Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Are you dreaming of owning a home in the US but are held back by your L1 visa status? You’re not alone! Many L1 visa holders worry about mortgage approval, visa uncertainty, and a lack of US credit history. But the good news is it’s possible!

Having worked with numerous L1 visa holders as they navigate the home-buying process, I’ve seen firsthand the challenges they face. From understanding lender requirements to overcoming concerns about temporary visa status, the hurdles can seem overwhelming. Limited credit history, higher down payment expectations, and varying lender policies often add to the complexity.

With the right mortgage solutions, you can secure financing, build stability, and plant your roots in a place you’ve worked hard to call home. No need to wait for years – homeownership could be closer than you think. Ready to explore your options? Let’s get started!

Key Takeaways:

1. L1 visa holders don’t need a green card to qualify for a mortgage and buy a property in the US.

2. L1 visa holders can explore no-credit mortgage solutions without an established US credit history based on international credit reports and proof of assets.

3. Buying a home on an L1 visa allows you to invest in property and build equity rather than losing money to rent during your stay in the US.

Table of Contents

Top 6 Reasons Why L1 Visa Holders Should Buy a House in the US

Purchasing a home in the US as an L1 visa holder is more than just a lifestyle choice; it’s a strategic financial decision. Here are six compelling reasons to consider:

1. Stop Losing Money on Rent and Start Building Wealth

Renting can cost 30-40% of your monthly income in major US cities without a return on investment. Owning a home allows you to build equity over time, especially as US real estate appreciation is high in many regions.

“Real estate values in the US have also shown a steady appreciation, with the Zillow Home Value Index indicating a 42% increase in the average home value over the past five years, making homeownership a reliable and lucrative investment”.

Stop wasting your money on renting and start capitalizing on your wealth, as buying is a better option than renting based on investment factors.

2. Create Financial Security with a Tangible Investment

Investing in a property in the US diversifies your portfolio with a tangible asset. The US housing market has become increasingly attractive to international investors.

- According to the latest reports of NAR (National Association of Realtors), non-resident investors have purchased $1 trillion-plus in US real estate in the last 10 years.

- Not only non-resident investors are seizing this lucrative opportunity. Almost $22.6 billion was spent in 2023-24 by non-US citizens who are recent immigrants (less than two years at the time of the transaction) or non-immigrant visa holders who have resided in the US for more than six months, including H1B visa holders.

This trend highlights the appeal and practicality of US real estate as a sound investment, even for those not physically present in the country. It also reflects new arrivals’ confidence in the US real estate market and their desire to establish roots here.

3. Protect Yourself Against Rising Rents

Rental Rates in the US have increased annually in key markets like Arizona, Florida, and Georgia by 6.5%, 8.2%, and 6.0%, respectively. Homeownership ensures predictable costs and shields you from rent hikes, offering long-term financial stability.

4. Maximize Tax Benefits as a Homeowner

Homeownership in the US comes with tax deductions, including mortgage interest and property taxes. These benefits can significantly reduce your taxable income, especially if you pay interest on a substantial loan.

If you itemize your deductions, you can deduct your mortgage interest and property taxes when you file your US federal income tax return. The amount of money you save on your taxes can help offset the cost of ownership. Consult with a tax advisor and follow this tax guide to see if you are eligible for this deduction.

5. Build a Stronger Future while enjoying Stability and Personal Freedom.

Owning a home lays the foundation for generational wealth and financial independence. It also offers stability for your family, especially if you plan to stay long-term. L1 visa holders can transform their temporary stay into a financially rewarding experience by purchasing a home.

Enjoy the perks of homeownership as it allows you to customize your living space without landlord restrictions. Additionally, many L1 visa holders buy properties near top schools or workplaces, enhancing convenience.

6. Home Prices are Affordable in the US

Home prices in the US are relatively affordable compared to many other global cities, making it an appealing investing option for international real estate investors.

“According to Zillow, the median home price in the US is around $363,438, making it accessible for many H1B workers to invest in real estate without excessive financial strain.”

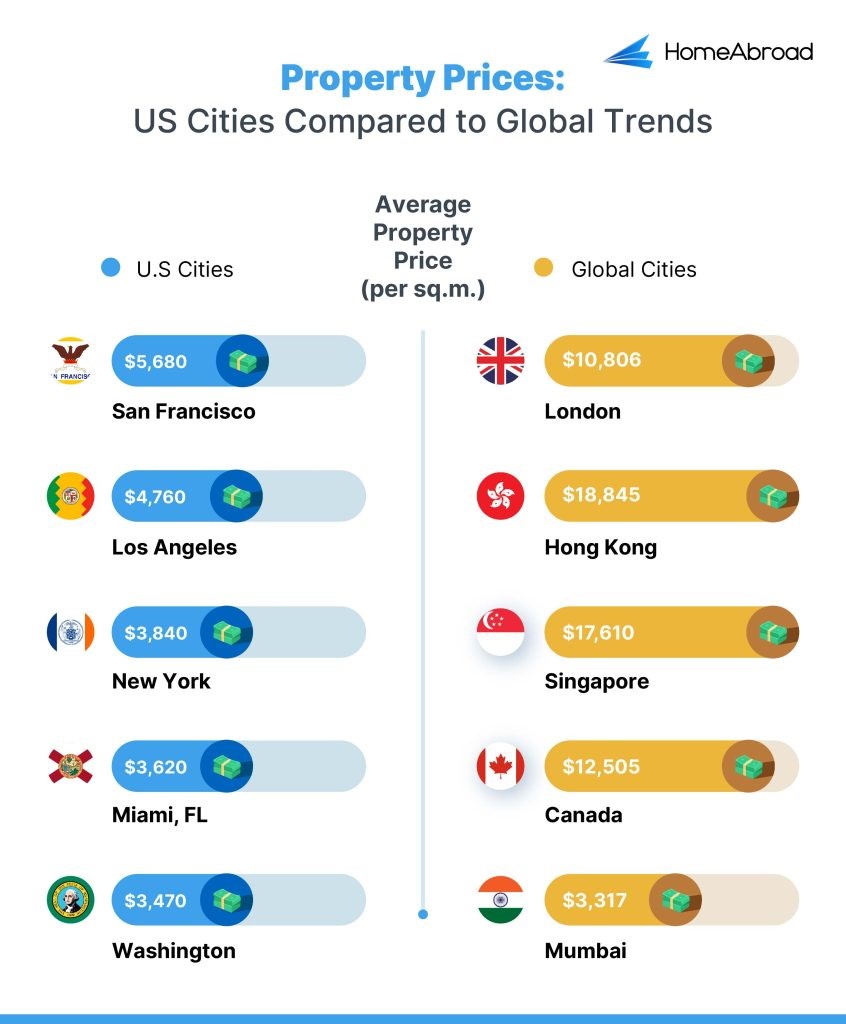

Let us see how home prices (per square meter) of some major US cities are affordable compared to global cities:

As you can see, US home prices are much lower compared to some of the most popular global cities. This affordability, coupled with lower mortgage rates, makes buying a home in the US an attractive option for L1 visa holders.

Loving the benefits but fearing visa expiry? We have HomeAbroad solutions for you. Let’s take you through a case study of a foreign national who successfully secured an L1 visa mortgage with HomeAbroad Loans.

Cut the Risk of Homebuying as an L1 Visa Holder with HomeAbroad

As a foreign national on an L1 visa, it’s obvious to get worried about visa uncertainty, immigration status, and absence of credit history. To understand how the process works, let’s analyze how HomeAbroad helped Sam secure a US mortgage with a personalized approach tailored to his unique needs and circumstances.

Case Study: Achieving Real Estate Goals as a UK Investor in the US

Problems Faced:

Sam Smith, a UK-based investor on an L1 visa, aimed to purchase a $500,000 rental property in Sarasota, Florida. However, obstacles like lacking a US credit history and visa uncertainties hindered his journey.

Traditional lenders rejected his applications despite his financial stability and investment vision. However, we assured him that non-residents can invest in US real estate with solutions like HomeAbroad DSCR loans.

Addressing Common Concerns that Sam Faced Initially

Most foreign investors on L1 visas, like Sam, face these questions when considering homebuying in the US. Let’s solve these common queries hindering your US homeownership journey.

What if my visa status changes?

Changing visa status can affect residency or employment but doesn’t impact property ownership. DSCR loans focus on rental income, ensuring loan continuity.

Even if your visa status changes, you can make higher rental yields to cover your mortgage payments and property maintenance and generate surplus income.

Is Getting a Mortgage Without U.S. Credit Risky?

Not with tailored solutions like DSCR loans. These loans enable investors to bypass credit history challenges by leveraging property income. Income-based evaluations make these loans accessible, even without a U.S. credit score.

What If I Return to My Home Country?

Rental properties can be managed remotely from your home country. DSCR loans remain unaffected as long as payments are met via rental income. You can rent out or sell the property remotely. Check HomeAbroad for guidance on selling or managing US properties from abroad.

By turning their monthly rent into equity, foreign nationals can quickly build a growing asset and benefit from property appreciation and potential future profits through renting or selling, all while sitting comfortably in their home country.

The HomeAbroad Solution:

HomeAbroad connected Sam with a lender specializing in DSCR (Debt Service Coverage Ratio) loans. This innovative loan type enabled Sam to achieve his US real estate goals without requiring a US credit score by focusing on the property’s income potential. Within 29 days, Sam secured the loan and fulfilled his investment dream.

HomeAbroad Loans provides tailored mortgage solutions for L1 visa holders, ensuring investors like Sam qualify for loans supporting their financial objectives even without US credit. HomeAbroad empowers global investors to achieve economic growth through US real estate by addressing these challenges.

Read the full story of Sam—a UK investor on an L1 visa who purchased a rental property in Florida.

Inspired by Sam’s story and want to be a successful real estate investor like him? Then, let’s see what US mortgage options are available for L1 visa holders.

Do L1 Visa Holders Qualify for a US Mortgage?

You can qualify for a US mortgage on an L1 visa as a foreign national. All foreign nationals can purchase and own property in the US without any restrictions. You will go through the same process as a US citizen when applying for a mortgage, except for a few steps.

Whether you want to purchase a primary residence or invest in rental properties, you can explore all the options with HomeAbroad. We can help you find a mortgage loan on an L1 visa that meets your needs and budget by connecting you with appropriate mortgage lenders suitable for your unique needs.

Follow the L1 visa home buying guide to learn about these loans’ eligibility criteria and requirements and the steps in applying for and securing an L1 visa mortgage.

Don’t waste a moment and get started with HomeAbroad today!

Get a L1 Visa Mortgage with HomeAbroad

Buying a home on an L1 visa? HomeAbroad simplifies the mortgage process with tailored solutions, competitive rates, and expert guidance—even if you have no US credit history.

As a one-stop PropTech and FinTech platform, HomeAbroad helps both US and international buyers navigate the US real estate market with:

- Foreign national mortgages designed for newcomers

- AI-powered property search for smart investment choices

- Expert real estate agents & concierge services for a seamless experience

Start your homeownership journey today! Contact HomeAbroad for a free consultation.

FAQs

Can an L1 visa holder get a US mortgage?

Yes, L1 visa holders can get a mortgage in the US without any restrictions, whether you’re looking to purchase a primary residence or invest in rental properties.

Can an L1 visa holder invest in rental properties in the US?

Yes, an L1 visa holder can invest in rental properties in the US through HomeAbroad’s DSCR Loans, as it focuses on the income potential of the property rather than the investor’s personal credit history or finances. You can qualify for this loan if the property’s rental income covers the loan payments, making it ideal for L1 visa holders without a US credit score.

Can L1 visa holders get a mortgage in the US without a credit history?

Yes, L1 visa holders without a US credit history can still secure a mortgage. HomeAbroad Loans offers tailored no-US-credit mortgage solutions that focus on your international credit history, income stability, and assets instead of relying solely on a US credit score.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in the U.S. Residential Real Estate

Zillow: Zillow Home Value Index

![L1 Visa Mortgages for Primary Residence and Investment [2026]](https://homeabroadinc.com/wp-content/uploads/2024/10/TaxesforUSforeignBuyers-scaled.jpg)