Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. A higher down payment typically leads to lower interest rates, reduced monthly payments, and more favorable DSCR loan terms for investment properties.

2. Down payment requirements are influenced by factors such as the property’s DSCR ratio, overall cash flow strength, and property type rather than personal income.

3. With HomeAbroad's DSCR loan, Foreign national investors can qualify without a US credit history, though a higher down payment is often required to strengthen the deal profile.

4. HomeAbroad offers DSCR loans for foreign national investors, with down payment options starting at a minimum of 25%, structured to secure competitive financing terms.

At HomeAbroad, our DSCR loans for foreign national investors start with a minimum down payment of 25%. Based on our experience working with international buyers, this level helps balance risk, improve loan terms, and support sustainable rental cash flow.

We’ve helped over 500 foreign nationals close DSCR loans without a US credit history. For international investors, down payment size influences not just approval, but also interest rates, monthly payments, and how comfortably the property clears DSCR requirements.

What we see most often is that a higher down payment improves loan terms by lowering leverage, reducing monthly debt obligations, and creating more margin in the property’s cash flow. As a result, many investors choose to put more than the minimum down to secure better pricing and stronger long-term performance.

Whether your goal is to strengthen cash flow or qualify for more favorable loan terms, understanding how DSCR loan down payments work is essential to maximizing returns on US investment properties.

This guide breaks down HomeAbroad’s DSCR loan down payment requirements and explains how factors like DSCR ratio and property type influence what you need to bring to the table.

Table of Contents

What is a DSCR Loan and How to Calculate it?

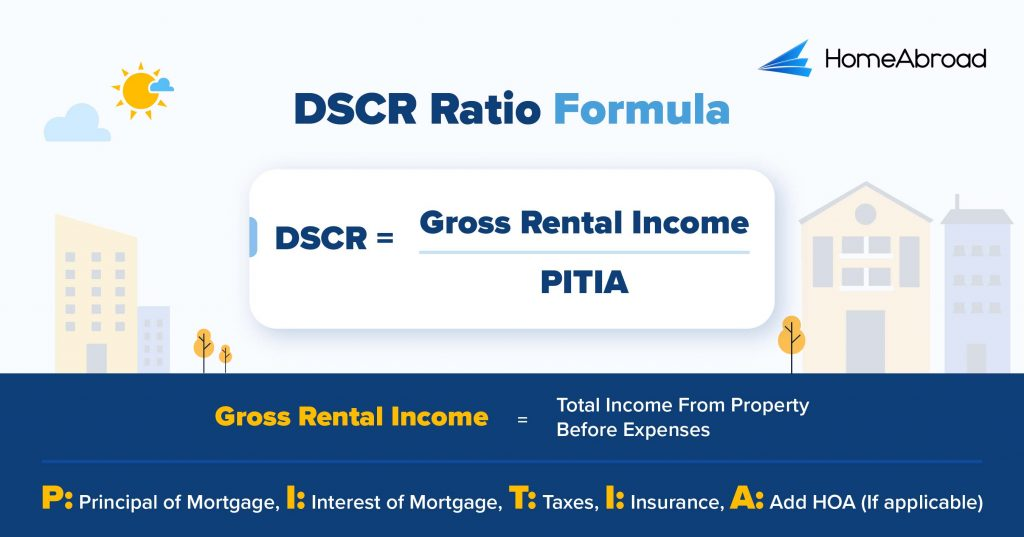

A DSCR (Debt Service Coverage Ratio) loan is a type of mortgage designed for real estate investors looking to purchase rental properties. Unlike conventional loans, DSCR loans allow investors to qualify based on the property’s income rather than their personal income.

The core metric for a DSCR loan is the DSCR ratio, which measures whether a property’s rental income is sufficient to cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

Recently, I worked with Emily Parker, an international real estate investor who wished to acquire a multi-family rental home but was confused about the DSCR calculations.

I worked with Emily and broke down the calculations, which showed that her rental property generates 23% more income than her debt obligations, resulting in strong cash flow and making her eligible for a DSCR loan. This allowed her to secure the loan without personal income verification, giving her flexibility to invest in more properties.

If you do not want to do the math, you can use HomeAbroad’s DSCR ratio calculator.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with firm long-term plans the opportunity to secure financing.

At HomeAbroad, we offer tailored DSCR loans to help international real estate investors like Eily grow their portfolios with competitive loan terms. Learn more about the DSCR loan and application process in our DSCR Loan Guide.

DSCR Loan Down Payment Requirements Explained

At HomeAbroad, we typically require a 25% down payment for foreign investors. This ensures that international real estate investors have access to competitive loan options tailored to their individual financial profiles and investment goals.

The reason this matters is that down payment size directly affects leverage, pricing, and refinancing flexibility over the life of the loan. With DSCR loans, equity isn’t just about qualifying. It influences how resilient the deal is under real-world conditions.

When we evaluate DSCR loans, several key factors are directly shaped by the size of the down payment.

1. Loan-to-Value (LTV):

Our loan officers at HomeAbroad evaluate risk through the loan-to-value (LTV) ratio, which compares the loan amount to the property’s purchase price or appraised value. A larger down payment lowers the LTV, reducing risk and helping you secure better loan terms, including lower interest rates.

2. Rate-Term Refinance:

For those seeking to lower monthly payments or secure a more favourable interest rate, we offer rate-term refinance options, enabling you to refinance your DSCR loan without increasing your loan balance. In this scenario, maintaining a favourable LTV ratio is key, often based on your initial down payment and current property equity.

3. Cash-Out Refinance:

Our cash-out refinance option lets you tap into your property’s equity, allowing you to refinance for a larger amount than the current loan balance.

To be clear, we generally require a higher down payment or greater equity to ensure a strong LTV ratio and maintain competitive loan terms in these scenarios.

At HomeAbroad, we tailor our loan products and down payment requirements to support foreign national investors, ensuring you have the flexibility and financing options to maximize your investment returns.

Benefits of a Larger Down Payment for DSCR Loans

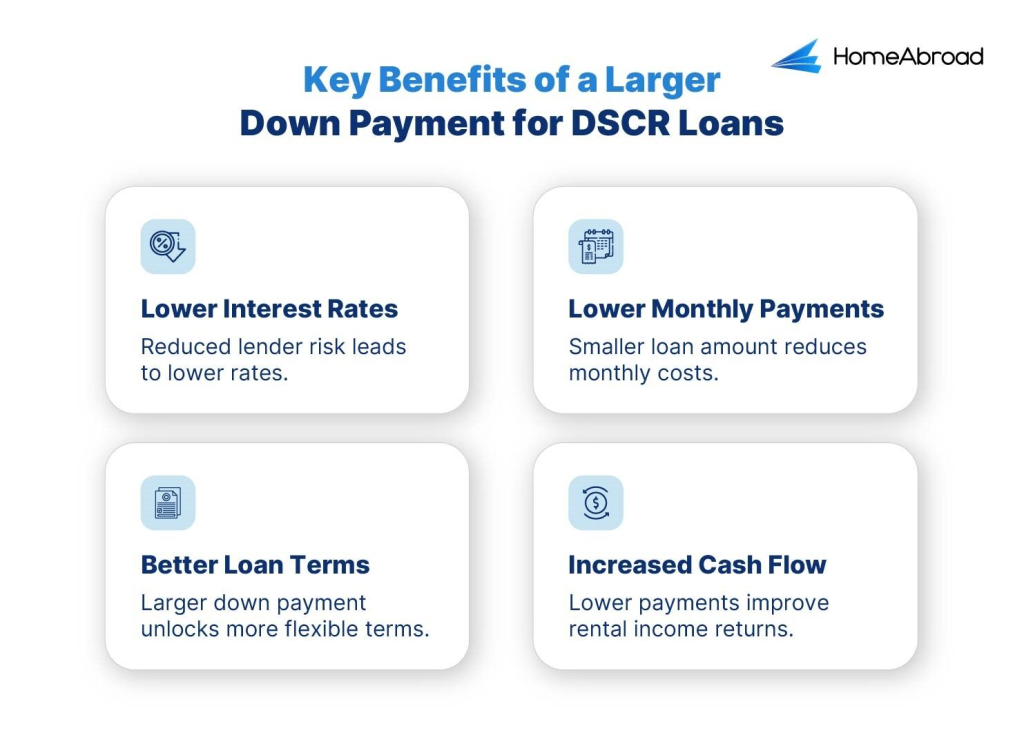

For DSCR loans, down payment size does more than satisfy a requirement. It directly shapes pricing, cash flow stability, and long-term flexibility for international real estate investors.

What we see most often is that investors who commit more equity upfront gain meaningful advantages across the life of the loan, especially when the property income is the primary qualifying factor.

Here’s how a larger down payment works in your favor.

1. Lower Interest Rates

A larger down payment can significantly reduce the interest rate on your DSCR loan. Since the risk to HomeAbroad Loans is lower when more money is put down up front, we’re able to offer more competitive interest rates.

Let us look at the example of Emily to understand this better:

Emily, an international real estate investor from South Africa, purchased a multi-family rental property with a 30% down payment. By opting for a higher down payment, Emily was able to secure a lower interest rate of 4.5% compared to the 5.2% she would have received with a 20% down payment. Over the life of her loan, this resulted in significant interest savings.

2. Lower Monthly Payments

A higher down payment also reduces your loan amount, leading to smaller monthly payments. With lower monthly debt obligations, you can maintain a more substantial cash flow from rental income, making the investment more sustainable in the long run.

In Emily’s case, her 30% down payment not only secured a better interest rate but also reduced her monthly mortgage payment by $500. This freed up more of her rental income to cover property expenses, boosting her property’s cash flow.

3. Better Loan Terms

At HomeAbroad, we reward larger down payments with improved loan terms. This might include more flexible repayment options, fewer prepayment penalties, or even faster loan approval. A higher down payment reduces risk, giving you leverage to negotiate terms that align with your investment goals.

With her 30% down payment, Emily also qualified for better loan terms, including a more flexible repayment schedule that allowed her to pay off her loan early without prepayment penalties. This gave her more control over her investment strategy.

Emily’s story highlights the clear advantages of making a larger down payment when securing a DSCR loan. By reducing interest rates, lowering monthly payments, and ensuring better loan terms, she was able to maximize her investment returns.

At HomeAbroad, we help investors like Emily leverage their down payments to unlock better opportunities and long-term success.

What Factors Influence DSCR Loan Down Payment?

Down payment requirements for DSCR loans aren’t arbitrary. They’re driven by how the property performs, how income is generated, and how much risk exists in the overall structure of the deal.

At HomeAbroad, we tailor DSCR loan structures based on these variables rather than applying a one-size-fits-all rule. Below are the key factors that influence how much equity is required.

1. Debt Service Coverage Ratio (DSCR)

DSCR is one of the most direct inputs into down payment requirements. A higher DSCR indicates stronger cash flow relative to the debt, which lowers risk.

The reason this matters is that stronger cash flow gives us more flexibility on leverage. Properties with higher DSCR ratios may qualify with standard down payment requirements and more favorable terms.

However, we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing. To be clear, it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates to mitigate the additional risk.

2. Credit Score

At HomeAbroad, Foreign investors do not need a US credit history or employment verification, making DSCR loans more accessible to them. However, because foreign investors lack a US credit history, they are considered higher risk, resulting in a higher down payment requirement.

This ensures the loan remains stable while keeping qualification accessible to international investors.

3. Short-Term Rental Properties

If you’re investing in short-term rental properties, your down payment may be higher due to potential fluctuations in income.

At HomeAbroad, we take into account the seasonal nature of short-term rentals. We may require a larger upfront payment to ensure the loan remains stable, even during periods of lower occupancy.

4. Cash-Out Refinance Considerations

If you’re opting for a cash-out refinance, your down payment or existing equity becomes even more critical.

At HomeAbroad, we typically require you to have more equity in the property to maintain a favourable loan-to-value (LTV) ratio. The more equity or the larger the original down payment, the better terms you can secure on the refinance, giving you access to more cash while maintaining a healthy financial position.

5. Lender-Specific Requirements

At HomeAbroad, we understand that each investment is unique. That’s why our down payment requirements are flexible. For foreign investors, we generally require a 25% investment.

However, we assess factors such as property type, investment strategy, and financial profile to ensure we offer terms that align with your goals. Whether you’re purchasing a new property or refinancing, we work with you to tailor down payment options that best suit your needs.

Jason Saylor,

Sr. Customer Loan Specialist, HomeAbroad Loans

Understanding these factors can help you plan your investment more effectively. At HomeAbroad, we strive to offer down payment solutions that align with your strategy, ensuring that you get the best possible terms for your DSCR loan.

Final Thoughts on DSCR Loan Down Payments

Understanding the down payment requirements for DSCR loans is essential for maximizing your investment opportunities. At HomeAbroad, we prioritise flexibility and tailor our down payment options to meet the unique needs of foreign investors.

Whether you’re aiming for better interest rates, lower monthly payments, or more favourable loan terms, the right down payment can make all the difference in securing the best financing for your property. By considering factors such as your DSCR, credit score, and investment strategy, you can ensure you’re setting yourself up for long-term success.

At HomeAbroad, we go beyond just financing. As a one-stop PropTech and FinTech platform, we simplify the process of purchasing US real estate for international real estate investors by offering tailored foreign national mortgages and an AI-powered investment property search platform.

With access to a network of 500+ expert US real estate agents and comprehensive concierge services, from setting up LLCs to opening US bank accounts and coordinating property management, we ensure your investment journey is seamless and successful.

Ready to unlock the full potential of your real estate investments? Connect with HomeAbroad today and explore how our competitive and accessible DSCR loans can help you build lasting wealth in the US market.

Frequently Asked Questions

1. What is the minimum down payment required for a DSCR loan at HomeAbroad Loans?

At HomeAbroad Loans, foreign investors typically need a minimum down payment of 25%. This ensures a solid equity position for international real estate investors.

2. Can I qualify for a DSCR loan with no US credit history?

Yes, foreign investors can qualify for a DSCR loan without a US credit history. HomeAbroad Loans focuses on the property’s income potential rather than your personal credit score, though a larger down payment (25%) is required to reduce the risk.

3. Can I lower my interest rate with a larger down payment?

Yes, at HomeAbroad Loans, a larger down payment can often lead to lower interest rates. By reducing the loan-to-value (LTV) ratio, you present less risk, allowing for more favourable loan terms.

4. Are short-term rental properties eligible for DSCR loans?

Yes, HomeAbroad Loans provides DSCR loans for short-term rental properties. However, due to the potential income fluctuations, we may require a higher down payment to ensure stability.

![DSCR Loan Down Payment Requirements [2026]](https://homeabroadinc.com/wp-content/uploads/2023/01/DSCR-loan-down-payment-500x325.png)

![DSCR Loans Guide for Foreign Nationals: What It Is & How to Apply in [2026]](https://homeabroadinc.com/wp-content/uploads/2022/06/dscr-loan-guide-FN.png)

![DSCR Loan Rates Today [February, 2026]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)