A DSCR (Debt Service Coverage Ratio) loan could be your ideal financing solution if you are looking to invest in the lucrative real estate market of Wisconsin without the hassle of traditional income verification. Instead of relying on W-2s, pay stubs, or tax returns, lenders evaluate the property’s rental income to determine eligibility, making the process quicker, simpler, and tailored for global investors.

Whether you’re expanding your real estate investment portfolio or refinancing an existing property, DSCR loans offer the flexibility and ease you need, all without needing a US credit history or green card.

Ready to invest? Get a DSCR loan in Wisconsin with HomeAbroad today!

Table of Contents

Key Takeaways:

1. DSCR loans assess the property's rental income rather than the borrower's personal income, making them ideal for investors with non-traditional income sources or high debt-to-income ratios.

2. DSCR loans allow cash-out refinancing to improve cash flow, lower interest rates, and unlock property equity for future investment purposes.

3. DSCR loans are applicable for financing various investment properties, including single-family homes, multi-family units, long-term rentals, and short-term rentals like Airbnb.

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a strategic financing option tailored for real estate investors, including both domestic and foreign nationals. Unlike conventional mortgages, which rely on employment history and extensive documentation, DSCR loans evaluate the property’s rental income to determine eligibility, making it easier for investors to secure funding based on the asset’s performance.

Having worked closely with a diverse range of investors over the years, I’ve witnessed how DSCR loans can open doors that conventional loans often keep closed. Whether it’s self-employed buyers, foreign investors, or those looking to expand their portfolios, DSCR financing removes the friction of income hurdles and streamlines the path to ownership.

Wisconsin’s stable rental market and competitive property prices make it a prime location for cash-flow-focused investments. With the right property, a DSCR loan allows you to tap into consistent rental income to cover your mortgage expenses while building long-term equity without the need for traditional financial vetting.

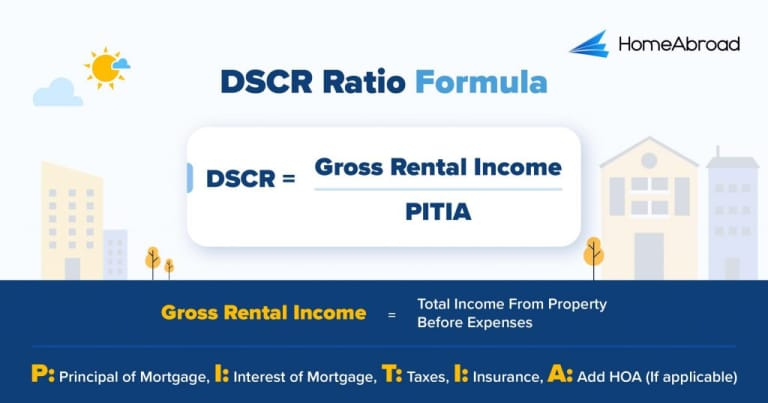

How to Calculate Your DSCR Ratio

The Debt Service Coverage Ratio (DSCR) is a crucial metric that lenders use to assess borrowers’ ability to cover mortgage payments with their rental income. For real estate investors, a higher DSCR indicates strong cash flow, which improves their chances of securing better loan terms.

Recently, I worked with a foreign investor who wanted to invest in Racine, Wisconsin, but he wasn’t sure if the property’s rental income could cover the monthly mortgage expenses. So, we broke down the numbers together and calculated the debt service coverage ratio (DSCR) of the property.

Example

Calculating the DSCR Ratio for a Wisconsin Property:

With a DSCR of 1.14, the property demonstrated strong rental income coverage, making the investment stress-free for my client. Not only did the property’s rental income cover the monthly mortgage and expenses, but it also generated a positive monthly cash flow of $184. This clarity gave him the confidence to move forward with financing.

If the DSCR had been below 1.0, he could still qualify for HomeAbroad’s DSCR loan, as we offer flexible options, including loans for DSCR ratios as low as 0.75 and even No-Ratio DSCR loans for properties with lower coverage, just with the condition of providing a higher down payment to mitigate the additional risk.

In Racine’s evolving real estate market, HomeAbroad’s DSCR loans allow investors to scale their portfolios without relying on traditional income verification.

DSCR Loan Interest Rates

Understanding these rates is crucial for investors as they significantly impact the profitability of investment properties. Before investing, follow our DSCR loan interest rates guide to learn about these rates and the factors that influence them.

Due to the unique nature of DSCR loans and the associated increased risk for lenders, DSCR loan interest rates are typically 1% to 1.5 % points higher than conventional mortgage rates. For more details on DSCR loans and how they work, visit HomeAbroad’s DSCR loan hub.

How to Qualify for a DSCR Loan in Wisconsin

At HomeAbroad, we make qualifying for a DSCR loan flexible and straightforward, whether you’re a domestic investor or a foreign national. Now, let’s learn about our tailored DSCR loan requirements to provide domestic and foreign investors with flexible financing solutions.

| Features | Domestic Investors | Foreign Investors |

|---|---|---|

| DSCR Ratio | 1 or Higher (No Ratio DSCR Program Available) | >= 1 for best terms, <1 eligible with higher down payment |

| Credit Score | 620 or higher | No US credit history required |

| Down Payment | 20% | 25% |

| Loan-to-Value (LTV) | Up to 80% for purchase/refinance Up to 75% for cash-out refinance | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

| Cash Reserves | 2 months | 6 months |

| Property Use | Investment properties (residential and commercial) | Investment properties (residential and commercial) |

| Loan Amount | $75K – $10M | $75K – $10M |

Areas We Lend in Wisconsin

- Madison

- Milwaukee

- Green Bay

- Kenosha

- Appleton

- Racine

- Waukesha

- Lake Geneva

- Wisconsin Dells

- Bayfield

- Minocqua

- La Crosse

- Eagle River

Let’s examine a case study of one of our past clients to understand how profitable investing in the Wisconsin real estate market can be.

Case Study: How John Secured a HomeAbraod DSCR Loan while Generating Positive Cash Flow

Property Details:

Location: Green Bay, Wisconsin

Property Price: $261,478

Monthly Rent: $1,900

Loan Details:

Loan Amount: $209,182

Down Payment: 20%

Monthly PITIA: $1,826

DSCR Calculation:

DSCR Ratio = Gross Rental Income ÷ PITIA

DSCR = $1,900 ÷ $1,826

DSCR = 1.04

The HomeAbroad Solution:

John, a domestic investor based in Wisconsin, chose a DSCR loan through HomeAbroad Loans to secure his property in Green Bay, as he wanted to expand his real estate portfolio. With a DSCR of 1.04, his rental income easily covered the property’s monthly mortgage expenses. This made the investment viable and attractive, allowing John to add another profitable property to his real estate portfolio.

The HomeAbroad DSCR loan offered a streamlined approval process based on the property’s rental income potential, which was ideal for John. As a working professional with a stable income but not needing to rely on traditional income verification methods, this proved to be a significant investment for him.

Why Does This Matter?

Steven Glick highlights the importance of this financing approach:

John, like many investors in today’s market, chose HomeAbroad’s DSCR loan because it allowed him to focus on the income generated by the property rather than traditional income verification methods. With a DSCR of 1.04, John was able to secure the property and create a positive cash flow of $74 per month, making this a smart addition to his portfolio.

Steven Glick, Director of Mortgage Sales, HomeAbroad

John’s investment in Green Bay showcases how a DSCR loan from HomeAbroad Loans provides domestic investors like him with a powerful tool for securing properties and generating positive cash flow. With a DSCR of 1.04 and monthly surplus income, John is well-positioned for success as he continues to grow his real estate portfolio.

This case study highlights the flexibility and profitability that DSCR loans can offer, making it easier for investors to secure rental properties that provide ongoing, consistent income.

Top Places to Invest in Wisconsin with a DSCR Loan

Wisconsin offers a thriving real estate market with affordable property prices, strong rental potential, and higher property appreciation rates. With an average home price of approximately $312,361, investors can find competitive opportunities in both long-term and short-term rentals.

Milwaukee, Madison, and Green Bay are prime locations for long-term rental demand, supported by steady economic growth. For short-term rentals, Lake Geneva and Wisconsin Dells attract year-round tourism, making them ideal for vacation rental investments.

With strong rental yields and attractive entry points, Wisconsin presents an excellent opportunity for real estate investors looking to invest in high-value investment properties with DSCR loans.

Here are some top investment cities in Wisconsin:

City | Rental Type | Rental Yield |

|---|---|---|

Wisconsin Dells | Short-Term | 21.6% |

Lake Geneva | Short-Term | 21.1% |

Eagle River | Short-Term | 19.8% |

Milwaukee | Long-Term | 8.24% |

Kenosha | Long-Term | 8% |

Need help finding the right investment property? Our AI-driven investment property search platform can help you discover high-performing rentals in Wisconsin or anywhere in the US!

Apply for a Wisconsin DSCR Loan with HomeAbroad

Investing in Wisconsin’s thriving real estate market has never been easier with HomeAbroad’s tailored DSCR loan solutions. Whether you’re a domestic or international investor, our expert-backed financing options make it simple to secure properties that generate positive cash flow.

With HomeAbroad, you gain access to our AI-powered property search, a network of over 500 real estate agents, and concierge services for LLC formation, banking, insurance, and property management, all designed to ensure a seamless investment experience.

Take advantage of Wisconsin’s growing real estate opportunities and start building your portfolio today. Apply for a DSCR loan with HomeAbroad, and unlock the potential for consistent rental income, financial flexibility, and long-term success in Wisconsin’s real estate market!

Pre-qualify for a DSCR Loan in a Few Clicks.

No Paystubs, W2s, or Tax Returns Required.

FAQs

Can anyone get a DSCR loan in Wisconsin?

As long as your investment property’s cash flow can cover the mortgage, you’re eligible for a DSCR loan.

What is the minimum DSCR ratio required for a DSCR loan?

To get qualified, a DSCR ratio of 1 or higher is generally required. The higher your ratio, the easier it is to get approved for your loan. However, HomeAbroad offers loans with DSCR ratios as low as 0.75 and even No-Ratio DSCR loans for properties with lower coverage, provided a higher down payment is made to mitigate the additional risk.

Does the debt-to-income ratio play a role in DSCR loans?

When it comes to DSCR loans, your debt-to-income ratio doesn’t matter to lenders. They’re not concerned about your personal income or job history; their primary focus is solely on the cash flow generated by the property and its ability to cover your monthly mortgage payment.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

Airdna: Short-Term Rental Data

Zillow: Home Value

![DSCR Loan Florida [2025]: Qualify with Your Property’s Income](https://homeabroadinc.com/wp-content/uploads/2022/09/DSCR-Loan-Florida.png)