Key Takeaways:

1. DSCR loans from HomeAbroad Loans allow real estate investors to qualify based on rental income, offering more flexibility than conventional loans, especially for self-employed borrowers and foreign nationals.

2. Investors do not need to rely on personal income or tax returns to qualify; instead, the property's cash flow is the key factor for securing financing.

3. Cities like Miami, Orlando, and Tampa provide high rental yields and opportunities for short-term and long-term rental income, making them ideal for DSCR loan investments.

Table of Contents

Investing in Florida real estate? A DSCR loan lets you qualify based on the property’s rental income rather than your personal income, making it easier to finance investment properties. With this approach, the property pays for itself, and well-performing rentals can even generate positive cash flow after covering mortgage payments.

Whether you’re purchasing a short-term rental in Miami or a long-term investment in Tampa or Orlando, DSCR loans offer a streamlined, investor-friendly financing solution.

Get started with a DSCR loan in Florida through HomeAbroad and grow your real estate portfolio with confidence!

What is a DSCR Loan?

A DSCR loan (Debt-Service Coverage Ratio loan) is a mortgage option for real estate investors that qualifies you based on the property’s rental income, not your personal income. Instead of relying on tax returns or W-2s, lenders look at whether the property’s income can cover the mortgage payments

I recently worked with an investor looking to invest in a short-term rental in Tampa. As a self-employed entrepreneur with limited documentation, he struggled with traditional loans. With our DSCR loan, we focused solely on the property’s income and were able to approve him without the usual income verification hassle.

With Florida’s average rental yield at 7.5%, real estate investors can leverage DSCR loans to acquire high-performing rental properties and boost returns in markets like Miami, Orlando, and Jacksonville.

How to Calculate the DSCR Ratio?

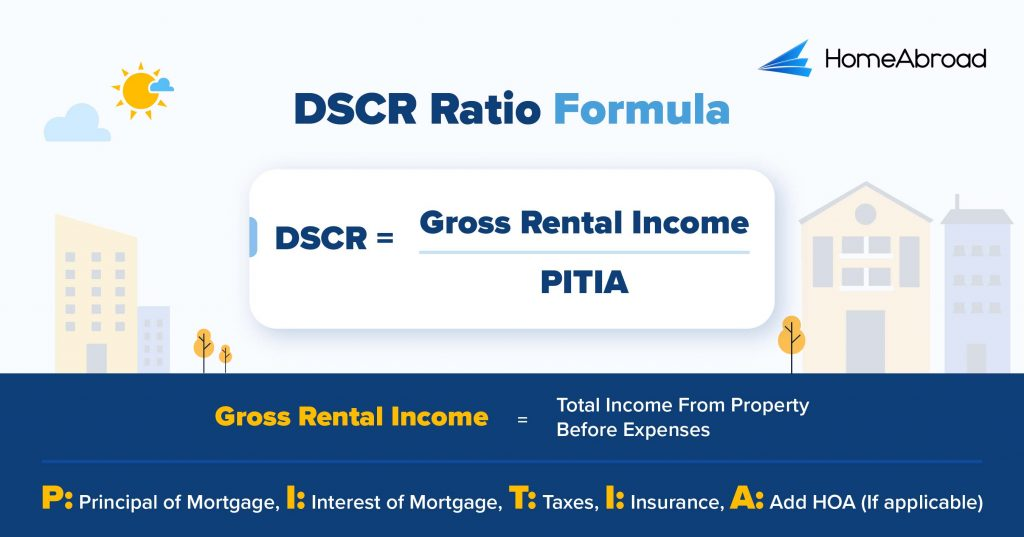

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key factor lenders use to assess loan eligibility.

Here is the DSCR formula:

A DSCR of 1.24 indicates that the property generates 24% more income than the mortgage payment, signaling strong cash flow.

While a DSCR of 1.0 is typically required, we understand that not every high-potential property meets the standard DSCR threshold. That’s why we offer flexible financing, even for properties with a DSCR as low as 0.75, through our specialized No-Ratio DSCR Program.

It’s a smart option for investors who see long-term value in a property but need a little more room in the numbers. However, this option requires a larger down payment and comes with higher interest rates to mitigate the additional risk.

Requirements of DSCR Loan in Florida

Getting a HomeAbroad DSCR loan in Florida is simple for both local and global investors. Here’s a breakdown of the key requirements for each:

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | Minimum 620 | No US credit needed |

| Down Payment | 20% | 25% |

| LTV Ratio | Up to 80% for Purchase and Rate/Term Refinance, Up to 75% for Cash Out Refinance | Up to 75% for Purchase and Rate/Term Refinance, Up to 70% for Cash Out Refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

With extensive experience working with both local and global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven property search tool helps you identify high-performing investment opportunities, while our lending experts tailor the best DSCR loan solutions to fit your goals across Florida.

Where We Lend DSCR Loans in Florida

- Miami

- Tampa

- Jacksonville

- Tallahassee

- Fort Lauderdale

- Orlando

- St. Petersburg

- Hialeah

- West Palm Beach

- Gainesville

- Lakeland

- Hollywood

- Pompano Beach

- Deltona

To see how a DSCR loan works in real life, let’s look at a case study of an investor who secured financing for a Florida rental property with the help of HomeAbroad.

Case Study: Meet Mark Stevens, A Self-Employed Investor

Mark Stevens, a US-based real estate investor and entrepreneur, wanted to expand his rental property portfolio by investing in a short-term rental in Orlando, Florida. However, traditional loan options were challenging for him because of his fluctuating personal income as a self-employed individual.

The Solution: HomeAbroad Loans’ DSCR Loan

Mark opted for a DSCR mortgage from HomeAbroad Loans, which allowed him to qualify based on the property’s rental income instead of his personal financials. Here’s how the DSCR worked for Mark:

- Gross Rental Income: $60,000 annually

- PITIA*: $50,000 annually

- DSCR Calculation: Gross Rental Income ÷ PITIA

- DSCR: 60,000 ÷ 50,000 = 1.2

Since Mark’s DSCR was 1.2 (indicating the property earned 20% more income than its debt payments), he was eligible for the loan.

*PITIA is Principal of Mortgage, Interest of Mortgage, Taxes, Insurance, and Association Fees (HOA).

Why This Worked for Mark:

- No Need for Personal Income or Tax Returns: Unlike traditional loans, Mark’s rental property was the key factor in qualifying for financing.

- Flexible Loan Terms: HomeAbroad Loans provided flexible loan terms to improve cash flow in the first few years of ownership.

- Investment Growth: With a DSCR loan, Mark successfully financed the property and grew his portfolio without the usual income constraints.

This case shows how HomeAbroad Loans’s DSCR loan programs empower investors like Mark to expand their real estate investments based on property income.

You can get more information on DSCR Loans and how it works in HomeAbroad Loans’s DSCR Loan Guide.

Top Places to Invest in Florida with a DSCR Loan

Florida is one of the most attractive states for real estate investors thanks to its warm climate, growing population, and strong rental demand. With an average home value of around $386,556 and a healthy statewide rental market, investors can find great opportunities across both short-term and long-term rental strategies.

Whether you’re targeting vacation-friendly cities or stable residential hubs, Florida offers the potential for strong returns backed by consistent rental income.

Here are some of the top-performing cities in Florida to consider for your next DSCR loan investment:

City | Rental Type | Rental Yield |

|---|---|---|

Orlando | Short-Term | 11.6% |

Tampa | Short-Term | 10.1% |

Miami | Short-Term | 9% |

Jacksonville | Long-Term | 6.9% |

Fort Lauderdale | Long-Term | 6.4% |

Need help finding the right investment property? Our AI-powered platform, Ziffy.ai, helps you find high-performing rental properties in Florida or anywhere in the US.

Get a HomeAbroad DSCR Loan in Florida

Securing financing for your investment property in Florida is simple with HomeAbroad. Our DSCR loans are designed for both local and global investors, offering flexible terms and competitive rates to help you grow a high-performing real estate portfolio.

HomeAbroad streamlines the entire investment journey. With our AI-powered property search platform, you can discover top-yield rental properties across Florida. Our expert local agents offer personalized guidance, and we assist with everything from LLC formation to US bank account setup and property management support.

Get a DSCR loan with HomeAbroad today and start building your Florida real estate portfolio with confidence.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Frequently Asked Questions

What are the interest rates for DSCR loans?

DSCR loan interest rates vary depending on market conditions, borrower profiles, and property types, but they are typically higher than conventional loan rates. However, HomeAbroad Loans offers competitive rates that allow investors to leverage property cash flow for better returns.

Can self-employed borrowers apply for a DSCR loan?

Yes, DSCR loans are ideal for self-employed borrowers who may not have consistent personal income or tax returns. The loan qualification is based on the property’s income rather than the borrower’s personal financial history.

Is cash-out refinancing available for DSCR loans?

Yes, HomeAbroad Loans offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

What is the minimum DSCR required to qualify?

HomeAbroad Loans typically require a minimum DSCR of 0.75, but we also offer “No Ratio DSCR” loan options for certain cases where the property’s income is below this ratio.

Can foreign nationals apply for DSCR loans in Florida?

Yes, foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data

Miami Realtors: International Homebuyer Transactions in Florida

![DSCR Loan Florida [2025]: Qualify with Your Property’s Income](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCR-Loan-Florida-500x343.png)

![How to Find the Right DSCR Lender – Top 7 Tips [2025]](https://homeabroadinc.com/wp-content/uploads/2022/10/Find-DSCR-loan-lender.jpg)

![DSCR Loan Interest Rates Today [July, 2025]](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCRLoanInterestRates.jpg)

![DSCR Loans: What It Is & How to Apply in [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/DSCR-loans-guide.jpg)

![DSCR Loan in Texas: Qualify with Rental Income [2025]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-Loans-Texas.jpeg)