Key Takeaways:

➡️ From April 2023 to March 2024, Canadians spent $5.9 billion on US residential real estate, including vacation homes, rentals, and primary residences.

➡️ Canada is the US's third-largest source of foreign real estate buyers, accounting for 13% of all foreign buyer purchases. - as per NAR.

➡️ Canadians can secure US mortgages, even without a US credit history, through HomeAbroad Loans tailored mortgages for Canadians.

➡️Thanks to the Canada-US tax treaty, Canadians investing in US property don't pay double taxes on their US property income.

Over the last decade, Canadians have been active buyers in the US real estate market. Between 2014 and 2024, Canadians purchased thousands of properties annually, with total investments reaching approximately $89.3 billion.

These figures, sourced from the National Association of Realtors, highlight the ongoing interest of Canadians in owning property in the US, whether for vacation homes, investments, or permanent residences.

Are you also considering buying a home in the sunny south or investing in a bustling city but feeling overwhelmed by the process?

To help you turn your American real estate dreams into reality, we’ve created a detailed guide that covers everything you need to know—from legal requirements and financing options to tax implications and a step-by-step buying process.

Let’s make your cross-border property purchase a smooth and exciting adventure!

But before we get into the details, are Canadians really buying real estate in the US? Let’s find out.

Table of Contents

Are Canadians Buying Property in the US?

From April 2023 to March 2024, Canada emerged as the largest source of foreign real estate buyers in the US, accounting for 13% of all foreign buyer purchases, according to the National Association of Realtors (NAR).

During this period, Canadians purchased approximately 7,100 existing home units in the US, totaling $5.9 billion.

Post-pandemic, there has been a noticeable surge in Canadian purchases of US real estate as travel restrictions eased, allowing for increased cross-border activity.

Canadians are showing renewed interest in US properties, particularly vacation homes in warmer states like Florida, Arizona, and California.

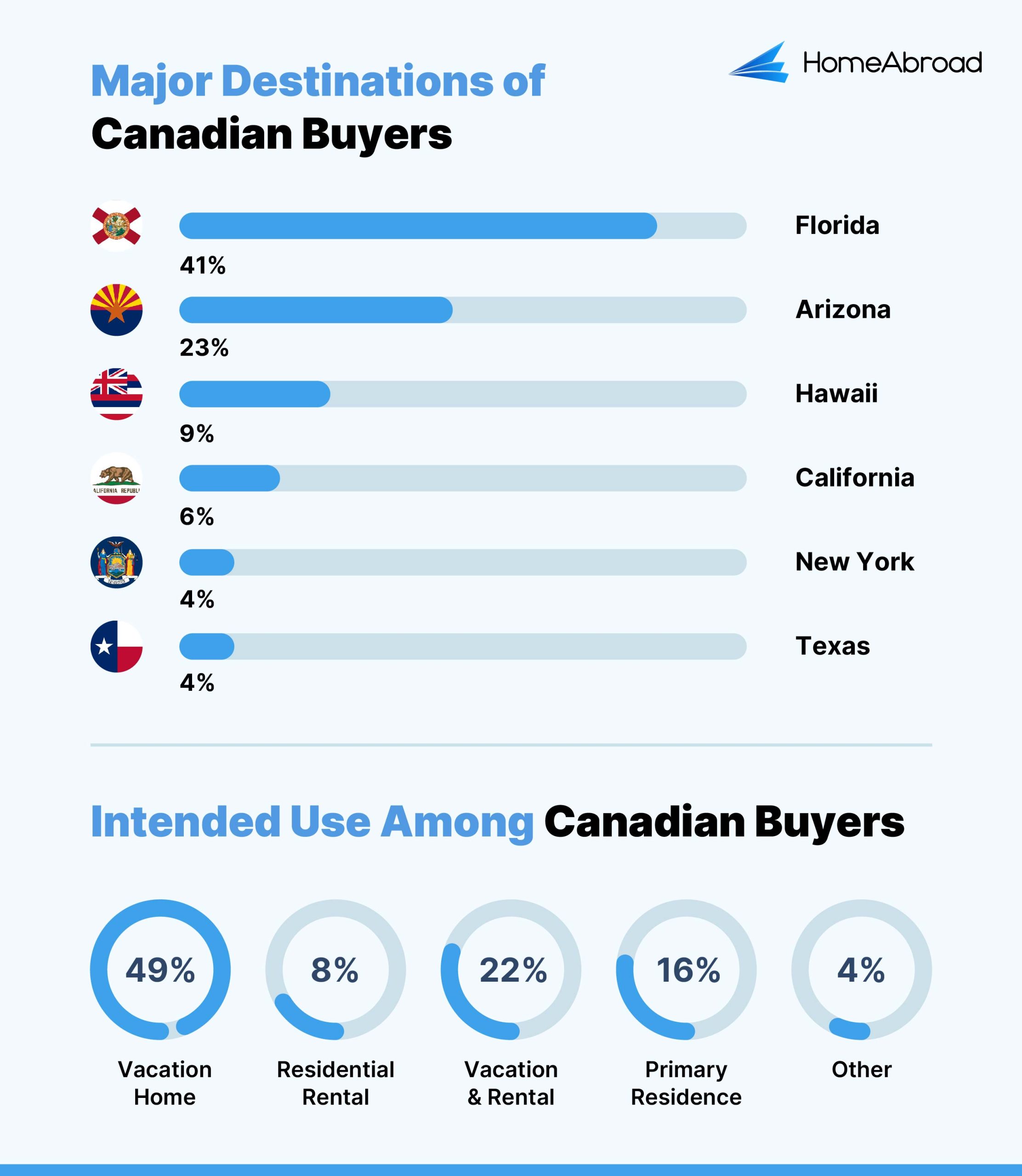

Here are the major destinations chosen by Canadian buyers and their intended use:

However, it’s important to note that this data is based on a survey of 17,060 people, of which only 1,407 reported an international residential foreign buyer.

As such, the actual number of Canadian buyers in the US is likely even higher, reflecting the strong demand that HomeAbroad is committed to supporting.

Now that we know Canadians buy real estate in the US, let’s understand why.

Why are Canadians Buying Property in the US?

For decades, the US has been a leading global destination for foreign investment due to its stable political and economic environment, large and diverse market, strong legal system, favorable taxes, and transparent market.

Here are some specific reasons Canadians are increasingly investing in US real estate. You will also see how buying property in the US differs from buying property in Canada:

- Stable Investment Environment: The US offers a stable political and economic environment, a large market, a strong legal system, favorable taxes, and transparency, making it a top destination for foreign investment.

- Warm Weather: Canadians are particularly drawn to warmer states like Florida, Arizona, and California. These locations offer not only pleasant climates but also a wide range of recreational opportunities, making them ideal for vacation homes. The appeal of escaping harsh Canadian winters is a strong motivator for many buyers.

- Portfolio Diversification: Many Canadians are diversifying by purchasing properties that serve as both vacation homes and rental income sources.

- High Rental Yields: The US real estate market offers lucrative rental opportunities, with rental yields averaging around 8%, providing positive cash flow and strong returns on investment.

Even in a high-interest-rate environment, the potential for rental income in the US can outweigh similar opportunities in Canada, where rental yields are at an average of 5.10%.

- Affordable Housing: The US offers more affordable housing compared to Canada, with prices per square meter at $10,947 in Toronto, Canada, and significantly lower in cities like San Francisco, CA ($8,250), Los Angeles, CA ($4,740), New York ($3,460), and Miami ($3,170). [Source: NAR]

Immigration lawyer Len Saunders confirmed this in an interview on CTV News

“Young people realize they can’t get into the (Canadian) housing market. Or if they are able to, they’re buying a condo, whereas in the US, they can buy a beautiful house.”

- No Additional Taxes: There are no additional taxes imposed on foreign buyers purchasing real estate in the US, and the tax implications are the same as those for US citizens.

The US-Canada tax treaty ensures that Canadians are not subject to double taxation on income earned from US real estate, making the investment even more attractive.

- Growing Trend: Recent trends show a significant increase in the number of Canadians moving to the US, driven by the lower cost of living and more affordable housing options.

In 2022, more than 126,000 people moved from Canada to the US, a 70% increase from the previous year. This migration trend is also a factor in the growing interest in US real estate.

- Longer Mortgage Tenure: The US offers longer mortgage loan terms, such as the 30-year fixed-rate mortgage, which is not as common in Canada.

This type of mortgage ensures lower monthly payments and stability throughout the loan term, making it a more appealing financing option for Canadians.

In contrast, Canadian mortgages often have shorter terms, leading to more frequent refinancing and potential interest rate increases over time.

You can also check out our video to understand why investing in US real estate is more lucrative compared to the Canadian market:

Here’s also an overview for you to understand the difference more:

| Feature | US Real Estate | Canadian Real Estate |

| Weather Appeal | Warm climates in states like Florida and Arizona | Cold climates; limited warm-weather options |

| Rental Yields | Average 8-10% in many areas | Typically lower, around 3-5% in major cities |

| Housing Affordability | Average housing price of $362,481 | Average housing price of CAD 730,600 or USD 532,764, much higher compared to US housing prices |

| Additional Taxes | No additional taxes for foreign buyers | Some provinces impose additional taxes on home purchases |

| Mortgage Terms | 30-year fixed-rate mortgages widely available | Shorter terms, at adjustable rate |

| National Average Appreciation (1-Yr period) | 4.8% | 1.6% |

With the reasons clear, let’s explore the requirements that a Canadian must meet to buy real estate in the US.

What are the Requirements for Canadians to Buy Property in the US?

Canadians looking to buy property in the US face a process similar to that of US citizens. Whether you’re a newcomer, snowbird, or investor, the steps are straightforward, and there are no special restrictions. All you need is either cash or a mortgage to purchase your property.

If you need a mortgage, HomeAbroad offers tailored mortgage programs for Canadians with no or thin US credit history. Reach out to get pre-approved.

Next, let’s discuss the steps for buying a house in the US as a Canadian.

How can Canadians buy property in the US?

Buying a house in the US as a Canadian is similar to buying in Canada but with a few subtle differences.

Here’s a quick rundown to get you started. For a detailed explanation, refer to our comprehensive guide on foreigners buying property in the US.

Step 1: Find Your Location:

Whether you’re buying a vacation home, investment property, or a home near work or college, choosing a location that best suits your needs is essential.

Do your market research while considering the property’s intended use and your goals to find the perfect neighborhood.

Step 2: Work with an Internationally Minded Real Estate Agent:

Finding the right property as a Canadian can be challenging, and hiring a professional can save you a lot of trouble. However, not all real estate agents understand foreign real estate transactions in the US.

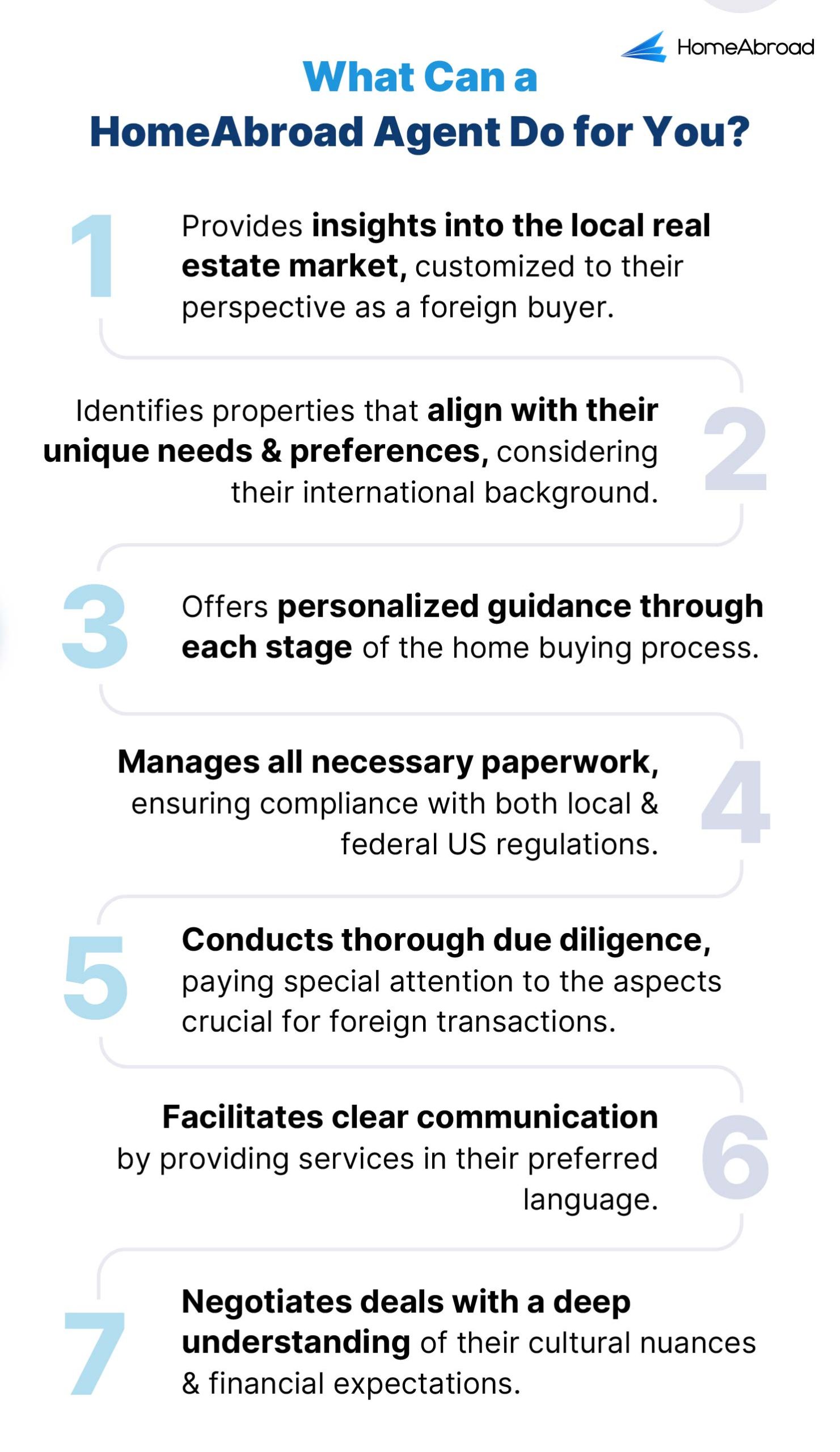

HomeAbroad agents specialize in working with foreign nationals and hold the Certified International Property Specialist designation, earned through specialized training in international real estate transactions. Our agents guide you through the process to ensure you navigate with confidence.

Still not sure? Here are some things a HomeAbroad agent can do for you:

Step 3: Explore Mortgage Options Available in the US for Canadians

This step only applies if you are getting a mortgage.

Many Canadians and foreign buyers believe they can only get a US mortgage with a US credit history, but this is not true. Let us look at the mortgage options available to you with HomeAbroad Loans:

1. US Mortgages for Investment

For Canadian investors, HomeAbroad Loans offers tailored loan programs designed specifically for investing in US real estate. These programs allow you to qualify based on the income generated by the property itself rather than relying solely on your personal income.

This approach enables you to finance multiple investment properties, as each one is assessed individually based on its income potential, without factoring in your overall debt-to-income ratio.

Additionally, HomeAbroad Loans can consider your Canadian credit history, and in some cases, even offer qualification without requiring your Canadian credit history, making it easier to obtain financing without a US credit history.

This approach is particularly beneficial for those looking to diversify their real estate portfolio by investing in the US market while leveraging their Canadian financial standing.

2. US Mortgages for US Newcomers from Canada

If you’re a Canadian newcomer to the US, HomeAbroad Loans offers tailored mortgage solutions that accommodate your unique needs.

These mortgages can use US-based verification methods, such as pay stubs from your US employer, an employment letter, and other forms of US-based financial documentation.

This approach allows you to secure a loan even if you haven’t yet built a substantial US credit history. It ensures that you can purchase a home in the US without the delay of establishing a lengthy credit record.

3. US Mortgages for Snowbirds

For Canadians who split their time between Canada and the US, commonly known as snowbirds, HomeAbroad provides mortgage options specifically designed for purchasing vacation homes.

These loans are structured to consider the seasonal nature of your residency, ensuring that your financial situation is adequately supported while you enjoy your time in warmer US climates.

Whether you’re investing in US real estate, moving to the US, or purchasing a vacation home, HomeAbroad offers flexible and tailored mortgage solutions to meet your needs.

You can check out our US Mortgages for Canadians guide to understand the mortgage options available for you.

Pre-qualify for a US mortgage as an international buyer.

No US credit history needed.

Step 4: Obtain a Pre Approval:

Before starting your property search in the US, securing a pre-approval letter is crucial. This letter confirms your financial ability to purchase a home up to a specific amount, demonstrating to both your real estate agent and sellers that you’re a serious buyer.

For Canadians without a US credit history, HomeAbroad Loans offers tailored mortgage solutions that can help you get pre-approved.

This ensures you have the financing in place, making your offer more competitive and speeding up the buying process.

Step 5: Begin Your Property Search:

After finalizing a mortgage program and getting pre-approval, start your property search by communicating your preferences with your HomeAbroad agent as you plan your financing.

With your budget and target area in mind, your agent can help you find properties that match your needs by providing highly targeted listings. They will also arrange open house visits or virtual tours according to your needs to help you find the perfect property.

Step 6: Make an Offer on the Property You Choose:

Once you’ve selected a property, your HomeAbroad agent will help you craft a solid offer, taking into account the property’s value and current market conditions. This will make your offer more likely to be accepted by the seller.

Step 7: Commit to Your Purchase with a Formal Contract:

After the seller accepts your offer, you’ll sign a purchase agreement and deposit earnest money of 1%-3% of the property price to formalize the transaction. The funds are held in an escrow account managed by a title company until the transaction is complete.

Step 8: Ensure Security with a Comprehensive Title Report:

Before finalizing your purchase, obtain a comprehensive title report through a title agent or company. This ensures the property has a clear title, is free from liens, and provides details on ownership history and potential legal issues.

Step 9: Conduct Home Inspection:

After completing legal checks, our agent will help you schedule a home inspection to identify any potential problems and ensure the property is in good condition. If issues are found, your HomeAbroad agent will assist in renegotiating the deal with the seller or requesting repairs.

Step 10: Mortgage Process:

After your offer is accepted, the next step is to send your purchase contract to your loan officer at HomeAbroad Loans. Your loan officer will initiate the mortgage process, guiding you through each step and assisting with all necessary documentation to ensure a smooth and timely approval.

Step 11: Close on Property:

After obtaining clear to close from HomeAbroad Loans, it’s time to close on your property. Ensure you have your mortgage approval by now. On closing day, you’ll complete the necessary paperwork, settle all dues, and take ownership of your property.

You can also check our homebuying video to understand the process better:

This is it. You are a proud US real estate owner now.

At HomeAbroad Loans, we offer tailored mortgage programs specifically for Canadians, making it easier to purchase property in the US without needing a US credit history.

Our network of expert real estate agents, combined with our advanced AI-powered property search platform, ensures you find the perfect property. We provide end-to-end support throughout your entire US real estate journey, ensuring a smooth and successful transaction.

Contact us for end-to-end support in your US real estate journey.

Don’t take our word for it. Hear from Mason – a snowbird who bought a vacation home in Florida with HomeAbroad.

I was searching for the ideal vacation home in Naples, Florida—a place where I could escape the Canadian winters and rent out during the off-season. HomeAbroad’s real estate agent really helped me with the whole process. Her deep understanding of the Naples market was invaluable in finding a home that matched my needs and budget. I also secured a US mortgage without needing a US credit history with the help of HomeAbroad. I highly recommend HomeAbroad to any Canadian looking to invest in US real estate.

Mason Dupont

Purchased Vacation Home in Naples, FL. Snowbird

Ready to buy real estate in the US? First, understand the taxes involved.

The Tax Implications for Canadians Buying Property in the US

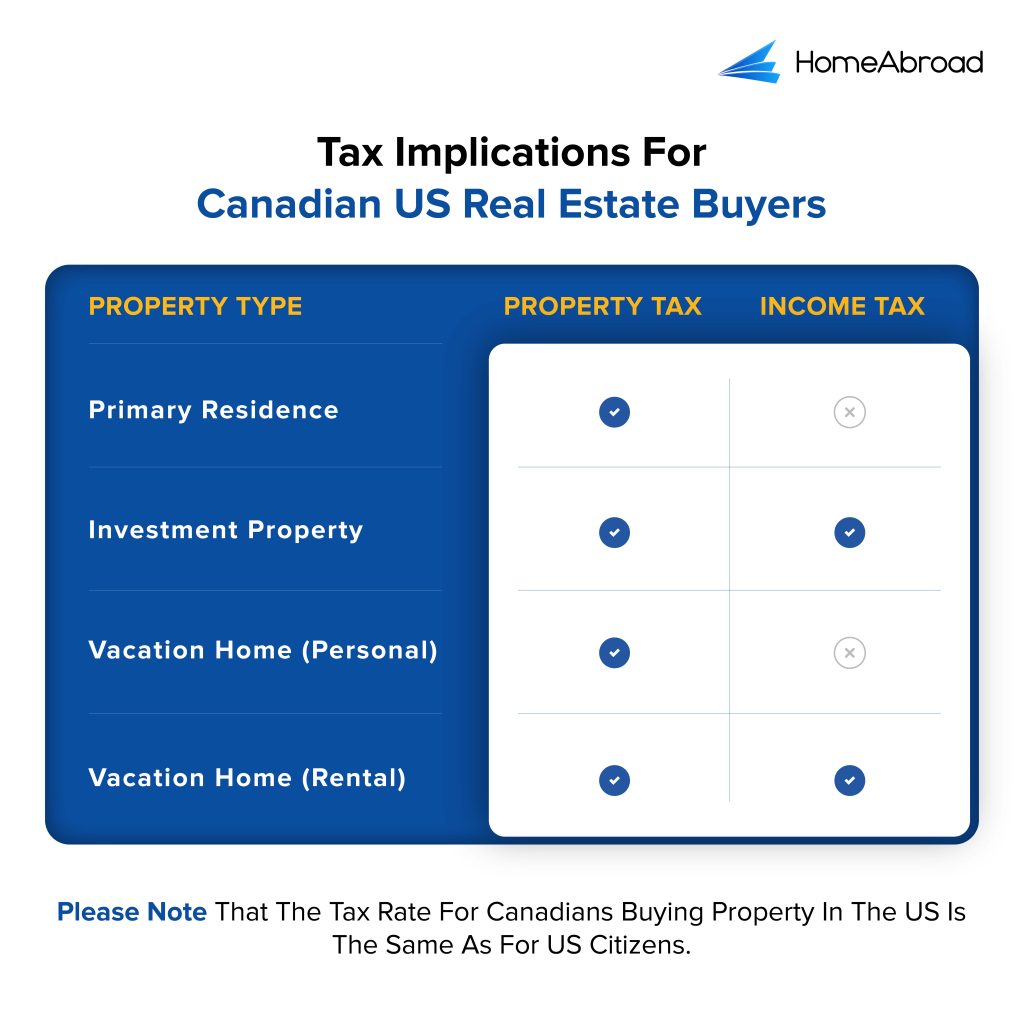

Canadians, like all other foreign buyers of US real estate, are subject to the same taxes as US citizens. All property buyers must pay property tax. Additionally, if the property generates income, they must also pay income tax at the same rate as US citizens.

US-Canada Tax Treaty:

The US-Canada tax treaty prevents Canadians from paying double tax when filing taxes in Canada on the same income generated from their US commercial property.

This treaty benefits Canadians by allowing them to offset taxes paid in the US against their Canadian tax liabilities, reducing their overall tax burden and maximizing profitability.

As a Canadian, you must also pay capital gain tax at the same rate as US citizens when selling your US real estate.

However, you’ll have to follow the FIRPTA (Foreign Investment in Real Property Tax Act) regulations to pay your capital gains tax.

What is FIRPTA?

The Foreign Investment in Real Property Tax Act (FIRPTA) is a US tax law requiring foreign persons selling US real estate to withhold 15% of the sale price for tax purposes.

This withholding is intended to ensure that the IRS collects taxes on gains from the sale.

The withholding applies to the gross sale amount, not just the profit. The buyer is generally responsible for withholding and submitting this amount to the IRS. There are certain exemptions and reductions, depending on the circumstances.

Let’s understand this with the help of an example:

A Canadian investor named Maria owns a condo in Miami and decides to sell it for $500,000. Because Maria is not a US citizen, FIRPTA requires that the buyer withhold 15% of the sale price—$75,000—and send it to the IRS. This withholding ensures that any taxes owed by Maria on the sale are paid to the US government.

Later, when Maria files her US tax return, she can calculate the actual tax owed on the sale. If it's less than $75,000, she can apply for a refund of the difference. If it's more, she must pay the remaining amount.

FIRPTA’s purpose is to make sure that the US government can collect taxes on the sale of US real estate by foreign investors.

However, FIRPTA does not always apply, especially when you reinvest the proceeds from selling a property into another similar property. This process is known as a 1031 Exchange.

1031 Exchange

A 1031 Exchange allows you to defer paying capital gains taxes on the sale of an investment property if you reinvest the proceeds into another “like-kind” property of equal or greater value.

This strategy is widely used by real estate investors to grow their portfolios while deferring taxes, making it a powerful tool for wealth accumulation.

Let’s take the same example of Maria from above to understand this –

Maria, a Canadian investor, owns a condo in Miami valued at $500,000. Instead of selling the property and facing a 15% FIRPTA withholding ($75,000) that must be sent to the IRS, Maria opts for a 1031 Exchange.

She reinvests the proceeds from selling her Miami condo into another investment property of equal or greater value. By doing so, Maria defers paying capital gains taxes, allowing her to continue growing her real estate investments without an immediate tax burden, thus avoiding the FIRPTA withholding.

There you have it! These are the taxes that Canadians would be accountable to. Now, let us look at the tax deductions.

Tax Deductions:

| For all properties | Deduct mortgage interest payments. |

| For investment properties | Deduct additional expenses like: – Property depreciation – Repairs and improvements – Property management costs |

These deductions can help you keep more of your profits.

Refer to our Tax Guide for Foreigners Buying US Real Estate to know more about these taxes and tax-saving strategies.

Buy a House in the US as a Canadian with HomeAbroad

The steps mentioned above are simple and the same for US citizens when buying a property. However, as you’ve seen, the role of a knowledgeable real estate agent and mortgage lender is integral to ensuring a smooth buying process.

At HomeAbroad, we provide specialized real estate agents with international expertise and tailored foreign national mortgage programs to offer comprehensive support to Canadians and other foreign real estate buyers in the US.

We onboard you on our tech-powered platform, where your real estate agent and mortgage officer are already there, ensuring your buying experience is seamless without the need for manual coordination.

We also offer an AI-powered property search platform to help you find your perfect property.

Experience a smoother buying journey with HomeAbroad. Get Started Today!

Frequently Asked Questions (FAQs)

How Long can a Canadian Stay in the US if They Own a House?

Purchasing a house in the US does not grant Canadians any special immigration status or residency. However, Canadian visitors are typically allowed to stay in the US for up to six months upon entry.

Do Canadians Pay Taxes on US Property?

Yes, Canadian buyers of US real estate have to pay US property taxes just like a US citizen. For more details, please refer to the tax section in this guide.

Are there Tax Implications for Canadians Selling Property in the US?

As a Canadian, you must pay capital gain tax at the same rate as US citizens when selling your US real estate. However, you’ll have to follow the FIRPTA (Foreign Investment in Real Property Tax Act) regulations to pay your capital gains tax.

At HomeAbroad, we ensure the reliability of our content by relying on primary sources such as government data, industry reports, firsthand accounts from our network of experts, and interviews with specialists. We also incorporate original research from respected publishers when relevant. Discover more about our commitment to delivering precise and impartial information in our editorial policy.

National Association of Realtors: 2024 International Transactions in U.S. Residential Real Estate

IRS: FIRPTA Withholding

Investopedia: Earnest Money Deposit

![Can Canadians Buy Property in the USA? [2025]](https://homeabroadinc.com/wp-content/uploads/2021/08/CanCanadiansBuyPropertyInTheUSA-500x325.jpg)

![Guide to US Mortgages for Canadians without a US Credit History [2025]](https://homeabroadinc.com/wp-content/uploads/2022/06/us-mortgages-for-canadians.jpg)