Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

➡️ The US real estate market provides long-term stability, ideal for building wealth through steady appreciation.

➡️ Foreign investors can choose from a range of property types and locations tailored to their goals, from high-demand urban rentals to growing suburban areas.

➡️ With a strong rental market, foreign investors can enjoy attractive average rental yields of 8% - 10%, and a reliable income stream.

Table of Contents

For foreign investors, the US real estate market represents a reliable path to wealth-building and portfolio diversification. With a robust economy, high demand for rentals, and a variety of property options, the US offers something unique: a stable and growth-oriented investment environment.

Not only that, but the US legal system treats foreign investors with the same protections as its citizens, giving you the confidence to invest securely.

In this article, we’ll explore the top 7 reasons foreign investors are increasingly drawn to the US real estate market and how HomeAbroad provides tailored support to make the process easy, efficient, and profitable.

7 Key Reasons to Invest in US Real Estate as a Foreign National

As we break down the advantages of US real estate, you’ll see why it’s such an attractive option for foreign investors. From economic stability to the potential for high rental yields, these factors make the US a top choice for international investment.

Let us look at these reasons in detail.

Reason 1: Open Market to Foreign Investors without any Restrictions

The US real estate market is one of the most accessible globally, with few restrictions on foreign ownership. Unlike some countries where foreign buyers face additional taxes or outright restrictions, the US welcomes international investors.

In fact, from April 2022 to March 2023, foreign nationals invested over $59 billion in US residential real estate, underscoring the market’s accessibility and appeal. [Source: NAR]

For example, countries like Australia (South) have imposed a 7% foreign buyer surcharge in some states. Canada implemented a ban on foreign home purchases up to January 1, 2027, to curb housing prices.

In contrast, the US imposes no significant restrictions on foreign ownership of residential, commercial, or industrial properties.

✅ Equal Ownership Rights: Foreign investors have the same property rights as US citizens, providing them with full ownership and use rights across all types of properties.

✅ Transparent Market: The US real estate market is supported by strong property laws and regulations, ensuring a fair, secure environment for foreign and domestic investors alike.

Let us see this how our UK-based investor was able to enter the US real estate market easily with HomeAbroad’s guidance:

Case Study: UK-based Investor

A UK-based investor, Sam Smith, recently entered the US real estate market with guidance and financing support from HomeAbroad. Here’s how HomeAbroad helped make this investment seamless and successful.

Investor Goal:

The UK investor wanted to diversify their portfolio with a high-yield rental property in the US, specifically targeting a property in a high-demand area like Florida.

Challenges Faced: Without a US credit history and with limited knowledge of US property regulations, Sam required extensive support for financing and documentation.

HomeAbroad’s Solution:

✅ DSCR Loan Program: HomeAbroad recommended a Debt Service Coverage Ratio (DSCR) loan, ideal for foreign investors without a US credit score. This loan is based on the property’s income potential rather than the investor’s personal credit history.

✅ Streamlined Documentation: HomeAbroad guided the investor through a simplified documentation process tailored for foreign nationals, reducing the need for extensive paperwork.

✅ End-to-End Guidance: From property selection to closing, HomeAbroad’s mortgage experts provided step-by-step support, ensuring the investor fully understood each phase.

Outcome:

The investor successfully purchased a rental property in Florida, gaining exposure to the US market’s rental yield potential and fulfilling their goal of portfolio diversification.

With high rental demand in Florida, the property offers the investor a steady income stream and the potential for long-term appreciation.

This successful investment showcases the unique opportunities and support available to foreign investors in the US market.

For more details on this case, read the complete case study here.

Reason 2: Strong Rental Yields in High-Demand Areas

The US rental market offers some of the most competitive rental yields globally, particularly in high-demand cities.

Below is a table highlighting average gross rental yields in some major cities and key factors driving rental demand in select cities:

| City | Average Gross Rental Yield | Key Factors Driving Rental Demand |

| Miami | 8.8% | High tourism influx, international business hub, and favorable climate attract both short-term and long-term renters. |

| Atlanta | 6.7% | Robust job market, affordable cost of living, and growing population contribute to strong rental demand. |

| Phoenix | 8.2% | Rapid population growth, expanding tech industry, and warm climate make it appealing for renters. |

| Austin | 8.6% | Thriving tech sector, vibrant cultural scene, and educational institutions attract a steady stream of renters. |

| Denver | 7.2% | Strong economy, outdoor lifestyle, and influx of young professionals drive rental demand. |

Reason 3: Diversify Your Portfolio with a Stable and Resilient Market

Investing in US real estate offers foreign investors a safe, stable asset that can balance a diversified portfolio. The US real estate market has a long history of resilience, even during global economic challenges.

For example, while many countries struggled to recover from the 2008 financial crisis, the US real estate market rebounded by 2012, and property values have been on a steady incline since.

Here are all the points that make the US a stable market at a glance:

Consistent GDP Growth

✅ Robust Economy: The US maintains its position as the world's largest economy, with a GDP of $27.36 trillion in 2023.

✅ Steady Expansion: In Q2 2024, the economy expanded at an annualized rate of 3%, indicating resilience and growth.

✅ Attractive Market: Foreign investors invested over $42 billion in US real estate, as of 2024, highlighted in the data released by NAR.

Home Price Appreciation

✅ Value Growth: US home values have appreciated by an average of 2.7% over the past year, according to Zillow.

✅ Regional Opportunities: Areas experiencing economic expansion, job growth, and migration trends offer even higher appreciation potential.

✅ Inflation Hedge: Real estate often outpaces inflation, preserving and enhancing the purchasing power of invested capital.

Controlled Inflation Rates

✅ Historical Stability: The US has managed an average inflation rate of 3.8% from 1914 to 2022.

✅ Recent Trends: Inflation peaked at 8% in 2022 but moderated to around 3.7% by September 2023.

✅ Federal Reserve's Role: Ongoing efforts aim to maintain a 2% target rate, supporting economic stability.

Transparent Legal System

✅ Equal Property Rights: Foreign investors enjoy the same property protections as U.S. citizens.

✅ Clear Regulations: A transparent legal framework ensures a straightforward and secure buying process.

✅ Investor Confidence: The reliability of the U.S. legal system instills trust, safeguarding investments.

These factors make the US a reliable and appealing choice for foreign investors looking for stability and growth in their real estate investments.

Reason 4: Access to Competitive Mortgages Without US Credit History

Foreign investors can access financing in the US even without a local credit history, thanks to loan products tailored specifically for international buyers.

At HomeAbroad, we specialize in providing tailored mortgage solutions for foreign nationals seeking to invest in US real estate. Understanding the unique challenges faced by international buyers, we offer competitive financing options without the need for a US credit history.

Key Features of HomeAbroad’s Foreign National Mortgage Program:

| Feature | Description |

| Down Payment | 25% for Foreign Real Estate Investors |

| Interest Rates | Competitive and determined based on your financial profiles |

| Documentation | Streamlined documentation process with minimal paperwork for a smooth and efficient loan approval |

| Expert Guidance | HomeAbroad’s expert mortgage officers provide personalized support, from application to closing. |

Reason 5: Affordable Property Prices Compared to Other Global Cities

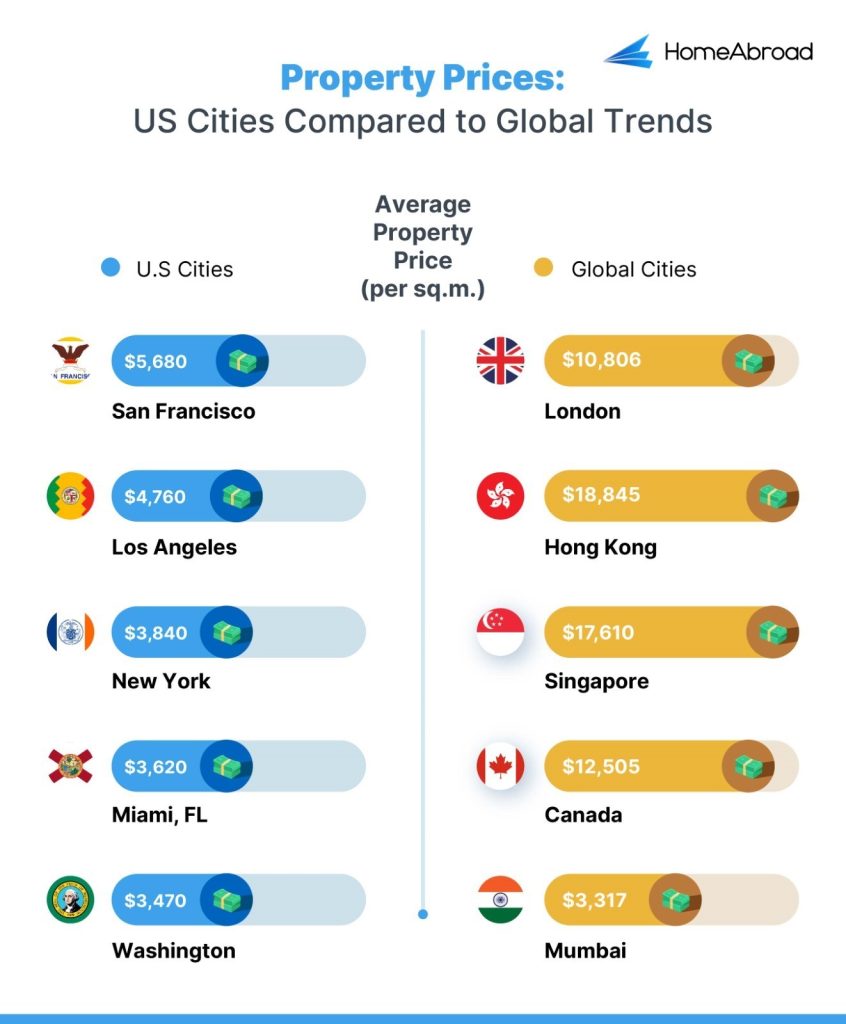

Compared to other major global cities, US real estate offers more accessible price points, allowing foreign investors to buy premium properties or diversify with multiple investments.

As you can see, the property prices in major global cities are higher compared to the cities in the US.

More Value for Money: In cities like Washington, New York, and Miami, the price per square meter can be as low as $3,000 to $5,000, allowing investors to purchase high-quality properties without exorbitant costs.

Opportunities in Emerging Markets: High-growth cities offer lower prices with high appreciation potential, making them attractive for foreign investors looking to maximize returns.

This price advantage provides foreign investors with a high value for their money compared to more expensive international markets.

Reason 6: Same Tax Rules for Foreign Investors as US Persons

Foreign investors in US real estate can benefit from tax advantages similar to those available to US citizens, enhancing the profitability of their investments.

Key benefits include:

✅ Deductible Expenses: Foreign investors can deduct mortgage interest, property management fees, and depreciation from rental income.

✅ Avoiding Double Taxation: The US has tax treaties with many countries, allowing investors to offset taxes paid in the US against their home country’s tax liabilities.

✅ Capital Gains Treatment: When foreign investors sell US real estate held for more than a year, they may qualify for long-term capital gains tax rates, which are generally lower than ordinary income tax rates. This treatment is similar to that for US citizens, potentially increasing after-tax returns.

By understanding and leveraging these tax benefits, foreign investors can enhance the financial performance of their US real estate investments.

Reason 7: Positive Cash Flow Potential in High-Growth Markets

Investing in US real estate, particularly in high-growth markets, offers foreign investors the potential for positive cash flow.

Key Factors Contributing to Positive Cash Flow:

✅ High Rental Demand: These cities attract new residents due to job opportunities and quality of life, resulting in strong demand for rental properties.

✅ Low Vacancy Rates: The influx of residents keeps vacancy rates low, ensuring consistent rental income.

✅ Favorable Rental Yields: Investors can achieve attractive rental yields, with some markets offering cash-on-cash returns between 7% and 9%.

Conclusion

The US real estate market provides foreign investors a unique combination of stability, growth potential, and accessibility. With minimal restrictions, competitive rental yields, and a robust legal system, the US is a premier choice for building a diversified and resilient portfolio.

HomeAbroad’s expertise in foreign national mortgages and market-specific guidance ensures that international investors have all they need to succeed. Whether financing, property selection, or tax planning, HomeAbroad’s comprehensive support empowers foreign investors at every step.

FAQs

1. Do I need a US credit history to get a mortgage for US real estate?

No, you don’t necessarily need a US credit history. Programs like the Debt Service Coverage Ratio (DSCR) loan are available through HomeAbroad, which assess the property’s income potential rather than the buyer’s credit score, making financing more accessible for foreign investors.

2. Can foreign investors buy real estate in the US without restrictions?

Yes, the US real estate market is highly accessible to foreign investors, with few restrictions. Foreign buyers can purchase residential, commercial, or industrial properties and enjoy the same property rights as US citizens.

3. How does the US tax foreign real estate investors?

Foreign investors are generally subject to the same tax regulations as US citizens. Also, the US has tax treaties with many countries to prevent double taxation. Additionally, foreign investors can deduct various expenses, such as mortgage interest and depreciation, to reduce taxable income.

4. What are DSCR loans, and how do they work for foreign investors?

DSCR loans (Debt Service Coverage Ratio loans) are designed based on the income generated by the property rather than the borrower’s personal credit score. This type of loan is particularly beneficial for foreign investors, as it considers the property’s potential to cover debt payments rather than relying on a US credit history.

5. What are the advantages of investing in the US real estate market compared to other countries?

The US real estate market offers unique advantages, including high rental yields, property price appreciation, stable economic growth, and fewer restrictions on foreign ownership. Moreover, the legal protections and transparent market in the US provide a secure investment environment for international buyers.

![7 Reasons Why Foreign Investors Should Invest in US Real Estate [2026]](https://homeabroadinc.com/wp-content/uploads/2022/03/mathieu-stern-1zO4O3Z0UJA-unsplash-500x333.jpg)

![Can Foreigners Buy Property in the USA? [2026]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)