Key Takeaways:

➡️ Thanks to its strong rental market, zero state income tax, and landlord-friendly laws, Texas is one of the most sought-after investment destinations for US real estate investors.

➡️ Texas is also a top destination for foreign real estate investors, including investors from India and Mexico. [Source: NAR]

➡️ HomeAbroad Loans provides customized DSCR loans with competitive interest rates, allowing both US and foreign investors to secure financing based on the property's income rather than personal income.

➡️ With DSCR loans from HomeAbroad, investors can finance a range of property types, using both short-term and long-term rental income to qualify.

Table of Contents

As of June 30, 2024, 20.4% of homes in Texas were sold above their list price, underscoring the fierce competition in the state’s real estate market (Source: Zillow). This figure highlights how many buyers are willing to pay more than the listed price to secure properties, indicating a highly competitive environment.

Texas is also the second-most popular destination for foreign investors, capturing a 13% share of investment properties; the state has become a prime market for real estate investors. (Source: NAR).

To help US domestic and foreign real estate investors make the most of the opportunities in Texas investment properties, HomeAbroad Loans provides tailored DSCR loan options.

Whether you’re targeting long term rentals (LTRs) or short-term rentals (STRs), our flexible loan programs and competitive terms ensure you can take full advantage of Texas’s booming real estate market.

What is a DSCR Loan and How Does it Work?

A Debt Service Coverage Ratio (DSCR) loan is a mortgage program designed for real estate investors who may not qualify for traditional financing for their real estate investment.

Unlike conventional loans that rely heavily on the borrower’s personal income and financial history, DSCR loans are underwritten based on the income generated by the investment property itself.

This unique approach allows investors to qualify based on the property’s ability to generate cash flow, making it an ideal solution for those looking to expand their investment portfolios or seeking a more flexible loan option with less documentation.

For more details on DSCR loan and how it works, check out our comprehensive DSCR Loan Guide.

DSCR Loan Requirements

Qualifying for a DSCR Loan for LTR and STR properties primarily focuses on the income generated by the property itself. The key requirements for HomeAbroad Loans’s DSCR loan program include:

With these requirements in mind, two key factors are crucial to underwriting your DSCR loan.

Generally, we focus on two main factors. For US citizens, credit score is considered, but assuming it meets the criteria, the focus shifts to these two factors. For foreign investors, we can proceed without a US credit score.

- Assets for Closing:

You need sufficient funds to cover the down payment (typically 25%) and closing costs, which usually range from 3% to 4% of the loan amount. We require a two-month history showing these assets in your account.

- Property Income:

We also need to verify the property’s rental income, either through an appraisal (1007 Rent Schedule) or through a history of short-term rental income.

If you can show the required assets for the down payment and closing costs, and we have rental income verification, securing the loan becomes a straightforward process.

Now that we understand the requirements and eligibility factors for DSCR Loans, let us look at how we can calculate our DSCR ratio.

How to Calculate Your DSCR Ratio

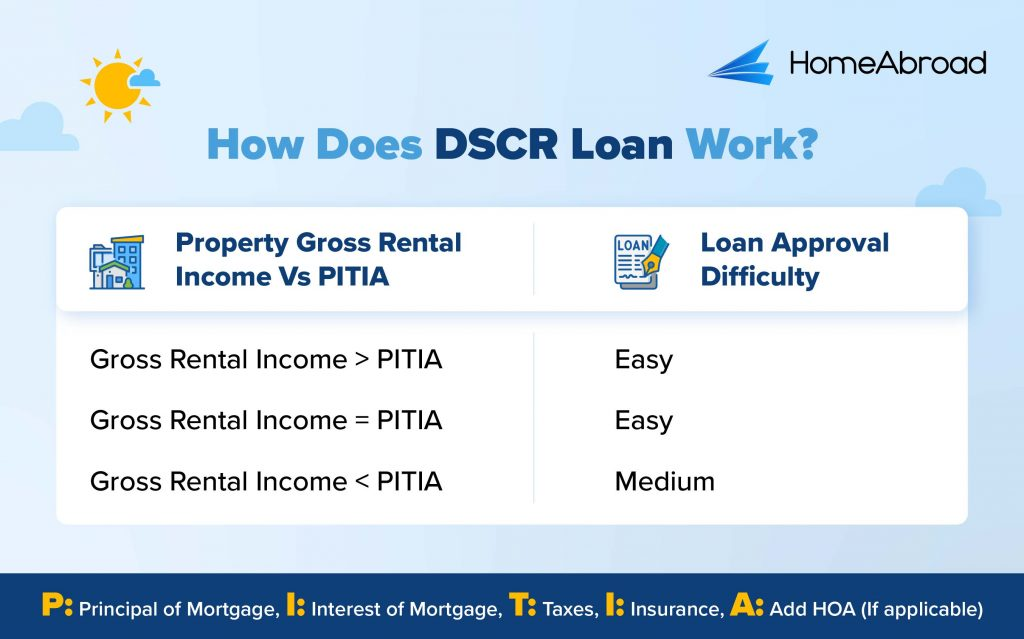

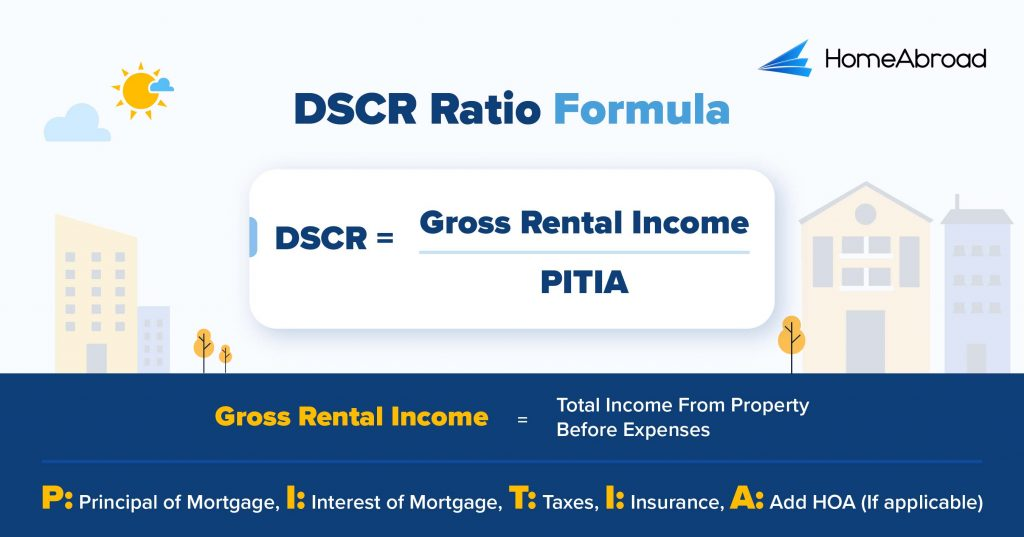

The Debt Service Coverage Ratio (DSCR) is a crucial metric that lenders use to assess a borrower’s ability to cover mortgage payments with their rental income. For real estate investors, a higher DSCR indicates strong cash flow, which improves your chances of securing better loan terms.

Here’s the formula to calculate your DSCR:

To simplify the process, HomeAbroad Loans offers an easy-to-use DSCR Calculator where you can instantly calculate your DSCR ratio without any mathematical hassle. Simply enter the key figures to see where you stand.

At HomeAbroad Loans, we specialize in providing DSCR loans tailored to real estate investors. While many lenders require a minimum DSCR of 1 and above, we offer flexibility with loans available for DSCR ratios as low as 0.75.

In some cases, we offer “No Ratio DSCR loans” for properties with a DSCR below 0.75, allowing you to secure financing even if your rental income doesn’t fully cover debt obligations. However, this option requires a larger down payment and comes with higher interest rates to mitigate the additional risk.

By using HomeAbroad Loans’s DSCR loan options, you can maximize your real estate investment potential in Texas, whether you’re targeting Austin, Houston, Dallas, or any other city in Texas. Our flexible loan programs ensure that you get the financing you need, regardless of your DSCR ratio.

How to Apply for a Texas DSCR Loan with HomeAbroad

Applying for a Texas DSCR loan with HomeAbroad is a straightforward process designed to cater to real estate investors. Whether you’re looking to finance a long-term rental or a short-term rental in Texas, HomeAbroad ensures you get the most suitable loan options with minimal hassle.

You can check out our DSCR Loan Guide to understand the application process.

You can also check our video to have a visual understanding of the process:

Thriving Areas in Texas with High ROI for Real Estate Investors

Texas has become a prime destination for real estate investors due to its strong economic growth, population increase, and attractive rental property markets.

Cities like Austin, Dallas, and Houston offer lucrative opportunities for both short-term and long-term investment properties. With a state income tax of zero and landlord-friendly laws, Texas is particularly appealing for investors looking to maximize rental income.

| City | Average Monthly Rent – LTR | Rental Yield % – LTR |

| Austin | 2050 | 8.13% |

| Dallas | 2000 | 9.97% |

| Houston | 1875 | 10.95% |

- Austin: As highlighted in John’s case, Austin’s high rental income of $2,050 per month makes it one of the top markets for foreign investors. With a booming tech industry and population growth of 0.48%, Austin is ideal for those looking at long-term rentals and multi-family properties.

- Dallas: Offering a solid rental yield of 9.97% and housing prices averaging $312,110, Dallas continues to attract foreign nationals looking for high-growth investment properties. Investors here also benefit from a vibrant rental market, particularly in short-term rental opportunities.

- Houston: Known for its affordability and growth potential, Houston provides a strong rental yield of 10.96%, with housing prices at $263,865. Investors in Houston benefit from steady cash flow and increasing property values, making it a key area for real estate investors to expand their portfolios.

[Data Collected from: Zillow]

These thriving areas not only offer high rental income but also cater to diverse investment opportunities, whether in single-family, multi-family, or condos. For real estate investors like John, utilizing a DSCR mortgage allows investors to maximize their investment opportunities without the hurdles of traditional loans.

Nothing simplifies the investment process like witnessing it in action. Here’s how we helped one of our clients successfully grow his rental portfolio in Texas using DSCR loans from HomeAbroad Loans.

How to Grow Your Rental Potential in Texas with DSCR Loans

John Davis, a seasoned real estate investor based in California, identified the booming Texas real estate market as the perfect place to expand his portfolio.

Case Study: John Davis Expands His Real Estate Portfolio in Texas

Investor Profile:

Name: John Davis (name changed for privacy)

Borrower Location: California

Investment Target: Multi-family rental property in Austin, Texas

Purchase Price: $500,000

Monthly Rent: $4,118 (LTR)

Annual Rent: $49,414

Credit Score: 700

DSCR: 1.2 (Calculation shown below)

Financing Solution:

John secured a DSCR loan from HomeAbroad Loans, focusing on the rental income of the property rather than his personal income or extensive documentation.

| Financial Metric | Amount (USD) |

| Loan Amount | $400,000 |

| Monthly Mortgage Payment | $2,398 |

| Annual Mortgage Payment | $28,778 |

| Annual Property Tax | $9,900 |

| Annual Insurance Cost | $2,500 |

| Total Annual Debt Service (PITIA)* | $41,178 |

| Annual Rental Income | $49,414 |

Now,

So, John’s DSCR = $49,414 / $41,178

DSCR = 1.2

Investment Benefits:

➡️Austin’s 5-year appreciation: ~44%

➡️Strong rental demand led to a steady increase in net operating income.

➡️The interest-only loan option allowed John to maintain positive cash flow and minimize out-of-pocket expenses.

Outcome:

With the help of HomeAbroad Loans’s DSCR loan, John successfully leveraged the property’s income to cover mortgage payments, maximizing returns and expanding his real estate portfolio with ease.

Boost Your Real Estate Investments with DSCR Loans in Texas

DSCR loans provide an excellent opportunity for real estate investors to unlock the full potential of investment properties in Texas. By focusing on the property’s income potential rather than the borrower’s personal income, these loans offer flexibility and accessibility to a wide range of investors, including foreign nationals.

Whether you’re investing in long-term rentals or short-term rentals, a DSCR loan can help maximize your rental income and grow your real estate portfolio.

At HomeAbroad Loans, we specialize in providing tailored DSCR loan options that meet the unique needs of both US and foreign investors.

With flexible terms, competitive interest rates, and options for No DSCR loans, we make it easy for you to secure financing and start building wealth in Texas’s thriving real estate market.

Ready to take the next step?

Explore our tailored DSCR loan options and start growing your real estate investments in Texas today. Contact HomeAbroad Loans to learn more and get personalized assistance from our expert team.

FAQs

1. Can you get a DSCR loan in Texas?

Yes, DSCR loans are available in Texas and are a popular option for real estate investors looking to finance rental properties. At HomeAbroad Loans, we offer tailored DSCR loan options for a variety of investment properties, including multi-family units, single-family homes, and short-term rentals.

2. Who is eligible for a Texas DSCR loan?

To qualify for a Texas DSCR loan, you need to demonstrate strong rental income from your investment property. Unlike traditional loans, DSCR loans do not focus on your personal income or credit score, but instead rely on your debt service coverage ratio (DSCR) to determine eligibility. At HomeAbroad Loans, we offer loans for borrowers with DSCR ratios as low as 0.75 and even No Ratio DSCR loans in certain cases.

3. What are the interest rates for DSCR loans in Texas?

Interest rates for Texas DSCR loans vary depending on the loan amount, LTV ratio, and your DSCR. Generally, higher DSCRs can result in better loan terms. At HomeAbroad Loans, we offer competitive interest rates to help investors maximize their cash flow and rental income. Speak to one of our loan officers to get your personalized rate quote here.

4. How long does it take to get a DSCR loan in Texas?

At HomeAbroad Loans, we streamline the application process, ensuring a smooth experience from loan application to closing. We ensure that the closing happens within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

Zillow: https://www.zillow.com/home-values/10221/austin-tx/

![DSCR Loan in Texas: Qualify with Rental Income [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-Loans-Texas-500x250.jpeg)

![DSCR Loan Florida [2025]: Qualify with Your Property’s Income](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCR-Loan-Florida.png)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)