreign buyers, and HomeAbroad ensures you have access to the best fit for your goals.

Let us look at them in detail:

Foreign National Mortgage Options for Investment Properties

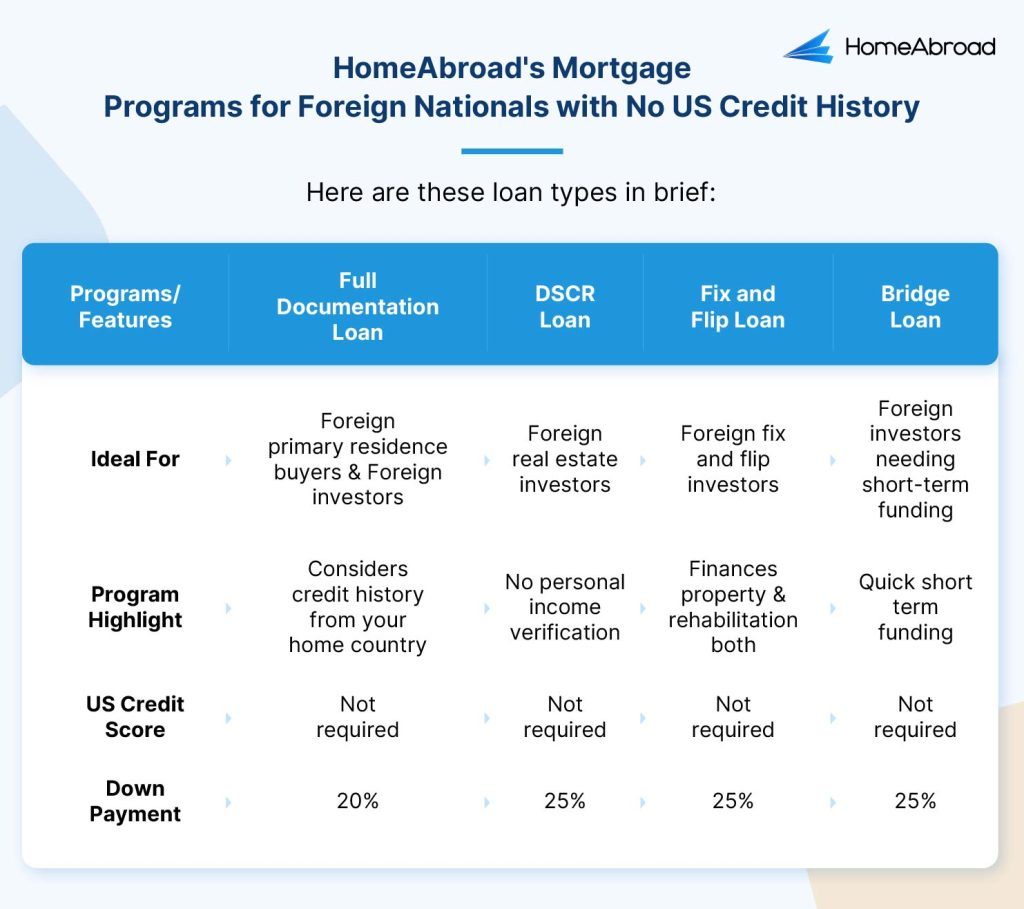

If you are a UK investor looking to invest in US real estate, these options are perfect for you, depending on your investment type. However, before we move to the details, here’s an overview of HomeAbroad’s investment mortgage programs:

1. DSCR (Debt Service Coverage Ratio) Loan

DSCR Loan evaluates the rental income potential of the property rather than the borrower’s personal income or credit history. This is an ideal foreign mortgage option for UK investors who want to purchase income-generating properties.

2. Fix and Flip Loan

Fix and Flip Loan is a short-term loan designed for investors who want to purchase, renovate, and resell properties quickly for a profit. This loan offers fast access to funds and flexible terms, making it ideal for high-return projects, particularly in emerging US markets like Philadelphia and San Jose, California.

3. Bridge Loan

A Bridge Loan is another short-term loan that provides immediate capital to secure properties while waiting for the sale of an existing asset. It is perfect for competitive markets where investors need to act quickly.

4. Full Documentation Loan

Full Documentation Loan is a comprehensive loan program for UK citizens purchasing vacation homes or rental properties, qualifying based on foreign income and assets. This mortgage program accepts international credit reports and bypasses the need for US credit history, offering quick approval within 30 days.

To know more about these loan programs and qualification criteria, check out HomeAbroad’s foreign national mortgage guide.

Foreign National Mortgage for Primary Residence

If you are a US newcomer on a visa buying a primary residence, and do not have a US credit history, this option is the best fit for you:

1. US Newcomer Mortgage

The newcomer mortgage program is a loan tailored for UK citizens who have recently moved to the US on a visa and want to buy primary residence.

With this loan program, you can qualify using your credit reports from the UK. It eliminates the need for a US credit score, making it accessible for newcomers purchasing a primary residence.

US Mortgages for UK Citizens with a Good Credit Score

If you have been in the US for quite some time and have established a good credit score, you can easily qualify for conventional loans, just like any US citizen. You can check FHA Loans or Conventional Loans.

Found the right mortgage program for your US credit situation and ready to apply? Here’s a detailed guide on “How can foreigners apply for a US mortgage?” which includes everything you need to know.

Step-By-Step: How UK Citizens Can Apply for a US Mortgage

Applying for a US mortgage as a UK citizen is simpler than you might think, especially with expert assistance from HomeAbroad.

With a clear roadmap and tailored solutions, you can secure financing for your dream property in no time.

Here’s a brief overview of the steps:

For detailed steps, do not miss out our detailed guide on foreign national mortgages.

Real-Life Scenario: How a UK Citizen Bought a $600,000 US Rental Property

To truly understand how UK citizens can invest in US real estate, let’s look at a real-life example.

This case study highlights how HomeAbroad helped a UK investor purchase a rental property in Florida using a DSCR loan.

The Investor’s Goal

A UK-based real estate investor, Sam Smith, aimed to acquire a $600,000 rental property in Florida, drawn by the area’s high rental yields and booming property market.

However, they faced challenges due to the lack of a US credit history and uncertainty about meeting US mortgage requirements.

The Challenges

Steven Glick,

Director of Mortgage Sales, HomeAbroad Loans

The Solution: DSCR Loan

HomeAbroad guided the investor through its DSCR loan program, which evaluates the property’s rental income instead of the borrower’s personal income or US credit history.

The Outcome

The investor successfully secured the property and now enjoys a steady rental income with long-term appreciation potential. This example demonstrates how HomeAbroad can simplify the process for UK citizens investing in US real estate.

Want to read the full story? Explore the complete case study here.

Now is The Best Time to Invest in the US

Investing in US real estate as a UK citizen is not only achievable but also an exciting opportunity to diversify your portfolio or secure a dream property.

With tailored mortgage solutions like DSCR loans, Fix and Flip loans, and US Newcomer Mortgages, HomeAbroad makes the process seamless and efficient.

Now is the perfect time to explore the US property market and turn your aspirations into reality.

FAQs

Can UK citizens buy property in the US?

Yes, UK citizens can buy property in the US without restrictions. Whether for personal use or investment, foreign nationals, including UK citizens, can purchase real estate and even secure a mortgage through lenders like HomeAbroad Loans.

Do I need a US credit history to get a mortgage in the US?

No, a US credit history is not required. HomeAbroad offers options like DSCR loans, which focus on the property’s income potential, and Full Documentation Loans, which accept international credit reports and foreign income for qualification.

What is the typical down payment for a US mortgage as a UK citizen?

UK citizens need a down payment of 25% when applying for foreign national mortgages.

Are there tax implications for UK citizens investing in US real estate?

Yes, UK citizens investing in US property should be aware of tax implications in both the US and the UK. Fortunately, the US and UK have a tax treaty that helps prevent double taxation on income and gains. For more details, check out our comprehensive Tax Guide.

Can I apply for a US mortgage remotely from the UK?

Yes, HomeAbroad offers a streamlined application process that allows you to apply and complete the closing process remotely. This is ideal for UK citizens who cannot travel to the US during the transaction.

![A Guide to US Mortgages for UK Citizens [2026]](https://homeabroadinc.com/wp-content/uploads/2022/06/USMorgagesGuideForUKInvestor-500x325.png)