Key Takeaways:

1. DSCR loans qualify you based on the property’s rental income, not your personal income, tax returns, or US credit history.

2. With no DTI limitations, you can expand your multifamily investments faster and more efficiently.

3. With a DSCR Loan, you can purchase properties under an LLC or business entity for added liability protection and potential tax benefits

Looking to invest in multifamily property but worried about income checks, paperwork, or credit score?

DSCR loans could be your easiest way in. Instead of evaluating your job history or tax returns, these loans focus entirely on the rental income potential of the property. That means faster approval, fewer roadblocks, and more flexibility for investors.

Whether you’re just starting out or expanding your real estate portfolio, this guide breaks down how DSCR loans can make your multifamily investment smooth and achievable.

Get started with a HomeAbroad DSCR loan and start your investment journey today!

Table of Contents

What is a DSCR Loan?

A DSCR (Debt-Service Coverage Ratio) loan is a type of real estate investment loan that focuses on the income-generating potential of a property, rather than the borrower’s personal income or employment history.

Unlike traditional loans that rely on tax returns, pay stubs, or employment verification, DSCR loans evaluate whether the property’s rental income can cover monthly expenses like mortgage payments, property taxes, and insurance.

This makes DSCR loans a popular choice for real estate investors, self-employed individuals, and foreign nationals who may not meet conventional income requirements but plan to own income-generating properties.

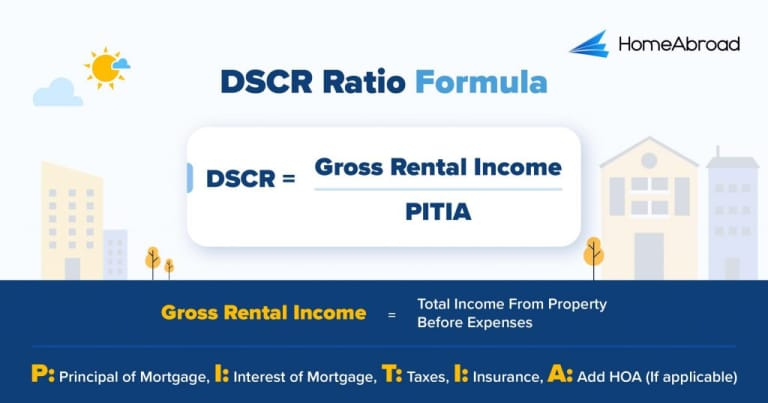

How to Calculate DSCR?

Calculating your DSCR (debt-service coverage ratio) will help you determine whether your investment property qualifies for a DSCR loan.

Here is the DSCR Formula:

For example, if your property brings in $3,250 in monthly rental income and your total PITIA is $2,600, then your DSCR would be:

- DSCR = $3,250 ÷ $2,600

- DSCR = 1.25

A DSCR of 1.25 means your rental income is 25% higher than your monthly debt obligations, a positive sign of financial stability.

At HomeAbroad, we typically look for a DSCR of 1 or higher when evaluating multifamily property loans. This means your rental income should cover or exceed monthly mortgage payments.

But what if your DSCR is below 1? That doesn’t automatically disqualify you.

An investor I recently worked with in Florida had his eye on a promising multifamily property, but the DSCR came in at just 0.85 below the typical requirement most lenders expect. He was struggling to qualify for a DSCR loan elsewhere. I helped him secure HomeAbroad’s No-Ratio DSCR loan and move forward with the investment.

For investors facing similar challenges, our No-Ratio DSCR loans offer more flexibility, allowing qualification with DSCRs as low as 0.75. It’s a great solution when the numbers don’t meet standard requirements, but the investment potential is still strong.

DSCR Loan Requirements for Multifamily Properties

HomeAbroad offers tailored DSCR loan programs to meet the unique needs of both local and global investors. Here are the key DSCR loan requirements for investors purchasing multifamily properties.

| Features | Local Investors | Global Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | Minimum 620 | No US credit needed |

| Down Payment | 20% | 25% |

| LTV Ratio | Up to 80% for Purchase and Rate/Term Refinance, up to 75% for Cash Out Refinance | Up to 75% for Purchase and Rate/Term Refinance, up to 70% for Cash Out Refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

With deep industry expertise and a commitment to investor success, HomeAbroad provides tailored DSCR loans, expert guidance, and seamless support to ensure a smooth and profitable real estate investment journey.

Step to Apply for a Multifamily DSCR Loan

Getting a DSCR loan doesn’t have to be complicated. At HomeAbroad, we simplify the process by offering tailored DSCR loans and expert support every step of the way. Here’s a quick step-by-step guide to applying for a DSCR loan:

Step 1 – Get Started with HomeAbroad

Step 2 – Connect with Our Mortgage Officers

Step 3 – Get Preapproval

Step 4 – Gather Your Documents and Complete the Application

Step 5 – Underwriting

Step 6 – Loan Approval

Step 7 – Closing

For a detailed walkthrough of each step, including documentation and timelines, check out our complete guide on how to apply for a DSCR loan.

To give you a clearer picture of how it works in real scenarios, here’s an example of how one investor successfully secured a DSCR loan for a multifamily property with HomeAbroad.

Case Study: DSCR Loan Success for a Multifamily Investment in Texas

Daniel, an investor based in Dallas, Texas, was ready to dive into real estate but wasn’t sure where to start. He approached HomeAbroad with the goal of generating consistent rental income through multifamily housing.

With guidance from Rachel Spaccarotelli, an experienced Customer Loan Manager at HomeAbroad, Daniel used Ziffy.ai, our AI-driven property search platform to find a promising 3-unit Multifamily property in a high-demand rental area.

Our team guided him in evaluating the property’s rental income potential, structuring the loan effectively, and ensuring it met all DSCR loan requirements.

Property Details:

Location: Dallas, Texas

Property Value: $520,000

Monthly Rental Income: $5,360

Loan Details:

Loan Amount: $416,000

Down Payment: 20% ($104,000)

Interest Rate: 7.2%

Loan Term: 30 years

Monthly Mortgage (PITIA): $3,802

DSCR Calculation:

DSCR = Gross Rental Income ÷ PITIA

DSCR = $5,360 ÷ $3,802

DSCR = 1.40

With a strong DSCR of 1.40, Daniel not only qualified for the DSCR loan but also generated a positive monthly cash flow of $1,558 from his multifamily investment.

From finding the right multifamily property to securing the DSCR loan, HomeAbroad guided Daniel through every step of the journey, helping him confidently close his first multifamily property in Dallas.

Daniel’s success is a perfect example of how DSCR loans can unlock real estate opportunities for investors who prioritize cash flow over personal income documentation. At HomeAbroad, we focus on helping investor’s structure smart, sustainable investments that generate long-term returns.

Rachel Spaccarotelli, Sr. Customer Loan Manager, HomeAbroad

Conclusion

DSCR loans are a powerful financing option for real estate investors looking to grow their multifamily portfolio without relying on personal income or credit history. By focusing on the property’s income potential, DSCR loans make it easier to secure financing while maintaining healthy cash flow.

HomeAbroad simplifies the entire investment process. With our AI-powered property search, you can easily find high-yield rental properties, and our expert local agents provide guidance at every step. We also assist with LLC formation, US bank account setup, and property management, giving you everything you need to invest confidently.

Get started with a HomeAbroad DSCR loan today and take the next step in your real estate journey.

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

FAQs

What is the minimum DSCR required for a multifamily loan?

At HomeAbroad, we prefer a DSCR of 1 or higher, meaning the property’s income covers the mortgage. However, we also offer No-Ratio DSCR loans, allowing approval even if DSCR is below 1, depending on other factors like down payment.

What are the interest rates for DSCR loans on multifamily properties?

Interest rates for DSCR loans are typically slightly higher than traditional loans because they’re based on the property’s income, not your personal finances. Rates can vary depending on factors like DSCR ratio, loan amount, property type, and investor profile. Check the latest DSCR Loan interest rates here.

How fast can I close on a multifamily property with a DSCR loan?

DSCR loans usually offer a faster closing timeline than conventional loans since they skip personal income documentation. At HomeAbroad, we aim to close within 30 days, helping you secure your investment property without unnecessary delays.

![DSCR Loan for LLC [2023]: Enhanced Liability Protection Loan](https://homeabroadinc.com/wp-content/uploads/2023/07/DSCR-Loan-for-LLC.jpg)