Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Florida’s rental market is one of the strongest in the US, and DSCR loans from HomeAbroad allow international real estate investors to qualify without needing US income, US credit history, or residency status.

2. DSCR loans are underwritten based on the property’s rental income, so foreign nationals don’t need to provide personal tax returns, pay stubs, or employment records.

3. Major Florida cities like Miami, Orlando, and Tampa offer high rental yields, strong demand driven by tourism and population growth, and excellent long-term appreciation potential.

4. HomeAbroad is a one-stop shop that makes the entire process simple for international real estate investors, helping you find properties using our AI-driven investment property platform, get mortgages, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Table of Contents

Welcome to Florida – the Sunshine State, where beaches stretch for miles, oranges grow year-round, and Gatorade was invented (courtesy of University of Florida athletes needing a hydration boost).

According to the National Association of Realtors, 21% of all foreign real estate investors in the US choose Florida, making it the top destination for international buyers.

And it’s easy to see why: investor-friendly laws, strong rental yields, no state income tax, and year-round demand make Florida an ideal real estate market. Whether you’re eyeing a vacation rental in Orlando, a long-term duplex in Tampa, or a luxury condo in Miami, Florida offers some of the most attractive real estate returns in the US, especially for foreign nationals using HomeAbroad DSCR loans.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt-Service Coverage Ratio loan) from HomeAbroad is a foreign national mortgage option for international real estate investors that qualifies you based on the property’s rental income, not your personal income. Personal DTI(Debt-to-Income) ratios don’t affect qualification, as approval depends entirely on the property’s cash flow performance.

I recently worked with an investor from the UK looking to invest in a short-term rental in Sarasota, FL. As a self-employed entrepreneur with limited documentation, he could not qualify for traditional loans and got rejected by multiple lenders. With our DSCR loan, we focused solely on the property’s income and were able to approve him without the usual income verification hassle. You’ll find the whole story later in the article.

With Florida’s average rental yield at 7.5%, foreign real estate investors can leverage DSCR loans to acquire high-performing rental properties and boost returns in markets like Miami, Orlando, and Jacksonville.

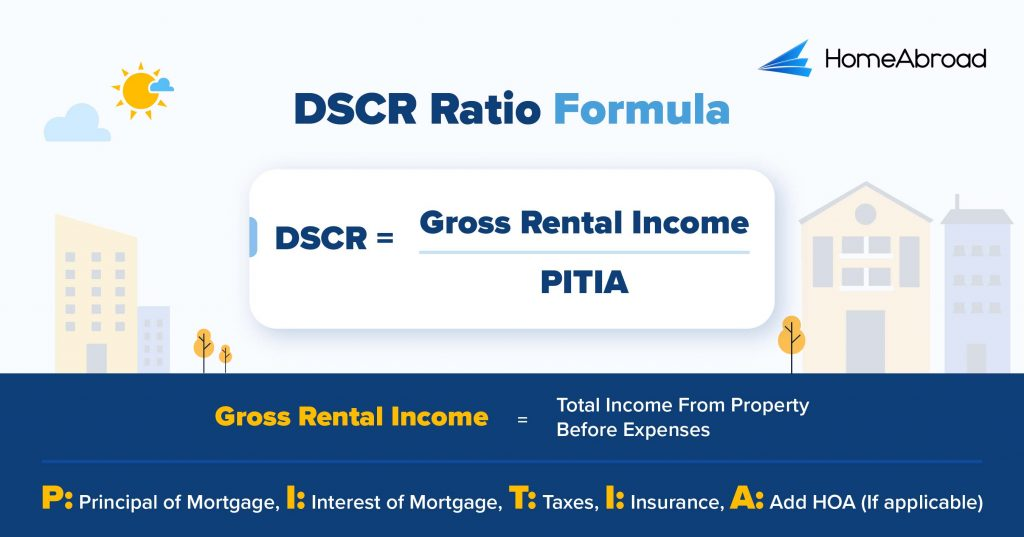

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

A DSCR of 1.24 indicates that the property generates 24% more income than the mortgage payment, signaling strong cash flow.

If you do not want to do the math, you can simply use HomeAbroad’s DSCR ratio calculator.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements in Florida for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined foreign national mortgage DSCR loan process tailored specifically for international real estate investors.

Whether you’re investing from abroad or don’t have a US credit history, our flexible terms, lower barriers, and remote-closing support make Florida real estate more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities, while our experts tailor the best DSCR loan solutions to fit your goals across Florida.

Where We Lend DSCR Loans in Florida

HomeAbroad offers DSCR loans across Florida, with tailored support for investors in top-performing cities like Miami, Orlando, Tampa, and more. Here are a few cities where we lend DSCR Loans in Florida.

- Miami

- Tampa

- Jacksonville

- Tallahassee

- Fort Lauderdale

- Orlando

- St. Petersburg

- Hialeah

- West Palm Beach

- Gainesville

- Lakeland

- Hollywood

- Pompano Beach

- Deltona

To see how a DSCR loan works in real life, let’s look at a case study of an investor who secured financing for a Florida rental property with the help of HomeAbroad.

Case Study: Meet Sam Smith, A UK Investor on an L-1 Visa

Sam Smith, a UK investor who recently arrived in the US on an L1 visa, aimed to purchase a rental property in Sarasota, Florida. However, he could not qualify for traditional mortgages due to his short residency in the US and a lack of a US credit history, leading to multiple rejections from various lenders.

The Solution: HomeAbroad Loans’ DSCR Loan

Sam opted for a DSCR loan from HomeAbroad, which allowed him to qualify based on the property’s rental income rather than requiring a US credit history.

HomeAbroad’s mortgage officer successfully reduced the DSCR interest rate to 7.375%, improving the property’s Debt Service Coverage Ratio (DSCR) and enabling Sam to qualify for a $341,000 loan. This tailored approach ensured the property’s income could cover its debt payments, making the loan feasible.

- Loan Amount: $341,000

- Purpose: Purchase

- Loan Type: 30-year fixed-rate

- Interest Rate: 7.375%

- Time to Close: 29 days

Why This Worked for Sam:

- No US Credit History Required: Unlike traditional loans, Sam’s eligibility was based on the property’s income potential, overcoming his lack of US credit history.

- Tailored Loan Terms: HomeAbroad adjusted the interest rate to ensure the DSCR was favorable, leading to loan approval within 29 days.

- Investment Growth: With a DSCR loan, Sam successfully financed a $500,000 single-family detached house in Sarasota, FL, expanding his real estate investments in the US.

This case study demonstrates HomeAbroad Loans’ expertise in empowering foreign real estate investors like Sam to expand their real estate portfolios in the US, providing flexible solutions that bypass typical income and credit constraints.

You can learn more about this case study here.

Top Places to Invest in Florida with a DSCR Loan

Florida continues to shine as one of the best states for real estate investment, and for good reason. With year-round sunshine, no state income tax, and a steady influx of new residents and tourists, it’s a natural hotspot for both long-term and short-term rental opportunities.

For foreign nationals investing in the US, Florida’s rental market offers an ideal landscape for using DSCR loans, especially when the focus is on the property’s rental income rather than the borrower’s personal income.

Here are some of the top-performing cities in Florida to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Orlando | Short-Term | 11.6% |

Tampa | Short-Term | 10.1% |

Miami | Short-Term | 9% |

Jacksonville | Long-Term | 6.9% |

Fort Lauderdale | Long-Term | 6.4% |

Orlando: The Theme Park Capital and Growing Tech Hub

Orlando isn’t just for Mickey Mouse or theme parks. While it remains a global magnet for tourism, it’s also growing fast in tech, healthcare, and logistics. This mix makes it a powerhouse for rental income, both from vacation rentals and long-term leases.

- Median Home Price: $381,502

- Average Rent: $2,000/month

What this means for investors: Steady appreciation, strong tenant demand, and the perfect setup for DSCR-based qualification thanks to consistently high rental income.

Investment Properties Listed Today on Sale in Orlando

Tampa: Gulf Coast Growth Meets Urban Appeal

Tampa blends big-city opportunities with Gulf Coast lifestyle. Think corporate headquarters, tech startups, and one of the country’s most desirable places to live and work. The revitalized downtown and constant job growth attract both professionals and renters in droves.

- Median Home Price: $376,278

- Average Rent: $2,200/month

What this means for investors: High rents paired with a stable economy make it easy to meet DSCR thresholds, even for foreign nationals without US income or credit history.

Investment Properties Listed Today on Sale in Tampa

Miami: The International Gateway to Luxury and Culture

Miami is a vibrant global hub attracting foreign nationals and high-net-worth individuals. Its luxury condos and waterfront properties drive strong demand, especially in the short-term rental market.

- Median Home Price: $588,264

- Average Rent: $3,250/month

What this means for investors: Miami’s high rents and luxury market provide significant rental income potential, making it a strong contender for DSCR loans even in a shifting market.

Investment Properties Listed Today on Sale in Miami

Jacksonville: The Affordable and Growing Gem

Jacksonville offers affordability combined with steady growth. Its diverse economy and large land area support solid rental demand, making it attractive for investors seeking reliable cash flow.

- Median Sold Price: $290,108

- Average Rent: $1,666/month

What this means for investors: With lower property prices and solid rents, Jacksonville is ideal for cash-flow-driven investors looking to meet DSCR loan requirements with ease.

Investment Properties Listed Today on Sale in Jacksonville

Fort Lauderdale: Coastal Charm Meets Investment Opportunity

With its winding canals and luxury lifestyle, Fort Lauderdale is ideal for high-end short-term rentals. Its strong vacation market and upscale appeal make it a great choice for international real estate investors aiming for premium returns.

- Median Home Price: $513,822

- Average Rent: $2,750/month

What this means for investors: The current market favors buyers, offering more room to negotiate on price. With elevated rents, it’s a perfect fit for DSCR financing, especially for luxury or waterfront properties.

Investment Properties Listed Today on Sale in Fort Lauderdale

Specific Considerations for Investing in Florida for Foreign Nationals

Florida’s real estate market offers compelling opportunities, but its unique characteristics demand a strategic approach. From weather-related risks to tax policies and local regulations, investors must understand the broader landscape to succeed in the Sunshine State.

Here are the most critical factors to keep in mind:

– Florida’s Property Insurance Landscape

Florida’s hurricane risk drives some of the highest property insurance premiums in the US. The market has been volatile, with insurers leaving and rates rising, pushing many to rely on the state-backed Citizens Insurance. Legislative reforms are improving stability, but older homes often face higher premiums or require costly upgrades to qualify for private coverage.

– Hurricane Risk and Climate Resilience

Coastal and flood-prone properties face significant storm damage risks, affecting insurance costs and long-term value. Buyers increasingly favor homes with hurricane-resistant features or choose inland locations. Investors should factor in these risks when assessing property sustainability and resale potential.

– Short-Term Rental Regulations

Florida requires vacation rentals to be licensed at the state level, but local rules vary widely. Cities and HOAs may impose occupancy limits, noise restrictions, or bans. Hosts must also collect and remit state and local taxes. Renting your primary residence short-term may impact homestead tax exemptions.

– Landlord-Tenant Laws and Rental Management

Florida allows rent increases without statewide limits but requires specific notice periods for lease termination. Evictions follow clear timelines, and landlords must return security deposits promptly. Maintaining habitable conditions is legally required. Professional management can ease compliance and tenant relations.

Strategic & Future Considerations for Foreign Nationals Investing in Florida

Florida remains a top choice for foreign nationals due to its strong real estate fundamentals and favorable ownership laws. Looking ahead, infrastructure expansions, like new transit projects and commercial developments, are reshaping growth patterns, making emerging suburbs and secondary cities attractive for investment beyond traditional hotspots.

Here are some future considerations that international real estate investors need to pay heed to:

1. Foreign Ownership-Friendly Policies: Florida has no restrictions on foreign property ownership, making it one of the most accessible states for foreign nationals. This openness encourages diverse foreign investment, especially from Latin America and Europe.

2. Foreign Buyer Impact on Luxury and Coastal Markets: High-net-worth international real estate investors significantly influence Miami’s luxury condo market and coastal beachfront properties. However, rising climate risk awareness is slowly shifting some investment toward newer developments with better resilience features.

3. Foreign Buyers’ Visa and Residency Trends: Florida’s popularity among visa holders, especially investors using E-2, EB-5, and other business immigration pathways, creates a unique demand niche. Understanding these residency-linked buying patterns helps tailor investment timing and exit strategies.

4. Growth of Secondary Cities: While Miami and Orlando dominate headlines, cities like Sarasota, Naples, and Fort Myers are attracting growing numbers of foreign buyers due to affordability, lifestyle, and healthcare infrastructure, opening up less saturated investment opportunities.

Get a HomeAbroad DSCR Loan in Florida as a Foreign National

Securing financing for your investment property in Florida is simple with HomeAbroad. Our DSCR loans are tailored specifically for global real estate investors, offering flexible terms and competitive rates to help you grow a high-performing real estate portfolio.

HomeAbroad streamlines the entire investment journey. With our AI-driven investment property search platform, you can discover top-yield rental properties across Florida. Our expert local agents offer personalized guidance, and we assist with everything from LLC formation to US bank account setup and property management support.

If you already own a rental property in Florida, HomeAbroad’s cash-out refinancing option lets you access your property’s built-up equity without needing US income or credit. Use the funds to purchase additional properties, renovate for higher returns, or diversify your investment strategy, all while keeping the approval process rental-income focused.

Get a DSCR loan with HomeAbroad today and start building your Florida real estate portfolio with confidence.

Frequently Asked Questions

Can foreign nationals apply for DSCR loans in Florida?

Yes, foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international real estate investors.

What are the interest rates for DSCR loans?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

Is cash-out refinancing available for DSCR loans?

Yes, HomeAbroad offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

What is the minimum DSCR required to qualify?

HomeAbroad typically requires a minimum DSCR of 0.75, but we also offer “No Ratio DSCR” loan options in some cases where the property’s income falls below this threshold.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

Miami Realtors: International Homebuyer Transactions in Florida

![How to Find the Right DSCR Lender – Top 7 Tips [2025]](https://homeabroadinc.com/wp-content/uploads/2022/10/Find-DSCR-loan-lender.jpg)

![DSCR Loan Interest Rates Today [December, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)