With affordable home prices and an impressive 8% rental yield, Missouri is a prime market for investors looking to generate strong cash flow. But if traditional lenders are slowing you down with income verification roadblocks, you’re missing out on prime opportunities. What if you could secure financing based solely on your property’s rental income?

Many investors I’ve worked with had issues getting a traditional loan because of their high debt-to-income (DTI) ratios, which were caused by their existing mortgages. I helped them qualify for a mortgage with our DSCR loan.

A Debt Service Coverage Ratio (DSCR) loan lets you qualify for a rental property mortgage without W-2s, tax returns, or personal income verification. Whether you’re eyeing Kansas City’s booming short-term rental market or St. Louis’s steady cash flow properties, here’s how a DSCR loan can help you scale your portfolio in Missouri faster and with fewer restrictions.

Table of Contents

Key Takeaways:

1. Tailored specifically for real estate investors, these loans allow you to qualify based on your property's rental income rather than personal income verification.

2. With DSCR loans, you can secure financing without W-2s, pay stubs, or tax returns, making them ideal for real estate investors.

3. You can finance single-family homes, multi-units, condos, and short-term rentals like Airbnb with DSCR loans, and there is no limit on the number of properties you can invest, making it ideal for portfolio growth.

What is a DSCR loan?

A Debt Service Coverage Ratio (DSCR) loan is a type of real estate investment loan that allows you to qualify based on your property’s rental income rather than your personal income. Instead of requiring W-2s, tax returns, or pay stubs, lenders assess the rental income vs. mortgage payment ratio to determine eligibility.

For example, I recently worked with a couple who financed their rental property using our DSCR loan. Their expected monthly rental income was $15,750, while their mortgage payment was $9,282. They quickly qualified for the loan and generated a positive cash flow of $6,468 after covering their mortgage.

In Missouri, where rental yields average around 8%, finding the right property with substantial rental income could mean owning a property that pays for itself while generating profit. Whether you’re targeting Kansas City, St. Louis, or Springfield, we can help you find and finance such rental property with a DSCR loan.

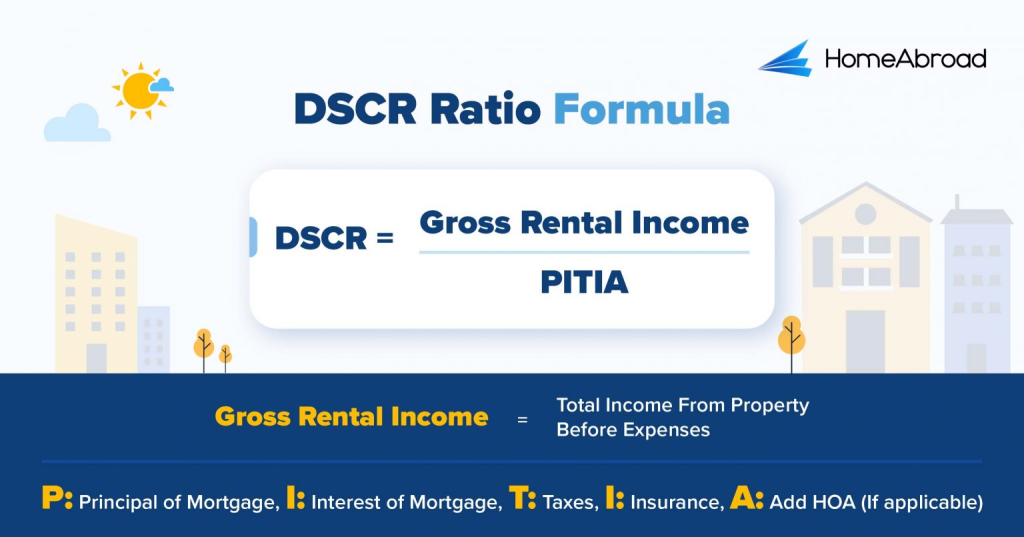

How to Calculate Your DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a key metric lenders use to determine whether a property’s rental income is sufficient to cover mortgage payments. A higher DSCR indicates strong cash flow, improving your chances of securing better loan terms and interest rates.

DSCR Loan Formula:

HomeAbroad offers a user-friendly DSCR Calculator to simplify your loan eligibility process in Missouri. I recently helped a client calculate the Debt Service Coverage Ratio (DSCR) for a property in Missouri. Here’s how we broke it down:

Example

Calculating the DSCR Ratio for a Missouri Property:

With this, the property generates 1.36 times its debt obligations, indicating positive cash flow, which is a great sign for future financial stability.

In this case, the monthly positive cash flow was $400, meaning my client is covering their mortgage and making extra income from the rental property.

HomeAbroad requires a minimum DSCR of 1.0 for standard financing, but we also offer flexible options with DSCRs as low as 0.75 for clients needing a bit more leeway. If the DSCR is below 0.75, we offer “No Ratio DSCR Loans” for those who still need funding, although this may require a higher down payment or slightly higher interest rates.

DSCR Loan Interest Rates

Understanding these rates is crucial for investors as they significantly impact the profitability of investment properties. Before investing, follow our DSCR loan interest rate guide to learn about current DSCR loan interest rates and their influencing factors.

Due to the unique nature of DSCR loans and the associated increased risk for lenders, these rates are typically 1% to 1.5% higher than those of conventional mortgages. For more details on DSCR loans and how they work, visit HomeAbroad’s DSCR loan hub.

Requirements for DSCR loans in Missouri

At HomeAbroad, we make qualifying for a DSCR Loan flexible and straightforward, whether you’re a domestic investor or a foreign national. Now, let’s learn about our tailored DSCR loan requirements to provide domestic and foreign investors with flexible financing solutions.

Whether you’re a first-time investor or an experienced buyer looking to expand your portfolio, our straightforward and efficient qualification process makes securing a DSCR loan easier.

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | 620 or higher | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% for purchase/refinance Up to 75% for cash-out refinance | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

Areas We Lend in Missouri

- Branson

- Osage Beach

- Lake Ozark

- Columbia

- Camdenton

- Sunrise Beach

- Hollister

- Kimberling City

- Springfield

- Columbia

- Kansas City

- St. Louis

- Chesterfield

- Springfield

- Wentzville

Let’s examine a case study of one of our past clients to understand how profitable investing in the Missouri real estate market can be.

Case Study: James Carter, A Self-Employed Investor, Secured a DSCR Loan in Missouri

Property Details:

Location: St. Louis, Missouri

Property Price: $500,000

Monthly Rent: $5,800

Loan Details:

Loan Amount: $400,000

Down Payment: 25%

Monthly PITIA: $4,500

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $5,800 / $4,500

DSCR = 1.29

Client Profile

- Investor: James Carter, Real Estate Investor

- Location: St. Louis, Missouri

- Property Type: 4-Unit Multi-Family Rental

- Loan Type: DSCR Loan

The Challenge

A self-employed investor, James wanted to acquire a high-yield rental property but struggled to qualify for a traditional mortgage due to fluctuating income.

The Solution

Rachel Spaccarotelli, Senior Customer Loan Manager at HomeAbroad, recommended a DSCR loan, which would allow James to qualify based on property cash flow instead of personal income.

In St. Louis, securing a conventional mortgage can be tough for self-employed investors like James Carter. With our DSCR loan, we focused on his property’s cash flow, not his income turning financing hurdles into a seamless investment. Now, he’s building equity and enjoying steady cash flow without the usual mortgage limitations.

Rachel Spaccarotelli, Senior Customer Loan Manager, NMLS# 1497555

The Outcome

- James successfully closed on his investment property without income verification and now enjoys the following:

- Positive Cash Flow: $1,300/month ($15,600/year)

- Annual Property Appreciation: 5% (Estimated $25,000/year)

- Equity Growth: Over $40,600/year (Cash Flow + Appreciation + Loan Paydown)

With HomeAbroad’s DSCR loan, James secured a hassle-free investment that generated both monthly income and long-term wealth.

Top Places to Invest in Missouri with a DSCR Loan

Missouri offers a strong real estate market with attractive rental yields, making it a prime investment opportunity. With an average home price of around $250,000, which is well below the national average of $355,328, investors can enter the market at a lower cost while still benefiting from steady property appreciation and strong rental demand.

Thanks to top universities and growing industries, cities like Branson and Hollister attract long-term demand from students and professionals. Meanwhile, Osage Beach and Kimberling thrive on tourism, creating excellent opportunities for short-term rentals.

With Missouri’s solid rental yields and access to DSCR loans, investors can secure properties that cover their mortgage and generate positive cash flow.

City | Rental Type | Rental Yield |

|---|---|---|

Branson | Long-Term | 10.4% |

Osage Beach | Short-Term | 9.7% |

Lake Ozark | Short-Term | 9.3% |

Hollister | Long-Term | 9.5% |

Kimberling | Short-Term | 9.1% |

Get a DSCR Loan in Missouri with HomeAbraod

HomeAbroad is dedicated to helping investors find and finance cash flow-generating properties in Missouri. As a leading PropTech and FinTech platform, we make it easy for seasoned investors and first-time buyers to secure DSCR loans, aligning with their investment goals.

With HomeAbroad, you can:

- Buy a property that pays for itself: Our DSCR loans focus on property cash flow, not your income.

- Leverage advanced tools & expert support: Use AI-powered property searches, get personalized advice, and enjoy end-to-end concierge assistance.

- Tap into a robust network: Connect with 500+ real estate professionals and explore specialized mortgage solutions for investors.

Find and finance a property in Missouri that generates positive cash flow with HomeAbroad. Apply for DSCR loans today and start unlocking your investment potential!

FAQs

Can foreign nationals apply for DSCR loans in Missouri?

Foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

Can self-employed borrowers apply for a DSCR loan in Missouri?

Yes, DSCR loans are ideal for self-employed borrowers who may not have consistent personal income or tax returns. The loan qualification is based on the property’s income rather than the borrower’s personal financial history.

How long does it take to get a DSCR loan in Missouri?

At HomeAbroad Loans, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Price