Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Domestic DSCR Loan Rate Benchmark

Use the benchmarks below as a starting point, then request a scenario-based term sheet based on your FICO, LTV, DSCR, and property use.

LTV (Down Payment) | Estimated DSCR Rate (Par) |

|---|---|

80% LTV (20% down) | 6.375% |

75% LTV (25% down) | 6.250% |

70% LTV (30% down) | 6.125% |

Ziffy.ai is our full-stack real estate investment brand for US-based real estate investors. It helps you find cash-flow deals, evaluate rental performance, compare DSCR loan structures, and request a personalized term sheet faster, so you can move from rates to real deals.

If you are financing a rental property, the baseline DSCR loan rate for 740 FICO, 70% LTV is 6.125% (par, 0 points).

To price your exact scenario, get a rate quote based on your FICO, LTV, and DSCR.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Foreign National Investors: foreign national DSCR loan rates are typically about 0.5% higher than comparable US investor pricing, depending on leverage, reserves, and overall deal profile.

You can use the table below to see the DSCR rate benchmark for foreign nationals:

Foreign National DSCR Loan Rate Benchmark

LTV (Down Payment) | Estimated DSCR Rate (Par) |

|---|---|

70% LTV (30% down) | 6.750% |

75% LTV (25% down) | 7.000% |

*A par rate is the rate offered at 0 points, meaning you do not pay upfront discount points to get that rate.

To get your exact price as a foreign national, get a rate quote based on your personal scenario.

In our experience underwriting DSCR loans for real estate investors, understanding why DSCR loan rates differ matters just as much as knowing the rate itself. Factors like rental income strength, property cash flow, and risk profile often determine whether an investor lands at the lower or higher end of the rate range.

In the following guide, we break down current DSCR loan interest rates, explain what drives them, and show how they can affect you as an investor.

Table of Contents

DSCR Loan Interest Rates vs Conventional Mortgage Rates

DSCR loan rates are often compared to “conventional mortgage rates,” but that comparison is frequently misleading. Since DSCR Loans are investor loans, the most useful comparison is not a primary-home rate.

A more accurate baseline is a conventional rental property mortgage rate with 0 points, since DSCR loans are also used for investment properties and many advertised “lowest rates” include points.

We track par pricing (0 points) for the same benchmark scenario over time so investors can see direction, not just a single day’s snapshot.

Benchmark scenario used for this trend:

LTV (Down Payment) | DSCR Rate (Par) | Bankrate Conventional Rental Rate (0 points) |

|---|---|---|

80% LTV (20% down) | 6.375% | 6.500% |

75% LTV (25% down) | 6.250% | 6.250% |

70% LTV (30% down) | 6.125% | 6.124% |

Instead of waiting, you can start building equity in your property. If market rates move lower later, refinancing may be an option, subject to eligibility, property performance, and loan terms.

Before moving forward, the key is running the numbers against your investment strategy. When the deal works on fundamentals, interest rate timing becomes secondary.

Why DSCR Loan Rates Change Week to Week

Even if your deal stays the same, DSCR rates can shift because the broader mortgage market shifts.

In our day-to-day pricing, the biggest drivers are:

- Mortgage-backed securities (MBS) pricing

- Treasury yield movements

- Risk appetite for investor loans

- Property performance expectations (especially for short-term rentals)

This is why the best approach is to evaluate your deal using the rate available today, then build a refinance strategy if the market improves.

How DSCR Loan Rates Are Calculated (What Actually Impacts Pricing)

DSCR loan rates are not “one-size-fits-all.” At HomeAbroad, we price DSCR loans based on how the property performs, the leverage you want, and how resilient the deal looks under real-world conditions.

Below are the key factors that shape DSCR loan interest rates.

1. DSCR Ratio

The Debt Service Coverage Ratio (DSCR) measures how well a property’s rental income covers its debt obligations. It is calculated by dividing the property’s gross rental income by its total monthly or annual debt payments, including PITIA (principal, interest, taxes, insurance, and HOA fees).

For example,

Monthly Rent: $10,000

Monthly PITIA: $8,333.33

DSCR = $10,000 / $8,333.33, which brings DSCR ratio to 1.2.

This number means the property generates 20% more income than its total debt obligations.

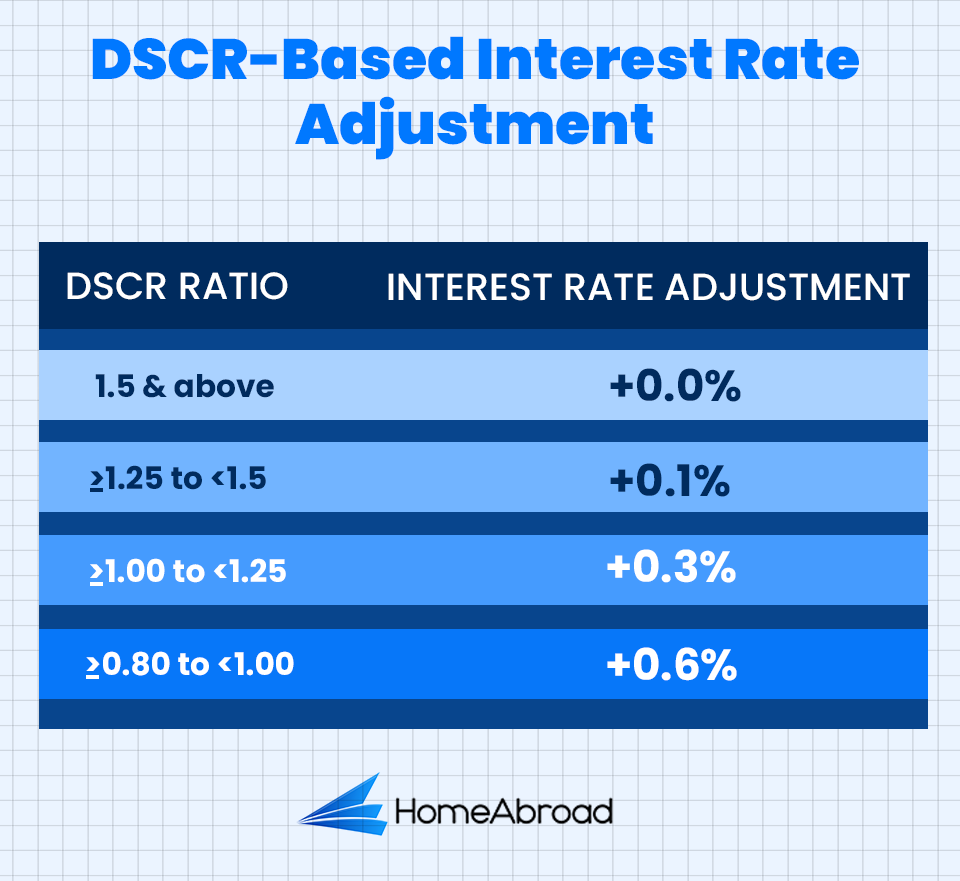

Ideally, you would need a DSCR of 1 or higher for a DSCR loan, as it shows sufficient income to cover the mortgage and other necessary expenses.

However, at HomeAbroad, why we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. With the No-Ratio program, you can still secure financing, although it will require a slightly larger down payment (a 5% reduction in LTV) and a higher interest rate. This option is ideal for investors with a strong long-term strategy who want to acquire properties that may not immediately generate a 1.0 cash flow ratio.

In our experience underwriting DSCR loans, the DSCR ratio affects both approval and pricing. The reason this matters is simple: higher coverage gives the lender more cushion against vacancies, expense spikes, or softer rent. Properties with stronger DSCR typically qualify for pricing closer to the lower end of the rate range, while thinner coverage often leads to pricing adjustments, tighter terms, or a larger down payment to bring the risk back into balance.

To get a quick estimate of your own property’s ratio, you can use our DSCR calculator and see how it may influence the rates you qualify for.

Here is a representation of how DSCR loan rates are adjusted with different DSCR ratios.

2. Credit Score

While DSCR loans are qualified based on a property’s rental income rather than personal income, credit history is still reviewed as part of the overall risk assessment.

A stronger credit profile generally supports more competitive pricing, while lower scores may result in rate adjustments that can often be offset with higher equity or stronger cash flow.

At HomeAbroad, we offer DSCR loans for foreign national investors that do not require a US credit history. With our 15+ years of DSCR lending, we focus more on the strength of the rental income, DSCR ratio, and deal structure rather than relying solely on traditional credit benchmarks.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

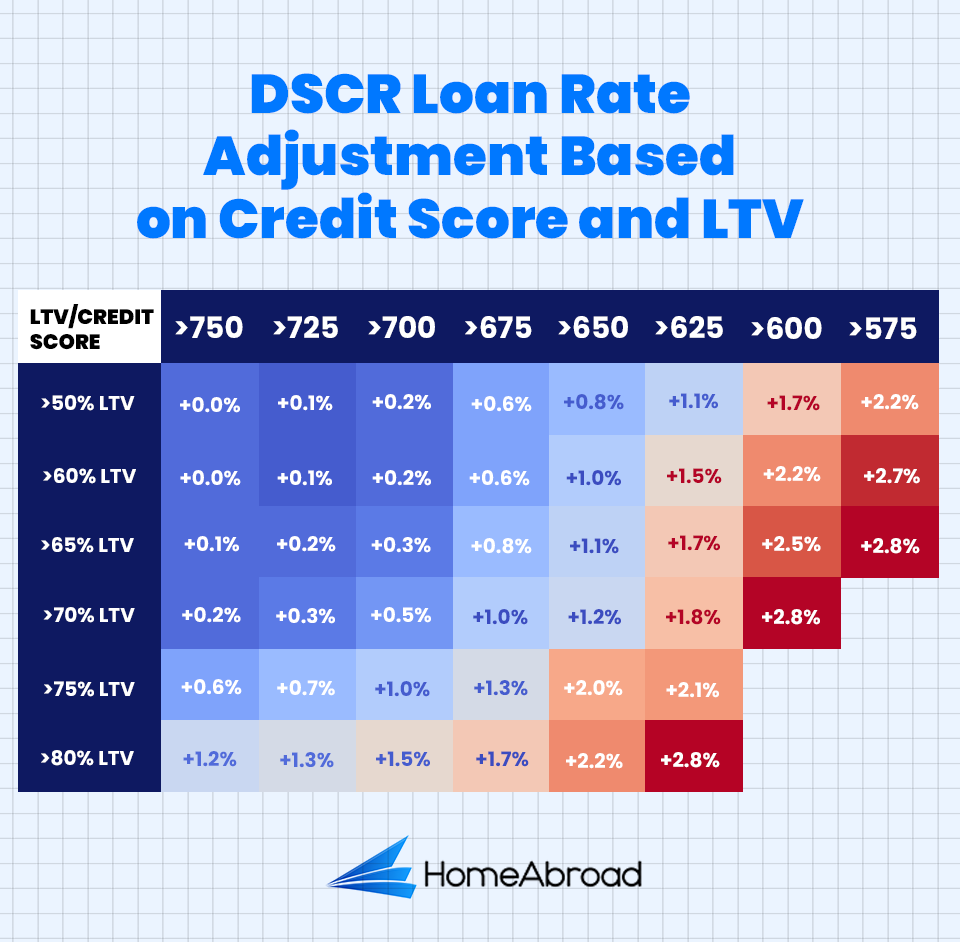

Below is a tabular representation of how different credit score ranges and LTV affect interest rates.

The table shows the rate adjustments based on credit score and LTV. For example, if your credit score is 700 and the LTV is 70%, we will increase the base rate by 0.5%.

While there is a minimum credit score requirement of 620 for DSCR loan qualification for domestic clients, international real estate investors do not need US credit score, income, or tax returns.

3. LTV (Loan-to-Value)

The Loan-to-Value (LTV) ratio shows the percentage of a property that is financed through borrowing.

For example, an 80% LTV ratio means you borrowed 80% of the property’s purchase price and paid 20% of the down payment.

Technically speaking, lower LTVs reduce risk by increasing equity in the property, which often results in more competitive interest rates. Higher LTVs carry more risk and typically lead to pricing increases.

Down payment strategy is one of the most effective levers investors can control when aiming for better DSCR loan terms.

4. Investor Experience (Helpful, Not Mandatory)

This is no financial metric, but an important one that we consider during DSCR loan application evaluation. A proven track record often signals that an investor understands how to operate rental properties, manage expenses, and stabilize income over time.

A pattern we’ve noticed is that experienced investors tend to move through underwriting faster because they understand documentation, insurance timing, and how rental income is assessed. That familiarity can reduce friction in the process, even though it doesn’t replace the need for a qualifying DSCR.

To be clear, prior investing experience is not mandatory to qualify for a DSCR loan. We regularly work with first-time investors who close successfully as long as the rental income, DSCR ratio, and deal structure meet our guidelines.

5. Short-term Rentals/Airbnb

Short-term rental properties generate less predictable income due to seasonality, occupancy swings, and local competition. That variability makes our income projections more difficult and increases the overall risk profile.

The reason this matters is that when income is less consistent, we have to price for that uncertainty. Higher risk doesn’t just affect interest rates. It can also translate into higher reserve requirements or additional down payment to offset volatility.

Based on our internal pricing and recent executions, short-term rental DSCR scenarios can price higher than comparable long-term rentals. That spread reflects the added uncertainty in projecting stable cash flow over the life of the loan, especially in seasonal markets. To be clear, the exact difference varies by documentation method, leverage, and coverage strength, so we size each file to the property’s actual income durability rather than a best-case rent assumption.

The trade-off is straightforward. Short-term rentals may offer higher gross revenue, but the increased borrowing costs and stricter underwriting assumptions need to be factored into the overall return to determine whether the strategy makes sense for the deal.

6. Mortgage Type

The structure of a DSCR loan also affects the interest rate. Common DSCR mortgage types include:

7. Refinance

Refinance and cash-out DSCR loans typically price slightly higher than purchase loans. The adjustment is usually around 0.2%.

This rate increase is mainly due to the higher risk associated with refinancing, particularly cash-out options. In such cases, we extend additional credit based on the property’s equity, thereby increasing their risk exposure.

These factors help shape your final DSCR loan interest rates. Rethink your borrowing strategy based on these factors to secure lower interest rates.

At HomeAbroad, we structure DSCR loans around the way you actually plan to run the asset. We review the property’s rent profile, PITIA, reserves, and your hold timeline so the loan terms fit the strategy, not the other way around. The process is fully online, and you work directly with a dedicated mortgage officer from initial sizing through closing and any future refinance planning.

Hear from our client Liam and Emma Thompson, a Canadian couple who bought a Hawaiian Rental Property, about how we helped them.

Despite having no US credit history, HomeAbroad guided us to the perfect DSCR loan, allowing us to invest in a stunning property in Lahaina. The process was smooth, and the rental income is covering our mortgage. We couldn’t be happier with their expert support and highly recommend them to any foreign national looking to invest in the US.

Liam and Emma Thompson, Lahaina, Hawaii

You may come across DSCR loan offers advertising very low interest rates. Don’t rush into a decision. In DSCR financing, the headline rate alone rarely reflects the true cost or suitability of the loan for your investment strategy.

How to Get a Lower DSCR Loan Rate (Practical Levers)

If your goal is to land closer to the lower end of the DSCR loan rate range, these are the highest impact moves:

- Strengthen DSCR (increase rent coverage)

- Choose neighborhoods with consistent rent demand

- Avoid thin deals where rent barely clears PITIA

- Lower leverage

- Bringing more down often reduces pricing friction immediately

- Select a Property Use that underwrites cleanly

- Long-term rentals tend to price more smoothly than STRs

- Reduce avoidable risk flags

- Clean documentation, clear leases, stable appraisal support, realistic expenses

Steven Glick,

Director of Mortgage Sales, HomeAbroad

What to Look for When Comparing DSCR Loan Interest Rates

When comparing DSCR loan options, it’s important to evaluate the full structure of the loan, not just the interest rate. Small differences in terms can have a meaningful impact on cash flow, flexibility, and long-term returns.

Here are the key factors to review:

From what we see most often with real estate investors, the headline rate rarely determines whether the deal is a long-term win. The distinction is in the execution details: points and lender fees, how the prepay is structured, and how reliably the loan closes on schedule. The formula looks simple, but those line items can move real cash flow and change your exit playbook, especially if you plan to refinance or sell within the first few years.

When we structure DSCR loans at HomeAbroad, we review each deal beyond just the rate. Our loan experts evaluate rental income strength, leverage, reserve requirements, and how the loan fits the investor’s broader strategy, especially for foreign nationals investing in the US for the first time.

This approach helps real estate investors move forward with clarity, confidence, and financing that aligns with how they actually invest in US real estate.

Ready to get started? Apply for a DSCR loan with HomeAbroad and get the best loan terms tailored to your investment goals today.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

Frequently Asked Questions

What are DSCR loan rates today?

As of March 2026, DSCR loan rates commonly range from 6.12% to 6.37%, depending on DSCR ratio, LTV, Property Use, and overall deal structure. Foreign national DSCR loans often range from 6.75% to 7.00%.

Are DSCR loan rates higher than conventional mortgage rates?

Often yes. Conventional rates provide a benchmark, but DSCR loans are priced based on property cash flow and investor-loan risk. Freddie Mac’s weekly 30-year fixed average was 6.00% as of March, 2026.

What DSCR ratio gets the best pricing?

DSCR 1.0+ typically prices best. Higher ratios usually mean stronger cushion, which supports better terms.

Can you get a DSCR loan with DSCR below 1.0?

Yes. You can still qualify with a DSCR below 1.0 depending on leverage, reserves, and deal structure. HomeAbroad also offers no-ratio DSCR, which allows you to qualify even when your DSCR falls between 0 and 1. In many cases, this comes with a larger down payment to offset the lower cash flow coverage.

Can I buy down the rate on a DSCR loan?

Yes. Discount points can reduce the interest rate. Always compare the upfront cost against your expected hold period.

![DSCR Loan Rates Today [March, 2026]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates-500x325.png)

![DSCR Loans Guide for Foreign Nationals: What It Is & How to Apply in [2026]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)

![DSCR Loan Down Payment Requirements [2026]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-loan-down-payment.png)