Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

Key Takeaways:

1. Wisconsin's real estate market, including cities like Milwaukee, Madison, and Green Bay, offers affordable prices, reliable rental demand, and strong cash flow for DSCR loan-based investments.

2. Wisconsin DSCR loans from HomeAbroad are tailored for global investors, allowing you to qualify with rental income alone, with no requirement of US tax returns, pay stubs, or US credit history.

3. Wisconsin properties often offer high rental yields and low property taxes, making them ideal for income-based DSCR financing with flexible terms like no requirement of permanent residency or employment verification for foreign nationals.

4. Wisconsin property acquisition is seamless for international real estate investors with HomeAbroad's AI-driven investment property search platform to discover properties, securing DSCR loans, setting up a US LLC, opening local bank accounts, and managing the closing process even remotely.

Table of Contents

Welcome to Wisconsin – the Badger State, where affordable real estate, a growing rental market, and thriving metro areas like Milwaukee and Madison make it an attractive destination for real estate investors.

Over the years, the state has seen consistent home value appreciation and strong rental demand, especially in urban and college-town markets. Wisconsin also offers relatively low property taxes compared to national averages, a landlord-friendly legal environment, and steady population inflows, all of which create favorable conditions for real estate investing.

That’s where DSCR (Debt Service Coverage Ratio) loans come in, allowing global investors to qualify based on a property’s rental income, rather than their personal income or employment. Whether you’re eyeing a duplex in Green Bay or a short-term rental near Wisconsin Dells, HomeAbroad DSCR loans make it easy for international real estate investors to enter the US market with no income verification, no US credit history, and flexible documentation.

What is a DSCR Loan for Foreign Nationals?

A DSCR loan (Debt‑Service Coverage Ratio loan) from HomeAbroad is a mortgage solution for international real estate investors that qualifies you based solely on the property’s rental income, not your personal income, or Debt-to-Income (DTI) ratio.

With Wisconsin’s average rent at $1,345/month (Zillow) and consistent demand in cities like Milwaukee, Madison, and Green Bay, DSCR loans offer a streamlined path to invest in high-yield rental properties across the state. These loans are beneficial for self-employed individuals, entrepreneurs, small business owners, and foreign nationals who may not have access to US credit or conventional documentation.

What makes DSCR loans even more powerful is their flexibility; you can take out multiple DSCR loans simultaneously, allowing you to scale your portfolio across different markets. Additionally, HomeAbroad offers cash-out refinancing options, allowing you to unlock equity from an existing property and reinvest it elsewhere without the hassle of income verification.

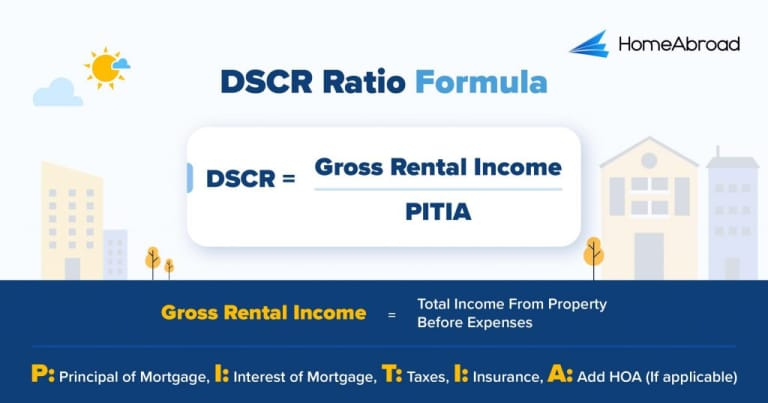

How to Calculate Your DSCR Ratio?

The Debt Service Coverage Ratio (DSCR) is a crucial metric lenders use to assess a borrower’s ability to cover mortgage payments with rental income from the property. For real estate investors, a higher DSCR indicates more substantial cash flow, improving their chances of securing better loan terms.

Recently, I worked with a foreign investor who wanted to invest in Racine, Wisconsin, but he wasn’t sure if the property’s rental income could cover the monthly mortgage expenses. So, we broke down the numbers together and calculated the property’s debt service coverage ratio (DSCR).

Example

Calculating the DSCR Ratio for a Wisconsin Property:

With a DSCR of 1.14, the property demonstrated strong rental income coverage, making the investment stress-free for my investor. Not only did the property’s rental income cover the monthly mortgage and expenses, but it also generated a positive monthly cash flow of $184. This clarity gave him the confidence to move forward with financing.

Our DSCR loans are designed to qualify you based on a property's income potential in relation to its mortgage payments. A standard DSCR loan works by ensuring the monthly gross rent is equal to or greater than the mortgage payment (PITIA), which means your DSCR is 1.0 or higher. This is the ideal scenario that qualifies you for the best terms.

However, we understand that not every property's rental income will meet this threshold, which is why we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. With the No-Ratio program, you can still secure financing, although it will require a slightly larger down payment (a 5% reduction in LTV) and a higher interest rate. This option is ideal for investors with a strong long-term strategy who want to acquire properties that may not immediately generate a 1.0 cash flow ratio.

You can now easily calculate your rental property’s DSCR ratio using HomeAbroad’s DSCR ratio calculator. In Racine’s evolving real estate market, HomeAbroad’s DSCR loans allow investors to scale their portfolios without relying on traditional income verification.

DSCR Loan Requirements in Wisconsin for Foreign Nationals

HomeAbroad offers a simplified and investor-focused approach to DSCR loans, particularly for foreign nationals seeking to enter Wisconsin’s lucrative real estate market.

If you’re investing from outside the US or don’t have a domestic credit profile, our accessible loan structure, minimal documentation needs, and full remote support make it easier than ever to build your investment portfolio in Wisconsin.

Here’s how our foreign national DSCR loan offerings differ from those of typical US lenders:

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with a higher down payment. We offer DSCR Loans for foreign nationals with a DSCR ratio as low as 0.75, which means you are eligible even if your rental property covers just 75% of the mortgage. | Typically, a property is considered viable if it generates at least 1.2 times its expenses, meaning it must produce at least 20% more income than its expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | A low down payment of 25%, which provides higher leverage and leaves more capital available for other investments. | Approximately 30-35%, which increases your upfront cost. |

In addition to the DSCR ratio, down payment percentage, and credit profile, other important factors can determine your eligibility as an international real estate investor.

With a seasoned team of experts and an AI-driven investment property search platform, HomeAbroad is committed to helping global investors tap into high-potential real estate markets across Wisconsin. We’ll work with you one-on-one to structure the ideal DSCR loan for your specific investment objectives.

Areas We Lend in Wisconsin

At HomeAbroad, we offer DSCR loans across Wisconsin, making it easier for foreign nationals to invest in cities with strong rental markets, such as Milwaukee, Madison, Green Bay, and Kenosha.

Our lending process is designed with global investors in mind, featuring remote-friendly closings and minimal documentation requirements. Whether you’re eyeing college-town rentals or vacation properties near the lakes, we’ve got you covered. Here are a few cities where we lend DSCR Loans in Wisconsin:

- Madison

- Milwaukee

- Green Bay

- Kenosha

- Appleton

- Racine

- Waukesha

- Lake Geneva

- Wisconsin Dells

- Bayfield

- Minocqua

- La Crosse

- Eagle River

To see how profitable a DSCR loan can turn out for your long-term investment goals, let’s examine a case study of an international real estate investor who leveraged a HomeAbroad DSCR loan to purchase a rental property in Wisconsin.

Case Study: How John Secured a HomeAbraod DSCR Loan while Generating Positive Cash Flow

John, a foreign national investor based in South Africa, sought to expand his real estate portfolio with a new rental property in Green Bay, Wisconsin; however, he was turned down by traditional US lenders. Then he turned to HomeAbroad, and we suggested financing his rental property using a foreign national mortgage DSCR loan. Seeking a financing solution that focused on the property’s income potential rather than traditional income documentation, John opted for a DSCR loan from HomeAbroad Loans.

This strategy proved successful, as the property’s rental income was enough to cover its monthly mortgage obligations and still generate positive cash flow. The streamlined process and favorable DSCR loan interest rate and terms made the deal both profitable and straightforward, a smart move for an investor aiming to scale.

Property Details:

- Location: Green Bay, Wisconsin

- Purchase Price: $261,478

- Monthly Rent: $1,900

Loan Details:

- Loan Amount: $209,182

- Down Payment: 20%

- Monthly PITIA: $1,826

DSCR Calculation:

- DSCR = $1,900 ÷ $1,826 = 1.04

- Monthly Positive Cash Flow: $74

What Worked:

- DSCR-Based Approval: The loan was approved solely on the basis of the property’s rental income.

- Positive Cash Flow: John generated $74/month in surplus income right from the start.

- Strong DSCR Ratio: A DSCR of 1.04 made the investment loan-eligible and profitable.

- Simplified Process: Minimal documentation and faster processing made closing easier.

- Scalable Strategy: This investment became another cash-flowing property in John’s growing portfolio.

- Expert Guidance: HomeAbroad’s mortgage team provided support from loan approval to closing.

This case highlights how DSCR loans from HomeAbroad offer international real estate investors a flexible, income-based financing option. With positive cash flow, low upfront costs, and a hassle-free process, John’s Green Bay investment is a prime example of how strategic financing can fuel long-term real estate success.

Top Places to Invest in Wisconsin with a DSCR Loan

Wisconsin may not always make the front page for real estate investment, but savvy real estate investors know it’s one of the Midwest’s most dependable and rewarding markets. With affordable home prices, strong rental demand, and a mix of urban and vacation rental opportunities, the state offers fertile ground for both long-term and short-term rental strategies.

For international real estate investors using DSCR loans, Wisconsin offers a practical, often overlooked option. The state’s focus on economic stability, regional job hubs, and tourism-friendly destinations enables foreign national investors to qualify based on the property’s income, rather than their personal finances.

Here are some of the most investor-friendly cities in Wisconsin to explore for your next DSCR loan-backed rental property.

City | Rental Type | Rental Yield |

|---|---|---|

Wisconsin Dells | Short-Term | 25.12% |

Lake Geneva | Short-Term | 23.6% |

Eagle River | Short-Term | 15.67% |

Milwaukee | Long-Term | 7.45% |

Kenosha | Long-Term | 6.57% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Wisconsin or anywhere in the US!

Wisconsin Dells: Midwest’s Vacation Capital Delivers Year-Round Demand

With its waterparks, resorts, and natural beauty, Wisconsin Dells is a tourism powerhouse. While it’s best known for summer crowds, year-round attractions keep occupancy steady even in shoulder seasons. STR performance here thrives on weekenders, family trips, and seasonal events.

- Median Home Price: $228,133

- Average Rent: $1,100/month

What this means for investors: Wisconsin Dells offers high nightly rates and strong seasonal returns. Investors who lean into experience-based stays, like themed cabins or family-friendly amenities, can outperform the market. While summer dominates, fall foliage and winter holidays provide bonus cash flow beyond peak months.

Investment Properties Listed Today on Sale in Wisconsin Dells

Lake Geneva: Luxury Lakefront Meets Chicago Weekend Surge

Lake Geneva has long been a retreat for Chicagoans looking for upscale lake escapes. The town blends boutique hotels, wineries, and lake activities into a consistent weekend getaway destination. STR demand is fueled by proximity to metro areas and high-spending guests.

- Median Home Price: $362,817

- Average Rent: $2,100/month

What this means for investors: The STR market here isn’t about volume; it’s about premium stays. High ADRs offset moderate occupancy, and homes with lake views or walkable access to downtown perform best. Operators with polished listings, concierge-style service, or unique design will command top-tier rates.

Investment Properties Listed Today on Sale in Lake Geneva

Eagle River: Rustic Escapes Powering Northwoods Revenue

Tucked in the lake-dense Northwoods, Eagle River offers a different kind of STR play: rustic, seasonal, and experience-driven. Cabins, fishing lodges, and snowmobile-friendly properties dominate here. This is an accurate escape market for families and outdoor adventurers.

- Median Home Price: $465,750

- Average Rent: $950/month

What this means for investors: Eagle River STRs are seasonal cash generators. Summer and snow season bookings can be intense, while spring shoulder months are slow. Investors who understand seasonal preparation, local permitting, and niche audiences (such as anglers, ATVers, and leaf peepers) can unlock real profitability in a low-competition market.

Investment Properties Listed Today on Sale in Eagle River

Milwaukee: Urban Appeal with Room to Optimize

Milwaukee seamlessly blends urban tourism, business travel, and local event traffic. From Fiserv Forum concerts to lakefront festivals, the city supports steady short-term rental activity. STRs in core neighborhoods, such as Bay View, Third Ward, and Brewer’s Hill, are popular with weekenders and professionals.

- Median Home Price: $208,633

- Average Rent: $1,295/month

What this means for investors: Milwaukee is a consistent market, with no massive surges but solid year-round demand. Investors who optimize cleaning turnover, self-check-in, and mid-length stays can hit strong DSCR metrics. Regulatory policy remains favorable but is evolving; therefore, staying compliant with local laws is crucial.

Investment Properties Listed Today on Sale in Milwaukee

Kenosha: Lake Michigan Charm with Commuter Stability

Halfway between Milwaukee and Chicago, Kenosha captures both weekenders and working professionals. Lake access, a growing downtown, and commuter rail options create a hybrid STR market with both leisure and business demand.

- Median Home Price: $169,483

- Average Rent: $975/month

What this means for investors: Kenosha rewards the flexible operator. You’ll see bookings from couples taking weekend trips, traveling nurses, and urban spillover from the Chicagoland area. Homes near the harbor, in historic districts, or in walkable areas tend to perform best. With moderate ADRs and high occupancy, cash flow is driven by volume, not luxury.

Investment Properties Listed Today on Sale in Kenosha

Specific Considerations for Investing in Wisconsin for Foreign Nationals

Wisconsin’s rental markets offer strong fundamentals for foreign nationals using DSCR loans, primarily in mid-sized cities where home prices are reasonable, rent demand is stable, and competition remains manageable. But investors must also understand the state’s regulatory environment, climate, tax structure, and local ordinances to make informed financing and risk decisions.

1. High and Variable Property Taxes Affect DSCR Ratios

Wisconsin consistently ranks among the top five US states with the highest property tax burdens. The effective rate averages 1.63%, but in some areas, such as Milwaukee County, it exceeds 2.5%. Meanwhile, other counties, such as Ozaukee, Dane, or La Crosse, may have slightly more favorable rates.

For DSCR loan investors, these taxes directly affect monthly obligations and net cash flow, which, in turn, affect whether the debt service coverage ratio meets lender thresholds. Always calculate DSCR using after-tax projections based on local mill rates.

2. Harsh Winters Raise Maintenance Costs and Operating Risk

Wisconsin winters are characterized by heavy snow, ice, and frequent freeze-thaw cycles, particularly from November to March. This puts wear on roofs, gutters, plumbing, and HVAC systems, increasing annual maintenance expenses. Snow removal and heating are essential services tenants expect, especially in Class B or C rental neighborhoods.

DSCR investors should prioritize properties built after 2000, with updated insulation, furnaces, and roofing, or budget for seasonal upkeep when modeling projected expenses.

3. Short-Term Rental (STR) Licensing is Strict and City-Specific

Wisconsin state law requires all short-term rental operators (operating for less than 29 days) to register as Tourist Rooming Houses through the Department of Agriculture, Trade, and Consumer Protection (DATCP). However, local STR rules vary widely by city and can include zoning limits, permit caps, owner-occupancy mandates, or tax compliance requirements.

Cities like Madison, Lake Geneva, and parts of Door County are known for their tight restrictions. DSCR loan investors should avoid STR-dependent projections unless the local market legally allows and supports vacation rentals.

4. Landlord-Tenant Laws Are Stable and Investor-Friendly, But Regulated

Wisconsin is considered moderately landlord-friendly. There’s no statewide rent control, and landlords can issue non-renewals or rent increases with proper notice. That said, the state does enforce clear rules around habitability, evictions, and security deposit returns.

Eviction processes require court filings and can take several weeks; therefore, foreign national investors, especially those managing remotely, are strongly encouraged to work with licensed property managers to ensure compliance.

Strategic & Future Considerations for Foreign Nationals Investing in Wisconsin

Wisconsin is emerging as a quiet performer for foreign national investors seeking long-term rental income with DSCR loans. With relatively low property prices, solid tenant demand in mid-sized cities, and infrastructure investment along key corridors, the state offers cash-flow-friendly opportunities. However, state-specific legal and economic factors must be considered to optimize risk and returns.

1. Foreign Ownership is Legal and Unrestricted, but Legal Guidance is Crucial

Wisconsin allows foreign nationals to own property with no restrictions, making it easy to purchase property in their own name or through a US-based LLC. There’s no citizenship or residency requirement, and foreign national buyers are free to own residential, commercial, or agricultural real estate.

However, it’s vital to secure title insurance, confirm zoning and use rights, and work with a Wisconsin-licensed real estate attorney to avoid issues related to property age, municipal rules, or adjacency to tribal land.

2. Mid-Sized Cities Offer the Best DSCR Potential

While Milwaukee is Wisconsin’s largest metro area, cities like Madison, Green Bay, Kenosha, and Eau Claire offer more favorable cash flow dynamics for DSCR borrowers. These cities benefit from strong rent demand, stable job markets (in education, manufacturing, and healthcare), and lower competition from institutional buyers.

In many of these cities, investors can find rental properties under $300,000 with cap rates of 6% to 9%, providing international buyers with room to meet DSCR thresholds without aggressive financing.

3. Interstate Corridor Growth Is Creating New Investment Zones

The I-94 corridor between Milwaukee and the Illinois border is rapidly developing into an industrial and logistics hub, supported by prominent companies such as Amazon, Uline, and Foxconn. Towns like Mount Pleasant, Racine, and Sturtevant are seeing increased rental demand and workforce housing needs.

Foreign national investors can target these growth corridors for long-term rental holds, as new job centers continue to expand housing demand beyond the traditional city cores.

4. Secondary Markets Offering Strong Returns

Wisconsin has some of the highest property taxes in the US, with county-by-county variations that can materially impact your DSCR calculations. For instance, Milwaukee County has an average effective rate over 2.5%, while places like La Crosse or Outagamie counties are closer to 1.8%.

Savvy real estate investors look beyond just property price and consider after-tax cash flow when selecting markets.

5. Demographic Trends Favor Long-Term Rentals Over Ownership

Wisconsin’s aging population, the influx of young renters in college towns, and the growth of remote workers are contributing to rising long-term rental demand. Markets like La Crosse, Stevens Point, and Oshkosh are seeing steady occupancy and rent growth, despite being under the radar for institutional investors.

Wisconsin may not be a headline market, but it offers solid DSCR loan opportunities through affordable entry points, steady rent demand, and statewide openness to foreign ownership. Long-term investors should target mid-sized cities, infrastructure corridors, and counties with moderate tax rates, while also keeping a close eye on seasonal weather-related maintenance costs and local STR laws.

By focusing on year-round rental markets and working with local property managers, global investors can create a dependable US income stream through Wisconsin real estate.

Get a HomeAbroad DSCR Loan in Wisconsin as a Foreign National

Securing financing for your investment property in Wisconsin is simple with HomeAbroad. Our DSCR loans are tailored for international real estate investors, offering competitive rates and flexible terms to help you invest confidently in Wisconsin’s steady and growing rental property markets.

At HomeAbroad, we streamline the entire investment journey for global investors. Our AI-powered platform helps you find high-yield rental properties across Wisconsin, while our expert local agents provide personalized guidance. We also assist with LLC formation, setting up US bank accounts, and providing end-to-end property management support.

Wisconsin offers a stable rental market with lower entry costs and strong demand in cities like Milwaukee and Madison. With HomeAbroad, you can build a profitable investment strategy that maximizes rental income and long-term appreciation, without needing US income or credit history.

Start building your Wisconsin real estate portfolio today with a DSCR loan from HomeAbroad and invest with clarity and ease.

FAQs

Can anyone get a DSCR loan in Wisconsin?

As long as your investment property’s cash flow can cover the mortgage, you’re eligible for a DSCR loan.

What is the minimum DSCR ratio required for a DSCR loan in Wisconsin?

To get qualified, a DSCR ratio of 1 or higher is generally required. The higher your ratio, the more likely you are to get approved for your loan. However, HomeAbroad offers No-Ratio DSCR loans for properties with lower coverage, provided a higher down payment is made to mitigate the additional risk.

Does the debt-to-income ratio play a role in DSCR loans?

When it comes to DSCR loans, your debt-to-income ratio is not a factor for lenders. They’re not concerned about your personal income or job history; their primary focus is on the property’s cash flow and its ability to cover your monthly mortgage payment.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Zillow: Rental and Housing Data

AirDNA: Short-term Rental Data