Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Real estate investment is regarded as some of the most reliable and profitable investments and generally carries less risk than other asset classes.

One of the most popular places for overseas real estate investment is the United States. Real estate investors have the ideal potential to earn cash flow in the United States through rental income, capital growth, and profits from businesses that rely on investment assets. Furthermore, the US is one of the few nations that impose no additional limitations or taxes on foreign investors’ real estate purchases.

However, one needs proper knowledge and guidance to make an effective real estate investment in the US as a foreigner.

This article will discuss everything about foreigners investing in US real estate and how you can do it.

Table of Contents

Why Should Foreign Real Estate Investors Invest In the USA?

There are numerous reasons to invest in US real estate. The US has a stable political and economic environment, which makes it a safe investment destination. Additionally, the US real estate market is highly liquid, offering investors easy access to their capital. Moreover, the US offers a wide variety of investment opportunities, from single-family homes to multi-unit properties.

The following are the main justifications why international investors in real estate ought to purchase property in the USA:

1. The US government places no restrictions on foreign real estate investors.

The first obstacle you presumably will encounter as a foreign real estate buyer with your foreign investment property abroad is the government’s limitations.

The good news is that the American government neither restricted nor outlawed foreign real estate investments. As a result, international buyers are not subject to additional taxes or regulations.

The rights to purchase and own property in the US are the same for foreign investors in US real estate as for US citizens.

2. Financing for Foreign Investors with No US Credit History for US Mortgage Loans

For non-resident foreign investors (without US credit) and US Newcomers on visas, US lenders with expertise in mortgages for foreign nationals provide long-term fixed-rate mortgages at competitive rates.

The US is the ideal location for foreign real estate investment because it can obtain mortgage house loan financing and lock in low-interest rates with a 15-year or 30-year mortgage (depending on your needs and preferences) without needing an established US credit history. Please refer to our complete guide on How can foreigners get US mortgages with no or thin US credit history for a detailed step-by-step process.

3. Relatively Low Prices for Real Estate

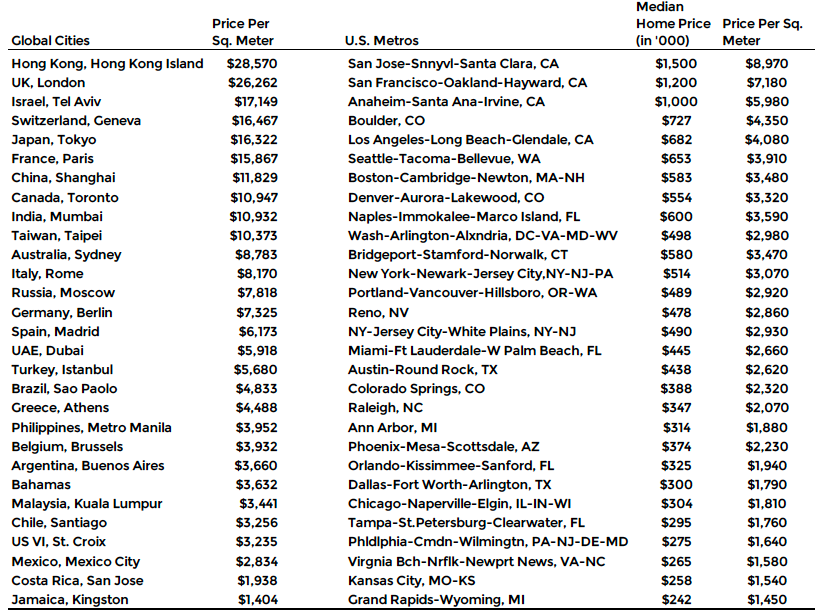

Home prices in many US metro areas are low compared to the central regions of other worldwide cities, which may be a surprise. For instance, residential real estate costs $7,180 per square meter even in a comparably more expensive US city like San Francisco, compared to $26,262 in London (UK), $28,570 in Hong Kong (China), $10,947 in Toronto (Canada), $10,932 in Mumbai (India), etc.

The below table compares Home Price Comparison Among Global Cities and US Metros :

4. The US has excellent rental yields

The US has a high demand for rental properties and homes and is a renter-friendly nation. As a result, renting out your investment property in the USA and earning an excellent rental income will be simple.

The annual gross rental revenue expressed as a share of the property’s purchase price is known as the rental yield. Before taxes, maintenance fees, and other costs, a landlord should aim to make this.

In the US, rental real estate costs have also been rising. For instance, the Zumper Year-End Rent Report shows that the cost of renting a two-bedroom apartment climbed by 13% in 2021.

5. Safe and reliable international investments with US dollar capital gains

One of the most respected real estate markets is in the United States. The relative stability of the US housing market makes it an attractive investment for foreign investors.

Additionally, according to the Zillow Home Value Index, US real estate values are projected to increase by 17.3% over the next year, providing an ideal chance for overseas investors to profit from USD capital gain.

Challenges of Investing in US Real Estate as a Foreign National

There are, of course, certain risks involved in any real estate investment. However, these risks can be mitigated by working with the right professionals and conducting due diligence on any property you’re considering for purchase.

When investing in US real estate as a foreign national, it’s essential to be aware of the following potential challenges:

1. Language Barrier

This is the most common issue for foreign investors looking to purchase property in the USA. Unless you’re fluent in English, it may be challenging to understand and review all of the documents involved in a real estate transaction, including the sales contract, mortgage paperwork, title insurance policy, etc.

Additionally, it leaves room for potential exploitation.

Unfortunately, some actively seek out chances to deceive and misdirect. This is why having a native speaker intermediary you can entirely rely on is crucial. This might be a close friend or relative, or it might be a dependable counselor. However, wait until you have a representative fluent in the language and knowledgeable about the industry to represent you and your interests before starting any discussions effectively.

2. Time Difference

If you live in a different time zone, scheduling conversations and meetings with your real estate agent, attorney, mortgage broker, and so on might be difficult. This is why it’s essential to choose a team of professionals willing to work with your schedule and accommodate your needs.

3. Qualifying for a Mortgage

Obtaining a mortgage approval can be difficult. Most lenders use US credit records to assess borrowers’ eligibility for loans. You might not have much credit history if you haven’t been in the US for a long time. This may prevent you from getting a conventional loan.

However, you may be eligible for a portfolio loan from a private lender if you have the necessary down payment and can prove your income and ability to repay the loan.

On the other hand, government-backed loans need supporting documentation that you might not have, such as two years’ worth of tax returns. On the other hand, a portfolio lender, a company that manages a portfolio of several loans, might be able to provide you with a loan.

HomeAbroad provides US mortgages with no US credit history required. We offer the best loan terms to our customers, with mortgage loan officers experienced in working with foreign nationals, ensuring the most hassle-free experience. Get started today!

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

4. Lack of Understanding of the Local Market

Investing in real estate in a foreign country can be daunting. You might not be familiar with the local customs, traditions, or market conditions. As a result, it’s essential to have a reliable and knowledgeable professional on your side who knows the ins and outs of the market you’re interested in.

A real estate agent who works with foreign buyers can help you navigate the market, find properties that fit your budget and investment goals, and negotiate the best possible price on your behalf.

When you are ready to buy a house in the US, you should ideally work with real estate agents with expertise in working with foreign national clients, such as a real estate agent with CIPS designation.

A CIPS (Certified International Property Specialist) real estate agent has undergone specialized training to handle real estate transactions smoothly for foreign real estate investors.

5. Distance

Managing an investment property in another country can also be challenging, especially if you’re unfamiliar with the area. This is where a professional property management company comes in handy. A good property manager will take care of all the day-to-day tasks, such as finding tenants, collecting rent, maintaining the property, etc., so you can sit back and relax.

HomeAbroad is the perfect solution for foreign investors purchasing property in the USA. We have a team of bilingual real estate professionals ready to assist you throughout the entire process, from start to finish. Contact us today to get started!

The Benefits of Real Estate Investment in the US!

As we’ve already explained, there are countless advantages to real estate investing. Unlike any other investment, real estate has unique leverage. Likewise, compared to other assets, there is a more steady demand for them. Real estate investing has helped some of the wealthiest people amass their money. Its ability to both help you build wealth and provide a terrific passive income stream makes it such a potent tool.

1. Wealth Creation

Investing in US Real estate can assist you in various ways to build wealth. Inflation is one of the most valuable weapons in your arsenal since it boosts property values constantly at the most basic level.

This holds even if you don’t make any changes to the house or property. A property in a desirable location will also increase in value over time when nearby homes or businesses are developed. The acquisition, upkeep, and sale of real estate can be utilized to grow wealth in several other ways.

2. Income Generation

Real estate can generate a reliable passive income and wealth-building techniques like those discussed above. You can keep the difference between your monthly mortgage and the rent as a regular source of revenue if you buy a house and rent it out. You could eventually have a strong base for your larger investment strategy if you accumulate enough of these passive income streams.

3. Diversification of Holdings

As is common knowledge, you shouldn’t put all your eggs in one basket. An intelligent investment to diversify your portfolio is real estate. Real estate values benefit from being monetized through rent and don’t fluctuate dramatically as many stocks do. As a result, real estate can be an excellent starting point for a more extensive, highly diversified portfolio.

4. Loss Hedging Strategy.

Property never loses value, which is one of its main advantages. Businesses could cease to exist. Even nations fall apart. However, real estate will always be worth something. Additionally, the property is an excellent strategy to protect against loss because its value typically rises faster than the inflation rate.

5. Income Tax Deductions

You can deduct a wide variety of expenses associated with your rental property from your taxable income if you own a rental property in the United States. These costs could include repairs and renovations to insurance premiums and mortgage interest payments. You’ll be able to keep more of your rental income due to these deductions.

As you can see, there are many reasons to invest in real estate in the United States. The country provides controlled and secure investment support and several unique benefits you won’t find anywhere else. If you’re ready to get started, contact HomeAbroad today! We’ll be happy to help you find the perfect property and start your investment journey.

Ways to Start with Real Estate Investment

Real estate investment, if done modestly, may be lucrative. It might be a second source of income and assist in diversifying your current investment portfolio. Additionally, many of the best real estate investments don’t necessitate attending to a tenant’s every need.

Problematically, a lot of novice investors have no idea where or how to invest in real estate. Here are some top real estate investment strategies, from low maintenance to high maintenance. Some of the best ways to invest in Real Estate are:

1. Real Estate Investment Trusts (REITs)

If you want to buy property right away and with the least amount of money possible, look into real estate investment trusts (REITs).

These publicly traded firms raise money by selling stock and issuing bonds. They then use the money to buy and rent real estate assets, including warehouses, offices, shopping centers, and office buildings. Nearly all of a REIT’s after-tax earnings must be distributed to investors as dividends.

Real Estate Investment Trusts simplify the hassle of property ownership. You merely have to sit back and collect dividends, frequently more significant than many stock-based investments because management takes care of all the ownership and rental logistics.

Like any publicly traded firm, REIT stock can be purchased and sold on the market using a brokerage account. Because of this, REITs are among the most liquid real estate investments.

Additionally, shares of exchange-traded funds (ETFs) that possess shares in numerous REITs are available for purchase. Through investing applications like Stash, M1 Finance, and Robinhood, new investors without a lot of capital can purchase fractional shares of REIT ETFs.

2. Real Estate Investment Groups (REIGs)

For those who wish to own rental property without dealing with the difficulties of management, real estate investment groups (REIGs) is the perfect option. A capital reserve and access to finance are necessary for investing in REIGs.

REITs are little mutual funds that make real estate investment decisions. In a typical real estate investment group, a business purchases or constructs a collection of apartment buildings or condominiums and then permits investors to acquire them through the business to become members of the group.

Self-contained living units may be owned by a single investor in one or more units. Still, the business managing the investment group oversees all teams, taking care of upkeep, advertising vacancies, and conducting tenant interviews. In return for performing these management duties, the business takes a percentage of the monthly rent.

3. Invest in Residential Properties

The most popular real estate investment for most people is their primary residence. You obtain a mortgage, pay your regular installments, and steadily increase your home’s equity. You might be able to profit from the equity in your property when you sell it with some luck and a healthy local market.

Long-term wealth-building can be achieved by investing in your own house, although average annual returns are lower than you might anticipate. According to a study by market researcher Black Knight, the value of properties only climbed by roughly 3.9 percent yearly from 1994 to 2019.

Although there are some regions of the country where home appreciation is much higher, on average, your home’s market value is not expected to increase significantly, especially when you account for expenses like upkeep and repairs, insurance, property taxes, and mortgage interest.

This is not to argue that you shouldn’t ever own a property or consider it an investment. You can buy a home for much less money than other real estate transactions, thanks to government assistance for the mortgage industry and initiatives that aid first-time homebuyers.

4. Purchase a Rental Property

Consider buying rental homes if you want to invest significantly in real estate. Although rentals have the potential to provide a consistent income flow as well as the chance of appreciation over time, they are one of the most labor-intensive real estate investment strategies.

The following are the two primary strategies to profit from rental properties:

Long Term Rentals: In principle, these buildings, which are often built to be rented for at least a year, should generate a consistent monthly cash flow, but this depends on your renters’ dependability. You might purchase a single-family home or a building with multiple units to rent to other people.

Short Term Rentals: Similar to Airbnb, these apartments cater to recurring tenants whose stays may be as brief as one night. While away, you might offer your entire house or apartment or buy a separate property designed solely for short-term rentals.

Real estate investments with rental properties have higher profit potential, but they also demand a lot of work from the investor. You must discover and carefully screen potential tenants, make necessary repairs and maintenance payments and deal with any additional issues.

5. Purchase Real Estate and Flip Houses

You don’t need to purchase rental properties to increase your real estate investment earnings. Buying and selling real estate is widespread, but flipping requires a lot of labor, as with rental properties. It entails remodeling houses and learning to spot emerging communities where you can resell your acquisitions for a profit.

If your home flipping approach includes construction and renovation, you are taking on additional risk and incurring significant out-of-pocket expenses.

In conclusion, it’s not as simple as it might appear on HGTV. You’ll need building permits for improvements, and expenses can be more than anticipated, mainly if you hire contractors or outsource additional work.

To reduce the amount of work involved in flipping properties, seek houses in developing neighborhoods that don’t require extensive improvements. If you rent the home out while you wait for the value to increase, this might become much more profitable. Keep in mind that the area you anticipate being trendy may never take off, leaving you with a home that makes it difficult to recover your investment.

Tax Implications of Real Estate Investing in the US as a Foreigner!

As a foreigner, you’re subject to the same tax rules as any other American regarding real estate investing. That means you’ll have to pay capital gains taxes on any profits you make from selling a property.

Some tax pointers for buying property in the US are:

1. The IRS Publication 515

Send IRS Publication 515 an article. This booklet is geared toward people who are not US residents but wish to buy real estate in the United States. The tax consequences of such a purchase, as well as withholding taxes, capital gains taxes, and inheritance taxes, are all addressed in detail.

2. Tax Rates

The income from US real estate is subject to a 30% withholding tax for non-US nationals.

However, this rate could be lower depending on the country’s tax treaty with the United States. If you’re a citizen of Canada, for example, the rate is only 15%.

As a general rule of thumb, if your home country has a tax treaty with the US, you’re likely to get a better deal on withholding taxes.

3. Capital Gains Taxes

If you’re not a US citizen but own real estate in the United States, you’re subject to capital gains taxes when you sell.

The long-term capital gains tax rate is 20% for properties held for more than a year. If the property is held for less than a year, it is taxed as ordinary income at your marginal tax rate, which could be as high as 37%.

Capital gains taxes are only levied on the profit you make from selling the property. So, if you sell a property for $500,000 that you paid $400,000 for, you would only owe capital gains taxes on the $100,000 profit.

4. You Have a Choice in How Your Rental Income Is Handled

You can decide whether or not your revenue from US real estate is considered to be directly related to a US trade or company. If you choose this option, you will pay taxes at the same rates as US citizens. Your income will be liable to taxation if you don’t select this option.

You’ll be subject to US estate taxes if you die and own US real estate. These are only levied on properties worth more than $60,000.

5. Elections to Make

You can make two different elections that will affect how your income from US real property is taxed.

The first election is the Net Election. If you make this choice, your rental income will be reduced by any allowable expenses, such as mortgage interest, property taxes, and repairs. The net payment amount will then be taxed at your regular income tax rate.

The second election is the Gross Election. If you make this choice, your rental income will not be reduced by any allowable expenses. The gross income will be subject to the 30% withholding tax.

6. Tax Treaties

If your nation and the United States have a tax treaty, you can be qualified for a lower withholding tax rate. Please visit IRS Publication 515 for further details.

7. Withholding Tax

Your US real estate buyer must deduct 10% of the sale price and send it to the IRS when you sell the property. Withholding tax is what we call this. You can choose IRC 897’s reduction or elimination of the withholding tax (I).

The IRS will require you to submit evidence that you have complied with all US tax laws if you want the withholding tax to be eliminated or reduced. You will need to provide a certification from the IRS, which you can get by filing Form 8288-B.

If you don’t comply with US tax law, you may be subject to a 10% penalty on the property’s sale price and interest and possible criminal charges.

8. State Property Tax

Your US property may be subject to state property tax. Depending on the property’s state, the tax will be different.

The Takeaway

As a foreigner, you can still reap the benefits of investing in US real estate. However, you must understand the tax implications before you dive in. Withholding taxes and capital gains taxes can eat your profits, but there are ways to minimize the impact. And, if you have a tax treaty with the United States, you may be able to reduce your withholding tax rate.

Tips To Keep in Mind before Buying US Real Estate!

If you’re a foreign national looking to buy real estate in the United States, there are a few things you should know you should know a few things before getting started. From obtaining a mortgage to understanding tax implications, here are some crucial information to assist you along the way some essential information to help you.

1. Establish a budget.

Being aware of your budget is crucial if you want to purchase the ideal property. It would help if you had a rough idea of how much it will ultimately cost and where the money for this purchase will come from, such as a down payment or other options like mortgage refinancing.

2. Know the property’s intended usage.

Purchasing real estate in the United States is a wise financial move that can give you consistent income and appreciation. Although it might not seem like much to some investors or relocators searching for new residences, buying real estate in the US has consistently been one of America’s finest investments, making it one of the most common reasons individuals purchase these properties abroad.

The local economy and culture offer opportunities for work-life balance while also being friendly to your wallet.

3. Obtain a mortgage.

If you’re not paying cash outright for the property, you’ll need to obtain a mortgage from a lending institution. The process for obtaining a mortgage as a foreign national can be different than if you were a domestic buyer. There are certain steps and specific documentation required by both the lender and the US government that you’ll need to follow.

4. Deduct Expenses from Income to pay U.S. Taxes.

If you choose to buy a house or any piece of property in the US, you must submit a tax return at the end of each tax year. Real estate investors must decide whether to deduct expenses from income to take advantage of the favorable tax treatment that the IRS accords to such assets.

This can be done by selecting that option (also known as an “election”) on your tax return. If you don’t file tax returns or opt for this, the IRS will automatically charge you 30% of the gross rental income. Since expenses like depreciation, standard charges, property taxes, repairs, and interest wouldn’t be deductible, it can drastically reduce profits.

Remember that many cash expenses, including depreciation (a non-cash item), can be written off, which means that you will initially be showing tax losses from your investment. You wouldn’t owe the government anything as a result. You must file your tax return immediately to make that decision, even if you have tax losses.

5. Evade Death Tax (Estate Tax)

The combined federal and state taxes that must be paid in the US might equal roughly 46% of the estate. Only a $60,000 exemption is given to overseas buyers. Accordingly, if a US property owner hasn’t made preparations for this, their passing could result in a hefty tax and a resulting loss of inheritance to their heirs.

Using a foreign corporation with its headquarters outside of the US is an option for purchasing the property directly or holding it in an LLC (which is insufficient to avoid the estate tax). Another choice is to buy inexpensive term life insurance that will, if necessary, pay the tax and is payable to your heirs.

Don’t let the estate tax stand in the way of your investing in US real estate because it is relatively straightforward for foreign nationals to avoid. It’s important to plan when investing. Please discuss this with HomeAbroad so we can tell you how our international clients structure their transactions to minimize taxes.

6. CIPS Certified Agents

If you’re looking for an agent to help with your purchase, look for one certified by the Certified International Property Specialist (CIPS) program. CIPS agents have completed extensive international real estate transactions coursework and are better equipped than the average US real estate agent to help you buy property here.

HomeAbroad can help you here to choose the best lender for your mortgage. Additionally, we can help you connect with the CIPS Certified Real Estate Agents to make your purchase and mortgage process effortless. We are proud to have multiple CIPS-certified agents on staff and are here to help you every step, from finding the right property to navigating the nuances of an international transaction.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

Can foreigners invest in real estate property in the USA?

Yes, foreigners are able to invest in real estate property in the USA. In order to do so, they must go through the proper channels and follow the correct procedures. There are a few different ways that foreigners can invest in US real estate, such as through a trust, a corporation, or by setting up a limited liability company. Go through this guide to know the complete information on the topic.

How much does it cost to buy a house in the US?

The answer to this question largely depends on the property you’re interested in purchasing. For example, a fixer-upper will generally cost less than a brand new home. Additionally, the property’s location will play a role in its price. Generally, properties in larger cities or popular tourist destinations will be more expensive than those in more rural areas.

What type of property can I buy in the US?

The types of properties available for purchase in the US vary greatly. You can find everything from small bungalows to large mansions and from simple apartments to luxurious penthouses. No matter what your budget or preferences, you should be able to find a property that suits your needs.

How do I finance a property purchase in the US?

There are a few different ways to finance a property purchase in the US. You can take out a loan from a bank or other financial institution, use your savings, or get financing from the seller. If you’re not sure how to finance your purchase, HomeAbroad can help you find the best option for your needs.

What are some things to consider before buying a property in the US?

A few important things to consider before purchasing a property in the US. First, you’ll need to determine your budget and what type of property you’re interested in. You’ll also need to decide whether you want to buy a fixer-upper or a brand new home. Additionally, you’ll need to research the US real estate market to find the right property for you. Finally, consulting with a CIPS-certified agent is essential to help you navigate the process of purchasing a property in the US.

Purchasing real estate in the United States as a foreign national isn’t as complicated as you might think. With the help of a knowledgeable and experienced agent, you can easily find the right property and avoid any potential pitfalls. HomeAbroad is here to help you with every step, from finding the perfect property to securing financing. Contact us today to get started on your US real estate purchase.