Before hopping on anything, can you get a green card through real estate investment?

Yes, you can obtain a green card through real estate investment in the United States. Although buying a real estate property will not directly help get a green card in the U.S., there are some ways to get a green card by investing in real estate.

One of the preferable ways is through the EB-5 Investor Program. The EB-5 Immigrant Investor Program provides a path to permanent residency for foreign nationals who can invest in new commercial enterprises. The E-2 Visa Program is another way to obtain a green card through investment. An E-2 visa is a nonimmigrant visa available to individuals looking to invest in or operate a business in the United States. This guide provides information on investing in real estate for people seeking green cards in the USA.

Table of Contents

A Guide to Get a Green Card through Real Estate Investor Visa

As you know, there are two options to get a green card through real estate investment EB-5 and E-2. Let’s start with the EB-5 program to get a green card.

The EB-5 Program

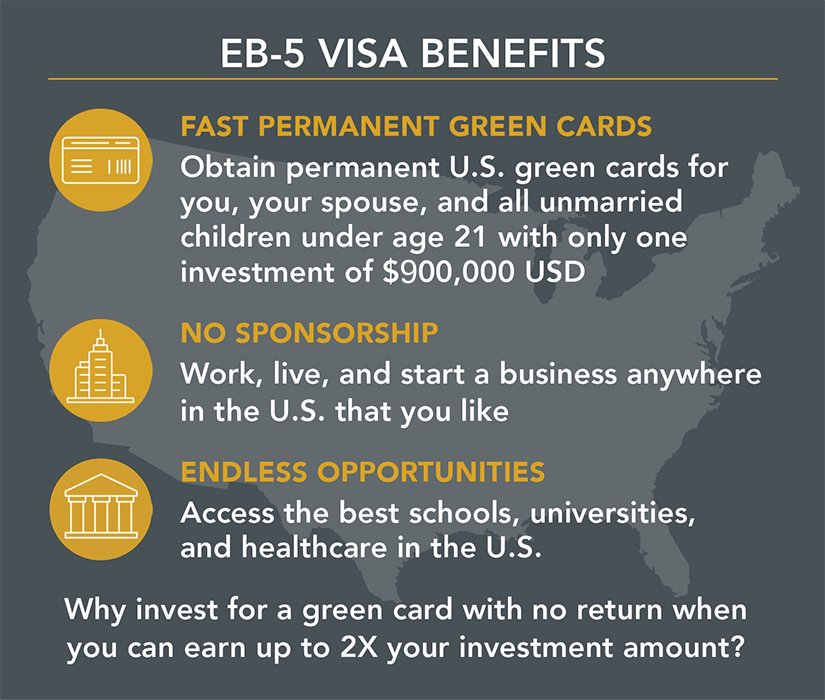

The EB-5 Immigrant Investor Program is an excellent way for real estate investors to get a green card while making a sound investment in the United States economy.

Congress created the EB-5 in 1990 to encourage foreign investments in the United States and create American jobs. The program provides foreign nationals with a path to permanent residency, also known as a green card, in exchange for an investment of a minimum of $900,000 in a real estate project.

The foreign investor’s program is divided into two sections:

1. Basic Program

Under the Basic Program, real estate investors must actively participate in their investments’ development and daily operation.

2. Regional Center Pilot

The Regional Center Pilot allows investors to invest in USCIS-approved real estate projects through partnerships or as partial owners. This is especially beneficial for real estate investors who do not want to be actively involved in the day-to-day management of their investments.

Both programs require a capital investment of $1.8 million, or at least $900,000 in a TEA. In addition, the real estate investment must bring or preserve at least ten full-time jobs for U.S. workers.

To qualify for either program (Basic or Regional), you must make your investment through legitimate channels and ensure that your investment will preserve ten full-time employment for American workers. You will also need to undergo an extensive background check and show that you have the financial resources to make the investment. If your application is approved, you and your family will be granted conditional permanent residency status two years after completing the EB-5.

The program offers several benefits like:

- Including tax incentives

- Preferential treatment in the allocation of government contracts

- Access to special economic zones

In addition, this provides for a streamlined process for setting up businesses in our country.

The regional center pilot has successfully attracted foreign investment and promoted economic growth. In the first year, more than $1 billion in foreign investments were recorded, Which has created thousands of new jobs and helped grow the economy and attract real estate, foreign and immigrant investors, and green card permanent resident applicants.

How does EB-5 Program Help in Obtaining a Green Card?

The EB-5 program is administered by the US Citizenship and Immigration Services (USCIS) through a network of regional centers. These regional centers are responsible for promoting investment opportunities and working with developers to ensure that projects meet the requirements.

Requirements for an applicant to qualify for the EB-5 for a green card are:

- Make a minimum investment of $1.8 million (or $900,000 if the project is located in a rural or high-unemployment area).

- The investment must also create or preserve at least ten full-time jobs for US workers.

- Once an applicant has made their real estate investment and fulfilled all of the requirements, they can apply for a green card.

This allows them to live and work in the U.S. indefinitely and provides access to other perks such as public education and healthcare.

Current Minimum Amount to Get a Green Card by real estate investment through EB-5.

To qualify for the EB-5 visa, an individual must make a minimum investment of $900,000 (or $1.8 million if the investment is not made in a targeted economic area). While the minimum investment amount has remained the same for years, the government has attempted to raise it in recent years. However, these efforts have been unsuccessful.

The US Senate passed legislation that would have allowed the minimum investment amount for targeted economic areas to be increased to $900,00 from $500,000.

The current minimum investment amount for the EB-5 visa remains at $900,000 (or $1.8 million for non-targeted economic areas). For more information on EB-5 visa requirements, please consult the 8 CFR 204.4.E.

How do I Process my Green Card through Real Estate Investment Under EB-5?

Here is how to qualify for EB-5. Visit this page to learn about the EB-5 application process.

Steps to qualify for EB-5:

- First, a prospective investor must invest at least $1.8 million in a real estate project or $900,000 in a regional center.

- Then the investor must create full-time jobs for at least ten American workers.

- Once the investment has been made, the investor must create at least 10 full-time jobs for US workers.

- After about a year, the investor can then file for I-829 to remove the conditions on their green card.

Once this has been approved, the green card will be valid for 10 years. It is important to note that the success of each step is contingent on the successful completion of the previous step. Hence, it is important to carefully follow all instructions throughout the process.

Benefits of Investing in EB-5 Regional Centers

There are many benefits for an investor in a regional center including, through EB-5 in the United States:

- the ability to pool funds with other investors

- the ability to invest in multiple projects

- the ability to receive guidance from experienced professionals.

When you invest in an EB-5 regional center, you are contributing to a business that has been designated by the United States Citizenship and Immigration Services (USCIS) as a place that promotes economic growth.

You can locate the regional centers in areas with high unemployment or low investment levels. Again, by becoming an investor in a regional center,r you can help create jobs and spur economic development.

There are currently over 600 EB-5 regional centers in the United States, and each one has its requirements and benefits. When you are choosing a regional center to invest in, it is important to do your research and make sure that the regional center is a good fit for your investment goals.

How Lucrative is Real Estate Investment in the United States?

Real estate is one of the most stable ways of building money because you can earn money by combining different methods. The U.S. real estate marketplace will snowball your investment in buying more homes and thereby create your own stable business unit.

The EB-5 visa can also help pave a path to a green card for foreign and EB-5 investors who invest in real estate or commercial enterprises in certain designated regional centers.

12 Unique Benefits of Real Estate Investment for Foreign Immigrants through EB-5

You will receive the following significant benefits for real estate investment if you’re a foreign immigrant:

- Real estate investment provides foreign immigrants with a tangible asset that can appreciate over time.

- Unlike many other investments, real estate is not subject to the same volatility as stocks and bonds, providing a more stable investment for those looking to preserve their wealth.

- Foreign investors may take advantage of lower prices when getting into U.S. real estate, as the current strong dollar makes properties more affordable than they would be if purchased with weaker currencies.

- Real estate can provide a steady stream of income through rental payments. This can help offset ownership costs and provide an additional source of funds for your further investments or other purchase and expenses.

- By becoming an investor in real estate, foreign investors can better understand the local economy and culture, which can be beneficial both personally and professionally.

- Real estate investment can be a relatively passive form of putting money in, as property managers can handle many of the day-to-day tasks associated with owning and operating rental properties and development projects.

- Foreign and EB-5 investors may be eligible for certain tax benefits when putting money into U.S. real estate. Such as, the Foreign Investment in Real Property Tax Act (FIRPTA) exclusion allows qualifying individuals to exclude up to $250,000 of gain from the sale of a primary residence.

- Real estate offers the opportunity to diversify their portfolio beyond their home country, providing potential protection against geopolitical and economic risks.

- Getting into real estate can be a way to leave a lasting legacy, as those properties can be passed down through generations.

- Real estate offers the potential for significant financial gain and the opportunity to positively impact development projects and local communities.

- Perhaps the most obvious benefit is that it allows the owner to live and work or even get a permanent residence in the United States indefinitely.

- Finally, owning a business can be a path to citizenship for immigrants who may not otherwise have citizenship.

What are the Risks of Owning a Business to Obtain a Green Card

There are a few risks of owning a business to obtain a green card:

- One risk is that if the business fails, the owner may be forced to leave the country.

- There is always the possibility that the government could change its immigration policies and law, which could impact the ability of owners to keep their businesses or obtain green cards.

- Finally, owning a business is a significant financial investment, and there is always the risk that the business will not be successful.

These factors can affect your permanent residence through the EB-5 visa program.

Requirements for Owning a Business Under EB-5 to Get a Green Card

To obtain a green card by owning a business through EB-5, you must first invest in or create a business in the United States if you are a real estate immigrant investor. Make sure to fulfill these requirements:

- If the business is to be located in a rural or underserved area of the United States

- The business must be a for-profit venture.

- You must have ownership of at least 51% of the business.

- Finally, you must demonstrate that the investment and the building project will benefit the U.S. economy and create jobs for American workers. If you meet all of these requirements, you may be eligible to obtain a green card by owning a new commercial enterprise. Real estate investments can also qualify if they meet certain criteria set forth by the USCIS.

- EB-5 can help you invest in real estate and create a new commercial enterprise of at least $1.8 million, or $900,000 if the enterprise is located in a rural area or high-unemployment area.

- Be involved in the management of the enterprise on a day-to-day basis. This can include serving as an executive or supervisor, but note that passive investors are not eligible for the procedure.

In addition to the above requirements, investors must also undergo a background check and show that their investment funds are legal and lawfully obtained.

E-2 Visa Program

The E-2 and EB-5 visa are two of the most popular processes for foreign nationals looking to invest in the United States. We already discussed the EB-5 visa program; now, here comes the E-2 visa program to get a green card through real estate investment.

What is E-2 Visa? How does it help in getting a green card through investment in real estate?

The E-2 visa is a visa classification used by nationals of countries with which the United States has a treaty of commerce and navigation. Foreigners who are coming to the U.S. to develop and direct the operations of an enterprise in which they have invested, or are in the process of investing, a substantial amount of capital can apply for an E-2 Visa.

Moreover, Dependents (spouse and unmarried children under 21) of E-2 visa holders may also enter the United States on E-2 visas.

To qualify for an E-2 Visa:

- The investor must be a national of a country with which the United States has a treaty of commerce and navigation

- The person must make a substantial investment in a bona fide U.S. business

- He/she must intend to come to the United States solely to develop and direct the investment enterprise.

Conclusion

The EB-5 program offers a path to citizenship for those willing to invest in certain types of businesses, including real estate. The E-2 visa program offers a path to obtaining a green card for immigrants who invest in a new commercial enterprise in the United States.

It’s recommended to have a (Certified International Property Specialist) real estate agent on your side to manage the process correctly and facilitate the accomplishment of your end goal, i.e., a profitable investment with a green card. Make sure to research all of your options and requirements before making any decisions.

FAQs

What is the easiest way to get a green card in the US for immigrants wanting to build a business?

The easiest way to get a green card in the USA for immigrants is through the EB-5 and E-2 Visa programs. By either of the programs, you can get a green card through investment in the real estate business.

Can anyone invest in a business to get a green card through the EB-5 visa program?

Yes, anyone can invest in a business to get a green card through the EB-5 visa program. There is no specific requirement for the investor other than being able to invest the required amount of money into the business, Which is a minimum of $900,000.

Am I eligible for a green card through EB-5?

To be eligible for an EB-5 green card, you must invest a minimum of $900,000 in a qualifying business venture in the United States. Additionally, your investment must create or preserve at least ten full-time jobs for U.S. workers.

![Can Foreigners Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/07/CanForeignersBuyinUS.jpg)