Key Takeaways:

➡️ Florida offers diverse cities with varying property prices, catering to different investment strategies and potential returns.

➡️ The state’s warm climate and tax-friendly policies make it attractive for both short-term and long-term rental properties.

➡️ Property appreciation rates in cities like Orlando and Miami continue to rise, making them prime locations for rental property investors.

➡️ HomeAbroad provides tailored mortgage solutions for both foreign and domestic rental property buyers.

Table of Contents

Florida is a state of contrasts, offering a mix of beauty, opportunity, and unpredictability.

As American writer Roxanne Gay once said, “Florida is a strange place: hot, beautiful, ugly. I love it here, and how nothing makes sense but still, somehow, there is a rhythm.”

This unique rhythm makes Florida one of the most attractive destinations for investors, both domestic and foreign. From its warm climate and thriving tourism industry to its investor-friendly tax policies, the Sunshine State offers unparalleled opportunities for those looking to invest in real estate and become homeowners.

At HomeAbroad, we specialize in guiding investors through every step of the process, ensuring a smooth transition into Florida’s dynamic real estate market.

Why is Florida the Ideal Location for Rental Property Investors?

Florida isn’t just a vacation paradise—it’s a top choice for both foreign and domestic rental property investors alike. Whether you’re looking to invest in short-term vacation rentals or long-term rental properties, Florida’s economy, tourism, and tax benefits make it an exceptional choice.

Economic Appeal: Investment Opportunities in Rental Properties

Florida’s cities are booming, attracting investors for various reasons:

- No state income tax: A significant advantage for investors looking to maximize rental profits.

- Affordable coastal living: Compared to other coastal states, Florida offers more affordable housing options, boosting rental demand.

Why Florida is the Ideal Location for Rental Property Investors

Florida is a top choice for both foreign and domestic rental property investors, offering excellent opportunities in short-term vacation rentals (STRs) and long-term rentals (LTRs). The state’s economic growth, booming tourism, and favorable tax environment make it a prime destination for maximizing rental income.

Economic Appeal: Investment Opportunities in Rental Properties

Florida attracts investors with key advantages:

- No state income tax: A major benefit for investors aiming to maximize rental income.

- Affordable property prices: Compared to other coastal states, Florida offers more affordable investment options with strong demand for rentals.

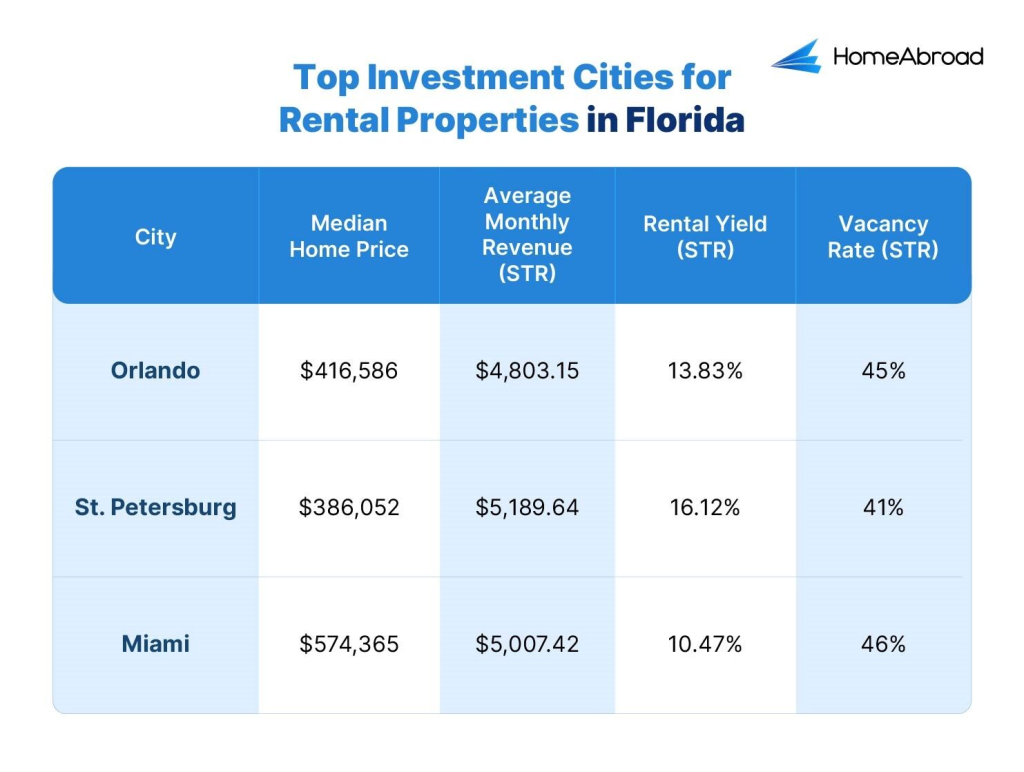

Best Investment Cities for Rental Properties in Florida [2024]

Here are the top three cities offering the best rental returns in Florida:

1. Orlando

Median Home Price: $416,586

Average Monthly Revenue (STR): $4,803.15

Rental Yield (STR): 13.83%

Vacancy Rate (STR): 45%

Why invest:

Orlando is a prime location for short-term rentals due to its proximity to world-famous attractions like Disney World and Universal Studios. With a 13.83% rental yield and relatively affordable property prices, it offers one of the highest returns for investors seeking short-term vacation rental income.

2. St. Petersburg

Median Home Price: $386,052

Average Monthly Revenue (STR): $5,189.64

Rental Yield (STR): 16.12%

Vacancy Rate (STR): 41%

Why invest:

St. Petersburg offers the highest rental yield among Florida cities, with an impressive 16.12% return on short-term rentals. Its lower property prices combined with high demand make it an excellent option for investors looking to maximize their profits, particularly in the STR market.

3. Miami

Median Home Price: $574,365

Average Monthly Revenue (STR): $5,007.42

Rental Yield (STR): 10.47%

Vacancy Rate (STR): 46%

Why invest:

Miami is a global city with a strong tourism and business presence, making it ideal for both short-term vacation rentals and long-term rental investments. With a 10.47% rental yield, Miami combines strong returns with high occupancy rates, driven by both international visitors and business professionals.

For rental property investors, Orlando, St. Petersburg, and Miami stand out as the top investment opportunities in Florida. These cities offer high rental yields, affordable property prices, and strong demand for both short-term and long-term rentals. Whether you’re looking for a vacation rental hotspot or a long-term investment, these cities provide the best returns in the state.

For more insights on buying property in the US as a foreigner, check out our detailed guide: Can Foreigners Buy Property in the US?

How to Start Investing in Florida Real Estate

Investing in Florida real estate offers both high rewards and unique challenges, whether you’re a foreign national or a domestic buyer. Here’s a comprehensive guide to ensure you’re well-prepared to make a successful investment.

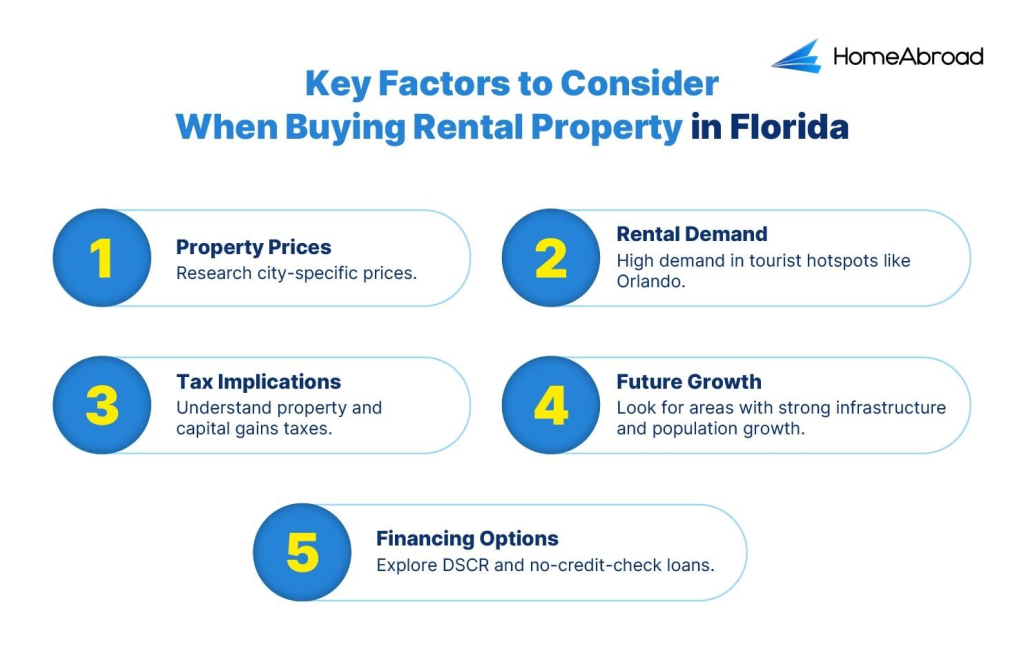

1. Research the Market

The first step in any real estate investment is understanding the market. Florida’s cities each offer different advantages depending on your goals, such as long-term rentals, short-term vacation properties, or resale. Key things to research include:

- Property Prices: Investigate current median home prices in cities like Miami, Orlando, and Tampa, where prices vary greatly.

- Rental Demand: Identify areas with high demand for rental properties, especially short-term rentals. Cities with strong tourism, such as Orlando and Key West, are ideal for vacation rentals.

- Future Growth: Look for areas where population and infrastructure growth indicate increasing property values, such as Tampa or Fort Lauderdale.

Understanding these factors will help you choose the best location to match your investment strategy.

2. Select the Right Location

Once you’ve researched the market, it’s time to narrow down the best location for your investment. Each city in Florida has distinct qualities to consider based on your specific goals:

- Short-Term Rentals: Cities like Orlando and Key West are tourism hotspots, providing consistent demand for vacation rentals.

- Long-Term Rentals: Areas such as Tampa and Fort Lauderdale are ideal for long-term rental investments due to their strong job markets and business hubs.

- Luxury Investments: For higher-end investments, Naples offers upscale residential options with potential for high returns.

3. Understand the Legal Framework

Florida is a favorable state for real estate investors, but it’s critical to understand the legalities involved:

- Property Taxes: Property taxes in Florida are assessed at the county level, averaging around 0.83% of a property’s value. There is no state income tax, which makes owning property in Florida more attractive compared to other states.

- Rental Laws: If you’re planning to rent out your property, familiarize yourself with Florida’s landlord-tenant laws to ensure you understand your rights and obligations. It’s crucial to comply with local rental regulations, particularly in high-demand areas like Miami and Orlando.

4. Secure Financing

Securing financing is a crucial step in the real estate investment process. As a buyer, whether domestic or foreign, you have a range of mortgage options:

- DSCR Loans: These are ideal for property investors as they focus on the rental income of the property rather than the borrower’s personal income. You can get more information in our [DSCR Loan Guide].

- No-Credit-Check Loans: Designed for foreign nationals who do not have a US credit score, these loans make it easier for international buyers to invest. HomeAbroad Loans specializes in offering these loans, ensuring foreign buyers can still secure a mortgage without the need for a traditional credit score. Looking into this loan? Check out our detailed guide.

- Conventional Loans: These are typically available for domestic buyers with established credit histories. They come with competitive interest rates and flexible terms.

Down Payment Requirements

The down payment requirements can vary depending on whether you’re a domestic buyer or a foreign national:

- Domestic Buyers: Typically, down payments range from 5% to 20% of the home’s purchase price, depending on the loan type and the buyer’s credit profile.

- Foreign Nationals: Generally, foreign buyers are required to make a higher down payment, usually around 25% of the home’s value. This higher requirement is standard due to the absence of a US credit history.

At HomeAbroad Loans, we streamline the mortgage process for both US and foreign buyers, offering personalized guidance to help you choose the best financing option for your situation. Our dedicated mortgage officers work with you every step of the way, ensuring a seamless experience from application to closing.

5. Conduct Property Due Diligence

Before making a final purchase, conducting thorough due diligence on the property is essential:

- Property Inspection: Always perform a detailed property inspection to assess the condition of the property, especially if it’s an older building. Inspections will reveal any potential repair or renovation costs.

- Appraisal: Get an independent appraisal to verify the property’s market value. This is crucial to ensure you’re making a sound investment and not overpaying.

- Title Search: Ensure a clean title with no legal disputes, unpaid taxes, or other liens against the property.

Completing these steps will give you a clear picture of the property’s value and any hidden costs that may affect your investment.

6. Close the Deal

Once you’ve completed due diligence and secured financing, the final step is closing the deal. During closing, you will:

- Sign all required documents, including the deed, loan papers, and closing statement.

- Pay closing costs, which typically range from 2% to 5% of the property’s purchase price. These costs include legal fees, loan processing fees, and property taxes.

- Transfer ownership, at which point you officially become the property owner.

At HomeAbroad, we ensure that all the paperwork is in order and handle the legalities to guarantee a smooth and stress-free closing process.

7. Manage Your Investment

After closing, you’ll need to decide how you’ll manage your property:

- Short-Term Rental: If your property is in a tourist area, consider listing it on platforms like Airbnb or VRBO for short-term rentals. You’ll need to manage bookings, maintenance, and guest relations.

- Long-Term Rental: If you’re planning for a long-term rental, hire a property manager to handle tenant screening, lease agreements, and ongoing maintenance.

If you’re new to property management, HomeAbroad can connect you with experienced property managers to ensure your investment runs smoothly and profitably.

Once you’ve grasped the process, the next essential step is securing financing. Let’s explore your options for financing your Florida home.

Taxes and Implications of Buying Rental Property in Florida

When purchasing rental property in Florida, understanding the tax implications is crucial for both domestic and foreign investors. Florida offers several tax advantages, but there are important considerations depending on your residency status and investment goals.

1. Property Taxes

Florida’s property tax rates vary by county, but on average, property owners can expect to pay around 0.83% of their property’s assessed value annually. As there is no state income tax in Florida, property taxes are a significant factor for rental property investors. You can find detailed tax rates for each county on the [Florida Department of Revenue website].

2. Capital Gains Tax

For both domestic and foreign property owners, selling rental property in Florida may result in capital gains tax on the profit made from the sale. For both US residents and foreign nationals, capital gains tax rates range from 15% to 20% depending on income.

- 1031 Exchange: For investors, using a 1031 exchange can defer capital gains taxes if the proceeds are reinvested in another like-kind property. This can be an advantageous strategy to minimize tax liabilities. Learn more about 1031 exchanges at the [IRS website].

3. Foreign Investment in Real Property Tax Act (FIRPTA)

Foreign buyers should be aware of the Foreign Investment in Real Property Tax Act (FIRPTA), which requires foreign sellers of US real estate to withhold 15% of the gross sales price for tax purposes. However, please note that this is not additional tax, but withholding which will be refunded when you file the tax return.

Why Florida is the Right Choice for Investors

Florida offers an unbeatable combination of real estate growth, tax benefits, and rental demand, making it an ideal state for both short-term and long-term rental property investors. At HomeAbroad, we guide you through each step of the investment process.

Find the best real estate agent with international expertise

Connect with a HomeAbroad real estate agent in your area.

FAQs

1. Can foreign nationals buy property in Florida?

Yes, foreign nationals can buy property in Florida without any restrictions. Whether you’re purchasing an investment property or a primary residence, Florida’s real estate market is open to international buyers. HomeAbroad can guide you through the entire process, from legal requirements to securing financing.

2. What are the down payment requirements for foreign buyers in Florida?

Foreign buyers typically need to make a down payment of around 25% of the property’s purchase price. This is standard due to the lack of a US credit history. However, HomeAbroad offers tailored financing solutions for foreign buyers to help them meet these requirements.

3. Are there any tax advantages to buying property in Florida?

Yes, Florida offers several tax benefits, including no state income tax and no estate or inheritance tax. Additionally, property taxes are relatively low compared to other states, averaging around 0.83% of the property’s value. Investors can also benefit from 1031 exchanges to defer capital gains taxes.

4. What financing options are available for domestic and foreign buyers?

Both domestic and foreign buyers have access to various mortgage options in Florida – no-credit-check loans or DSCR loans, even if they don’t have a US credit score.

5. How does FIRPTA affect foreign property sellers?

The Foreign Investment in Real Property Tax Act (FIRPTA) requires foreign sellers to withhold 15% of the property’s gross sales price for tax purposes. However, there are ways to reduce or avoid this withholding, such as filing for a withholding certificate or if the property is a primary residence.

How Does HomeAbroad Help?

"Unlocking US real estate for the world with our tailored offerings."