Are you looking to invest in North Carolina real estate but finding the financing process frustrating? You’re not alone. I have encountered countless investors who face obstacles like excessive paperwork, strict credit score requirements, and complex debt-to-income ratios that can hold them back.

Imagine if you could qualify for a rental property mortgage without needing to show personal income or tax returns. That’s precisely how a Debt Service Coverage Ratio (DSCR) loan lets you secure financing based solely on your property’s rental income.

Whether you’re eyeing Charlotte’s booming rental market or Raleigh’s steady cash flow properties, a DSCR loan can help you move forward faster and with fewer restrictions. It’s wise to focus on your investment’s potential rather than getting bogged down by extensive documentation or personal financial hurdles.

Break free from traditional mortgage barriers, grow your real estate portfolio, and apply for a DSCR loan in North Carolina today!

Table of Contents

Key Takeaways

1. DSCR loans qualify investors based on rental income rather than personal finances such as tax returns, W-2s, or pay stubs.

2. With DSCR loans, investors can secure financing even with multiple mortgages or a high DTI ratio, enabling portfolio expansion.

3. DSCR loans apply to various property types, including short-term rentals, long-term rentals, and multi-family units, while also allowing for cash-out refinancing or financing multiple properties to scale your portfolio.

What is a DSCR Loan?

A DSCR (Debt Service Coverage Ratio) loan allows real estate investors to qualify based on a property’s rental income rather than personal earnings. Lenders assess the property’s cash flow to determine eligibility, focusing on its ability to cover debt obligations instead of requiring traditional income documentation.

In my experience, I have witnessed investors with multiple properties, high debt-to-income ratios, or non-traditional income sources facing significant hurdles due to conventional loans. DSCR loans offer a streamlined solution that addresses these challenges.

This versatile financing option can be used by all types of investors, like first-time buyers, seasoned investors, self-employed professionals, business owners, and those managing multiple rental properties, to expand their portfolios without the usual income verification requirements.

In markets like North Carolina, where the average rental yield hovers around 6.77%, leveraging DSCR loans is a strategic move that covers debt obligations and generates positive cash flow, setting the stage for sustainable long-term growth.

How to Calculate Your DSCR Ratio

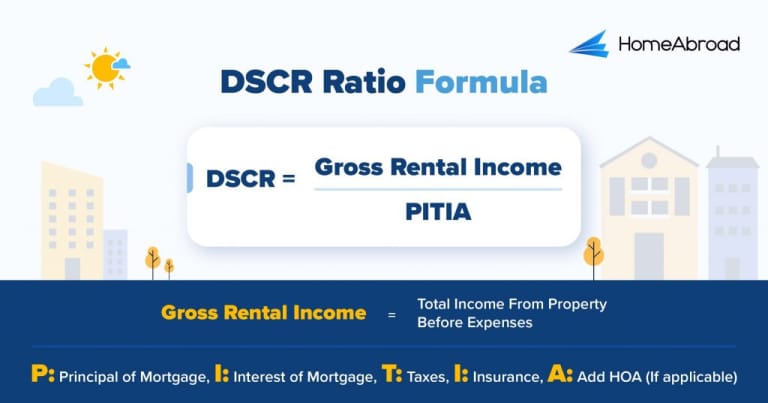

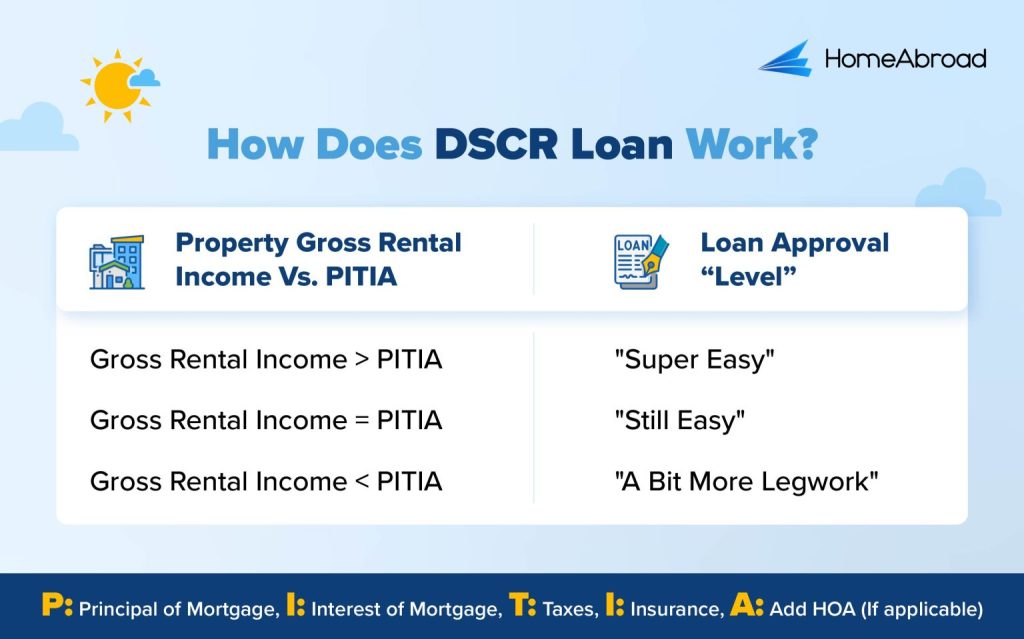

The Debt Service Coverage Ratio (DSCR) is a crucial metric that lenders use to assess borrowers’ ability to cover mortgage payments with their rental income. For real estate investors, a higher DSCR indicates strong cash flow, which improves their chances of securing better loan terms.

Here’s the formula to calculate your DSCR:

I recently dealt with a case where a real estate investor in North Carolina needed to evaluate the potential of a rental property before proceeding with a DSCR loan. We ran the numbers together to see how the property would perform, and here’s what we found:

Example

Calculating the DSCR Ratio for a North Carolina Property:

With a DSCR of 1.16, the property showed strong rental income coverage, making it a great candidate for financing. Since the rental income exceeded the mortgage payment, the investor secured a positive cash flow of $280 per month, ensuring the property remained profitable.

At HomeAbroad, we require a minimum DSCR of 1, but in exceptional cases, we also offer loans for DSCR ratios as low as 0.75. For properties with a DSCR below 0.75, our “No Ratio DSCR loans’ offer financing options, although they require a larger down payment and higher interest rates to account for the added risk.

DSCR Loan Interest Rates

Understanding these rates is crucial for investors as they significantly impact the profitability of investment properties. Before investing, follow our DSCR loan interest rate guide to learn about current DSCR loan interest rates and their influencing factors.

Due to the unique nature of DSCR loans and the associated increased risk for lenders, these rates are typically 1% to 1.5% higher than those of conventional mortgages. For more details on DSCR loans and how they work, visit HomeAbroad’s DSCR loan hub.

How to Qualify for a DSCR Loan in North Carolina

At HomeAbroad, we make qualifying for a DSCR loan flexible and straightforward, whether you’re a domestic investor or a foreign national. Now, let’s learn about our tailored DSCR loan requirements to provide domestic and foreign investors with flexible financing solutions.

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | 620 or higher | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% for purchase/refinance Up to 75% for cash-out refinance | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

Areas We Lend in North Carolina

- Charlotte

- Raleigh

- Durham

- Greensboro

- Winston-Salem

- Cary

- Fayetteville

- Asheville

- Wilmington

- Concord

- Greenville

- Chapel Hill

- Hickory

- Burlington

- Boone

Let’s examine a case study of one of our past clients to understand how profitable investing in the North Carolina real estate market can be.

Case Study: Lorenzo, A Self-Employed Investor, Expands His Rental Portfolio in North Carolina

Property Details:

Location: Charlotte, North Carolina

Property Price: $450,000

Monthly Rent: $3,800

Loan Details:

Loan Amount: $350,000

Down Payment: 25%

Monthly PITIA: $2892

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $3800 / $2892

DSCR = 1.31

How HomeAbroad Helped:

HomeAbroad’s DSCR loan made the process seamless by evaluating Lorenzo’s eligibility based on property income rather than personal tax returns. With flexible loan terms and an interest-only option, she was able to:

- Secure financing without traditional income verification.

- Maintain strong cash flow.

- Minimize upfront expenses and maximize rental profits.

Charlotte’s real estate market is expected to appreciate 30% in the next five years, making it a prime investment opportunity. With a DSCR of 1.31 and a monthly positive cash flow of $908, Lorenzo’s property has a positive cash flow, ensuring a steady return.

Why Does This Matter?

Steven Glick highlights the importance of this financing approach:

Lorenzo’s challenge was proving income stability as a self-employed investor. With our DSCR loan, we focused on the property’s income potential instead of tax returns. This allowed her to secure financing easily while keeping a strong cash flow. Charlotte’s rental market made this an even smarter investment.

Steven Glick, Director of Mortgage Sales, HomeAbroad

Lorenzo’s success shows how DSCR loans simplify financing, allowing investors to secure profitable properties and maintain strong cash flow. With Charlotte’s market poised for growth, now is the time to leverage a DSCR loan and scale your portfolio.

Top Places to Invest in North Carolina with a DSCR Loan

North Carolina offers affordable real estate and attractive rental yields, making it a prime destination for investment. With an average home price of around $250,000, well below the national average of $355,328, investors can enter the market at a lower cost while still enjoying substantial rental income.

Thanks to renowned universities and thriving industries, Raleigh, Durham, and Charlotte experience steady, long-term demand from students and professionals. Meanwhile, Asheville, Wilmington, and the Outer Banks benefit from robust tourism, driving high short-term rental potential.

With North Carolina’s solid rental yields and access to DSCR loans, investors can secure properties that cover their mortgage and generate positive cash flow.

Here are some of the top investment cities in North Carolina:

City | Rental Type | Rental Yield |

|---|---|---|

Asheville | Short-Term | 10.3% |

Wilmington | Short-Term | 9.4% |

Boone | Short-Term | 11.6% |

Charlotte | Long-Term | 8.6% |

Raleigh | Long-Term | 7.6% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in North Carolina or anywhere in the US!

Invest in North Carolina with HomeAbroad’s DSCR Loan

HomeAbroad makes real estate investment simple for both US and international investors. We offer tailored DSCR loan solutions so you can buy cash flow-generating properties in North Carolina’s hottest markets like Charlotte, Raleigh, or Durham.

As a one-stop PropTech and FinTech platform, we help you overcome hurdles like a lack of a US credit history through AI-powered property searches and expert guidance. With a network of over 500 experienced agents, we provide personalized support, from finding the right property to handling LLC formation, US bank accounts, homeowners’ insurance, property management, and ongoing investment support.

Ready to seize North Carolina’s real estate potential? Apply for a DSCR loan with HomeAbroad and build your investment portfolio today!

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

FAQs

Can foreign nationals apply for DSCR loans in North Carolina?

Foreign nationals can apply for DSCR loans through HomeAbroad Loans without needing a US credit score, making it a flexible financing option for international investors.

How long does it take to get a DSCR loan in North Carolina?

At HomeAbroad Loans, we streamline the application process, ensuring a smooth experience from loan application to closing. We guarantee that the closing will happen within 30 days.

Is cash-out refinancing available for DSCR loans in North Carolina?

HomeAbroad Loans offers cash-out refinancing options for DSCR loans, allowing investors to extract equity from their properties for further investments or renovations.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Rental Data

Zillow: Home Prices