Editorial Integrity

Making informed real estate decisions starts with having the right knowledge. At HomeAbroad, we offer US mortgage products for foreign nationals & investors and have a network of 500+ expert HomeAbroad real estate agents to provide the expertise you need. Our content is written by licensed mortgage experts and seasoned real estate agents who share insights from their experience, helping thousands like you. Our strict editorial process ensures you receive reliable and accurate information.

As the real estate market continues to evolve, the traditional concept of a rental-income mortgage has evolved into a more easily accessible investment option: the DSCR (Debt Service Coverage Ratio) loan.

Based on my prior experience in property financing and investment strategy, I’ve seen how DSCR loans are reshaping the way investors qualify for mortgages. Instead of relying on personal income, tax returns, or employment documentation, these loans focus on the property’s rental income performance, enabling investors to use their portfolio’s cash flow as a gateway to new investment opportunities.

Key Takeaways:

1. DSCR loans let investors qualify for financing using rental income rather than personal earnings, making them ideal for international real estate investors, business owners, and global buyers looking to scale portfolios.

2. HomeAbroad’s DSCR loan programs provide access to property financing even without traditional documentation or US income, credit history, enabling seamless entry into the US real estate market.

3. DSCR loans are underwritten based on the property’s rental income, so foreign nationals don’t need to provide personal tax returns, pay stubs, or employment verification records.

4. HomeAbroad is a one-stop shop that makes the entire process simple for international real estate investors, helping you find properties using our AI-driven investment property platform, get mortgages, set up a US-based LLC, open a local bank account, and handle paperwork required for closing.

Table of Contents

Understanding Rental Income Mortgage And How it Works?

Rental income loans represent a paradigm shift in the mortgage landscape, where rental income is central to determining eligibility. These loans offer borrowers a unique opportunity to leverage income from their rental properties, helping them qualify for a mortgage that might otherwise be out of reach.

The fundamental principle behind rental income mortgage, DSCR loans is impactful yet straightforward, assessing whether the property’s rental income is sufficient to cover its debt obligations. Unlike traditional mortgages, which rely heavily on personal income and employment verification, a rental income mortgage prioritizes a property’s income-generating capacity as a primary qualification factor.

Instead of depending on the borrower’s income, paystubs, tax returns, or credit history, these loans assess a property’s income-generating capacity to cover its mortgage payments, making it ideal for international real estate investors who may lack a US credit score or local financial documentation.

For example, one of our international clients, a South African investor named Sarah Williams, wanted to purchase a rental property in Ohio. Still, her investment goals were initially turned down due to her limited budget. Through HomeAbroad’s DSCR loan program, we not only helped her find a property that matched her budget but also helped her generate consistent rental income and healthy cash flow every month. You can read the full success story here: South African Investor Buys Property in Ohio.

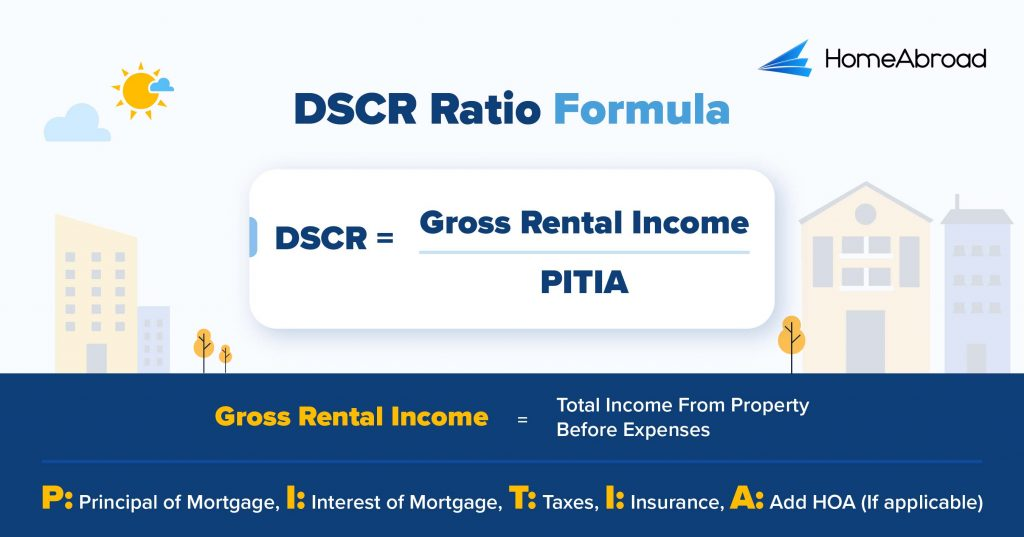

How to Calculate the DSCR Ratio?

The Debt-Service Coverage Ratio (DSCR) measures whether a property’s rental income can cover its mortgage obligations. It’s a key factor we use to assess loan eligibility.

Here is the DSCR formula:

A strong DSCR of 1.24 indicates that the property generates 24% more income than the mortgage payment, signaling positive cash flow.

If you do not want to do the math, you can simply use HomeAbroad’s DSCR ratio calculator.

HomeAbroad’s DSCR loans qualify you based on a property’s rental income relative to mortgage payments. A standard DSCR loan requires the monthly gross rent to be equal to or greater than the mortgage payment (PITIA), which means a DSCR of 1.0 or higher is the ideal scenario for securing the best loan terms.

However, not all properties will meet this threshold, so we also offer our No-Ratio DSCR Program for properties with a DSCR between 0 and 1. This option allows investors to still qualify for financing, but it comes with a slightly larger down payment (a 5% hit to LTV) and higher interest rates. This program focuses less on rental income and more on other factors, giving investors with strong long-term plans the opportunity to secure financing.

DSCR Loan Requirements for Foreign Nationals

Compared to traditional lenders, HomeAbroad offers a streamlined foreign national mortgage DSCR loan process tailored specifically for international real estate investors.

Whether you’re investing from abroad or don’t have a US credit history, our flexible terms, lower barriers, and remote-closing support make international real estate investing more accessible than ever.

Here’s how our lending criteria compare to conventional lenders when it comes to DSCR loans for foreign nationals.

| Features | HomeAbroad DSCR Loan | Other Lenders |

|---|---|---|

| DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment. We provide DSCR Loans for foreign nationals at a DSCR ratio as low as 0.75, which means you are eligible even if your rental covers just 75% of the mortgage. | Usually 1.2 and above, which means the property must generate 20% more income than expenses. |

| Credit Score | You can qualify without a US credit score. We underwrite the loan based on your property’s rental income, not personal income. | Other lenders require you to have a minimum credit score of 620. Many lenders also do not consider foreign credit reports. |

| Down Payment | Low down payment of 25%, which gives you higher leverage and leaves more capital free for other investments. | About 30 – 35%, which increases your upfront cost. |

Additional DSCR Loan Requirements Foreign Nationals Should Know

Beyond DSCR ratio, down payment, and credit score, there are a few more requirements and considerations that can significantly impact your ability to qualify for a DSCR Loan as an international real estate investor.

With extensive experience working with global investors, our team at HomeAbroad provides personalized support at every step. Our AI-driven investment property search platform helps you identify high-performing investment opportunities just like Sarah did, while our experts tailor the best DSCR loan solutions to fit your investment goals.

The Role of Rental Income to Qualify for the Mortgage

Rental income is a cornerstone of the qualification process for an RIM loan, enabling borrowers to leverage the property’s income potential to secure financing. This specialized type of mortgage emphasizes the property’s ability to generate rental income and cover debt obligations. Here’s how rental income assists borrowers in qualifying for a RIM loan:

1. Income Sustainability

RIM loans recognize the stability and predictability of rental income. Rental properties with a history of consistent cash flow are attractive to lenders, as they provide a reliable source of funds to cover expenses, including the mortgage.

2. Rental Income Mortgage (RIM)

The primary factor that differentiates RIM loans is the focus on RIM. This ratio quantifies the relationship between the property’s net operating income (NOI) and its debt payments. Rental income contributes to the property’s NOI, allowing borrowers to achieve a higher RIM and meet lender requirements.

3. Enhanced Qualification Potential

Rental income can be a strong compensatory factor for borrowers who may not meet traditional income criteria. The ability of rental income to augment the borrower’s overall cash flow enhances the likelihood of meeting the lender’s RIM threshold.

4. Diversification of Income

Rental income diversifies a borrower’s income portfolio, reducing reliance on personal earnings alone. This diversification contributes to a healthier financial profile and demonstrates the borrower’s capacity to manage multiple income streams.

5. Higher Loan Amounts

Rental income’s positive impact on the property’s cash flow can lead to higher loan amounts. A property with strong rental income potential may qualify for a larger loan, allowing borrowers to invest in properties with greater income potential.

6. Flexible Documentation

RIM loans often have more flexible documentation requirements than conventional loans. The emphasis on rental income provides borrowers with alternative pathways to meet qualification criteria.

In essence, rental income is a powerful tool that empowers borrowers to qualify for a RIM loan by demonstrating the property’s ability to generate consistent income and cover debt obligations. However, understanding the related requirements can increase the likelihood of loan approval before applying for the RIM loan.

How to Get Your Eligibility Check for a Rental Income Mortgage?

Qualifying for a RIM (Rental Income Mortgage) loan involves meeting specific criteria that focus on the property’s income-generating potential and its ability to cover debt obligations. This loan prioritizes rental income and the property’s financial stability. Here are the key requirements to qualify for a RIM loan:

1. Property Cash Flow

The property’s cash flow, primarily generated from rental income, is a central consideration. The rental income must demonstrate a consistent and sufficient revenue stream to cover the property’s operating expenses, mortgage payments, and other debt obligations.

2. Borrower’s Creditworthiness

The best part of the RIM loan is that foreign nationals don’t need a US credit history to qualify, making it a convenient, easily accessible investment strategy for US newcomers and foreign nationals alike.

3. Down Payment

Some RIM loan programs may require a higher down payment compared to traditional mortgages. The borrower’s ability to provide a substantial down payment demonstrates commitment and financial stability.

4. Property Type

RIM loans are commonly used for various types of properties, such as rental, commercial, and vacation homes. The property’s type and intended use help determine its eligibility for a RIM loan.

5. Property Condition

Lenders assess the property’s overall condition and market value. A well-maintained property with positive rental history is more likely to meet the lender’s requirements.

6. Reserves

Lenders may require the borrower to have reserves, such as cash or liquid assets, to cover potential vacancies, repairs, or unexpected expenses. Adequate reserves enhance the property’s ability to withstand financial challenges.

7. Property Management Plan

A well-defined property management plan that outlines how the borrower intends to manage and maintain the rental property can contribute to a favorable loan decision. Lenders appreciate a strategic approach to property management.

8. Documentation

Comprehensive documentation of rental income, lease agreements, operating expenses, and other financial information is essential to support the property’s income potential and economic stability.

9. Appraisal

A qualified professional’s appraisal helps assess the property’s value and rental income potential. A well-documented appraisal contributes to accurate NOI and RIM calculations.

Meeting these requirements demonstrates the property’s income stability, its potential to generate rental revenue, and its overall financial viability. As RIM loans focus on property performance, borrowers must present a compelling case that their rental property can effectively cover its financial obligations and provide a consistent income stream.

How to Apply for a Rental Income Mortgage (RIM) Loan: Key Steps and Considerations

Buying property in the US as a foreign investor has never been easier, especially with mortgage options such as Rental Income Mortgages (RIMs), also known as DSCR (Debt Service Coverage Ratio) loans. These loans allow you to qualify based on your property’s rental income, not your personal income or US credit history.

If you’re a global investor looking to build or expand your US real estate portfolio, here’s a simplified, step-by-step guide to help you navigate the RIM loan process.

Step 1 – Choose the Right Location

The foundation of any successful real estate investment is location. Research cities and neighborhoods with strong rental demand, healthy appreciation, and stable cash flow potential.

Suppose you’re unfamiliar with the US market. In that case, HomeAbroad’s AI-driven investment search platform can help you compare neighborhoods by cap rate, cash-on-cash return, and growth outlook, helping you identify the best ZIP codes that align with your goals.

Step 2 – Get Pre-Approved for a RIM Loan

Before you start making offers, get a pre-approval letter for your RIM or DSCR loan. This shows sellers you’re a serious buyer and helps you understand your purchasing power.

HomeAbroad offers specialized DSCR mortgage programs for foreign nationals with no US credit score required.

To get pre-approved, you’ll typically need:

- A bank or brokerage statement showing 25% of the purchase price plus estimated closing costs

- Your passport (photo page)

- Optional but helpful: proof of income or a source-of-funds letter

Getting pre-approved early lets you move quickly once you find your ideal property.

Step 3 – Work with an Investor-Friendly Real Estate Agent

Finding the right property from overseas can be tricky, but the right real estate agent makes it easy for you.

HomeAbroad connects you with CIPS-certified (Certified International Property Specialist) agents who specialize in helping foreign investors navigate the US market.

Your agent will help you shortlist high-performing rental properties, schedule virtual or in-person tours, and prepare offers that align with your investment strategy.

Step 4 – Gather and Submit Property Income Documentation

Once you’ve chosen a property, prepare documents that show its rental income potential:

- Lease agreements or market rent projections

- Rental history (if available)

- Operating expenses and financial statements

- A summary of Net Operating Income (NOI)

Lenders will calculate your Debt Service Coverage Ratio (DSCR) by dividing your NOI by total debt payments to ensure the property’s income covers the loan.

Step 5 – Property Evaluation and Underwriting

After you apply, the lender orders an appraisal to confirm the property’s market value and rent potential.

The underwriting team reviews your documentation and verifies all income calculations. You may also need to show proof of reserves (6 months of cash reserves or updated financials).

Underwriting typically takes about 5–7 business days, depending on the lender.

Step 6 – Clear to Close & Signing

Once all conditions are met, you’ll receive a Clear to Close (CTC) and a Final Closing Disclosure summarizing your total costs.

You can complete your closing:

- In person at a US title office

- At a US embassy or consulate (with apostille)

- Or online via Remote Online Notary (RON)

Once signed and funded, congratulations, you now own a rental income mortgage for your US investment property!

Using rental income to qualify for a mortgage opens doors for international investors who may not have US credit or conventional income documentation. With a RIM (DSCR) loan, your property’s income potential does the talking.

Whether you’re investing in Miami, Austin, Los Angeles, or anywhere across the US, HomeAbroad connects you with trusted lenders, agents, and mortgage experts who specialize in helping foreign buyers succeed in the US real estate market.

What are the Benefits of a Rental Income Loan?

RIM loans offer several compelling advantages for borrowers seeking to use rental income to qualify for a mortgage:

1. Enhanced Eligibility

RIM loans expand eligibility by leveraging rental income, allowing borrowers with strong property cash flow to qualify for larger loan amounts.

2. Investment Growth

RIM loans empower real estate investors to capitalize on the income potential of their rental properties, supporting portfolio growth and wealth accumulation.

3. Flexible Criteria

By prioritizing property income, RIM loans offer flexibility to unconventional borrowers, including self-employed individuals and those with limited credit histories.

Rental Income Mortgage vs. Traditional Mortgage: A Comparative Overview

Aspect | Rental Income Mortgage | Traditional Mortgage |

|---|---|---|

Eligibility Focus | Rental income and property performance | Personal income and credit scores |

Qualification Basis | Property’s income-generating capacity | Individual financial metrics |

Borrower Profile | Tailored for real estate investors | General eligibility for various borrowers |

Risk Mitigation | Emphasis on Property’s cash flow stability | Relies on borrower’s financial history |

Income Source Diversification | Utilizes rental income as a qualification factor | Personal income is the primary source |

Credit Score Flexibility | Provides flexibility for unconventional borrowers | Standard credit score requirements apply |

Property Performance Importance | High importance is given to the rental property’s performance for loan approval | Property’s condition and market value are key factors for loan approval |

Income Variability Management | Mitigates potential income fluctuations | less focus on addressing income variability |

Documentation Requirements | Emphasizes rental income documentation | Traditional income and financial documentation |

Investment Property potential | Encourages real estate portfolio growth | primary focus on primary residents |

How Much Rent is Tax-Free? Considerations for Borrowers

If you’re planning to use rental income to qualify for a mortgage, one of the most common questions is: “How much rent is tax-free?”

The short answer: rental income is generally taxable, but there are many ways to reduce your taxable amount through deductions. These deductions can significantly impact your net qualifying income for mortgage purposes.

While all rental income must typically be reported to the IRS, you can lower your taxable income by claiming eligible deductions such as property maintenance and repairs, mortgage interest, depreciation, insurance premiums, property management fees, and property taxes.

These deductions not only help minimize your overall tax liability but can also make your financial profile stronger when applying for a mortgage, since lenders often look at net rental income after expenses.

Because tax laws and deduction rules vary depending on your property type, location, and personal situation, it’s essential to consult a tax professional. They can help you understand how your rental income is taxed, how to structure it efficiently, and how it factors into your mortgage qualification.

For more details on foreign investor tax implications, including FIRPTA and capital gains tax, visit HomeAbroad’s tax implications for foreign real estate buyers page.

Get a Rental Income Mortgage with HomeAbroad

Securing financing for your investment property is simple with HomeAbroad’s rental income mortgage. Our DSCR loans are tailored specifically for global real estate investors, offering flexible terms and competitive rates to help you grow a high-performing real estate portfolio.

HomeAbroad streamlines your entire investment journey. With our AI-driven investment property search platform, you can discover top-yield rental properties. Our expert local agents offer personalized guidance, and we assist with everything from LLC formation to US bank account setup and property management support.

With HomeAbroad’s DSCR loan, you also get a cash-out refinancing option that lets you access your property’s built-up equity without needing US income or a credit score. Use the funds to purchase additional properties, renovate for higher returns, or diversify your investment strategy, all while keeping the approval process rental-income focused.

Get a DSCR loan with HomeAbroad today and start building your international real estate portfolio with ease and confidence.

Frequently Asked Questions

Does a rental property count against your debt-to-income ratio?

Once you own the home, the debt will be considered. If you are renting or intend to purchase and stay where you live, your rental cost will be included. Your projected housing expenses include the principals, interest, taxes, insurance, and the HOA fees.

How is rental income taxed?

Rental income is subject to the same tax rules as any other income you earn. You must report your rental profit or loss on your annual tax return. However, you may be able to deduct certain expenses, like repairs, maintenance, mortgage interest, and property taxes.

What is future rental income?

The amount you anticipate making from renting and residing in them is your future rental earnings. When determining your loan eligibility, we use this term from the mortgage industry, which refers to projected rental income. All types of properties fall under these terms. However, your rental income may help with the additional payment for your new mortgage, or it may help. Most people cannot obtain a mortgage without additional funds from tenants.

When is predicted rental income accepted for underwriting?

Because rental income is seldom proven in tax returns, if you recently bought a home, your rental income would be estimated and could possibly be used in other areas. Showing the property’s earning potential is another way to go about this. If the renters have tenants, then the lender may use a percentage of their earnings as an estimate for the renter’s income.

Does rent count as income for a mortgage?

Yes, rental income can count as income for mortgage qualification, especially when applying for certain types of mortgages that consider rental income as part of your overall financial picture. This is particularly relevant for investment properties or properties with rental units.

What are the interest rates for DSCR loans?

DSCR loan interest rates vary based on market conditions, borrower profiles, and property type, but are typically higher than conventional loan rates. However, HomeAbroad offers competitive rates that enable investors to leverage property cash flow to achieve better returns.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

![DSCR Loan Rates Today [February, 2026]](https://homeabroadinc.com/wp-content/uploads/2022/09/dscr-loan-interest-rates.png)

![How to Get DSCR Loans for Airbnb? [A 2026 GUIDE]](https://homeabroadinc.com/wp-content/uploads/2022/10/GettingDSCRForAirBnB.jpg)