Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways from the July 2025 US Rental Data

1. US rents are growing again, with a national median of $1,790 in July 2025.

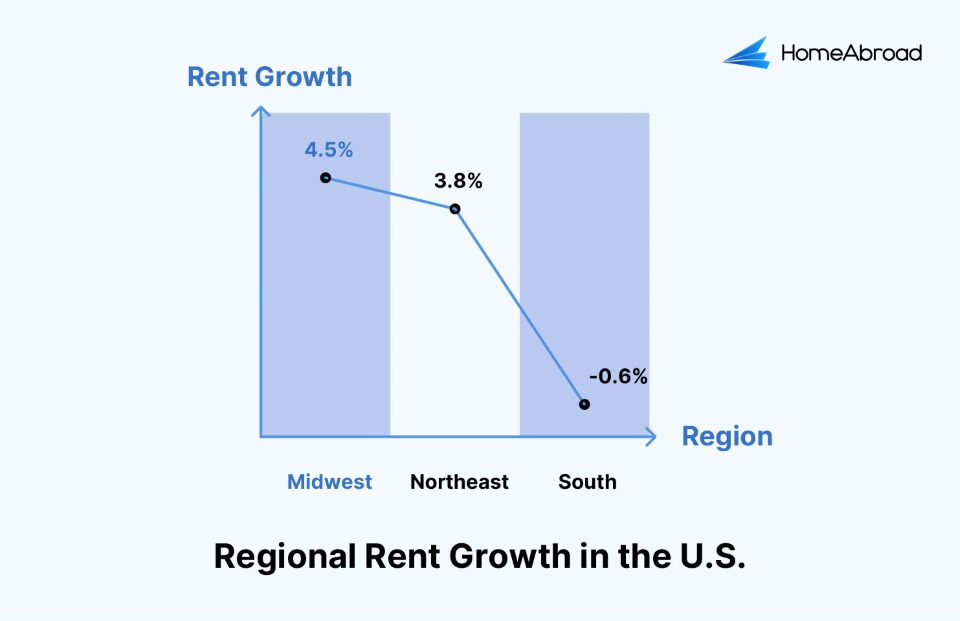

2. Midwest and Northeast markets are outperforming, while the South shows signs of oversupply.

3. Studios and single-family rentals are leading demand, offering strong opportunities for investors.

4. For foreign nationals, limited housing supply and strong rental demand make 2025 a favorable entry point.

Table of Contents

The US rental market is back on the upswing, with median asking rents climbing 1.7% year-over-year in July 2025, the fastest growth in more than two years.

This rebound is being fueled by a housing shortage of over 4.5 million homes and record-high ownership costs that continue to keep millions of households renting. For foreign nationals, these dynamics present a unique window of opportunity as rising rents, improving tenant affordability, and constrained supply align in investors’ favor.

Here’s a closer look at the rental trends shaping US real estate in 2025 and what they mean for international real estate investors.

US Rental Market Trends at A Glance

General Rental Market Trends in 2025

- Rent growth accelerates: Median asking rents increased 1.7% year-over-year, with the national median now at $1,790 per month.

- Demand shifts to smaller units: Studios and one-bedroom apartments are leading the rebound, as affordability pressures push renters toward smaller spaces.

- Single-family rentals hold strong: Despite softer demand in some regions, single-family homes remain attractive, especially in suburban and secondary markets.

- Tenant affordability improves: Slower wage growth and high homeownership costs are keeping rental demand stable, creating consistent occupancy for landlords.

Regional Highlights Investors Should Watch

- Midwest: Rents rose by 4.5% year-over-year, the strongest regional growth, fueled by affordability and job growth.

- Northeast: Up 3.8%, especially strong in markets like Boston and Philadelphia, where supply remains limited.

- South: Rents fell 0.6% in July, with oversupply in cities like Austin and Atlanta leading to concessions.

- West: Largely flat, but resilient in high-demand metros such as San Diego and Denver.

Why US Rentals Matter for Foreign Nationals?

The US real estate market continues to be one of the most attractive destinations for international real estate investors. With a housing shortage exceeding 4.5 million homes, as reported by the US Chamber of Commerce, ownership affordability remains out of reach for many Americans.

This structural imbalance has funneled more households into rentals, making multifamily and smaller-unit investments especially compelling.

For foreign nationals, these conditions create a dual advantage:

- Consistent rental income from a growing tenant pool.

- Long-term appreciation potential as supply struggles to keep pace with demand.

International real estate investors often face barriers when entering US real estate, but the current rental upswing makes the timing especially favorable.

HomeAbroad ensures access to foreign nationals with tailored US mortgage financing options without requiring a US credit history, bridging the gap for global investors.

Tenant Affordability Strengthens Market Stability

One of the strongest indicators of a healthy rental market is tenant affordability.

Although rents are rising, wage growth is outpacing rental costs. For landlords, this is critical. Tenants who can comfortably afford their rent are less likely to default, ensuring stable income streams and reduced vacancy risk.

For foreign nationals, this translates into an investment environment where cash flow is not only strong but also reliable, providing the foundation for scalable US portfolios.

Market Opportunities: Where to Look and What to Avoid

Rental growth varies widely by region and property type. Understanding these trends helps foreign nationals target high-performing investments.

- High-growth markets: San Jose, CA (+8.8%) is outperforming, supported by a strong job market and housing constraints.

Investment Properties on Sale Today in San Jose

- Cooling markets: Jacksonville, FL (-3.5%) demonstrates that oversupply and local dynamics can weigh on rents.

Investment Properties on Sale Today in Jacksonville

- Emerging trends: Studios and one-bedrooms are in high demand nationwide, offering investors a targeted strategy to capture rental growth.

- Regional leaders: The Midwest and Northeast are showing the strongest overall rent growth, while the South and West are seeing flatter performance.

Foreign nationals should approach these markets with a selective strategy. Identifying cities with strong employment growth, favorable rent-to-income ratios, and limited new construction will be key.

Risks That International Real Estate Investors Need to Consider

Despite favorable conditions, global investors should remain aware of potential risks.

- Concessions in oversupplied markets, such as free rent offers, signal weaker near-term returns.

- Management challenges can be greater for international landlords, especially when operating across time zones.

- Regulatory variations across states and cities require careful research and local expertise.

Working with experienced property managers and using HomeAbroad’s tailored mortgage solutions can help mitigate these risks while unlocking the market’s upside.

Conclusion: A Window of Opportunity for Foreign Nationals

The US rental market’s resurgence underscores why it continues to attract global capital. For foreign nationals, rising rents, limited housing supply, and strong tenant affordability make this an opportune moment to enter or expand within US real estate.

By focusing on the right markets, aligning with local experts, and securing financing solutions that cater to international investors, foreign nationals can capitalize on a trend that shows no sign of slowing down.

FAQs

1. Is now a good time for foreign nationals to invest in US rentals?

Yes. Rising rents, a strong tenant base, and limited housing supply make this a favorable moment to enter the market.

2. Which property types are performing best?

Studios and one-bedrooms are experiencing the highest rent increases, making them a strong choice for rental income growth.

3. Which regions show the best opportunities?

The Midwest and Northeast are currently leading rent growth, while the South and West are cooling.

4. Are single-family rentals still attractive?

Yes. Single-family homes continue to see steady demand, especially from families, although vacancy rates are rising in some areas.

5. How can foreign nationals finance a US rental property without a US credit score?

HomeAbroad offers mortgage solutions tailored specifically for global investors, making it possible to invest without prior US credit history.

![7 Reasons Why Foreign Investors Should Invest in US Real Estate [2025]](https://homeabroadinc.com/wp-content/uploads/2022/03/mathieu-stern-1zO4O3Z0UJA-unsplash-scaled.jpg)

![Can Foreigners Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)