Key Takeaways:

➡️ Canadian investors, snowbirds, and other visa holders can get US mortgages regardless of their US credit history.

➡️ Visa holders don’t need a green card, and non-resident investors don’t need any visa to obtain a US mortgage and buy real estate.

➡️ In contrast to Canada, HomeAbroad offers mortgage loans with terms of up to 30 years at fixed interest rates. This longer loan term allows your monthly mortgage payments to be lower, maximizing rental yield, as the loan amount is spread over a more extended period. Additionally, you benefit from the stability of consistent monthly payments, making it easier to plan your finances.

In the previous year, Canadians have invested approximately $89.3 billion in US properties, making them the largest group of foreign buyers by number.

This total represents the significant investment Canadians have made in the US real estate market, driven by factors such as favorable exchange rates, the appeal of US vacation destinations, and the stability of US property investments.

If you’re among those aspiring buyers but concerned about financing, worry not! HomeAbroad Loans offer tailored US mortgage programs that don’t require a US credit history or green card, making it easier for Canadians to buy US real estate.

Let’s explore HomeAbroad Loans’ mortgage options and guide you through the process of securing a US mortgage as a Canadian real estate buyer.

Table of Contents

Can Canadians Get a Mortgage in the US?

Yes, Canadians can indeed get mortgages in the US, regardless of their citizenship, immigration status, or residency. Notably, having a US credit history is not a requirement.

HomeAbroad Loans offers tailored foreign national mortgages tailored for Canadians, including different visa holders new to the US, snowbirds, and investors without a US credit history, catering to various investment and personal needs.

Additionally, all visa holders with a good US credit score can access conventional loans, similar to those available to US citizens.

In this guide, we will discuss all available mortgage loan options for both groups. But first, let’s establish the key differences between US and Canadian mortgages to provide a solid foundation.

Canadian Bank Mortgages vs. US Mortgages

You can get mortgages to buy property in the US from Canadian banks, but there are certain differences when you compare them to HomeAbroad Loans. Let us look at how Canadian Banks differ from HomeAbroad:

| Feature | Canadian Mortgages | US Mortgages for Canadians |

|---|---|---|

| US Credit History | Requires strong financials in Canada | No US credit history required; can use international credit |

| Loan Term | Begins with an initial term of 3, 5, 7, or 10 years, with Adjustable Rate Mortgages. | Typically, 30 years or based on the specific loan product, with Fixed Rate Mortgage and zero restrictions. Adjustable Rate Mortgages are also available. |

| Interest Rates | Higher than the interest rates for Canadian domestic transactions | Competitive rates; interest rates can vary based on loan type and financial profile; only 25-50bps higher than interest rates for US citizens. |

| Down Payment Requirement | 20% or higher | 25% |

| Documentation Required | Extensive documentation including proof of income, assets, and Canadian credit history | Streamlined process; we use property’s income. Personal income is not required. |

| Processing Time | Longer due to cross-border considerations | Quick approvals, often within 30 days |

| Closing Process | May require travel to the US for closing | No need to travel to the US; remote closing available |

US Mortgage Options for a Canadian Citizen

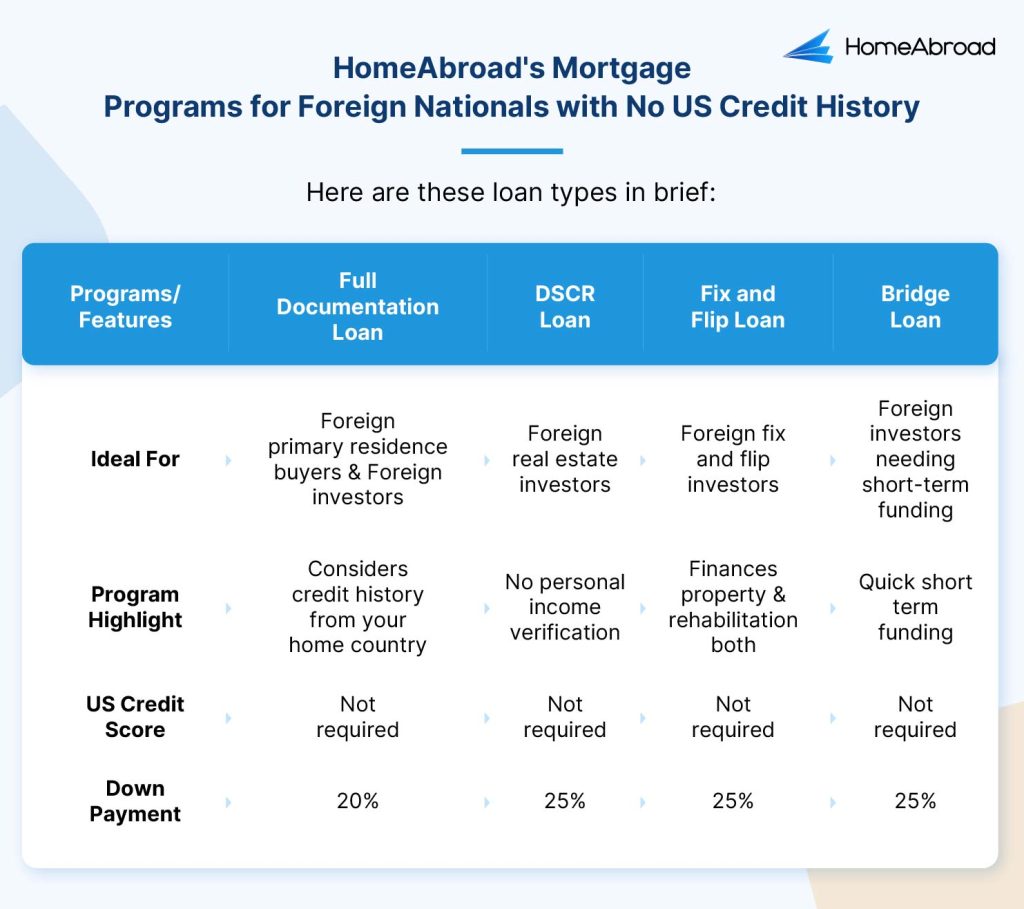

HomeAbroad offers tailored US mortgages for Canadian citizens without US credit history. Our mortgage loan programs are designed to meet the diverse needs of Canadian buyers, whether you’re purchasing a home, an investment property, or a vacation home in the US.

US Mortgages for Canadian Investors

If you are a Canadian investor looking to invest in US real estate, these options are perfect for you, depending on your investment type:

1. DSCR Loan

For Canadian real estate investors eyeing the booming US rental market, a Debt Service Coverage Ratio (DSCR) loan is a powerful tool. This loan is perfect for those looking to invest in income-generating properties in cities like Florida, Chicago, or Hawaii, where rental yields are attractive.

| City | Rental Yield |

|---|---|

| Florida | 7% |

| Chicago | 9% |

| New York | 8% |

| Data Source: Zillow | |

Case Study: Canadian Investor Secures a Home in Hawaii

Let us take the example of our Canadian client, who was able to secure a $1.2 million rental property in Hawaii using DSCR Loan. HomeAbroad Loans approved the mortgage based on the property’s income potential rather than the borrower’s personal financials, showcasing the flexibility and accessibility of this program.

If we take the example of our investor, he faced challenges due to the lack of a US credit history and needed a streamlined solution to qualify quickly.

The Challenge

The client aimed to acquire a high-value rental property in Hawaii, a competitive market, but faced hurdles common to foreign buyers:

- Lack of US credit history.

- Uncertainty about meeting US mortgage qualifications.

- Limited time for extensive documentation processes.

The Solution

HomeAbroad Loans guided the investor through our DSCR loan program. This loan type evaluates the property’s income potential rather than the borrower’s personal income or credit history. Here’s how we made it possible:

- Simplified Qualification: The approval process focused on the property’s rental income, bypassing the need for a US credit score.

- Competitive Terms: The investor secured a fixed interest rate with a 30-year term, ensuring manageable monthly payments.

- Efficient Process: The remote closing eliminated the need for the investor to travel to the US.

You can read the full story and explore how HomeAbroad Loans can help you achieve similar success in our Canadian Buys Hawaii Property Case Study.

2. Fix and Flip Loan

Canadians are increasingly drawn to Fix and Flip loans due to their high potential for return on investment, particularly in emerging US markets like Philadelphia and San Jose, California.

HomeAbroad’s Fix and Flip loans empower Canadian investors to purchase, renovate, and resell properties swiftly, taking advantage of both favorable exchange rates and growing demand for renovated homes in these dynamic markets.

The short-term nature of these loans, combined with minimal personal financial risk and the opportunity to build a robust US real estate portfolio, makes them particularly appealing.

Furthermore, the creative control over renovation projects adds another layer of attractiveness, allowing investors to directly influence the market value of their properties.

3. Bridge Loan

Canadians are also inclines towards Bridge Loans as a strategic tool to facilitate quick real estate transactions in the US, particularly in high-demand markets like New York City and Miami.

These loans are especially beneficial for investors who need immediate capital to secure new properties before selling their existing ones.

For example, in New York City, where the real estate market moves rapidly, Bridge Loans allow Canadian investors to act swiftly, ensuring they can purchase a property in a competitive environment without waiting for the sale of another asset.

In fast-paced markets where properties sell quickly, Bridge Loans enable swift action by leveraging current assets as collateral.

They offer short-term financing flexibility, which is crucial for bridging the gap between buying and selling. This approach supports creative financial planning and helps investors manage multiple transactions, which is essential for building a strong US real estate portfolio.

4. Full Documentation Loan

HomeAbroad’s Full Documentation Loan is ideal for Canadians buying primary residences, vacation homes, or rental properties in the US, particularly in popular spots like Florida, Arizona, and California. Our Full Doc. Loan program considers your foreign income and assets for qualification.

This loan bypasses the need for a US credit history by using an International Credit Report from Canada, a bank reference letter, and a payment history on two tradelines.

It’s perfect for Canadians new to the US or investing from abroad, offering quick approval—typically within 30 days.

You can check out the overview of these loan types below:

To know more about these loan programs and qualification criteria, check out HomeAbroad’s foreign national mortgage guide.

US Mortgages for Canadian Primary Residence Buyers

If you are a US newcomer on a visa buying a primary residence, and do not have a US credit history, this option is the best fit for you:

US Newcomer Mortgage

The US Newcomer Mortgage is tailored for Canadians who have recently moved to the US on a visa and want to buy a primary residence but lack a US credit history.

This program allows them to qualify using their US income and a credit report from Canada, eliminating the need for a US credit score. It offers an accessible way for newcomers to purchase a home and settle into their new lives in the US.

US Mortgages for Canadians with a Good US Credit Score

As a visa holder with a good US credit history, you can qualify for traditional loan options – FHA Loans and Conventional Loans – similar to those available to US citizens.

1. FHA Loan

For Canadians with a US visa and good credit, FHA Loans are an appealing option. Insured by the Federal Housing Administration, these loans offer low down payments, as low as 3.5%, making them ideal for first-time US homebuyers.

However, they require a minimum credit score of 580 and a US employment history, making them best suited for established Canadians in the US. The requirements and terms are identical for foreign nationals and US citizens, with no additional overlays based on nationality or immigration status.

2. Conventional Loans

For Canadians with a strong US credit score, Conventional Mortgages are a solid option. These loans, not backed by government insurance, often provide competitive interest rates and require down payments as low as 3% for qualified buyers.

Typically, they require a minimum credit score of 620 and a stable US employment history. This makes Conventional Mortgages ideal for Canadians who are well-established in the US and meet these financial criteria.

While Canadians can obtain conventional mortgages from many lenders, not all are experienced in working with foreign nationals, which can lead to significant delays or even rejection.

With HomeAbroad Loans, you can have peace of mind knowing that you are working with a mortgage company that understands visa holders and expats.

Found the right mortgage program for your US credit situation and ready to apply? Here’s a detailed guide on “How can foreigners apply for a US mortgage?” which includes everything you need to know.

Secure a US Mortgage with HomeAbroad Loans

Securing a US mortgage as a Canadian can be difficult, but HomeAbroad Loans simplifies the process with expert guidance, tailored mortgage options, and comprehensive support.

Our team assists you with the documentation and approval process.

We also offer personalized solutions whether you’re buying a home, investing in real estate, or need a tailored loan product.

From initial consultation to closing, HomeAbroad Loans ensures a smooth experience by helping you understand credit requirements, manage cross-border financial considerations, and connect with our Certified International Property Specialist (CIPS) real estate agents.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

Frequently asked questions (FAQs)

Do Canadians need a US credit history to get a mortgage in the US?

No, Canadians do not necessarily need a US credit history to get a mortgage in the US. HomeAbroad Loans offers tailored foreign national mortgages that don’t require a US credit history. Reach out to get started!

Are interest rates higher for Canadians getting US mortgages?

Interest rates for Canadians seeking US mortgages are typically slightly higher than those for standard conventional mortgages due to increased risk. However, at HomeAbroad, we are committed to democratizing US real estate for foreign nationals by offering highly competitive rates. Get a rate quote today!

Can I buy a property in the US with a mortgage from a Canadian bank?

Yes, you can buy a property in the US with a mortgage from a Canadian bank. The US offers long-term mortgages with tax-deductible interest rates and monthly compounded rates, making it a beneficial and affordable borrowing option.

Do Canadians need a Social Security Number to apply for a US mortgage?

No, Canadian investors and snowbirds do not need a Social Security Number (SSN) to apply for a US mortgage. Instead, you will need to obtain an Individual Taxpayer Identification Number (ITIN) for tax and identification purposes.

What happens if a Canadian defaults on a US mortgage?

If a Canadian defaults on a US mortgage, the process is similar to that faced by US citizens. The lender can initiate foreclosure proceedings to take possession of the property. A default can also negatively impact your credit score and financial standing both in the US and Canada.

How much money can Canadians borrow from US mortgages?

With HomeAbroad Loans, Canadians can borrow $75K to $10M depending on the loan program and your financial profile.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

Zillow: Home Values and Rent Data

ATTOM: Home Flipping Data

![Guide to US Mortgages for Canadians without a US Credit History [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/us-mortgages-for-canadians-500x325.jpg)

![Can Canadians Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/08/CanCanadiansBuyPropertyInTheUSA-scaled.jpg)